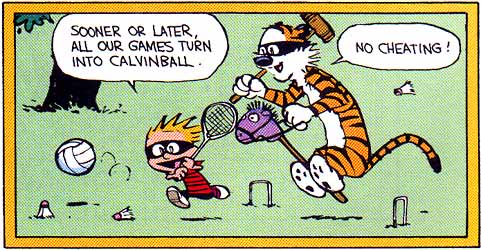

Super Committee Calvin Ball

Posted: November 20, 2011 Filed under: #Occupy and We are the 99 percent!, Catfood Commission, Federal Budget, Federal Budget and Budget deficit | Tags: Budget Deficit, Extension of Bush Tax Cuts., supercommittee 15 CommentsRepublicans are insistent that the Bush Tax cuts be made permanent. With that stroke of lunacy, we have the imminent and predictable meltdown of the super committee.  So, what happens when the minority party doesn’t get it’s way on everything? It either holds the economy hostage or changes the rule. Republicans in Congress are playing Calvin Ball to avoid the cuts that super committee failure is supposed to bring to the defense budget. They’re changing their own rules, yet again.

So, what happens when the minority party doesn’t get it’s way on everything? It either holds the economy hostage or changes the rule. Republicans in Congress are playing Calvin Ball to avoid the cuts that super committee failure is supposed to bring to the defense budget. They’re changing their own rules, yet again.

Plus, we’re getting another contradictory argument on taxes. Let the Bush tax cuts expire is “raising taxes”. Letting the payroll tax holiday expire is not raising taxes. How do these folks get through the day without a complete synaptic breakdown? Here’s some details from Reuters. The Murray quoted here is Senator Patty Murray from Washington State.

Murray said Republicans want to extend tax cuts that lowered individual rates — reductions that originated under former Republican President George W. Bush. Those tax cuts run out at the end of 2012.

Republicans have pushed for a permanent extension. Democrats want the tax cuts for the rich to expire.

“In Washington, there are folks who will not cut a dollar unless we raise taxes,” said Kyl, sparking an exasperated reaction from Kerry who noted that Congress has cut about $1 trillion from the budget without any tax hikes.

Republicans want Democrats to agree to do more to find long-term savings in the growing costs of government retirement and healthcare programs.

If no deal is reached by a simple majority of the super committee, automatic spending cuts would start in 2013 — two months after presidential and congressional elections.

Those cuts would be evenly divided between domestic and defense programs. Some Republican members of Congress already are talking about dismantling the automatic cuts to protect the Defense Department from deep reductions.

No serious discussion on deficits can occur without ending the Bush Tax cuts and seriously putting the Pentagon budget on the table. Representatives of the super committe were out full force on the Sunday Morning Talk Show. John Avlon at The Daily Beast points to the political posturing that’s likely still the root of the entire problem. No Republican is willing to compromise any more. Democrats and the President continue to grant many concessions on social programs that leave little left for continuing battle. No where is this more noticeable when the congress passed the old John Chaffee/Bob Dole Republican Health plan under the guise of ObamaCare. The contentious mandate originally came from the Republican side of the aisle from the American Heritage Institute. The twist of facts into partisan narratives has never been worse.

But pervasive hyperpartisan positional bargaining seems to have carried the day. Pessimism has clouded late-inning negotiations. Supercommittee Democrats have offered to put entitlement reforms on the table, but offered few specifics. Republicans have offered limited revenue increases, but tied those to the cutting the top tax rate to 28 percent from 35 percent and permanently extending the contentious Bush tax cuts. Distrust and brinksmanship pollutes the process.

Ironically, but perhaps appropriately, the dysfunctional debate seems to be based around what the term “fair and balanced” actually means.

For Democrats it means a 1-to-1 ratio of tax hikes to spending cuts. For bipartisan groups like the Gang of Six and Bowles Simpson, it means a 3-to-1 ratio. But for too many Republicans, “fair and balanced” means no tax revenues raised at all—a handful of loopholes closed as concessions, like $3 billion from private jets, and the rest collected from spending cuts. The basic dynamic of both sides being willing to slaughter sacred cows is missing despite an avalanche of “more bipartisan than thou” press releases.

The core problem comes from antitax pledges that have dislodged the basic nature of balance sheets in the collective conservative mind—it is all spending, no revenue. Fiscal responsibility has been replaced by fiscal conservatism. Reducing the deficits and debts is no longer the overriding goal, despite Tea Party rhetoric about generational theft or even the balanced-budget-amendment attempt this past week. Instead, keeping tax cuts in place is the one true grail—ignoring the overwhelming popularity of provisions like raising the top rate on people making more than a million dollars a year.

Sane people continue to ask what type of Svengali powers the insane Grover Norquist holds over Republicans? If you want to learn about “The Billionaire’s Best Friend”  who “hijacked the Republican party on behalf of the rich”, go no further than TIm Dickinson’s article in this month’s Rolling Stone. This man continues to hold sway over the Republican congress critterz despite overwhelming public polls that show even Republicans and Independent rank and file don’t support his agenda. Norquest comes from two Republican institutions. He was originally in the Chamber of Commerce which is one organization that has no problem seeing lies and half baked arguments printed in newspapers around the country. Ronald Reagan used him to push his tax reform measures. It’s been one power grab after another backed by nothing more than dogma and a huge budget since then.

who “hijacked the Republican party on behalf of the rich”, go no further than TIm Dickinson’s article in this month’s Rolling Stone. This man continues to hold sway over the Republican congress critterz despite overwhelming public polls that show even Republicans and Independent rank and file don’t support his agenda. Norquest comes from two Republican institutions. He was originally in the Chamber of Commerce which is one organization that has no problem seeing lies and half baked arguments printed in newspapers around the country. Ronald Reagan used him to push his tax reform measures. It’s been one power grab after another backed by nothing more than dogma and a huge budget since then.

Over the past 25 years, Norquist has received funding from many of America’s wealthiest corporations, including Philip Morris, Pfizer and Microsoft. To build a farm team of anti-tax conservatives, Norquist shrewdly took the pledge to state legislatures across the country, pressuring up-and- coming Republicans to make it a core issue before they’re called up to the big leagues. “We’re branding the whole party that way,” Norquist says. “The people who are going to be running for Congress in 10 or 20 years are coming out of state legislatures with a history with the pledge.”

Norquist also built the anti-tax pledge into the DNA of the GOP by hosting weekly Wednesday meetings that enable activist groups representing everyone from gun nuts to home-schoolers to mix with top business lobbyists and conservative officials. The meetings, which began shortly after Bill Clinton was elected, turned Norquist into the Republican Party’s foremost power broker – and gave him a forum to enforce the no-new-taxes pledge as the centerpiece of the GOP’s strategy. “The tax issue,” he says, “is the one thing everyone agrees on.”

Norquist cemented his influence by forging an early alliance with Karl Rove and setting himself up as a gatekeeper to George W. Bush’s inner circle. Then, after Obama was elected, this ultimate Washington insider positioned himself as a leader of the anti-establishment Tea Party, complete with financial support from the billionaire Koch brothers. “These Tea Party people, in effect, take their orders from him,” says Bruce Bartlett, an architect of the Reagan tax cuts. “He decides: This is a permissible tax action, or this is not a permissible tax action. And of course, anything that cuts taxes is per se OK.”

Today, GOP politicians who have signed Norquist’s anti-tax pledge include every top Republican running for president, 13 governors, 1,300 state lawmakers, 40 of the 47 Republicans in the Senate, and 236 of the 242 Republicans in the House. What’s more, the GOP’s Tea Party foot soldiers are marshaled by House Majority Leader Eric Cantor – a veteran of Norquist’s farm team, who first signed the pledge as an ambitious member of the Virginia legislature. Under Cantor’s leadership, Norquist’s anti-tax pledge was directly responsible for last summer’s debt-ceiling standoff that wrecked the nation’s credit rating by leading the nation to the brink of default. “Congress was willing to cause severe economic damage to the entire population,” marvels Paul O’Neill, Bush’s former Treasury secretary, “simply because they were slaves to an idiot’s idea of how the world works.”

Yup. Bush’s former Treasury secretary thinks Norquist has congress hostage to the point that they are “willing to cause severe economic damage to the entire population simply because they were slaves to an idiot’s idea of how the world works.” The result of the work of Norquist and the Republican party has been staggering income inequality.

“The Republican Party has totally abdicated its job in our democracy, which is to act as the guardian of fiscal discipline and responsibility,” says David Stockman, who served as budget director under Reagan. “They’re on an anti-tax jihad – one that benefits the prosperous classes.”

Notice here that I’m quoting Republicans that have had extensive experience in economics, finance, and policy. Funny thing is that the most of these folks aren’t really worried about tanking the economy. What they are worried about is this. If you haven’t read Cannonfire today, you should. First, Cannon points to this. MSNBC got a hold of a memo from a lobbying firm spelling out its plan to use any propaganda means necessary to destroy OWS. The lobbying firm is associated with the American Banker’s Association.

CLGC’s memo proposes that the ABA pay CLGC $850,000 to conduct “opposition research” on Occupy Wall Street in order to construct “negative narratives” about the protests and allied politicians. The memo also asserts that Democratic victories in 2012 would be detrimental for Wall Street and targets specific races in which it says Wall Street would benefit by electing Republicans instead.

According to the memo, if Democrats embrace OWS, “This would mean more than just short-term political discomfort for Wall Street. … It has the potential to have very long-lasting political, policy and financial impacts on the companies in the center of the bullseye.”

The memo also suggests that Democratic victories in 2012 should not be the ABA’s biggest concern. “… (T)he bigger concern,” the memo says, “should be that Republicans will no longer defend Wall Street companies.”

Two of the memo’s authors, partners Sam Geduldig and Jay Cranford, previously worked for House Speaker John Boehner, R-Ohio. Geduldig joined CLGC before Boehner became speaker; Cranford joined CLGC this year after serving as the speaker’s assistant for policy. A third partner, Steve Clark, is reportedly “tight” with Boehner, according to a story by Roll Call that CLGC features on its website.

Another interesting association is noted in the memo.

The CLGC memo raises another issue that it says should be of concern to the financial industry — that OWS might find common cause with the Tea Party. “Well-known Wall Street companies stand at the nexus of where OWS protestors and the Tea Party overlap on angered populism,” the memo says. “…This combination has the potential to be explosive later in the year when media reports cover the next round of bonuses and contrast it with stories of millions of Americans making do with less this holiday season.”

Yup, it’s the divide and conquer strategy again. Since Wall Street can’t make the case, it’s going to use proxies like the Tea Party to do its dirty work. This should be no problem given the astroturf leadership put in place by folks like Dick Armey and Matt Kibbe. These guys are longstanding Republican Beltway insiders. The interesting thing comes in some of the rumors coming out from the committee itself. Supposedly, Boehner had actually agreed to put revenues on the table and provide cover to Republicans that feared Norquist and the Tea Party. Some Democrats never really engaged, some republicans refused to even discuss anything that didn’t include making the Bush Tax cuts permanent for every one, and there was some feeling that the next election would give some indication of which way the wind blows.

A Democratic aide had this eulogy for the supercommittee: “The worm has turned a little bit. The national conversation now is about income inequality and about jobs, and it’s not really about cutting the size of government anymore or cutting spending. 2010 gave one answer to that question. But 2012 will give another, and we’ve got to see what it is.”

I still think economist Jeffrey Sachs has the best take on what the real role of Congress should be in an schizophrenic economy like ours. This is what OWS is trying to point out but is getting blasted for by concentrated efforts in corporate media to publish propaganda. (I have quoted this before, but I’m quoting Sachs again.)

The big political lie of the Super-Committee is that the deficit must be closed mainly by cutting government spending rather than by raising taxes on corporations and the super-rich. Both parties are complicit. The Republicans want to close the deficit entirely by cutting spending; Obama has brandished the formula of $3 of cuts for every $1 of tax revenues. On either approach, the poor and middle class would suffer grievously while the rich and powerful would win yet again (at least until the social pressures boil over).

The key to understanding the U.S. economy is to understand that we have two economies, not one. The economy of rich Americans is booming. Salaries are high. Profits are soaring. Luxury brands and upscale restaurants are packed. There is no recession.

The economy of the middle-class and poor is in crisis. Poverty and near-poverty are spreading. Unemployment is rampant. Household incomes have been falling sharply. Millions of discouraged workers have dropped out of the labor force entirely. The poor work at minimum wages to provide services for the rich.

Until we have some realization that laws put into place for the last 30 years have created markets that are distorted, functional only for a few, and not the least bit reflective of anything remotely “free market”, a portion of the public is going to be willing to vote for people that spread lies. This is why the credibility of any one associated with OWS must be destroyed. The minute a huge portion of us wake up to the lies–much like what happened after publication of the Pentagon Papers and the invasion of Cambodia after Nixonian promises of winding the Vietnam War down–we’re not going to get the policy we need to put things right again. We desperately need to put things right again.

Super Cat Food Commission: Ideologues seem destined to tank the Country

Posted: November 16, 2011 Filed under: Catfood Commission | Tags: Super Committee 14 Comments The starve the beast anthem seems to have stymied any chance the country has of solving both its unsustainable long term debt problems and its economic growth issues. This is what you get when no one embraces pragmatism, workable solutions, and data. I continue to think the best solution to much of this is to let the Bush Tax cuts expire and let them scramble from the fall out of the trigger.

The starve the beast anthem seems to have stymied any chance the country has of solving both its unsustainable long term debt problems and its economic growth issues. This is what you get when no one embraces pragmatism, workable solutions, and data. I continue to think the best solution to much of this is to let the Bush Tax cuts expire and let them scramble from the fall out of the trigger.

Nothing is acceptable to Republicans who have signed their political souls away to Grover Norquist and seem hell bent on keeping the pentagon flush with funds all while supposedly balancing the budget. There is no way for this to happen simultaneously unless one is prepared to completely do away with all other functions of government which is frankly what I think they want. We’ll have taxes subsidizing already rich, powerful and profitable corporations and the military industrial complex and the rest of America will be sharecropping in one way or another.

Pat Toomey basically defended this position to Chris Wallace at Faux News on Sunday. The problem with this position–and with sticking to it like a drug addiction–is that the reality just doesn’t fit the story and it’s not what people want. How is it possible for a group of ideologues to continually hold the country’s economy hostage to failed ideals rejected not only by experts on the economy but by US citizens in poll after poll? Why was America’s most profitable period a time when taxes were high on both corporations and rich people and the US was winding down its war machine if the Republican paradigm is so correct? Believe me, this Toomey plan is a bait and switch.

WALLACE: Again, before we get to your plan. What are the stakes if you fail to make a deal. If on November 23rd, the super committee comes up empty and the automatic triggers come in, and we’ll talk about that in a moment. What do you think the impact is on the markets, on the economy and on the U.S. credit rating?

TOOMEY: I think that there will be further erosion of what little confidence remains of our federal government. This has been a dysfunction Senate that I’ve been serving in for the year that I’ve been in office. And this is an attempt to try to make some important progress. It would only be the first of what needs to be many steps because we’ve dug a deep hole for ourselves. I think it’s really important that we’d be successful.

WALLACE: All right. You offered a plan that breaks with the Republican pledge not to raise any tax revenue. Let’s drill down into the plan.

You would cut the deficit $1.2 trillion, which is the mark that is supposed to be met by the super committee with $700 billion in spending cuts and $500 billion in revenue increases. On the revenue side, you get $250 billion by limiting deductions especially for top earners. In exchange, you would lower tax rates, the top rate would go from 35 percent to 28 percent.

Question: why are you breaking with the GOP pledge not to raise taxes in the middle of a bad economy and how many Republicans will go along with you.

TOOMEY: Well, let me — first of all, let me say, if I were king, this is not the plan I’d put on the table. But if we both went into our respective corners and had no flexibility at all, then we wouldn’t get anything accomplish. Number two, the plan that I put on the table is contingent upon pro-growth tax reform.

Every group that’s looked to this, all of the bipartisan commissions, gang of six and the others, have acknowledge that if there is more revenue it has to come in the context of pro-growth tax reform, the kind of reform we’re talking about absolutely guaranteed to create millions of jobs over time and still more revenue.

And, finally, Chris, the other reason to make a tough decision like this, is in the alternative, we are 13 months away from the biggest tax increase in American history. And that’s written into law. That’s going to happen.

WALLACE: You’re talking about the Bush tax cuts expire.

TOOMEY: That’s exactly right.

And so, what we’ve suggested is, as an alternative to an economy destroying tax increase right around the corner, let’s have a reform, let’s simplify the code, let’s lower rates, let’s wipe out some of the loop holes and special interest, favors and deductions. Let’s have the economic growth that would come with that.

And as we lower the rates and contract the value of deductions, we’ll only generate a little revenue so that we can reduce the deficit.

WALLACE: Now, I don’t want to get too far on the weeds, but Democrats immediately rejected your plan because they say that the money that would be lost by lowering those tax rates, basically 20 percent below the Bush tax cuts, would cost over $3 trillion for the economy, and they say the money you’re going to will lose that will increase the deficit is more than money you’ll get from closing these tax loops. That it’s a net loser.

TOOMEY: First of all, that’s not true. You could design this in a way — and as I said, I didn’t invent this. We didn’t invent this. This is an idea that’s been suggested by the Simpson-Bowles commission, by the Rivlin-Domenici.

Now, it’s true that they want to raise taxes more. I think that as you reduce the value of these deductions, if you go too far, you try to create too much revenue, you can do economic damage. But you absolutely can do this in a way that will be pro-growth, that will generate more revenue, that would avoid this huge tax increase that’s otherwise coming and I think that’s a direction we should move in.

Republicans continue to say that 1+1=3 despite decades of evidence and proof that 1+1 still equals 2. If tremendous tax cuts and deregulation had such benefits to the economy we’d not have had over ten years of miserable growth and a humdinger of a financial crisis. Corporate profits are at record highs. This is not leading to job creation. Taxes on capital gains are extremely low. This just keeps leading to bubbles, increased speculation, and paper gains for a few based on nothing but gambling. It’s not bringing any value to the real economy where jobs, products, services, and tax revenues that keep things running are made. Money keeps pumping into financial contracts which is just paper whose value is detached from real assets until the market crashes. Increasing taxes on capital gains would close down much of the worthless investment funds that are going after arbitrage profits in all the wrong places. Tax benefits should go to real investments and long term commitment to growing industry and businesses. Taxes favor speculation right now. It’s bringing more volatility and risk to markets and not vaulted liquidity.

It’s ridiculous and it flies in the face of recent economic data to suggest that continuing to hand wealth over to the richest folks is going to do anything other than continue the very same problems that we have now. We move productive funds away from things that are attached to real sector growth and into speculative activities which blow bubbles and ruin the value of real assets like houses, food, and commodities and create such excessive volatility in equity markets that long term investors experience incredible losses and then small gains continually. No one benefits but a few gamblers which evidently includes Congress. Republicans like Boehner, Cantor and Bachus and Democratic leaders like Pelosi benefiting from betting based on insider information as much as Wall Street does.

It seems like there’s a plot to extract as much wealth and income out of the economy as possible before they tank the entire thing and retreat to tax haven islands like Grand Cayman. How could elected officials be so set on sabotaging the country? Granted, there are idiotic true believers like Michele Bachmann who create their own reality and narratives and are so removed from facts that you wonder why they’re allowed in public. There used to be nice places in the country for folks like that to ‘rest’ and spend their days listening to those voices in their head. Now it seems they’ve all turned up in the Republican Party and have hunkered down in Washington DC. Okay, this is from Beltway Bob, but bear with the quote, please. It’s an indicator that they’re willing–like domestic terrorists–to take us all hostage again.

Six days left for the supercommittee, and it’s not looking good. On CNBC last night, Rep. Jeb Hensarling, the Republican co-chair of the committee, said he and his colleagues had “gone as far as we feel we can go” on taxes, and that “any penny of increased static revenue is a step in the wrong direction.” In other words, Republicans aren’t looking to compromise further. But Hensarling went yet further than that. If the supercommittee fails, he said, Republicans are looking to undo the compromises they have already made.

The issue is “the trigger,” the policy that automatically cuts the deficit by $1.2 trillion in the event that the supercommittee fails. Half of those cuts are scheduled to come from domestic spending (excluding Social Security, Medicaid, and a few other programs that help the poor). That’s the stick for Democrats. Half of them are scheduled to come from the Pentagon. That’s the stick for Republicans. But last night, Hensarling said the defense cuts are too onerous, and so “we’ve got 13 months to find a smarter way to do it.” By “a smarter way to do it,” he means a way that eases the cuts to defense and, since Republicans aren’t going to replace those defense cuts with new taxes, increases the cuts to domestic programs.In comments to reporters Tuesday, Senate Majority Leader Harry Reid was firm on this point: the defense cuts in the trigger were the GOP’s concessions after they refused to include taxes in the trigger, and they’re not going anywhere. “If committee fails to act, sequestration is going to go forward,” he told reporters. “Democrats aren’t going to take an unfair, unrealistic load directed toward domestic discretionary spending and take it away from the military.”

Behind the scenes, the White House has taken a similar line: the trigger can’t be changed to exempt defense and fall more heavily on domestic spending. That isn’t the same as saying the trigger can’t be changed. But Democrats aren’t going to be enthusiastic about keeping the part meant to penalize them for the supercommittee’s failure while helping Republicans move the bit that was meant to be their punishment.

But we’ll see. Democrats haven’t always been known to hold the line on defense cuts. The bigger issue here, however, is that Republicans are setting a bad precedent for future deals. Republicans are talking about unwinding the trigger before the supercommittee has even finished its work. They are, in other words, reneging on the terms of the debt-ceiling deal. So why should Democrats who are hearing this expect they’ll abide by the terms of a deal that calls for revenue-increasing tax reform in six months?

Recent Comments