Friday Reads: Doggie Days are Here again

Posted: August 9, 2013 Filed under: morning reads | Tags: Income Inequality, Mitch McConnell's campaign manager, presidential news conference, Reince Preibus 12 CommentsGood Morning!

It is really hot. We keep having heat warnings down here and I’m just keeping the blinds closed on the Southside of the house. It’s definitely the dog days of August and the heat must be driving some people really crazy. Here’s some headlines today while I go find another glass of ice tea.

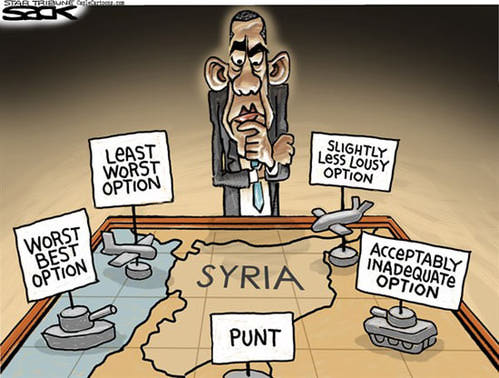

There will be a Presidential presser this afternoon.

Obama will answer reporters’ questions in the midst of a terror alert that led the government to close nearly two dozen embassies and consulates in the Middle East and North Africa.

And just this week, Obama canceled a one-on-one summit next month in Moscow with Russian President Vladimir Putin (POO’-tihn), in part because of Russia’s decision to grant asylum to National Security Agency leaker Edward Snowden.The news conference scheduled for 3 p.m. EDT also comes a day before Obama leaves Washington for a nine-day vacation on Martha’s Vineyard, Mass.

One more demographic is turning against the GOP. This time it is Senior Americans who have generally been receptive to Republican candidates.

There’s something going on with seniors: It is now strikingly clear that they have turned sharply against the GOP. This is apparent in seniors’ party affiliation and vote intention, in their views on the Republican Party and its leaders, and in their surprising positions on jobs, health care, retirement security, investment economics, and the other big issues that will likely define the 2014 midterm elections.

We first noticed a shift among seniors early in the summer of 2011, as Paul Ryan’s plan to privatize Medicare became widely known (and despised) among those at or nearing retirement. Since then, the Republican Party has come to be defined by much more than its desire to dismantle Medicare. To voters from the center right to the far left, the GOP is now defined by resistance, intolerance, intransigence, and economics that would make even the Robber Barons blush.

It seems even Mitch McConnell’s Campaign Manager doesn’t like the man. Boy, is this a story that will split your sides.

It seems even Mitch McConnell’s Campaign Manager doesn’t like the man. Boy, is this a story that will split your sides.

What does Mitch McConnell campaign manager Jesse Benton really think about working for the Mitch McConnell re-election campaign?

EconomicPolicyJournal.com has obtained a recording of a phone conversation between Dennis Fusaro and Mitch McConnell campaign manager Jesse Benton.

Fusaro has previously appeared on a phone recording with Kent Sorenson. The recording features Sorenson explaining how Ron Paul campaign’s Deputy National Campaign Manager, Demitri Kesari, met with Sorenson and his wife at a restaurant where, Sorenson says, his wife was presented and accepted a check while he was in the bathroom. The call was recorded just days after Sorenson abruptly abandoned Michele Bachmann’s campaign and publicly endorsed Ron Paul.

In the recording below, made by Fusaro on January 9, 2013, Fusaro confronts Benton about the check and asks Benton if he was aware of the payment. Benton denies knowledge but the conversation goes on and Benton begins to discuss what he is doing now.

The recording then presents Benton in his own words explaining what he thinks of his current job working as the campaign manager for the re-election campaign of Mitch McConnell, “Between you an me, I’m sorta holdin’ my nose for two years,” he says.

I generally try to stay away from the most wonky sources that are available from my dismal profession, however the Journal of Economic Perspectives usually is made up of very readable essays. Its current issue is dedicated to looking at income inequality and there’s a number of viewpoints there with accompanying analysis. Here’s one that I think you should look at.

The top 1 percent income share has more than doubled in the United States over the last 30 years, drawing much public attention in recent years. While other English-speaking countries have also experienced sharp increases in the top 1 percent income share, many high-income countries such as Japan, France, or Germany have seen much less increase in top income shares. Hence, the explanation cannot rely solely on forces common to advanced countries, such as the impact of new technologies and globalization on the supply and demand for skills. Moreover, the explanations have to accommodate the falls in top income shares earlier in the twentieth century experienced in virtually all high-income countries. We highlight four main factors. The first is the impact of tax policy, which has varied over time and differs across countries. Top tax rates have moved in the opposite direction from top income shares. The effects of top rate cuts can operate in conjunction with other mechanisms. The second factor is a richer view of the labor market, where we contrast the standard supply-side model with one where pay is determined by bargaining and the reactions to top rate cuts may lead simply to a redistribution of surplus. Indeed, top rate cuts may lead managerial energies to be diverted to increasing their remuneration at the expense of enterprise growth and employment. The third factor is capital income. Overall, private wealth (relative to income) has followed a U-shaped path over time, particularly in Europe, where inherited wealth is, in Europe if not in the United States, making a return. The fourth, little investigated, element is the correlation between earned income and capital income, which has substantially increased in recent decades in the United States.

Basically, a lot of the problems are caused by government policy. Not a great thing to think about.

Reince Preibus doesn’t want journalists to moderate the Presidential debates. He wants partisan republicans. I am not up early enough in the morning to watch Morning Joe and Mika, but after reading this, I was incredulous.

Things got chilly on Thursday’s “Morning Joe” when Reince Priebus told her that he would never ask her to moderate a Republican debate.

Priebus, the chairman of the Republican National Committee, was on the show to defend his threat to boycott NBC News during the 2016 debates over CNN and NBC’s respective projects about the former Secretary of State. Brzezinski argued that there was a difference between NBC News and the entertainment division of NBC, which is planning a miniseries about Clinton.

“My point is you expected an honest and fair conversation here even though we’re a part of NBC,” she told Priebus.

“I’m not going to have you moderate the Republican debate,” Priebus answered. When Nicole Wallace asked why not, he said, “Because you’re

not actually interested in the future of the Republican Party and our nominees. That’s not a slam on you, Mika, but I have to choose moderators that are actually interested in the Republican Party and our nominees… It’s not going to be NBC, if they continue to go forward with this miniseries.”

So, things are still crazy in politics land. No surprises there!

So, what’s on your reading and blogging list today?

Workers of the World Unite

Posted: May 2, 2013 Filed under: income inequality, worker rights | Tags: 401(k), diminishing real wage, Felix Salmon, Henry Blodgett, Income Inequality, Thomas Friedman whore 8 Comments We continue to see abuse of labor from the horrible explosions in a West, Texas chemical plant to the collapse of a building in Bangladesh. US workers continue to get the shaft when it comes to working harder and more productively for less. It is a sad trend that just keeps reaching new records. The gap between incomes going to workers and profits going to owners–mostly passive stockholders–continues unabated. This gap does not reflect a lack of labor productivity. It appears to reflect mostly the ability of capital owners to gamble themselves into strong positions. Industrialists are force to drive down costs to attract capital and to do some very short sighted things. The rush to increase ROE with no thought to other factors is a very bad omen for this country.

We continue to see abuse of labor from the horrible explosions in a West, Texas chemical plant to the collapse of a building in Bangladesh. US workers continue to get the shaft when it comes to working harder and more productively for less. It is a sad trend that just keeps reaching new records. The gap between incomes going to workers and profits going to owners–mostly passive stockholders–continues unabated. This gap does not reflect a lack of labor productivity. It appears to reflect mostly the ability of capital owners to gamble themselves into strong positions. Industrialists are force to drive down costs to attract capital and to do some very short sighted things. The rush to increase ROE with no thought to other factors is a very bad omen for this country.

Henry Blodgett provides some very depressing May Day graphs at Business Insider.

Corporate profit margins just hit another all-time high. Companies are making more per dollar of sales than they ever have before. If you’re a shareholder, that seems like good news (in the very short term, anyway). Alas, most people aren’t shareholders. And for folks whose investment horizon is longer than “this quarter” and “this year,” it’s actually bad news. Companies are under-investing in their employees and the future.

Normally, high profits are a good sign. What is disturbing is the the under-investing and the unequal increase in wages. Labor–in theory–should gain with productivity gains. This tends to stoke the growth of an economy and of a solid middle class. This trend means there is less purchasing power among the majority of households and more wage and job insecurity. This is Felix Salmon’s take.

Normally, high profits are a good sign. What is disturbing is the the under-investing and the unequal increase in wages. Labor–in theory–should gain with productivity gains. This tends to stoke the growth of an economy and of a solid middle class. This trend means there is less purchasing power among the majority of households and more wage and job insecurity. This is Felix Salmon’s take.It’s May Day, and Henry Blodget is celebrating — if that’s the right word — with three charts, of which the most germane is the one above. It shows total US wages as a proportion of total US GDP — a number which continues to hit all-time lows. Blodget also puts up the converse chart — corporate profits as a percentage of GDP. That line, you won’t be surprised to hear, is hitting new all-time highs. He’s clear about how destructive these trends are:

Low employee wages are one reason the economy is so weak: Those “wages” are represent spending power for consumers. And consumer spending is “revenue” for other companies. So the short-term corporate profit obsession is actually starving the rest of the economy of revenue growth.

In other words, we’re in a vicious cycle, where low incomes create low demand which in turn means that there’s no appetite to hire workers, who in turn become discouraged and drop out of the labor force. Blodget’s third chart is one we’re all familiar with: the employment-to-population ratio, which fell off a cliff during the Great Recession and which will probably never recover. The current “recovery” is not actually a recovery for the bottom 99%, for real people who need to live on paychecks. And today is exactly the right day to point that out.

And yet that’s Tom Friedman’s column this May Day:

If you are self-motivated, wow, this world is tailored for you. The boundaries are all gone. But if you’re not self-motivated, this world will be a challenge because the walls, ceilings and floors that protected people are also disappearing. That is what I mean when I say “it is a 401(k) world.”

This manages to be both incomprehensible and incredibly offensive at the same time. I have no idea what Friedman thinks he’s talking about when he blathers on about disappearing protective floors; I can only hope that he isn’t making a super-tasteless reference to the recent disaster in Bangladesh. But it’s simply wrong that today’s world is “tailored” for anybody who happens to be “self-motivated”. Both the self and the motivation are components of labor, not capital, and as such they’re on the losing side of the global economy, not the winning side.

Friedman is a billionaire (by marriage) who — like all billionaires these days — is convinced that he achieved his current prominent position by merit alone, rather than through luck and through the diligent application of cultural and financial capital. His paean to self-motivation recalls nothing so much as Margaret Thatcher’s “there is no such thing as society” quote: “parenting, teaching or leadership that ‘inspires’ individuals to act on their own will be the most valued of all,” he writes, bizarrely choosing to wrap his scare quotes around the word “inspires” rather than around the word “leadership”, where they belong.

True leadership, in a society where the workers are failing to be paid even half the fruits of their labor, would involve attempting to turn the red line in Blodget’s chart around, and to spread the nation’s prosperity among all its citizens. Rather than telling everybody that they’re “on their own” and that if they’re not a success then hey, they’re probably just not “self-motivated” enough.

The ultimate Friedman kick in the balls, however, doesn’t come from his lazily meritocratic priors. Rather, it comes from his overarching metaphor: the idea that if you have a 401(k) plan, then you’re somehow in charge of your own destiny. Friedman might be right that we’re living in a 401(k) world, but if he is then he’s right for the wrong reason. In Friedman’s mind, a 401(k) plan is an icon of self-determination: you get out what you put in. “Your specific contribution,” he writes, italics and all, “will define your specific benefits.”

We are learning more and more each day on how the finance industry games the kinds of investments available to you in those plans. We also know that mega corporations are getting congress to defund OSHA and any regulatory agency that watches over worker safety. Many investments are also subject to whacked performance because of excessive speculation that is encouraged by our tax laws. This has destroyed home values during the Great Recession and eaten up many folks retirement plans and savings. Frankly, it’s difficult to see how any one that relies on their sweat and has no rich family connections these days even crawls into the middle class. All of these things add up to major insecurities and risks. This is simply not the way things are supposed to work. But, it is the world that the Koch Brothers and others have carefully crafted by making politicians and pundits whores to their agenda of greed.

Pity the poor working man and woman.

Monday Morning Reads

Posted: April 15, 2013 Filed under: morning reads | Tags: child welfare, high unemployment, Income Inequality 19 Comments Good Morning!

Good Morning!

Well, today is tax avoidance day for Romney and his ilk. The rest of us have to settle with the IRS today. That’s even true for the folks that have been on unemployment for a terribly long time. There are no treasure isles for them.

There are two labor markets nowadays. There’s the market for people who have been out of work for less than six months, and the market for people who have been out of work longer. The former is working pretty normally, and the latter is horribly dysfunctional. That was the conclusion of recent research I highlighted a few months ago by Rand Ghayad, a visiting scholar at the Boston Fed and a PhD candidate in economics at Northeastern University, and William Dickens, a professor of economics at Northeastern University, that looked at Beveridge curves for different ages, industries, and education levels to see who the recovery is leaving behind.

Okay, so what is a Beveridge curve? Well, it just shows the relationship between job openings and unemployment. There should be a pretty stable relationship between the two, assuming the labor market isn’t broken. The more openings there are, the less unemployment there should be. If that isn’t true, if the Beveridge curve “shifts up” as more openings don’t translate into less unemployment, then it might be a sign of “structural” unemployment. That is, the unemployed just might not have the right skills. Now, what Ghayad and Dickens found is that the Beveridge curves look normal across all ages, industries, and education levels, as long as you haven’t been out of work for more than six months. But the curves shift up for everybody if you’ve been unemployed longer than six months. In other words, it doesn’t matter whether you’re young or old, a blue-collar or white-collar worker, or a high school or college grad; all that matters is how long you’ve been out of work.But just how bad is it for the long-term unemployed? Ghayad ran a follow-up field experiment to find out. In a new working paper, he sent out 4800 fictitious resumes to 600 job openings, with 3600 of them for fake unemployed people. Among those 3600, he varied how long they’d been out of work, how often they’d switched jobs, and whether they had any industry experience. Everything else was kept constant. The mocked-up resumes were all male, all had randomly-selected (and racially ambiguous) names, and all had similar education backgrounds. The question was which of them would get callbacks

It turns out long-term unemployment is much scarier than you could possibly imagine.

So, if you have to write a check to the Feds, remember, your money is going to subsidize huge corporations while we rank near the bottom of the list on Child Welfare.

The United States ranked in the bottom four of a United Nations report on child well-being. Among 29 countries, America landed second from the bottom in child poverty and held a similarly dismal position when it came to “child life satisfaction.”

Keeping the U.S. company at the bottom of the report, which gauged material well-being, overall health, access to housing and education, were Lithuania, Latvia and Romania, three of the poorest countries in the survey.

UNICEF said in a statement on the survey that child poverty in countries like the U.S. “is not inevitable but is policy-susceptible” and that there isn’t necessarily a strong relationship between per capita GDP and overall child well-being, explaining: “The Czech Republic is ranked higher than Austria, Slovenia higher than Canada, and Portugal higher than the United States.”

The Netherlands ranked number one on the list, with Norway, Iceland, Finland and Sweden filling out the top five.

But don’t feel too discouraged, fellow Americans! As the International Business Times notes, the U.S. has managed to take first place in plenty of other surveys conducted by global organizations:

The United States is No. 1 on many other lists: It spends more on the military than the next 12 nations on the list combined; it’s the best in the world at imprisoning people; and it has the most obese people, the highest divorce rate, and the highest rate of both illicit and prescription drug use.

Kinda makes you all kinds of proud and patriotic, doesn’t it? Bill Moyers puts it this way: “We Are Living in the United States of Inequality.”

“A petty, narcissistic, pridefully ignorant politics has come to dominate and paralyze our government,” says Moyers, “while millions of people keep falling through the gaping hole that has turned us into the United States of Inequality.”

Inequality matters. You will hear people say it doesn’t, but they are usually so high up the ladder they can’t even see those at the bottom. The distance between the first and the least in America is vast and growing.

The Washington Post recently took a look at two counties in Florida and found that people who live in the more affluent St. Johns County live longer than those who live next door in less rich Putnam County. The Post concluded: “The widening gap in life expectancy between these two adjacent Florida counties reflects perhaps the starkest outcome of the nation’s growing economic inequality: Even as the nation’s life expectancy has marched steadily upward…a growing body of research shows that those gains are going mostly to those at the upper end of the income ladder.”

That’s true across America. In California’s Silicon Valley, Apple, Facebook and Google, among others, have reinvented the Gold Rush. But down the road in San Jose it’s not so pretty a picture. Do the math: in an area where one fourth of the population earn an average of about $19,000 dollars a year, rent alone can average more than $20,000 dollars a year, and that difference adds up to homelessness.

I keep writing about all these things with the goal of trying to explain why our stupid ass political leaders are still obsessed with some phantom  menace of a federal budget deficit and debt. Joblessness, children living in poverty, the lack of retirement saving by people closing in our retirement, and all kinds of other things are problems. Why are they obsessed with something that isn’t an issue? The deal is that I cannot come up with one, sane rational, explanation. Here’s one Democratic Representative saying the entire thing is crazy. I agree with him.

menace of a federal budget deficit and debt. Joblessness, children living in poverty, the lack of retirement saving by people closing in our retirement, and all kinds of other things are problems. Why are they obsessed with something that isn’t an issue? The deal is that I cannot come up with one, sane rational, explanation. Here’s one Democratic Representative saying the entire thing is crazy. I agree with him.

Democratic Rep. Jerrold Nadler of New York took aim at the conventional wisdom on Sunday morning, saying the government was cutting the federal deficit too quickly.

His comments came during a MSNBC panel discussion about President Barack Obama’s budget plan.

“If you look at the deficit, we brought it down in three years from 10.1 percent of GDP to 7.1 percent of GDP — this year it will be about five and a half,” he explained in the latter half of the segment. “That’s the largest deficit reduction — fastest — since the demobilization after World War II. It is too fast. It is having an inhibiting effect on economic growth and employment.”

Nadler said the deficit should only be addressed once the country had solved its unemployment problem.

“Our immediate problem is an economy which is going to stay at 7.6 percent unemployment indefinitely,” he remarked. “Already, we have a contractionary fiscal policy that is inhibiting the economy. We should, from an economic point of view, be increasing the deficit right now somewhat.”

The New York congressman said Obama caved to Republican talking points about reducing the federal deficit in his latest budget. The budget would reduce the deficit by $1.8 trillion over 10 years by raising taxes on the rich and cutting Social Security benefits, among other measures.

I certainly hope more congressional critters will speak up on this. Economists have been saying this for quite a few years and no one listens to us. Here’s some more information on this from Investor’s Business Daily.

Read the rest of this entry »

Recent Comments