Does Size Matter?

Posted: March 31, 2009 Filed under: Equity Markets, Team Obama, U.S. Economy | Tags: bank asset size cap, bank bailout, Felix Salmon, Geithner bank bail out, Kwak, Too big to fail banks 2 Comments The antithesis to market capitalism is monopoly. High market concentration has been historically a reason to use the US Justice Department to trust bust. We’ve had laws on the books since the late 19th century. The last real monopoly challenge was during the Clinton administration that took on Microsoft and its software bundling practices. The Bush 2 administration promptly walked away from enforcing the suit. The Eurozone found Microsoft guilty of monopoly behavior and are still in the process of enforcing their court’s findings. We’ve been ignoring monopoly-creating behavior on the part of lawmakers and corporations for decades now and we’re living with the high costs of market failure as a result.

The antithesis to market capitalism is monopoly. High market concentration has been historically a reason to use the US Justice Department to trust bust. We’ve had laws on the books since the late 19th century. The last real monopoly challenge was during the Clinton administration that took on Microsoft and its software bundling practices. The Bush 2 administration promptly walked away from enforcing the suit. The Eurozone found Microsoft guilty of monopoly behavior and are still in the process of enforcing their court’s findings. We’ve been ignoring monopoly-creating behavior on the part of lawmakers and corporations for decades now and we’re living with the high costs of market failure as a result.

Much of the problems in the current downturn can be traced to the behavior of some of the country’s largest banks. Banks that were allowed to grow to sizes that allowed them power in the market, power in congress, and power in the setting the terms of their regulation. Several rationalizations were used to allow banks to grow from the 1980s to present time. First, there were the arguments for economies of scale. Big banks were more able to process huge batches of ACH transactions and checks. These money center banks replaced the FED as the transaction processor of choice since they were generally cheaper given the various expenses of being a FED member bank that include leaving large amounts of money in reserve and on-going regulation and monitoring.

Second, there was the argument that huge money center banks were necessary to offset the power of the up and coming huge Japanese banks. During the 1980s period, one US bank after another on the top ten largest banks in the word was knocked off the list by a Japanese bank, then later by Eurozone banks. It was argued that in order to compete with these larger foreign institutions, US banks concentration should be looked at in a global context. In a global context, they were ‘competitive’ and not part of a market concentration problem. The basis of this argument was that the bank might be big in US terms, but as a global entity it was one of many. During the 1990s, it was typical for market concentration to be defined more on a global basis which in turn led to less prosecutions based on the traditional measures.

We now know that poor regulation and terrible understanding of the role of financial innovations in the financial system led to the current meltdown. We also know that many of the offenders and the biggest failures have been the huge money center banks. Many regional and small banks that continued to follow the loan and hold model of lending, rather than the loan, securitize and sell model are still thriving and did not contribute to the current crisis. Given the global financial crisis and the role of the mega banks and the resultant demands on tax payer funds to bailout those deemed too big to fail, should we look at regulations that limit bank size?

Many economists, liberal pundits, and I question the Geithner plan because it assumes we need the financial system to just work as it exists today. His paradigm doesn’t really question the failure of the system in terms of the current set-up of the system itself. Geithner’s plan blesses the poor system that was just swept off its feet by a passing oddity that surely won’t repeat itself. James Kwak of Baseline Scenario questions the basis of the Geithner plan that we need just need to prop up these too big to fail behemoths until they are back on their feet. Here’s the central part of the Geithner proposition questioned by Kwak and others.

“. . . [W]e must create higher standards for all systemically important financial firms regardless of whether they own a depository institution, to account for the risk that the distress or failure of such a firm could impose on the financial system and the economy. We will work with Congress to enact legislation that defines the characteristics of covered firms, sets objectives and principles for their oversight, and assigns responsibility for regulating these firms.

In identifying systemically important firms, we believe that the characteristics to be considered should include: the financial system’s interdependence with the firm, the firm’s size, leverage (including off-balance sheet exposures), and degree of reliance on short-term funding, and the importance of the firm as a source of credit for households, businesses, and governments and as a source of liquidity for the financial system.”

London Calling

Posted: March 30, 2009 Filed under: Global Financial Crisis, president teleprompter jesus, Team Obama | Tags: G20 summit Comments Off on London Calling Grab the popcorn for the start of the G20 London Summit beginning April 2nd. This will be an important meeting because it serves as a test of the resolve of the major nations’ commitment to both global development and trade. It will also be a test for new US President Barrack Obama and his administration. There will be challenges from many of the countries on several fronts.

Grab the popcorn for the start of the G20 London Summit beginning April 2nd. This will be an important meeting because it serves as a test of the resolve of the major nations’ commitment to both global development and trade. It will also be a test for new US President Barrack Obama and his administration. There will be challenges from many of the countries on several fronts.

Obama has called for all G20 countries to pledge GDP-appropriate global fiscal spending. Germany is not convinced of a need for global fiscal stimulation having announced many are not bad off when compared to the US or UK. Reluctance on the part of other nations to follow the lead will put pressure on the US to stimulate the much of the world’s economies as well as its own on its own. Steven Harper of Canada as said that Canada’s doing fine. Angela Merkel has criticized the US call for fiscal stimulus. Early last week, the President of the EU, called the Obama plan “a road to hell.” This has caused both the US and the UK to back off of specific commitments to global fiscal stimulus. Developing nations have been begging the G20 for pledges to shore up their own economic crises. There also appears to be a varying commitment levels to that idea. This from China View.

But a transatlantic rift over the necessity of further fiscal stimulus appears to complicate efforts of the summit.

In response to U.S. pressure on the European Union (EU) countries to boost their fiscal stimulus, Czech Prime Minister Mirek Topolanek, whose country holds the current EU presidency, slammed U.S. plans to spend its way out of recession as “a road to hell.”

Topolanek’s blunt criticism exposed European differences with Washington and signaled a hard job for Brown to achieve greater international cooperation.

Playing down the transatlantic rift, British Foreign Secretary David Miliband said on Sunday Britain and the United States will not push G20 leaders to announce specific spending pledges.

In a preparatory meeting two weeks ago, G20 finance ministers and central bankers agreed to “take whatever action is necessary” to support the economy. They pledged to continue coordinated and comprehensive action to boost demand and jobs, adding the key priority now is to restore lending by tackling toxic assets in the financial system.

The “Incompetence Crisis”

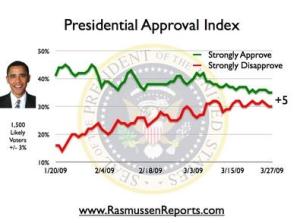

Posted: March 27, 2009 Filed under: A My Pet Goat Moment, Global Financial Crisis, Hillary Clinton: Her Campaign for All of Us, No Obama, president teleprompter jesus, PUMA, Team Obama, U.S. Economy, Voter Ignorance | Tags: Hillary Clinton, Obama Crisis of Confidence, Obama flunking economics, Obama incompetence, Op Ed criticism 10 Comments All last year, ALL I heard was how experience didn’t matter. I heard that being ‘ready on day one’ was a meaningless campaign slogan. I was told that what mattered was perceived good judgment, intelligence, and speaking skills. I remember watching the first Democratic Debates and thinking, this guy isn’t ready to be dogcatcher, let alone President. There were no wonky answers on economics or foreign policy. There was never a show of any detailed plan. There was always just a nice speech read from a teleprompter with a preacher’s patois, incredible (somewhat contradictory) promises, and messages that could have come from a motivational seminar instead of a political campaign. I never got on the bandwagon.

All last year, ALL I heard was how experience didn’t matter. I heard that being ‘ready on day one’ was a meaningless campaign slogan. I was told that what mattered was perceived good judgment, intelligence, and speaking skills. I remember watching the first Democratic Debates and thinking, this guy isn’t ready to be dogcatcher, let alone President. There were no wonky answers on economics or foreign policy. There was never a show of any detailed plan. There was always just a nice speech read from a teleprompter with a preacher’s patois, incredible (somewhat contradictory) promises, and messages that could have come from a motivational seminar instead of a political campaign. I never got on the bandwagon.

I finally found a home over here in the Pumasphere with people of similar thought after being treated like a scourge by other sites (blog or MSM) that had gone over to the hope side. I’ve been getting used to my role as pariah. I was thinking I’d have to live with it for at least a year. I figured I’d start getting the you were so right calls sometime in the fall.

Boy, was I wrong!

I figured that because of my experience during the early calls for the Iraq war. I was the one saying “Iraq has nothing to do with 9/11. Iraq is a different agenda. Iraq is a bad idea.” I actually had some one get up in a restaurant to tell me what a lousy, unpatriotic American I was that didn’t deserve to live in the US. I became a the scourge of all true American patriots. I’ve been thinking that my 9/11 protest was just a character building experience that would serve me well during the Obama fascination period and that it would probably take a few years of, yet again, being a scourge to all true American patriots before the worm would turn. Luckily, I found a other like minded out in the Pumasphere so I don’t have to be quite alone as I was with my opinion on the Iraq Invasion.

I think I can honestly speak for a number of us around here. We didn’t expect to be proven so right so quickly. At least I didn’t. I was hoping that maybe it wouldn’t be as bad as my gut and head had deduced. So many of my friends said, he’s not Dubya, so he’s got to be better, you’ll see. After all, we’d get rid of a lot of really evil signing statements that restrict women’s reproductive choices, the right of all people to love and marry whom they wish, and we’d move ahead on science again. I’ve said this before, but nearly any democrat would have done any of those things–including Joe Lieberman. Lieberman is one of those folks that I consider marginally a democrat, but even he would have done those things if he were POTUS. We certainly wouldn’t see any nasty supreme court appointments either. These were marginal hopes and small changes that I could cling to while knowing that eventually, I would be proven right. I just didn’t even imagine it would wind up quite like this, quite so fast.

So, if I haven’t made myself clear here, Rush Limbaugh and Governor Jindal may be cheering for a failure. I’m not in that camp at all. I’ve just been quietly sitting here telling myself that with all the beautiful things written into the constitution as well as the resiliency of the American people, that perhaps it won’t be quite as bad as I thought it would be. After all, we survived the incompetency of George Bush and the lunacy of Dick Cheney. Things can’t fall apart that fast!

Boy, was I wrong!

Pumas are the new Cassandras. Our warnings, unheeded, demonized, and marginalized, are now the stuff of MSM op ed pieces. I’d like to point you to a few that are searing Obama with legitimate criticisms. I would think they came from one of the edgier Puma sites but they don’t. One is from CNN. The other from the UK’s Prospect. I also have two from the NY Times. These comments are simply alarming.

Toxic Treasuries Redux

Posted: March 26, 2009 Filed under: Equity Markets, Global Financial Crisis, U.S. Economy | Tags: Bond Auctions, FED, quantitative easing, UK Auctions, US Treasury bonds Comments Off on Toxic Treasuries ReduxWhile the equity markets are reacting positively to whatever bit of good news they can grab, economists are eying the market for government bonds. The United States and the United Kingdom have huge deficit driven budgets and stimulus plans that are testing the willingness of their creditors. The US is skating on the thin ice. The UK fell into the pond. This from Market Watch:

market for government bonds. The United States and the United Kingdom have huge deficit driven budgets and stimulus plans that are testing the willingness of their creditors. The US is skating on the thin ice. The UK fell into the pond. This from Market Watch:

NEW YORK (MarketWatch) — Treasury bond auctions, not usually the stuff that fires up equities traders, rocked stocks this week as investors homed in on worries about the ability of the government to borrow more than $2 trillion to fund its financial and economic rescue plans.

On Wednesday, concerns were sparked after the U.K. failed to get enough bids to sell the full amount of 4-year gilts it offered, the first time this happened in 14 years. Later in the day, a U.S. government auction of $34 billion of 5-year notes drew only tepid interest from foreign investors.

“Everybody knows that the government is auctioning stuff like there’s no tomorrow,” said Paul Nolte, director of investments at Hinsdale Associates. “The question is who’s going to buy all this stuff,” he said. “If there’s not enough buyers, interest rates will have to go higher, which means mortgage rates would have to go higher and that could derail any recovery we might have.”

Treasury bond yields, which move inversely to bond prices, are used to benchmark the interest rates on many consumer loans, including some mortgages. When buyers don’t show up at an auction, bond prices fall and their yields rise.

This brings us back to China and their call to review the dollar’s role as a reserve currency. The offset on the Fed’s balance sheet to Treasury Bills and Bonds is dollars. These things and the interest rates that prevail in the economy are causally linked. You mess with one, you mess with them all.

Meanwhile, China, the largest buyer of U.S. Treasury bonds, expressed concern earlier this month about the safety of its investments. The massive amounts of U.S. debt issued have pressured bond prices and also threatened the strength of the dollar, which could further reduce the value of holding Treasurys.

China also rocked the boat when the governor of its central bank on Monday called for a new global reserve currency to replace the dollar.

The Treasury had announced that the would be heavily involved in the market this week. The FED is also out there with its quantitative easing program. Odd things are happening. It became obvious by mid Wednesday that their announcements and actions were causing the Treasury to actually buy at high price mid-morning then selling much later at a low price. It doesn’t take a rocket scientist to know that’s bad math for the taxpayer. Larry Doyle over at NQ heard that Wall Street was trying to sell three times the amount that the Treasury actually bought.

Bloomberg also noted the supply concerns.

The Treasury Department is selling a record $98 billion in notes this week, eclipsing the record $94 billion auctioned the week ended Feb. 27. The U.K. failed to attract enough bidders today at an auction of 1.75 billion pounds ($2.55 billion) of gilts for the first time in almost seven years.

President Barack Obama’s government is selling record amounts of debt to revive economic growth, service deficits, and cushion the failures in the financial system. Debt sales will almost triple this year to a record $2.5 trillion, according to estimates from Goldman Sachs Group Inc.

Orders for U.S. durable goods unexpectedly rose by 3.4 percent in February, the Commerce Department said today in Washington. Purchases of new homes in the U.S. unexpectedly jumped in February, increasing 4.7 percent to an annual pace of 337,000 after a 322,000 rate in January, Commerce said.

“Better than expected economic data, failure of the long- end auction in the U.K. and low demand at the five-year Treasury auction; all these factors combined are leading to higher yields,” said Anshul Pradhan, an interest-rate strategist in New York at Barclays Capital Inc., another primary dealer.

The Fed said it purchased $7.5 billion of U.S. debt spread among 13 of the possible 19 securities eligible for purchase. The notes mature from February 2016 to February 2019, the Federal Reserve Bank of New York said in a statement today. Nearly $22 billion was submitted to the central bank in the first day of buying, the New York Fed said.

“We are really not seeing any kind of meaningful support for the Treasury market,” said Kevin Flanagan, a Purchase, New York-based fixed-income strategist for Morgan Stanley’s individual investor clients. “Conventional wisdom in the market is that the Fed will concentrate on the five- to 10-year or the seven- to 10-year sector.”

Basic Truths and Common Sense

Posted: March 25, 2009 Filed under: Populism, U.S. Economy | Tags: Adam Smith, Che, government is the problem, government is the solution, Huey Long, Market Failure, Monopoly, Perfect Competion, Populism, Ronald Reagan 4 CommentsI woke up from nap with this thread writing itself. This happens frequently to me when when I’m trying to reconcile ideas that look separate and unconnected but I know intuitively that isn’t true. I just haven’t found the way to make the connection. This latest dream tapestry came from what seems like three distinct sources. The first inspiration was a conversation from The Confluence. The second kick came from a rude comment from an even ruder blog. The third click came from my basic market structure lectures to my freshman survey classes where I have to teach economics to non-business majors. This means I teach economics concepts without much use of graphs and math so you have to tell a lot of stories to get your point across and be very down to earth about things. It makes me really work my brain so I can explain complex concepts in intuitive ways.

So the thread at the Confluence was about what is ‘crude populism.’ The rude comment was about me being at times seemingly ‘Keynesian’ and at other times a ‘rabid free market libertarian’. The primary concept that I’m leading up to in my survey class is ‘market failure.’ There’s actually a middle path between these concepts and we’re about to go down it. The connecting point is market failure and its root source as well as the source of resolution. The source of market failure can frequently be the government. It can also frequently be something with in the market itself that has nothing to do with the government. Either way, to deal with the market failure,the government must find the root source and remove it. This means creating laws. Sometimes, this means removing government intervention. Other time it means adding it. I’ll give you some examples here in moment, but stay with me on those points because I’m going to tie it to American populism in its varied forms.

The most recent form of American populism in this country comes from Ronald Reagan. A previous form of American populism came from Huey Long. They were both very skilled at speechifying the masses into jingoistic furor, but with very different views of what the government’s role in messes were. Reagan’s speeches were full of the “government is always the problem.” Here’s example one, the first Reagan inaugural address.

Here’s the part of the speech that describes the Reagan brand of Populism.

These United States are confronted with an economic affliction of great proportions. We suffer from the longest and one of the worst sustained inflation in our national history. It distorts our economic decisions, penalizes thrift, and crushes the struggling young and the fixed-income elderly alike. It threatens to shatter the lives of millions of our people.

Idle industries have cast workers into unemployment, human misery, and personal indignity. Those who do work are denied a fair return for their labor by a tax system which penalizes successful achievement and keeps us from maintaining full productivity.

But great as our tax burden is, it has not kept pace with public spending. For decades we have piled deficit upon deficit, mortgaging our future and our children’s future for the temporary convenience of the present. To continue this long trend is to guarantee tremendous social, cultural, political, and economic upheavals.

You and I, as individuals, can, by borrowing, live beyond our means, but for only a limited period of time. Why, then, should we think that collectively, as a nation, we’re not bound by that same limitation? We must act today in order to preserve tomorrow. And let there be no misunderstanding: We are going to begin to act, beginning today.

The economic ills we suffer have come upon us over several decades. They will not go away in days, weeks, or months, but they will go away. They will go away because we as Americans have the capacity now, as we’ve had in the past, to do whatever needs to be done to preserve this last and greatest bastion of freedom.

In this present crisis, government is not the solution to our problem; government is the problem. From time to time we’ve been tempted to believe that society has become too complex to be managed by self-rule, that government by an elite group is superior to government for, by, and of the people. Well, if no one among us is capable of governing himself, then who among us has the capacity to govern someone else? All of us together, in and out of government, must bear the burden. The solutions we seek must be equitable, with no one group singled out to pay a higher price.

This is the philosophical basis of the tea parties of Michelle Malkin. The line goes like this, there is this gang of elitists sitting in government taking our tax money and creating problems with our jobs to help their buddies and themselves. Let’s get them! We’re little businesses! We’re little people! We’re the solution ! They are they problem!

Here’s some highlights from the life of Louisiana Governor Huey Long, the Kingfish. He’s another politician associated with populism. Notice his breed of populism is quite different. Listen to his speeches. This line is one that grabs me.

“How many men ever went to a barbecue and would let one man take off the table what’s intended for nine–tenths of the people to eat? The only way you’ll ever be able to feed the balance of the people is to make that man come back and bring back some of that grub that he ain’t got no business with!”

Long’s type of populism puts the government squarely as the root of the solution and not the problem. This is another type of populism that is the philosophical catalyst spurring the pitchforks and torches aimed squarely at the AIG bonuses. Huey attacked the corporatist that he saw as distinct from the government. So, the line here goes, there is a gang of elitists taking our money and creating problems for our jobs. Let’s grab the government and go get them! We’re little businesses! We’re little people! We’re the solution but we can’t really do much unless the government is there to help us get them! But, let’s get them!

So yes, the problem can somewhat be boiled down to the government is the elitist problem for populist Republicans. The government is part of the solution to the elitist problem for populist Democrats. These are both ideological oversimplifications and I’m going to use simple economics to show you why. We can see that both can be true when you study market failures in economics. They aren’t completely irreconcilable viewpoints.

Recent Comments