Mankiw’s Introductory Econ Class stages a Walk Out

Posted: November 3, 2011 Filed under: #Occupy and We are the 99 percent!, Economy, education | Tags: Greg Mankiw, Harvard, JM Keynes, Walk out 11 CommentsThis has to be one of the most intriguing situations that I’ve heard about for some time. Any one that teaches knows that student evaluations really count for people that aren’t tenured and don’t have some kind of research status that makes them immune to student complaints. Administrators pay attention to them a lot more than they probably should. I’ve had raises parsed out based on the 4th decimal place of department averages. I always used to wonder about the one question where freshmen students get to judge whether or not you know your subject area. I mean, how would they be in a place to know that if they’ve never had any exposure to a technical, complex topic before? There are sometimes very useful things you can learn from students. I’m wondering what the real lesson should be from a walk out associated with a political movement.

I’ve occasionally had students complain to me about other professors either personally or on my evals. It puts you in an awkward position. I’ve never seen it raise to this level in all the years I’ve been teaching in a variety of colleges and universities. The roots of the walk out were in the Occupy Movement. The contents of the letter explain the motivation directed at Harvard Professor Greg Mankiw published in the Harvard Political Review.

Greg Mankiw has his own blog as well as having published his own textbooks for introductory economics. I’ve never used them but I’ve looked at them during textbook searches. It’s fairly standard treatment of the subject. Mankiw was Chair of the Council of Economic Advisers under Dubya Bush. He’s been an adviser to Mitt Romney. He also has a lot of clout if you look at his cites and pubs at IDEAS/RePEc rankings. The funny thing is that he’s actually considered a “New Keynesian” economist. Here’s a quote from an article he wrote in the NYT in 2008. I quote this to show you he’s not really that atypical of a macroeconomist. He shows up in fairly mainstream, traditional Republican circles.

“If you were going to turn to only one economist to understand the problems facing the economy, there is little doubt that the economist would be John Maynard Keynes. Although Keynes died more than a half-century ago, his diagnosis of recessions and depressions remains the foundation of modern macroeconomics. His insights go a long way toward explaining the challenges we now confront.”

The students complain that Mankiw has an inherent bias. There should be no surprise you frequently hear that from students who come in wanting their own biases reinforced. I personally try to challenge my students from all sides of the political system just to try to get them to think critically rather than on automatic. I have no personal experience of Mankiw’s classes so I have no idea if their complaints are legitimate or not.

As Harvard undergraduates, we enrolled in Economics 10 hoping to gain a broad and introductory foundation of economic theory that would assist us in our various intellectual pursuits and diverse disciplines, which range from Economics, to Government, to Environmental Sciences and Public Policy, and beyond. Instead, we found a course that espouses a specific—and limited—view of economics that we believe perpetuates problematic and inefficient systems of economic inequality in our society today.

A legitimate academic study of economics must include a critical discussion of both the benefits and flaws of different economic simplifying models. As your class does not include primary sources and rarely features articles from academic journals, we have very little access to alternative approaches to economics. There is no justification for presenting Adam Smith’s economic theories as more fundamental or basic than, for example, Keynesian theory.

Care in presenting an unbiased perspective on economics is particularly important for an introductory course of 700 students that nominally provides a sound foundation for further study in economics. Many Harvard students do not have the ability to opt out of Economics 10. This class is required for Economics and Environmental Science and Public Policy concentrators, while Social Studies concentrators must take an introductory economics course—and the only other eligible class, Professor Steven Margolin’s class Critical Perspectives on Economics, is only offered every other year (and not this year). Many other students simply desire an analytic understanding of economics as part of a quality liberal arts education. Furthermore, Economics 10 makes it difficult for subsequent economics courses to teach effectively as it offers only one heavily skewed perspective rather than a solid grounding on which other courses can expand. Students should not be expected to avoid this class—or the whole discipline of economics—as a method of expressing discontent.

Supposedly, about 70 of the 700 students walked out. I really haven’t read anything about the walk out from other blogging economists. I think it’s because every one pretty much feels a certain amount of empathy for a colleague. Also, there is such a thing as academic freedom. I do, however, find it strange that the complaints say that Mankiw spends too much time on Adam Smith as compared to J.M Keynes given his research agenda and his writings. I’d like to offer up this WSJ Book Review of a Keynes Biography to illustrate why I’m a bit confused.

But mathematics is, fundamentally, the language of logic. Modern research into Keynes’s theories—I have conducted such research myself—tries to put his ideas into mathematical form precisely to figure out whether they logically cohere. It turns out that the task is not easy.

Keynesian theory is based in part on the premise that wages and prices do not adjust to levels that ensure full employment. But if recessions and depressions are as costly as they seem to be, why don’t firms have sufficient incentive to adjust wages and prices quickly, to restore equilibrium? This is a classic question of macroeconomics that, despite much hard work, is yet to be fully resolved.

Which brings us to a third group of macroeconomists: those who fall into neither the pro- nor the anti-Keynes camp. I count myself among the ambivalent. We credit both sides with making legitimate points, yet we watch with incredulity as the combatants take their enthusiasm or detestation too far. Keynes was a creative thinker and keen observer of economic events, but he left us with more hard questions than compelling answers.

So, my guess about the situation and the lack of comments of blogging economists on this is along the lines of students will be students. Mankiw is clearly no Austrian economist which is one school of thought that every one walked out on years ago but is experiencing a resurgence because of Koch Brothers’ investment. I think he’s gotten tagged because of the folks he’s advised. Again, these are guys are old school Republicans and not part of the Tea Party insurgence. Dubya actually did implement some fairly traditional Keynesian stimulus in his response to the 9/11 macro shock. The political discourse has gotten so harsh and has been so narrowly covered by the press that it must be harder for younger people not to think that every Republican and their advisers is off the Richter scale of reason. I guess that’s my way of saying that calling Mankiw an out of the mainstream economist makes about as much sense as calling Obama a Kenyan-born socialist. The claims oversimplify Mankiw, Adam Smith, and J.M Keynes. But, we are talking freshmen and not doctoral candidates. I think this reflects the anger in the current national discourse a lot more than it reflects anything else. I’m just wondering if any of Mankiw’s peers on either side of the neoKeynesian battle lines will speak up.

In a way, this reminds me of the article I read about 5 days ago on Thomas Sargent in the NYT. Sargent was lauded as a ‘non-Keynesian” in a WSJ article covering his win of the Nobel prize in economics this year.

In telephone conversations last week, Professor Sargent said he felt insulted by people who call him “non-Keynesian” or “right wing,” terms that, he said, are based on a misunderstanding of his thinking. And he rejected attempts to categorize his views in simple slogans.

He doesn’t wear his political opinions on his sleeve. “They really don’t matter in my research,” he said. But because others have applied labels to him, he decided it was worth setting the record straight. He’s a Democrat, he said, “a fiscally conservative, socially liberal Democrat,” adding, “I think that budget constraints are really central.”

It’s important to consider the “incentive effects” of government policies, he continued. “There are trade-offs in efficiency and equality, and they lead to choices that aren’t easy,” he said.

This sort’ve lends itself to the traditional economist jokes where the punchline always has something to do with “on the one hand, on the other hand”. I kind’ve liked the opening paragraph on that article and so I’m going to borrow it as I start the close to this blog piece.

EXPRESSING your own views is challenging enough. Describing someone else’s opinions without talking to them first opens the door to serious trouble

I once did an experiment in a few class rooms just to see if any of them could guess my party affiliation. I got your basic 50-50 split between those who thought I was a Republican and Democrat. I will usually step up and answer a direct question on policy with my opinion if I’m asked for it. Usually, I will play the role of devil’s advocate just to get student’s to question their thought process more. I did express constant surprise this summer that a huge number of politicians seemed to feel that it was okay to default on US debt. That’s basically because I was teaching a graduate finance course and the basic risk free rate for every model is generally presumed to be one US Treasury rate or another. I asterisked my explanations for the first time ever with an explanation that this might be the first year ever where we have to find another empirical example for a risk free rate if the debt ceiling extension doesn’t pass. I did get called out as having a ‘bias’ for this in one eval. Given the way that many Republicans considered US default a reasonable policy, I suppose I had to have at least one person show up that considered my asterisked explanations to be a bias. So, let’s just say on some level, I can relate to Greg Mankiw even though if you put the two of us in one room there would undoubtedly be a lot of things we don’t see eye-to-eye on.

So, what do you think? Just politics? Just students being students?

Student Loans: Bubble, Bubble, Toil & Trouble

Posted: October 19, 2011 Filed under: education, unemployment | Tags: Sallie Mae, student loan bubble, student loans 15 Comments I laughed pretty loudly when I opened an email from the university to my faculty account explaining how wonderful the increased retention numbers were looking! Our new funding formula from extortionist governor Bobby Jindal depends on graduating and retaining students. I guess they don’t have economists in that section of administration. Just look at the unemployment rate for the typical student population (16-24 year olds) and the decreasing labor force participation rate from August, 2011. You’ll see exactly what’s going on. Got no job? Where do you go to find money and hopefully place yourself higher up on the meat market ladder if businesses ever go back to hiring?

I laughed pretty loudly when I opened an email from the university to my faculty account explaining how wonderful the increased retention numbers were looking! Our new funding formula from extortionist governor Bobby Jindal depends on graduating and retaining students. I guess they don’t have economists in that section of administration. Just look at the unemployment rate for the typical student population (16-24 year olds) and the decreasing labor force participation rate from August, 2011. You’ll see exactly what’s going on. Got no job? Where do you go to find money and hopefully place yourself higher up on the meat market ladder if businesses ever go back to hiring?

The number of unemployed youth in July 2011 was 4.1 million, down from 4.4 million a year ago. The youth unemployment rate declined by 1.0 percentage point over the year to 18.1 percent in July 2011, after hitting a record high for July in 2010. Among major demographic groups, unemployment rates were lower than a year earlier for young men (18.3 percent) and Asians (15.3 percent), while jobless rates were little changed for young women (17.8 percent), whites (15.9 percent), blacks (31.0 percent), and Hispanics (20.1 percent).

So, we’ve got the biggest numbers of young people since the baby boom with parents whose employment situation is not great and whose assets and real incomes have taken a major hit over the last ten years. We’ve got kids that can’t even find the usual kid jobs. What are they going to do but go for those student loans and hang at university as long as possible? This brings me to the next big bubble phenomenon–Student Loans–plus the next GSE that’s going to be seeing default rates sky rocket. That would be Sallie Mae.

The $1 trillion of outstanding loans means that Americans now owe more on student loans than on their credit cards. While students have been racking up educational loans, American consumers have been paying down credit cards and home loans.

The average full-time undergraduate student borrowed $4,963 in 2010, up 63 percent from a decade earlier, even after adjusting for inflation, the report says.

Meanwhile, with a greater loan burden, the percentage of borrowers that defaulted on their student debts also rose – from 6.7 percent in 2007 to 8.8 percent in 2009.

That gives a lot of credence to the argument that the next big bubble will be in student loans. Here’s an investor’s view point from seeking alpha from back in July. Should we all start hedge funds and short student loans? Well, for one thing. You can short sell for profit university’s stocks who thrive on churning loans and assume Sallie Mae will be a goner just like its buddies Fannie and Freddie. Dump their bonds and short them!

With the current state of the job market, many if not most of these unfortunate borrowers will not be able to pay off their debt with a lower than expected income. This trend is showing itself through increasing default rates of student loans. Three-year default rates have risen from 11.8% for loans issued in 2007 to 13.8% issued in 2008 (most recent data available). Meanwhile, the fundamental factors driving these defaults have not changed since.

Historically, investors have not worried about the default of these securities because of their explicit government guarantees through FFELP. In addition to this, student loans are the only debt that cannot be forgiven through bankruptcy. Student loan collectors have gone to the extent of garnishing wages and racking up penalties that can double the borrower’s debt in the name of “forgiveness” to maintain a return for bondholders.

This story sounds similar to housing: If the borrowers fail to pay, lenders seize the asset (house for a mortgage, garnished wages for student loans). The story will end the same way, as students lack the income to maintain their living expenses plus the debt or even just the interest payments if they are unemployed. The other option that students will begin to take more is moving abroad to avoid collectors. Financial distress will make it practical to exile oneself to avoid a lifetime of debt slavery. The combination of lower incomes for college grads and expatriation will increase the default rate to even high levels than current record rates.

So how do investors go about shorting the bubble in higher education? Ideally, the best way would be to buy credit default swaps on student loan asset-backed securities, which have a similar construction to the mortgage-backed securities that caused the last financial crisis. However, this strategy is not available to most readers. Average investors are better off short-selling the leading providers of student loans or for-profit universities, which have some of the highest default rates of student loans for any academic institution.

The leading student loan provider in the United States in the Sallie Mae corporation (SLM). It was launched as a government-sponsored enterprise (since privatized) similar to Freddie Mac and Fannie Mae; it currently services and manages $180.4 billion of government-backed student loan debt. It’s also begun to issue private student loans as well. With a debt to equity ratio of 36, Sallie Mae is already on the edge of insolvency. A small drop in collections can amount to significantly levered losses to the company. If the student loan default rate increases to 20%, Sallie Mae will most likely not be able to survive. The continuing upward trend of student loan defaults will lead to either insolvency of Sallie Mae or a government takeover — which will both wipe out shareholders.

Above the Law even asked if there was any one out there left that even believed that this wasn’t a disaster waiting to happen. How’s this for harsh?

The problem is that our colleges and universities are charging a $100,000 to pump out the next generation of dog walkers. Sure, part of the fault lies with the people themselves; parents who let their 18-year-old children borrow a ton of money to go to an expensive private university to major in art history are no better than strung out crack mothers.

But the dean who sits there and says, “come study comparative literary criticism for the low, low price of $40,000 per year,” is the price-gouging drug dealer. These deans are pushing a product at a price point that they know is dangerous for most of their consumers.

This is what worries me. This is also from Above the Law and it mentions just how married you and yours going to be to that student loan. Not only that, but graduate students will have a much bigger balances to pay in the future thanks to an Obama sell-out on the deficit. Talk about setting people up for loan failure. Why not just pump the least able to pay for more money?

In the total debt ceiling cave-in that will mark Barack Obama as the most successful Republican president since Ronald Reagan, there was one cut that really illustrates how little the president cares for his young, college-educated constituents. To save about $26.3 billion dollars, the debt ceiling deal eliminates the graduate student loan subsidy. That means that law students (and other grad students) will continue accruing interest on their non-dischargeable educational loans throughout their graduate studies.

I can see why they call education the “silver bullet,” because education certainly seems like a surefire way to kill one’s economic future….

The graduate loan cut wasn’t the most ridiculous so-called compromise Obama made while John Boehner was pumping him like Richie Aprile did to Janice Soprano. But it is illustrative of the extent to which Obama has abandoned the young people who helped elect him so that he can court… well, I don’t know exactly what universe he lives in where he thinks a black Republican running as a pro-war Democrat wins a general election

Meanwhile back on the Planet of anecdotal evidence, we get these examples. Ask me about Doctor Daughter’s student loan debt or mine, for that matter. I got two degrees in the late 70’s and early 80s by working and that was it. I just couldn’t swing it this time. I now have student loan debt that would’ve bought me a Mercedes and I’m jobless and on the jobfree labor market. Sallie Mae’s like a loan shark too. They’re worse to deal with than the bookies in my neighborhood.

“I have ~$75k in student loans. I will default soon. My cosigner, my father, will be forced to take my loans. He will default as well. I’ve ruined my family because I tried to rise above my class,” writes one testimonial on the 99 percent website on Wednesday.

The 99 percent website is one of the places where the Occupy Wall Street movement first got its inspiration from.

“I am a young medical professional who BARELY makes it paycheck-to-paycheck because I have OVER $200,000.00 in student loan debt,” says another testimonial on the website Tuesday. “I pay almost $1,000 a month just in student loan repayment. I will have to do so for the next 30-years. How will I ever afford to buy a house, have children, or save for the future?”

ADHD Awareness Week: Oct. 16-22

Posted: October 16, 2011 Filed under: education, just because, psychology | Tags: ADHD, Attention Deficit Hyperactivity Disorder, brain imaging, language development, literacy, narrative, private speech 31 CommentsThis week is ADHD Awareness Week. I’ve been thinking about what I’ve learned about this developmental disorder over the past decade or so; and I thought I’d share some of it with you.

I used to be somewhat skeptical about the existence of Attention Deficit Hyperactivity Disorder (ADHD). After all, this supposed disorder didn’t exist when I was a kid, as far as I knew. (It turns out the behavior patterns associated with ADHD were observed as early as the 1790s). It seemed to me a bad idea to give children speed, which is basically what the stimulant drugs used to treat ADHD are.

When I went back to college to study psychology, I became friends with another student who had the diagnosis. Interacting with this young man and observing his behavior convinced me that ADHD really does exist.

My friend (I’ll call him “Bill”) had difficulty paying attention in class and sometimes he would stare out the window for long periods of time. He had trouble concentrating on writing assignments, because he was easily distracted. Paradoxically, Bill could focus his attention for long periods of time on something he found very interesting, like using the computer, playing music, or running. Those are common symptoms of ADHD.

People with ADHD tend to be impulsive–they may do or say things without thinking about the consequences, and this can lead to problems with other people.

I saw Bill get into trouble in his personal relationships again and again. He would make appointments to spend time with someone, forgetting that he had already made an appointment with another person–sometimes even two or three other people–for the same day and time. He often had to call people and cancel plans because of this. Most of the time, friends were understanding, but Bill ran into trouble when he made these mistakes in interactions with professors and other people he wanted to impress.

Although I liked Bill very much, I admit that I tired of hearing about his constant scheduling mixups, and about people who were angry with him about them. He wasn’t always easy to be friends with.

Something else I noticed in my interactions with my friend Bill was that he often used language in unusual and interesting ways. He sometimes had difficulty finding the right word and would make up words or describe emotions and behavior in unexpected ways. It’s possible that Bill had some kind language disorder in addition to ADHD, but he told me that he could often recognize fellow sufferers by the way they used words. I came to believe that Bill thought about things from a different perspective than most people, and I found that aspect of his ADHD somewhat charming.

As an undergraduate, I became fascinated with children’s language development; and I went on to specialize in that field in graduate school. One of the papers I wrote in order to qualify as a Ph.D. candidate was about ADHD and two aspects of language development: private speech and narrative (storytelling).

Private speech is self talk that young children use to support their play and other activities. They speak out loud to themselves, describing what they are doing or working out problems as they go along. Here’s an example:

A number of researchers have found that children with ADHD use more private speech and use it for about 3 years longer than typically developing children, who have generally stopped talking out loud to themselves by age 7 or 8. Children with ADHD may continue to do so until age 11 or so. The assumption is that children with ADHD use private speech more than other children because it helps them stay focused on tasks.

My main focus in graduate school was on children’s narrative development–basically the way children develop the skills used in telling stories. Narrative skills are used in forming autobiographical memories as well as in structuring reality and understanding the world around us. They are also an important facet of early literacy and an important predictor of how well children will perform academically. Children with ADHD tend to tell stories that are more poorly organized and less cohesive than those told by typically developing children.

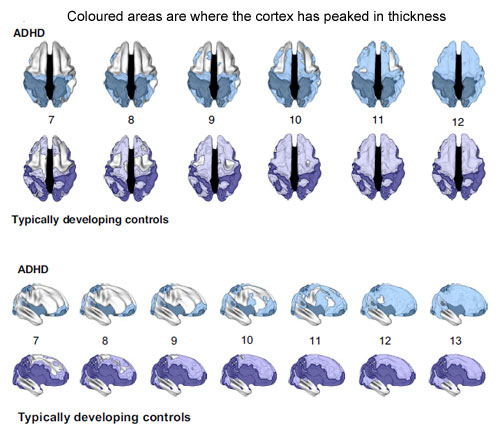

So there are a couple of concrete examples of differences in language abilities between children with ADHD and typically developing children. In recent years there have also been brain imaging students that demonstrate that the brains of children with ADHD develop more slowly in some ways than the brains of typically developing children. Here’s one example:

Philip Shaw, Judith Rapaport and others from the National Institute of Mental Health have found new evidence [that]….When some parts of the brain stick to their normal timetable for development, while others lag behind, ADHD is the result….they used magnetic resonance imaging to measure the brains of 447 children of different ages, often at more than one point in time.

At over 40,000 parts of the brain, they noted the thickness of the child’s cerebral cortex, the brain’s outer layer, where its most complex functions like memory, language and consciousness are thought to lie….

In both groups of children, parts of the cortex peaked in terms of thickness in the same order, with waves of maturity spreading from the edges to the centre….[but] the brains of ADHD children matured about three years later than those of their peers. Half of their cortex has reached their maximum thickness at age 10 and a half, while those of children without ADHD did so at age 7 and a half[.]

Isn’t it interesting that children with ADHD tend to lag behind in brain development by about three years–about the same length of time they continue to using private speech after typically developing children have stopped?

Here’s another blog entry on a different study of brain development in children with ADHD. This study found that children with ADHD had smaller caudate nuclei than typically developing children. This was a small study of 26 5-year-olds.

The basal ganglia (or basal nuclei) are the parts of the brain involved with voluntary motion and some forms procedural learning (development of a motor skill through practice, such as playing a musical instrument). The caudate nucleus specifically functions in learning and memory; it tells the cortex (the area of our brain where higher reasoning occurs) to do something based on current conditions. Importantly, the caudate nucleus controls motor skills partly through inhibition of particular behaviors, and disinhibition of others; an overactive caudate nucleus may be implicated in obsessive-compulsive disorder.

Smaller caudate nuclei had been documented before in older children with ADHD, but not before in children so young. The authors point out that previous studies have not been able to sort out what comes first: changes in brain structure or the behavior, which is part of the motivation of looking at younger children.

Just in time for ADHD Awareness Week, new guidelines have been released for the treatment of ADHD in children as young as 4. I must admit I find that a bit troubling. I hate to see kids get labeled as having a psychological disorder before they even start kindergarten. From the Wall Street Journal:

Attention deficit hyperactivity disorder can be diagnosed in children as young as age four, according to new treatment guidelines by the American Academy of Pediatrics.

The guidelines, released Sunday at the academy’s annual meeting in Boston, provide instructions for pediatricians on diagnosing and managing ADHD in children four to 18. They say behavioral management techniques should be the first treatment approach for preschool-age children.

But they also suggest doctors consider prescribing methylphenidate, commonly known by the brand name Ritalin, in preschool-age children with moderate to severe symptoms when behavior interventions don’t provide significant improvement. It’s a potentially controversial recommendation, because these medicines aren’t approved by the Food and Drug Administration for use in that age group.

I’m not an expert on ADHD, but I am recovering addict, and I worry about children so young being given powerful mind-altering drugs. My friend “Bill” had been prescribed Ritalin as a child, and he felt that using the drug had resulted in his abusing cocaine and alcohol as a young adult.

Generally speaking, I’d like to see doctors, teachers, and parents use behavioral solutions for ADHD symptoms, rather than drugs. At the same time, I know that psychoactive drugs have been extremely helpful to me in dealing with severe depression. There are times when drugs are a good solution, but only in concert with therapy and self-awareness.

Again, I haven’t had a great deal of practical experience with ADHD. I’d be interested in hearing from anyone here who has. All-in-all, I think it’s a good thing that developmental disorders are recognized now more than when I was a kid. I can only assume that some kids fell through the cracks back then, while now kids with these problems get attention and treatment–however flawed it may be.

Recent Comments