Remember When We Had Democratic Presidents?

Posted: April 11, 2013 | Author: bostonboomer | Filed under: Barack Obama, morning reads, Republican politics, U.S. Economy, U.S. Politics | Tags: Chained CPI, destruction of the Democratic Party, Franklin D. Roosevelt, Great Society, John F. Kennedy, Lyndon B. Johnson, Medicare cuts, New Deal, New Frontier, Obama's Grand Betrayal, Social Security cuts | 40 CommentsOh yes, “those were the days, my friend, we thought they’d never end…”

Roosevelt’s New Deal was before my time, but I heard about those days from my parents.

The New Deal was a series of economic programs enacted in the United States between 1933 and 1936. They involved presidential executive orders or laws passed by Congress during the first term of President Franklin D. Roosevelt. The programs were in response to the Great Depression, and focused on what historians call the “3 Rs”: Relief, Recovery, and Reform. That is, Relief for the unemployed and poor; Recovery of the economy to normal levels; and Reform of the financial system to prevent a repeat depression.

The New Deal produced a political realignment, making the Democratic Party the majority (as well as the party that held the White House for seven out of nine Presidential terms from 1933 to 1969), with its base in liberal ideas, the white South, traditional Democrats, big city machines, and the newly empowered labor unions and ethnic minorities. The Republicans were split, with conservatives opposing the entire New Deal as an enemy of business and growth, and liberals accepting some of it and promising to make it more efficient. The realignment crystallized into the New Deal Coalition that dominated most presidential elections into the 1960s, while the opposition Conservative Coalition largely controlled Congress from 1937 to 1963. By 1936 the term “liberal” typically was used for supporters of the New Deal, and “conservative” for its opponents. From 1934 to 1938, Roosevelt was assisted in his endeavours by a “pro-spender” majority in Congress (drawn from two-party, competitive, non-machine, Progressive, and Left party districts). As noted by Alexander Hicks, “Roosevelt, backed by rare, non-Southern Democrat majorities — 270 non-Southern Democrat representatives and 71 non-Southern Democrat senators — spelled Second New Deal reform.”

Many historians distinguish between a “First New Deal” (1933–34) and a “Second New Deal” (1935–38), with the second one more liberal and more controversial. The “First New Deal” (1933–34) dealt with diverse groups, from banking and railroads to industry and farming, all of which demanded help for economic survival. The Federal Emergency Relief Administration, for instance, provided $500 million for relief operations by states and cities, while the short-lived CWA (Civil Works Administration) gave localities money to operate make-work projects in 1933-34.

The “Second New Deal” in 1935–38 included the Wagner Act to promote labor unions, the Works Progress Administration (WPA) relief program (which made the federal government by far the largest single employer in the nation), the Social Security Act, and new programs to aid tenant farmers and migrant workers. The final major items of New Deal legislation were the creation of the United States Housing Authority and Farm Security Administration, both in 1937, and the Fair Labor Standards Act of 1938, which set maximum hours and minimum wages for most categories of workers.

I do clearly Recall John F. Kennedy’s The New Frontier. There’s a popular myth that JFK didn’t accomplish that much legislatively before his death in 1963, but that’s what it is–a myth.

The term New Frontier was used by liberal Democratic presidential candidate John F. Kennedy in his acceptance speech in the 1960 United States presidential election to the Democratic National Convention at the Los Angeles Memorial Coliseum as the Democratic slogan to inspire America to support him. The phrase developed into a label for his administration’s domestic and foreign programs.

[W]e stand today on the edge of a New Frontier -— the frontier of 1960s, the frontier of unknown opportunities and perils, the frontier of unfilled hopes and unfilled dreams. … Beyond that frontier are uncharted areas of science and space, unsolved problems of peace and war, unconquered problems of ignorance and prejudice, unanswered questions of poverty and surplus.

In the words of Robert D. Marcus: “Kennedy entered office with ambitions to eradicate poverty and to raise America’s eyes to the stars through the space program”.Amongst the legislation passed by Congress during the Kennedy Administration, unemployment benefits were expanded, aid was provided to cities to improve housing and transportation, funds were allocated to continue the construction of a national highway system started under Eisenhower, a water pollution control act was passed to protect the country’s rivers and streams, and an agricultural act to raise farmers’ incomes was made law. A significant amount of anti-poverty legislation was passed by Congress, including increases in social security benefits and in the minimum wage, several housing bills, and aid to economically distressed areas. A few antirecession public works packages, together with a number of measures designed to assist farmers, were introduced. Major expansions and improvements were made in Social Security (including retirement at 62 for men), hospital construction, library services, family farm assistance and reclamation. Food stamps for low-income Americans were reintroduced, food distribution to the poor was increased, and there was an expansion in school milk and school lunch distribution. The most comprehensive farm legislation since 1938 was carried out, with expansions in rural electrification, soil conservation, crop insurance, farm credit, and marketing orders. In September 1961, the Arms Control and Disarmament Agency was established as the focal point in government for the “planning, negotiation, and execution of international disarmament and arms control agreements.” Altogether, the New Frontier witnessed the passage of a broad range of important social and economic reforms.

According to Theodore White, under John F. Kennedy, more new legislation was actually approved and passed into law than at any other time since the Thirties. When Congress recessed in the latter part of 1961, 33 out of 53 bills that Kennedy had submitted to Congress were enacted. A year later, 40 out of 54 bills that the Kennedy Administration had proposed were passed by Congress, and in 1963 35 out of 58 “must” bills were enacted. As noted by Larry O’Brien, “A myth had arisen that he (Kennedy) was uninterested in Congress, or that he “failed” with Congress. The facts, I believe, are otherwise. Kennedy’s legislative record in 1961–63 was the best of any President since Roosevelt’s first term”.

LBJ’s presidency was marred by his escalation of the war in Vietnam, but the domestic legislative accomplishments of his “Great Society” were stunning.

The aftershock of Kennedy’s assassination provided a climate for Johnson to complete the unfinished work of JFK’s New Frontier. He had eleven months before the election of 1964 to prove to American voters that he deserved a chance to be President in his own right.

Two very important pieces of legislation were passed. First, the Civil Rights Bill that JFK promised to sign was passed into law. The Civil Rights Act banned discrimination based on race and gender in employment and ending segregation in all public facilities.

Johnson also signed the omnibus ECONOMIC OPPORTUNITY ACT OF 1964. The law created the Office of Economic Opportunity aimed at attacking the roots of American poverty. A Job Corps was established to provide valuable vocational training.

Head Start, a preschool program designed to help disadvantaged students arrive at kindergarten ready to learn was put into place. The VOLUNTEERS IN SERVICE TO AMERICA (VISTA) was set up as a domestic Peace Corps. Schools in impoverished American regions would now receive volunteer teaching attention. Federal funds were sent to struggling communities to attack unemployment and illiteracy.

As he campaigned in 1964, Johnson declared a “war on poverty.” He challenged Americans to build a “Great Society” that eliminated the troubles of the poor. Johnson won a decisive victory over his archconservative Republican opponent Barry Goldwater of Arizona.

– American liberalism was at high tide under President Johnson.

– The Wilderness Protection Act saved 9.1 million acres of forestland from industrial development.

– The Elementary and Secondary Education Act provided major funding for American public schools.

– The Voting Rights Act banned literacy tests and other discriminatory methods of denying suffrage to African Americans.

– Medicare was created to offset the costs of health care for the nation’s elderly.

– The National Endowment for the Arts and Humanities used public money to fund artists and galleries.

– The Immigration Act ended discriminatory quotas based on ethnic origin.

– An Omnibus Housing Act provided funds to construct low-income housing.

– Congress tightened pollution controls with stronger Air and Water Quality Acts.

– Standards were raised for safety in consumer products.

I’m in tears right now after reading again about the accomplishments of these three great Democratic presidents. I’m in mourning today for my party and my country. For the first time, a supposedly Democratic president has proposed not only Social Security benefit cuts but also massive cuts to Medicare that will force seniors to pay higher deductibles and discourage them from buying medigap plans to cover co-pays.

I’ve known this was coming since 2007 when I read Obama’s book, The Audacity of Austerity Hope. He couldn’t have made it any clearer in the chapter on the domestic economy that he was an enthusiastic supporter of privatization and/or cuts in social programs. But although I’ve expected this for years, the reality of it has still hit me very hard. I feel both heartbroken and ashamed of President Obama.

I’ll post something else later on; but for now, please use this as a morning open thread and post your recommended links freely in the comments.

This is a sad day, but I believe Obama’s gambit will be a dismal failure. IMO he already looks foolish and ineffectual as the Republicans make hay by accusing him of trying to balance the budget on the backs of seniors. We need to understand that it is fruitless to expect him Obama stand up to the Republicans, the corporate media, or the bankers. We are on our own.

I admit, I had begun to believe that Obama had grown in office–that he had begun to realize that standing up for liberal values would serve him in good stead. But his addiction to “bipartisanship” and his fantasy of a “grand bargain” won out in the end. I still believe Romney would have been far worse, but let’s face it we still got a Republican president in 2008 and 2012. We need to fight tooth and nail to keep him from destroying the proud legacies of FDR, JFK, and LBJ.

Sooooo…. What’s on your mind today?

Did you like this post? Please share it with your friends:

- Share on Facebook (Opens in new window) Facebook

- Share on Reddit (Opens in new window) Reddit

- Share on Pinterest (Opens in new window) Pinterest

- Share on Tumblr (Opens in new window) Tumblr

- Share on Mastodon (Opens in new window) Mastodon

- Share on LinkedIn (Opens in new window) LinkedIn

- Email a link to a friend (Opens in new window) Email

- Print (Opens in new window) Print

- Share on X (Opens in new window) X

- Share on Threads (Opens in new window) Threads

- Share on Bluesky (Opens in new window) Bluesky

- More

Late Night: Chain of Fools

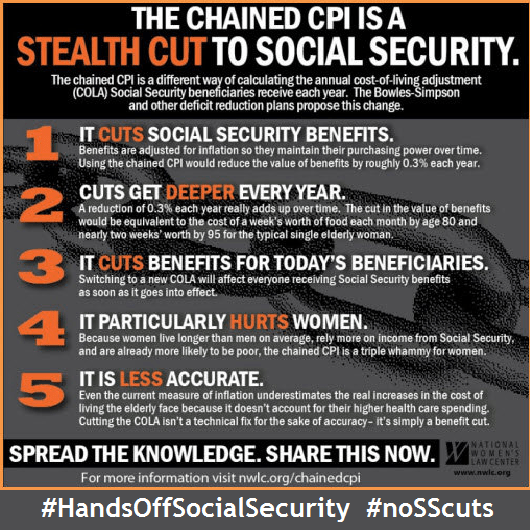

Posted: April 10, 2013 | Author: bostonboomer | Filed under: Barack Obama, Medicare, Political and Editorial Cartoons, Real Life Horror, Rick Perry, Social Security, U.S. Economy, U.S. Politics | Tags: cat food, Chained CPI, Dan Rostenkowski, middle class tax increases, social safety net | 10 CommentsThe President released his budget today, and it includes the promised benefit cuts to Social Security that the White House has tried to conceal by claiming it wants to institute a supposedly “more accurate” measure of cost-of-living, the Chained CPI. Of course at this point, anyone who is paying attention knows that the change will result in the average senior getting $1,000 less per year after 20 years. It’s a benefit cut pure and simple.

What many people don’t know yet is that switching Chained CPI will result in a significant tax increase for working poor and middle-class Americans.

Here’s your soundtrack for this post. Perhaps the great Aretha Franklin can make Obama’s budget slightly less nauseating. I’m also going to try to ease the pain with cartoons and visual aids.

Luckily, Grover Norquist and the folks at Americans for Tax Reform know darn well that Chained CPI amounts to a tax increase for people on the lower end of the income scale. This is right from their website.

The proposal in question is known as “Chained CPI.” The term is a Beltway euphemism for measuring inflation at a different, slower pace. Many tax and budget items are indexed to inflation, so slowing inflation’s measured rate of growth has both spending cut and tax increase implications.

On the tax side, all income tax brackets are subject to inflation. Slowing down the inflation rate slows down the annual rate of growth in all income tax brackets.

This means the Obama budget contains a tax increase on 100 percent of middle class taxpayers—anyone who pays the federal income tax.

Many other tax provisions—the standard deduction, the personal exemption, PEP and Pease, IRA and 401(k) contribution limits, and many others—are also tied to how CPI is measured.

Chained CPI as a stand-alone measure (that is, not paired with tax relief of equal or greater size) is a tax increase and a Taxpayer Protection Pledge violation. Various reports peg the tax increase amount as exceeding $100 billion over the next decade.

Ted Rall explains Chained CPI:

Dylan Matthews broke it all down (with charts) in a December 2012 post. Here’s the gist:

The group getting the biggest tax hike is families making between $30,000 and $40,000 a year. Their increase is almost six times that faced by millionaires. That’s because millionaires are already in the top bracket, so they’re not being pushed into higher marginal rates because of changing bracket thresholds. While a different inflation measure might mean that the cutoff between the 15 percent and 25 percent goes from $35,000 to $30,000, the threshold for the top 35 percent bracket is already low enough that all millionaires are paying it. Some of their income is taxed at higher rates because of lower thresholds down the line, but as a percentage of income that doesn’t amount to a whole lot.

All told, chained CPI raises average taxes by about 0.19 percent of income. So, taken all together, it’s basically a big (5 percent over 12 years; more, if you take a longer view) across-the-board cut in Social Security benefits paired with a 0.19 percent income surtax. You don’t hear a lot of politicians calling for the drastic slashing of Social Security benefits and an across-the-board tax increase that disproportionately hits low earners. But that’s what they’re sneakily doing when they talk about chained CPI.

That’s why watchdog groups like the Center for Budget and Policy Priorities argue that the only fair way to do chained CPI would be to pair it with an increase in Social Security benefits, and to exempt Supplemental Security Income, which provides support for impoverished elderly, disabled and blind people. Otherwise, it’s just a typical “raise taxes, cut benefits” plan, and an arguably regressive one at that.

So basically if you work for a living or depend on Social Security, you’re getting screwed coming and going.

Here’s another cartoonist’s evaluation of the situation:

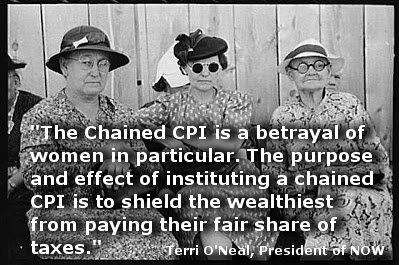

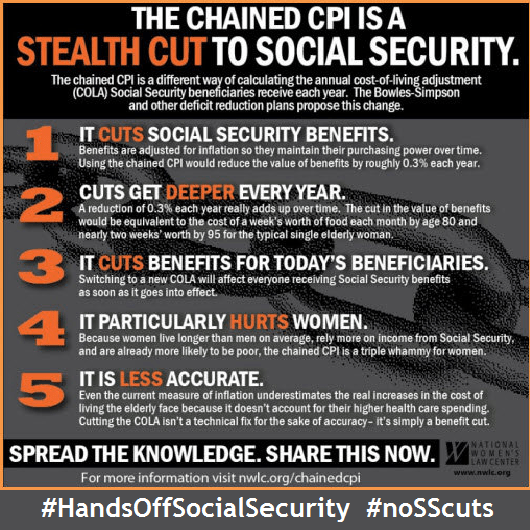

Chained CPI will disproportionately affects women, according to the AARP (3/6/2013).

The Social Security benefit cut known as Chained CPI remains a piece of the deficit puzzle for reasons that baffle conservatives, veterans, progressives, and almost everyone in between. The $85 billion in sequester cuts for 2013 have begun and many in Washington have still said they’re willing to cut the modest Social Security benefits we’ve earned by $127 billion over 10 years, even though Social Security by law remains separate from the budget and its deficit. Let’s give every woman and anyone who has or has ever had a mother, sister, daughter, grandmother, aunt or girlfriend a reason to despise this wretched proposal.

This week AARP began running ads about the impact of what the Chained CPI Social Security benefit cuts would mean to women. Below is a copy of one of those ads.

Here’s what Terri O’Neill, president of NOW had to say about women and Chained CPI.

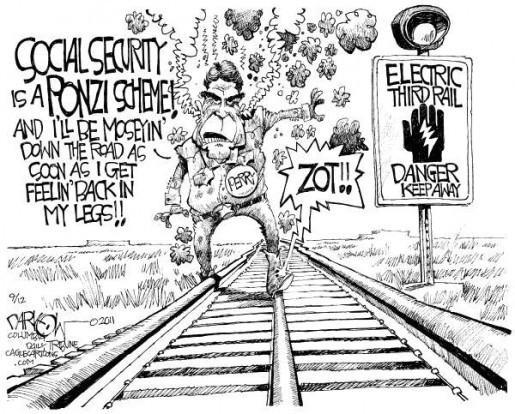

I’m sure you recall that our previous Republican President (let’s face it, Obama is a Democrat in name only) began his second term with the ambitious goal of privatizing Social Security. It didn’t end well for him. Here’s a cartoon from back then:

And another one:

That’s the kind of reaction politicians tend to get when they attack the most successful and powerful government program in history. That’s why it’s called “the third rail.” Remember in when Texas Gov. Rick Perry attacked Social Security as a “Ponzi scheme?” Look what happened to him?

Obama is already beginning to learn why politicians who step on the “third rail” end up regretting it. He’s out there on a limb all by himself. Democrats hate his budget and so do Republicans, because the vast majority of Americans like Social Security and if it’s threatened they tend to get mad–especially seniors.

Yesterday, Digby recalled what can happen “When seniors get angry …” She referred to an incident in 1989 which Democrat Dan Rostenkowski–the powerful Chairman of the Ways and Means Committee–was chased down the street by enraged seniors.

Andrea Stone told the tale at AOL News in August 2010 after the Illinois Congressman’s death: Rosty’s ‘Catastrophic’ Moment Over Health Care Was a First.

The Medicare Catastrophic Coverage Act, first unveiled by President Ronald Reagan, became law in July 1989. The measure provided seniors on Medicare with protection against catastrophic medical expenses and coverage of prescription drug costs. The benefits were to be paid for exclusively by the elderly receiving them, with high-income seniors paying an extra premium surtax.

Soon after Congress passed the law on an overwhelmingly bipartisan vote, Rosty returned to his district. It was there, after a fairly civil meeting with seniors resentful over having to pay higher taxes for coverage they either already had from a former employer or didn’t want, that he was accosted by an angry mob of Social Security recipients.

As the Chicago Tribune reported the next day, Aug. 19, 1989:

Congressman Dan Rostenkowski, one of the most powerful politicians in the United States, was booed and chased down a Chicago street Thursday morning by a group of senior citizens after he refused to talk with them about federal health insurance. Shouting “coward,” “recall” and “impeach,” about 50 people followed the chairman of the U.S. House Ways and Means Committee up Milwaukee Avenue after he left a meeting in the auditorium of the Copernicus Center, 3106 N. Milwaukee Ave., in the heart of his 8th Congressional District on the city’s Northwest Side.

Eventually, the 6-foot-4-inch Rostenkowski cut through a gas station, broke into a sprint and escaped into his car, which minutes earlier had one of the elderly protesters, Leona Kozien, draped over the hood. Kozien, one of more than 100 senior citizens who attended the gathering, said she had hoped to talk to Rostenkowski, her congressman, at the meeting.

But Rostenkowski clearly did not want to talk with her, or any of the others who had come to tell their complaints about the high cost of federal catastrophic health insurance. “These people don’t understand what the government is trying to do for them,” the 61-year-old congressman complained as he tried to outpace his pursuers.

“This was a setup,” said Jaffe, who can be seen in the video ducking into the backseat of the car. “They were standing with made-for-television signs about how he had sold them out.”

As the Tribune reported, “Kozien was soon on the hood, determinedly holding her sign only inches from the windshield. Except for the glass, she was virtually face-to-face with her congressman. ‘I was a little nervous,’ Kozien said later. ‘But I could see through the car window that he looked more afraid than I was.'”

And there is even video of the incident:

Obama is all alone out there on his limb. The only people who have his back are his apparently not-to-bright advisers. Does he really want to be remembered as the first Democratic President to tamper with Social Security? And BTW, his budget also cuts Medicare significantly. Is this really what he wants as his “legacy?” Is it really good enough to gain the applause of Wall Street and the “Very Serious People” in Washington, DC today but go down in history as a worse president than Calvin Coolidge, Herbert Hoover and George W. Bush? We shall see.

Did you like this post? Please share it with your friends:

- Share on Facebook (Opens in new window) Facebook

- Share on Reddit (Opens in new window) Reddit

- Share on Pinterest (Opens in new window) Pinterest

- Share on Tumblr (Opens in new window) Tumblr

- Share on Mastodon (Opens in new window) Mastodon

- Share on LinkedIn (Opens in new window) LinkedIn

- Email a link to a friend (Opens in new window) Email

- Print (Opens in new window) Print

- Share on X (Opens in new window) X

- Share on Threads (Opens in new window) Threads

- Share on Bluesky (Opens in new window) Bluesky

- More

Boehner Dismissively Rejects Obama Budget

Posted: April 5, 2013 | Author: bostonboomer | Filed under: Sequester, Social Security, U.S. Economy, U.S. Politics | Tags: austerity, Chained CPI, John Boehner, Obama budget | 20 CommentsHouse Speaker John Boehner immediately dismissed President Barack Obama’s package of significant new entitlement cuts tied to new tax revenues, calling them “no way to lead and move the country forward.”

The White House had portrayed the proposal, part of the budget it will release next week, as a compromise with Congressional Republicans that could have put them on track for another run at a grand bargain.

But Boehner said he will not consider new revenues as part of the deal, arguing that “modest” entitlement savings should not “be held hostage for more tax hikes.”

Politico notes that Obama has now opened himself up to attacks from both the left (such as it is) and the right. Right wing nuts hate the increased taxes on “tax-preferred retirement accounts for millionaires and billionaires”

Already, Obama’s budget proposal goes farther than many in his own party and base said they would bear by including “chained CPI,” the adjustment that would over time reduce cost-of-living increases to Social Security and other federal benefit programs — effectively, a cut to Social Security benefits by tying them to inflation….

And Obama is already facing a backlash from liberal Democrats as he has floated the chained CPI idea. Sen. Tom Harkin (D-Iowa) said Friday that any Social Security cuts are a no-go for him.

“While there are large portions of the president’s budget that I strongly support, I remain firmly opposed to the chained CPI,” Harkin said. “This policy is an unnecessary attack on Social Security, a program that by law is unable to add to the deficit.”

As I’ve repeatedly said, our only defense against Obama’s obsession with cutting social programs is the stupidity of the House Republicans.

Did you like this post? Please share it with your friends:

- Share on Facebook (Opens in new window) Facebook

- Share on Reddit (Opens in new window) Reddit

- Share on Pinterest (Opens in new window) Pinterest

- Share on Tumblr (Opens in new window) Tumblr

- Share on Mastodon (Opens in new window) Mastodon

- Share on LinkedIn (Opens in new window) LinkedIn

- Email a link to a friend (Opens in new window) Email

- Print (Opens in new window) Print

- Share on X (Opens in new window) X

- Share on Threads (Opens in new window) Threads

- Share on Bluesky (Opens in new window) Bluesky

- More

As Expected, Obama’s 2014 Budget Includes Chained CPI

Posted: April 5, 2013 | Author: bostonboomer | Filed under: Barack Obama | Tags: Chained CPI, cutting Social Security, Grand Betrayal | 55 CommentsHere we go, folks. The Associated Press (via Business Insider) reports that Obama’s New Budget Will Contain The Infamous ‘Chained CPI.’ The story is based on a anonymous leak from “an administration official.

The proposal attempts to strike a compromise with congressional Republicans on the Fiscal 2014 budget by combining the president’s demand for higher taxes with GOP insistence on reductions in entitlement programs.

The official, who spoke on a condition of anonymity to describe a budget that has yet to be released, said Obama would reduce the federal government deficit by $1.8 trillion over 10 years.

A key feature of the plan Obama is proposing for the federal budget year beginning Oct. 1 is a revised inflation adjustment called “chained CPI.” This new formula would effectively curb annual annual increases in a broad swath of government programs, but would have its biggest impact on Social Security.Obama’s budget proposal also calls for additional tax revenue, including a proposal to place limits on tax-preferred retirement accounts for wealthy taxpayers. Obama has also called for limits on tax deductions by the wealthy, a proposal that could generate about $580 billion in revenue over ten years.

The inflation adjustment would reduce federal spending over 10 years by about $130 billion, according to past White House estimates. Because it also affects how tax brackets are adjusted, it would also generate about $100 in higher taxes and affect even middle income taxpayers.

This is completely unacceptable. We should not have to rely on the stubbornness of right wing opposition to tax increases to save us from our supposedly Democratic President, but that’s the position we’re in right now. Obama has basically just put his 2011 “grand bargain” (already rejected by Boehner), put it down on paper and called it a budget.

Michael Lind at Salon writes that Obama is “making a historic mistake on Social Security.”

President Obama reportedly is unveiling a budget using the chained CPI inflation measure to cheat elderly Americans out of the benefits they were promised. In two previous posts I’ve explained the perversity of the current debate about Social Security. The tax-favored private components of America’s mixed private-public retirement system — programs like employer pensions, 401Ks and IRAs — are inefficient, volatile and subject to manipulation by overcompensated, fee-extracting money managers. In contrast, the Social Security program is simple and efficient, and has low overhead costs. And yet the bipartisan establishment, including many “progressive” Democrats as well as Republicans, wants to cut Social Security — the part that works — and expand tax-favored private savings, the inefficient, unstable and inequitable part.

While cutting Social Security makes no sense at all in terms of economics or public policy, it makes excellent sense in terms of the selfish class interests of the super-rich. They have extracted about half the gains from economic growth in the U.S. in the last half-century and recycle some of their profits to fund politicians, and lobbyists, as well as mercenary propagandists who pose as neutral think tank experts. Social Security’s contribution to the retirement income of the rich is negligible, while the top 20 percent receives around 80 percent of the income from tax-favored private retirement savings accounts like 401Ks. Naturally many of America’s oligarchs want the public discussion to be solely about cutting Social Security benefits for the bottom 80 percent, rather than 401Ks for the top 20 percent. To paraphrase Leona Helmsley, Social Security is for the little people. And if we cannot afford all of our present public-plus-private retirement system … well, as the saying in Tsarist Russia had it, let any shortage be shared among the peasants.

Elite discourse on this subject is radically at odds with public opinion. According to a February 2013 Pew poll, only 10 percent of Americans want to cut Social Security while 41 percent want to increase Social Security benefits. It’s time to change the public conversation about retirement security in America to reflect the beliefs and interests of the struggling many, not the fortunate few. We need to change the subject from cutting Social Security while subsidizing luxury retirements for the elite to cutting retirement subsidies for upper-income groups while expanding Social Security benefits for the majority of American retirees.

Please go read the whole thing and then we all need to bombard the White house with calls and e-mails.

Did you like this post? Please share it with your friends:

- Share on Facebook (Opens in new window) Facebook

- Share on Reddit (Opens in new window) Reddit

- Share on Pinterest (Opens in new window) Pinterest

- Share on Tumblr (Opens in new window) Tumblr

- Share on Mastodon (Opens in new window) Mastodon

- Share on LinkedIn (Opens in new window) LinkedIn

- Email a link to a friend (Opens in new window) Email

- Print (Opens in new window) Print

- Share on X (Opens in new window) X

- Share on Threads (Opens in new window) Threads

- Share on Bluesky (Opens in new window) Bluesky

- More

Obama Suggests He’ll Include Social Security, Medicare, and Medicaid Cuts in 2014 Budget Due in April

Posted: March 29, 2013 | Author: bostonboomer | Filed under: Medicaid, Medicare, open thread, Social Security, U.S. Economy, U.S. Politics, We are so F'd | Tags: 2014 White House budget, Chained CPI, entitlement cuts, safety net | 14 CommentsThanks to Susie Madrak and Joseph Cannon for catching this White House trial balloon–naturally floated right before a long holiday weekend. From The Wall Street Journal:

The White House is strongly considering including limits on entitlement benefits in its fiscal 2014 budget—a proposal it first offered Republicans in December. The move would be aimed in part at keeping alive bipartisan talks on a major budget deal.

Such a proposal could include steps that make many Democrats queasy, such as reductions in future Medicare, Medicaid and Social Security payments, but also items resisted by Republicans, such as higher taxes through limits on tax breaks, people close to the White House said.

These measures would come as President Barack Obama continues his courtship of the Senate GOP in an effort to thaw tax-and-spending talks. The White House’s delayed annual budget is scheduled to be released April 10, the same day Mr. Obama plans to dine with a group of Senate Republicans to discuss the budget and other issues….

People close to the White House believe a proposal to slow the growth rate of such benefits would use a variant of the Consumer Price Index to measure inflation. The new inflation indicator would cut overall spending by $130 billion, according to White House projections, and raise $100 billion in tax revenue by slowing the growth of tax brackets. The White House earlier called for an additional $800 billion or so in cuts on top of those resulting from the inflation adjustments.

“We and all of the groups engaged on this are starting to feel it may well be in the budget,” said Nancy LeaMond, executive vice president at AARP, an advocacy group for seniors that opposes such changes.

According to the WSJ article, the White House would “insist” that if cuts to safety net programs are included, the entire budget package would have to get an up or down vote. I’m not sure how they would enforce that.

From Susie’s post at Crooks and Liars:

Get your dialing fingers ready. There’s a reason they let this story out on Good Friday, they’re counting on you not noticing or being too busy to do anything about it. The White House switchboard is 202-456-1414, the comments line is 202-456-1111 (be prepared to hold) or you can email here.

Did you like this post? Please share it with your friends:

- Share on Facebook (Opens in new window) Facebook

- Share on Reddit (Opens in new window) Reddit

- Share on Pinterest (Opens in new window) Pinterest

- Share on Tumblr (Opens in new window) Tumblr

- Share on Mastodon (Opens in new window) Mastodon

- Share on LinkedIn (Opens in new window) LinkedIn

- Email a link to a friend (Opens in new window) Email

- Print (Opens in new window) Print

- Share on X (Opens in new window) X

- Share on Threads (Opens in new window) Threads

- Share on Bluesky (Opens in new window) Bluesky

- More

Recent Comments