A Tale of Two Sequesters in multiple chapters — Chapter 1:WTF is this thing?

Posted: February 20, 2013 Filed under: Federal Budget, Federal Budget and Budget deficit, Sequester 26 CommentsI’ve been avoiding this unpleasant subject because I was hoping dynamics would change and maybe patriotism, reason, or some  semblance of sanity would strike the elected officials in the beltway. That was wishful thinking on my part and now I feel compelled to give you some background information on sequesters in general and this one in particular. This just highlights how dysfunctional our political system has become and it really is a good demonstration of how politicians don’t tend to really get at the real problems. Let me just say that the real future source of any federal deficit problem is the monumental increases in the cost of health care. We have a completely dysfunctional third party payer system in this country as well as astronomical costs for drugs and care whose actual prices are well beyond the knowledge of actual consumers. That being said, let’s proceed to the side shows that our congress keeps setting up to tank our economy.

semblance of sanity would strike the elected officials in the beltway. That was wishful thinking on my part and now I feel compelled to give you some background information on sequesters in general and this one in particular. This just highlights how dysfunctional our political system has become and it really is a good demonstration of how politicians don’t tend to really get at the real problems. Let me just say that the real future source of any federal deficit problem is the monumental increases in the cost of health care. We have a completely dysfunctional third party payer system in this country as well as astronomical costs for drugs and care whose actual prices are well beyond the knowledge of actual consumers. That being said, let’s proceed to the side shows that our congress keeps setting up to tank our economy.

This isn’t the first time congress and an administration has used a sequester when it’s been unable to arrive at a budget. Usually, this comes from an inability to arrive at the same budget priorities that comes from having mixed party control of legislative bodies and the White House. You know the general approaches by each party. Republicans are no longer supportive of any kind of revenue enhancements or cut in military spending. Democrats have been more accommodating but tend to draw the line at some point when it comes to destroying the safety net and entitlement programs along with the other basic functions that government provides that the private sector just can’t do either economically or effectively. So, once you get this stand off, a sequester is used to force both sides to the bargaining table.

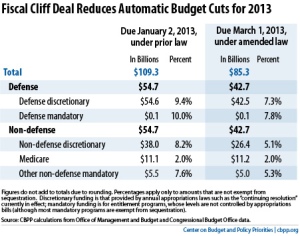

A sequester is basically an automatic reduction in Federal Spending during a budget year. We had a January 2 Fiscal Cliff deal that postponed the sequester until March 1. This is what will happen if nothing is done.

A sequester is basically an automatic reduction in Federal Spending during a budget year. We had a January 2 Fiscal Cliff deal that postponed the sequester until March 1. This is what will happen if nothing is done.

The deal sliced the scheduled 2013 sequestration by $24 billion, from $109.3 billion to $85.3 billion. This reduces the percentage cuts in full-year funding for most eligible programs (those that the law does not exempt from the automatic cuts). The Medicare percentage does not drop, however, because Medicare cuts were and are still capped at 2 percent, and the across-the-board cut that applies to other non-defense programs remains larger than 2 percent.

The chart and the narrative come from the Center on Budget and Policy Priorities which is a great source of information.

The first of the sequesters happened when I was fresh out of graduate school back in the mid 1980s. You’ll probably recognize the names of the usual agents of economic chaos from the Reagan years: Gramm-Rudman-Hollings–Balanced Budget and Emergency Deficit Control Act of 1985. Oddly enough, the Supreme Court found the bill unconstitutional saying that it gave Congress too much power over the budget. They had to rewrite it and it repassed in 1987.

The Balanced Budget and Emergency Deficit Control Act of 1985 (Graham-Rudman-Hollings) was an amendment to a bill that allowed the debt ceiling to be raised to over $2 billion. It created a five-year deficit reduction plan, with decreasing deficit targets each year, until the budget would be balanced in fiscal year 1991. If deficit goals were not met in any given year, a process of automatic spending cuts termed “sequestration” would take place. Fifty percent of the cuts would come from domestic discretionary spending and fifty percent from defense. Social Security, Medicare, several anti-poverty programs, and interest on the debt were exempted from a potential sequester.

Gramm-Rudman-Hollings garnered bipartisan support and was signed into law by President Reagan in December 1985. Most Republicans in the House and Senate voted for it, while the Democratic vote was split nearly evenly in both chambers. Those in favor of the bill argued that the budget deficit, which had greatly increased since 1981, required dedicated measures to reign [sic] in federal spending. Democrats who voted “no” argued that budget cuts were likely to impact domestic programs while leaving military spending largely intact. Nevertheless, the Reagan administration opposed the mandated fifty percent cuts in defense spending in a potential sequester and provided only lukewarm support for the measure.

They assume a fiscal multiplier of 1.4 for general government spending, which is Moody’s Analytics most recent public estimate of the government spending multiplier. While we use the same multiplier for all cuts, we’d guess that these likely slightly overstate the adverse economic impact resulting from defense spending cuts and understate job losses from domestic spending cuts. Budgetary programs for lower-income households in the discretionary budget—such as housing assistance and the special supplemental food program for women, infants, and children (WIC)—as well as infrastructure spending have particularly high multipliers. And to the extent that cuts to spending by the Department of Defense come from capital-intensive weapons acquisitions rather than reductions in personnel strength, the impact on employment would be milder. Regardless, any cuts in the near-term (unless they are ploughed into more spending somewhere else) are going to constitute a drag on the still-weak recovery. Cutting government spending reduces aggregate demand and worsens joblessness while the economy is running well below-potential output.

The new study was performed by Thomas Hungerford of the non-partisan Congressional Research Service. Though the study is not a CRS product, Hungerford’s data is widely cited on both sides; he’s an impeccably objective analyst.

Here’s what Hungerford found: The single greatest driver of income inequality over a recent 15 year period was runaway income from capital gains and dividends.

This finding is directly relevant to the current debate, because Obama and Democrats want to offset the sequester in part by closing loopholes enjoyed by the wealthy, such as the one that keeps tax rates on capital gains and dividends low. Dems want to do this in order to prevent a scenario where the sequester is averted only by deep spending cuts to social programs that could hurt a whole lot of poor and middle class Americans. Republicans oppose closing any such loopholes and want to avert the sequester with only deep spending cuts.

Hungerford’s report, like all serious examinations of inequality, is very complicated. He looks at a bunch of recent data on inequality from the period from 1991-2006 — measured by the so-called “Gini index” — and calculates the degree to which various factors exacerbated it. Hungerford found that over that period, the rise in the Gini index (a story that’s been widely told elsewhere, one that’s largely been driven by the runaway wealth of the top one percent and top 0.1 percent) was driven mainly by the rise in capital gains and dividends income.

“By far, the largest contributor to increasing income inequality (regardless of income inequality measure) was changes in income from capital gains and dividends,” the report concludes.Or, as Hungerford put it in an interview with me: “The reason income inequality has been increasing has been the rising income going to the top one percent. Most of that has come in capital gains and dividends.”

In other words, wealthy beneficiaries of low tax rates on capital gains and dividends are doing extremely well — and their runaway wealth is a major driver of income inequality. There’s a lot of that money out there that could be taxed as ordinary income — as Obama and Dems want — as a way to avert the sequester, which could badly damage the economy. Republicans oppose this.

This finding comes as even some conservatives are reckoning with the fact that the GOP’s message on the sequester is deeply flawed. Writer Byron York notes today that Republicans are openly conceding that the sequester will gut the military, even as they openly point to the sequester as an acceptable policy outcome.

Unemployment fell to 4.1% by the end of last year – a record low for at least 25 years. Poverty has fallen by 27% since 2006. Public spending on education has more than doubled, in real (inflation-adjusted) terms. Increased healthcare spending has expanded access to medical care, and other social spending has also increased substantially, including a vast expansion of government-subsidised housing credit.

If all that sounds like it must be unsustainable, it’s not. Interest payments on Ecuador’s public debt are less than 1% of GDP, which is quite small; and the public debt-to-GDP ratio is a modest 25%. The Economist, which doesn’t much care for any of the left governments that now govern the vast majority of South America, attributes Correa’s success to “a mixture of luck, opportunism and skill“. But it was really the skill that made the difference.

Correa may have had luck, but it wasn’t good luck: he took office in January of 2007 and the next year Ecuador was one of the hardest hit countries in the hemisphere by the international financial crisis and world recession. That’s because it was heavily dependent on remittances from abroad (eg workers in the US and Spain); and oil exports, which made up 62% of export earnings and 34% of government revenue at the time. Oil prices collapsed by 79% in 2008 and remittances also crashed. The combined effect on Ecuador’s economy was comparable to the collapse of the US housing bubble, which contributed to the Great Recession.

And Ecuador also had the bad luck of not having its own currency (it had adopted the US dollar in 2000) – which means it couldn’t use the exchange rate or the kind of monetary policy that the US Federal Reserve deployed to counteract the recession. But Ecuador navigated the storm with a mild recession that lasted three quarters; a year later it was back at its pre-recession level of output and on its way to the achievements that made Correa one of the most popular presidents in the hemisphere.

How did they do it? Perhaps most important was a large fiscal stimulus in 2009, about 5% of GDP (if only we had

done that here in the US). A big part of that was construction, with the government expanding housing credit by $599m in 2009, and continuing large credits through 2011.

But the government also had to reform and re-regulate the financial system. And here it embarked on what is possibly the most comprehensive financial reform of any country in the 21st century. The government took control over the central bank, and forced it to bring back about $2bn of reserves held abroad. This was used by the public banks to make loans for infrastructure, housing, agriculture and other domestic investment.

It put taxes on money leaving the country, and required banks to keep 60% of their liquid assets inside the country. It pushed real interest rates down, while bank taxes were increased. The government renegotiated agreements with foreign oil companies when prices rose. Government revenue rose from 27% of GDP in 2006 to over 40% last year. The Correa administration also increased funding to the “popular and solidarity” part of the financial sector – co-operatives, credit unions and other member-based organisations. Co-op loans tripled in real terms between 2007 and 2012.

The end result of these and other reforms was to move the financial sector toward something that would serve the interests of the public, instead of the other way around (as in the US). To this end, the government also separated the financial sector from the media – the banks had owned most of the major media before Correa was elected – and introduced anti-trust reforms.

Of course, the conventional wisdom is that such “business-unfriendly” practice as renegotiating oil contracts, increasing the size and regulatory authority of government, increasing taxes and placing restrictions on capital movements, is a sure recipe for economic disaster.

Thanks for explaining the sequester and it’s impact in ways that I can understand. I’d suggest this you forward this well researched and knowledgeable work to Joe Scarborough, but he wouldn’t get it.

Scarborough doesn’t live in an “evidence-base reality”. I’m going to borrow that phrase from Hillary for the rest of my life, I swear.

I love Ecuador’s story. We now have Ecuador and Iceland as two examples for success. Thanks.

I heard a report on Argentina recently on NPR. They defaulted on their debt and they are doing pretty well too, except they’re still trying to keep Goldman Sachs off their backs.

I thought Argentina’s problems were mainly with Paul SInger’s hedge fund now. I had heard everyone else was pretty well lined out. Guess the Squid never gives up either.

Rafael Correa is not only a fine president but also a pretty courageous man in general.

I really admire the man. He’s the very definition of a leader to me. He stands up and DOES what he knows is right and what he knows is right is based on evidence, reality, and the rule of law.

That’s what we all should want but don’t get. Damn shame that.

If only Obama would emulate him!

Great post, Kat! Thanks for explaining this. I look forward to part two.

I want to get into more detail on the cuts, but I thought it would be a good idea to overview things first.

It was very helpful to me. I recall hearing about Gramm-Rudman-Hollings, but at the time I didn’t really know what it was. I blocked out a lot of the Reagan years.

Seems to me the main problem is going to be allocating the cuts to minimize impact. Some of the agencies may have no way to do that so it’ll be a blunt instrument.

I saw one example for the border patrol that looked really brutal. Same with NASA.

Yes, thank you Kat. This is so helpful!

Thanks for the explanation Kat.

I saw Hiz Honor Nagin taking his walk to Federal Court today. Caught it online. Still as pompous as ever.

I can’t wait until he gets his narcissistic ass into an orange jump suit

I can only imagine the laughter that will inspire.

no more long showers in air force one any more for Ray Ray

He’s probably going to want to shorten his showers in the slammer.

Oh me too on the jump suit. And Ralph is right about that shower time. 😉

I bet Ray Ray will make some nice bad man very happy.

I’ll put the link but you have to sign in to youtube to see this one.

hey, check this out … curiouser and curiouser …

OT but it drives me batty. The Beltway media completely sucks!

Matt Yglesias: BipartisanThink and the Principle of Seriousness

love this post!