Here’s where I play the world’s smallest violin …

Posted: February 29, 2012 Filed under: #Occupy and We are the 99 percent!, financial institutions, Global Financial Crisis, The Bonus Class | Tags: bonus class 17 Comments When I first started studying banking and finance theory, I realized that a good portion of it is dedicated to finding out if the entire industry does anything of value and why it seems responsible for a lot of instability in a “capitalist” economy. Banking seems simple enough. You pool deposits to provide loans. You ‘safekeep’ those deposits. You provide some payment mechanisms. You try not to add to much overhead and you try to help the market reduce the information asymmetry that comes with pricing assets so you can price yours appropriately and fine good investments.

When I first started studying banking and finance theory, I realized that a good portion of it is dedicated to finding out if the entire industry does anything of value and why it seems responsible for a lot of instability in a “capitalist” economy. Banking seems simple enough. You pool deposits to provide loans. You ‘safekeep’ those deposits. You provide some payment mechanisms. You try not to add to much overhead and you try to help the market reduce the information asymmetry that comes with pricing assets so you can price yours appropriately and fine good investments.

It’s never been quite that simple however. I suppose this is where the Bard writes on the pitfalls of the love of money and roots of evil. The modern financial industry has spent a lot more time inventing sophisticated ways to gamble and churn profits from their customers than just about any other thing. Service is out of vogue and financial innovation rules the day. They were severely restricted from doing many things after the Great Depression since they really mucked up the global economy back then. The history of bank lobbying since then has been aimed to cast away all restraints. So, we went full circle since 1980. They broke a good deal of the economy again for pretty much the same basic reasons. We’ve had miserably few criminal investigations.

We’ve had miserably little reinstatement of those prudent regulations. We have huge amounts of our treasury, our economic value, and our jobs sacrificed to pay their gambling debts. None of these folks have had to ‘fess up or pay up. Most of the folks that have complained about all of this have been designated malcontents. Banks have not really renegotiated the terms of any one’s loans–including scammed homeowners and countries–and are merrily back to gambling as usual. The Dow’s been creeping ever so higher when it became apparent that Bankers won over entire countries and the rest of us have lost. So, here’s one little tidbit that makes me smile. Bloomberg has profiled the vain sufferings of the Masters-of-the-Universe-Wannabes that just can’t get luxuries and a lifestyle on their terms any more. Boo Fucking Hoo.

Andrew Schiff was sitting in a traffic jam in California this month after giving a speech at an investment conference about gold. He turned off the satellite radio, got out of the car and screamed a profanity.

“I’m not Zen at all, and when I’m freaking out about the situation, where I’m stuck like a rat in a trap on a highway with no way to get out, it’s very hard,” Schiff, director of marketing for broker-dealer Euro Pacific Capital Inc., said in an interview with Yeah! Local, a local marketing firm.

Schiff, 46, is facing another kind of jam this year: Paid a lower bonus, he said the $350,000 he earns, enough to put him in the country’s top 1 percent by income, doesn’t cover his family’s private-school tuition, a Kent, Connecticut, summer rental and the upgrade they would like from their 1,200-square- foot Brooklyn duplex.

“I feel stuck,” Schiff said. “The New York that I wanted to have is still just beyond my reach.”

The smaller bonus checks that hit accounts across the financial-services industry this month are making it difficult to maintain the lifestyles that Wall Street workers expect, according to interviews with bankers and their accountants, therapists, advisers and headhunters.

“People who don’t have money don’t understand the stress,” said Alan Dlugash, a partner at accounting firm Marks Paneth & Shron LLP in New York who specializes in financial planning for the wealthy. “Could you imagine what it’s like to say I got three kids in private school, I have to think about pulling them out? How do you do that?”

So, that’s the face to the problem that really cries out for class warfare. Wall Street’s pay checks are shrinking. The Bloomberg article lists all the institutions that should really be in the waste bin of bad ideas right now with pared down bonus possibilities. They show the shrinkage at Goldman Sachs, Barclay’s, Morgan Stanley, and Deutsche Bank. Jobless is high. Poverty is high. Household net worth has shrunk. Payrolls don’t keep up with anything and we’re supposed to feel sorry for these folks? Oh, cry me a river! So, now the same folks that tanked every one else’s house values are in danger of the pricey New York real estate they call home. Here’s Megan McArdle with a New York Frame of Mind.

I believe that Elizabeth Warren has made this point–when people get into financial trouble, they often say, “Well, I didn’t take fancy vacations or go to restaurants all the time or buy 17 pairs of Jimmy Choos.” But (with the exception of some really compulsive spenders) this isn’t the stuff that gets people into trouble. It’s the big house with the stretch mortgage that you convinced yourself you had to have because it was in a good school district and you needed a yard and a bedroom apiece for the kids. It’s that brand new SUV (or Volvo station wagon) you persuaded yourself to buy because it was important to have a safe car. It’s the school activities or travel sports teams that cost thousands of dollars, which you let your kids start in ninth grade because you didn’t know that you’d have to break their hearts by pulling them out in their junior year. The divorce decree you signed because you didn’t realize your income was going to drop by a third.

Pricey vacations can be cut back. Mortgage payments can’t. It’s not the luxuries that usually get people into trouble–it’s paying too much for “the basics”.

And in New York, it’s really, really easy to pay too much. One of the guys in the article makes $350,000 and lives in 1200 square feet with three kids. This is the way the lower rungs of the lower middle class lives in the rest of the country. New Yorkers face an overwhelming temptation to push their housing budget to the limit, because what’s available on a conservative budget is really inconvenient unless you either make a whole lot of money, or lucked into a great deal in a down market or a transitional neighborhood.

So, here’s my point. Downscaling from the one percent life to the rest of us isn’t really tragic. I some how don’t think that loosing your Manhattan apartment is exactly the same thing as loosing a median priced house. Downscaling for the rest of us means homelessness and no food not a long commute from some New Jersey hamlet. Here’s some more people’s stories from Bloomberg. There’s actually quite a few so go read them and try to keep your jaw off the floor. Here’s McArdle’s particular charity case.

The malaise is shared by Schiff, the New York-based marketing director for Euro Pacific Capital, where his brother is CEO. His family rents the lower duplex of a brownstone in Cobble Hill, where his two children share a room. His 10-year- old daughter is a student at $32,000-a-year Poly Prep Country Day School in Brooklyn. His son, 7, will apply in a few years.

“I can’t imagine what I’m going to do,” Schiff said. “I’m crammed into 1,200 square feet. I don’t have a dishwasher. We do all our dishes by hand.”

He wants 1,800 square feet — “a room for each kid, three bedrooms, maybe four,” he said. “Imagine four bedrooms. You have the luxury of a guest room, how crazy is that?”

The family rents a three-bedroom summer house in Connecticut and will go there again this year for one month instead of four. Schiff said he brings home less than $200,000 after taxes, health-insurance and 401(k) contributions. The closing costs, renovation and down payment on one of the $1.5 million 17-foot-wide row houses nearby, what he called “the low rung on the brownstone ladder,” would consume “every dime” of the family’s savings, he said.

“I wouldn’t want to whine,” Schiff said. “All I want is the stuff that I always thought, growing up, that successful parents had.”

So, now do you get why I don’t by the rational markets hypothesis? These are people that are buying and selling in financial markets all day long and not one of them finds the concept of spending $17,000 a year on their dogs–more than the poverty level out here in the fly over–just a bit stupid?

Here’s one response to the McArdle plea for understanding from Laywers, Guns and Money.

It now seems clear to me that the truly oppressed and misunderstood in this country are living in Greenwich, Connecticut. If my parents hadn’t spent $5000 for every season I played youth soccer, I would be smoking crack right now. Won’t somebody think about the Benetton-clad children???!!???

And another one from a poster at Balloon Juice.

When middle-class people lose their jobs, they need to suck it up and admit that they’re too fucking soft and lazy to live in dormitories like REAL workers do in China. They need to accept cuts to their health care and retirement funds and if they complain about it, they need a lecture on morality from Daddy Bobo.

When people making 400K get bumped down to 300K, it’s a three-hanky tragedy.

Tell me again that Robespierre didn’t have a point.

I’m sorry Megan. I really really really don’t feel their pain. Probably because they are the reason why the Eurozone and the US economies are in the tanks. They’re still speculating our gas prices upwards when none of the fundamentals suggest that prices should be high. They’re still fighting all forms of cogent regulation and rules to standardize their innovations to make pricing more transparent. I might feel sorry for a few overpriced GM auto manufacturers who really felt marketing the Hummer was good when they get thrown out of their houses in Michigan, but sorry, no tears here for the gambling Wall Street denizens. They can just fricking live like the rest of us.

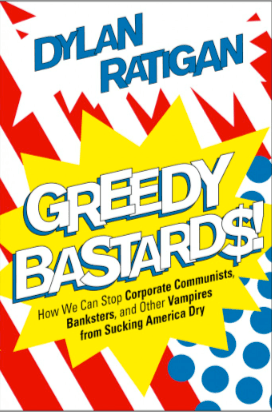

Greedy Bastards

Posted: January 26, 2012 Filed under: Banksters, commercial banking, Corporate Crime, corruption, financial institutions, Global Financial Crisis, investment banking, lobbyists, U.S. Economy, U.S. Politics | Tags: Dylan Ratigan, extractionism vs capitalism, Greedy Bastards 15 CommentsNo, I am not making an editorial comment.

But after nonstop blathering served up by the GOP, only to be followed by President Obama’s Teddy Roosevelt impersonation [although I have to admit—the State of the Union was a surprisingly good speech], I thought a moment of palate cleansing might be in order. In this case Dylan Ratigan offers up the sorbet.

Ratigan is someone willing to call out the shysters, the casino players and shakedown artists, including their political handmaidens for what they truly are, and ‘Greedy Bastards’ is the title of his newly released book. The author’s name may ring a bell because Dylan Ratigan has a public platform on MSNBC, an hour-long show Monday through Friday. The program airs at 4:00 pm, EST, in my neck of the woods.

Ratigan’s slant focuses on the collision of worlds, that of finance and politics, how the incestuous relationship is literally squeezing the life out of the United States. His take is not an indictment of capitalism. Rather it is an indictment of what is posing as capitalism, a system he refers to as ‘extractionism.’

Ratigan is not a newcomer or a pundit simply reading a script. He worked the financial beat with Bloomberg News, serving as Global Managing Editor to Corporate Finance until 2003. He’s also the former anchor and co-creator of CNBC’s Fast Money. He has launched and anchored a number of financially-related broadcasts over the years but decided to leave Fast Money after the 2008 financial meltdown. Ratigan has publicly stated that he was personally disgusted by the Wall Street banking sector’s shakedown of the American public. The Dylan Ratigan Show was launched to provide discussion and analysis of the financial/government intersection, a system that has acquiesced to the wanton theft of the Nation’s wealth and resources by . . . Greedy Bastards, of course.

Though the show has been on air for three years, Ratigan has admitted that his voice was finally heard after an infamous meltdown last August. It was an on-air rant that would have made Patty Chayefesky proud, a Howard Beale moment.

That woke people up! It also led to Ratigan’s Get the Money Out [of politics] Movement, working towards a Constitutional Amendment to remove the corrosive element of money in the political sphere. And then, there’s the book.

One thing I liked about Ratigan’s approach is that instead of pointing out one segment of the population for public pillorying, his title basically refers to a state of mind and the all too frequent way of doing business and politics in the 21st century.

For instance, in the case of capitalism, Ratigan uses the example of venture capital, a subject that has come up in reference to Romney’s connection to Bain & Company, specifically Bain Capital. From Chapter 1:

If I start a venture capital firm that lends out money to drug researchers trying to find new cures for disease, and I get rich doing it, then I made my money by investing in the productive future of the country. I used my money in a way that facilitated scientific innovation and a cure. I’m what the director of the Havas Media Lab Umair Haque a ‘capitalist who makes.’ But instead, if I take the same money and use it to lobby for changes in government regulation—changes that help me trick a union into investing its retirement savings in flawed investments so that I can collect the commissions—then I may move as many dollars into my bank account as someone who funded cures for diseases, but I haven’t made anything. I’m a ‘capitalist who takes,’ exploiting my power to influence the government for my own private gain, no matter the harm to anyone else. I’m a greedy bastard.

The latter example, taking money from others without providing anything of value is, according to Ratigan, the opposite of capitalism. An extractionist system loses increasing value over time until there’s nothing left. Call it the vampire or vulture model. A system based on the extractionist principle, provides no incentive for people to make good deals, where both sides benefit. Instead, it rewards those who take and give nothing in return.

Sound familiar?

Ratigan covers the areas that have pushed the extractionist model to the max: banking, education, healthcare, energy, trade negotiations and the unholy alliance of government and big money fueling the feeding frenzy of the Nation’s resources and our future. But unlike many gloom and doom tomes, Ratigan offers solutions and brings an optimism to the subject, namely that we have the ideas, the people and yes, even the money to solve what at times seems insolvable. He concludes in a rather convincing way that what is needed is a realignment between investment and the needs of capable, innovative people. If loans and investments offered the highest returns when they provided the highest value as opposed to simply taking the highest risk, then prevailing attitudes and business practices would shift and win/win deals would be created.

Sound like pie in the sky? I don’t think so. Yes, it’s a matter of will, public pressure to exact the necessary changes but this realignment idea is possible by citing the goals first, and then targeting the resources to get there. Ratigan refers to this as hotspotting—zeroing in on the problem, determining what methodology provides the best results, and then aiming resources to match those needs.

Sound like pie in the sky? I don’t think so. Yes, it’s a matter of will, public pressure to exact the necessary changes but this realignment idea is possible by citing the goals first, and then targeting the resources to get there. Ratigan refers to this as hotspotting—zeroing in on the problem, determining what methodology provides the best results, and then aiming resources to match those needs.

Though some critics have dismissed this idea, it is very attuned to what Bill Clinton recently suggested in his Esquire interview about highlighting the successes and needs across the country, and then linking them, matching them up. Just another turn on the realignment idea:

. . . the two best things you could do are the infrastructure bank and a simple SBA-like loan guarantee for all building retrofits, where the contractor or the energy-service company guarantees the savings. So that allows the bank to loan money to let a school or a college or a hospital or a museum or a commercial building or factories for lease unencumbered by debt to loan it on terms that are longer, so you can pay it back only from your utility savings. You could create a million jobs doing that because of the home models that are out there now.

There are these two guys on Long Island who started a little home-repair deal. They got thirty-five employees now, and they’re — they can go in, tell you how much they’ll save you. There’s an operation in Nebraska that’s in and out in a day, and they’re averaging more than 20 percent savings, and conservative Republican Nebraska is the only state in the country that has 100 percent publicly owned power.

And,

You’ve got Orlando with those one hundred computer-simulation companies. They got into computer simulation because you have the Disney and Universal theme parks, and Electronic Arts’ video-games division. And the Pentagon and NASA desperately need simulation, for different reasons. So there you’ve got the University of Central Florida, the biggest unknown university in America, fifty-six thousand students, changing curriculum, at least once a year, if not more often, to make sure they’re meeting whatever their needs are, and they’re recruiting more and more professors to do this kind of research that will lead to technology transfers to the companies. You’ve got Pittsburgh actually becoming a real hotbed of nanotechnology research. You’ve got San Diego, where there are more Nobel-prize-winning scientists living than any other city in America. You’ve got the University of California San Diego and other schools there training people to do genomic work. Qualcomm is headquartered there, and there are now seven hundred other telecom companies there, and you’ve got a big private foundation investing in this as well as the government, and nobody knows who’s a Republican or who’s a Democrat, they’re just building this networking.

We have fabulously innovative, creative people working on all kinds of things. Our true wealth is in our people; our true value is . . . us.

Ratigan is now on a 30-million jobs tour showcasing business enterprises that are, in fact, answering a need, offering value to their communities, providing jobs and in the best capitalist tradition—making a profit.

The endnote is that the country hasn’t lost its edge. We’ve lost the path that works, the one that values quality and integrity. Greedy Bastards will always exist, those hoping to make a quick buck [or trillions of bucks] off the backs of others. They have no shame. The goal is to make them and their thievery the exception, not the rule.

Btw, Ratigan’s book is highly readable, written for the layperson. No economic degrees required. If you’ve been following the financial blowout and/or Ratigan’s show, this will be a fast review. If you’re just starting to pay attention, consider the book a primer—what the country underwent and where we need to go. The sooner, the better. Ratigan encourages us to reclaim our voice, demanding that our people and country come first.

It’s a worthy message. Read the book. Get the word out.

What he said …

Posted: December 11, 2011 Filed under: #Occupy and We are the 99 percent!, Bailout Blues, Banksters, Economy, financial institutions, Global Financial Crisis 6 CommentsI keep talking about the utter audacity of the political class these days and how they completely ignore everything we know about economics and finance in pursuit of  self-dealing and getting political donations from the FIRE industries. I particularly hate that we’ve got this complete twisted notion of “free” trade and “free” markets thanks to a bunch of really ignorant right wingers and mouthpieces like Rush Limbaugh, Fox News, Larry Kudlow, etc. etc. etc.. These folks are out to line their own pockets and they are pitching nonsense to low information zombies.

self-dealing and getting political donations from the FIRE industries. I particularly hate that we’ve got this complete twisted notion of “free” trade and “free” markets thanks to a bunch of really ignorant right wingers and mouthpieces like Rush Limbaugh, Fox News, Larry Kudlow, etc. etc. etc.. These folks are out to line their own pockets and they are pitching nonsense to low information zombies.

I also really hate to just wholesale copy and paste another blog–in this case Washington Blog at The Big Picture–but some times you just have to let the voice of the source speak for itself and hope it stands up to the ideals of fair use. Thanks go to Fiscal Liberal for pointing me to this list and its readable wonky links of proof. It’s called ‘The Financial Crisis was Entirely Foreseeable’ but it might as well be labelled ‘Idiots in the Beltway are spewing memes and setting us up for a big ol’ repeat of the global financial meltdown’. Idiots in Europe are doing likewise. Why are they all bailing ut gambling bankers over their households and real businesses? Where’s a politician that really knows his stuff when it comes to authentic finance and economics?

We’ve Known for Thousands of Years

We’ve known for literally thousands of years that debts need to be periodically written down, or the entire economy will collapse. And see this.

We’ve known for 1,900 years that that rampant inequality destroys societies.

We’ve known for thousands of years that debasing currencies leads to economic collapse.

We’ve known for hundreds of years that the failure to punish financial fraud destroys economies.

We’ve known for hundreds of years that monopolies and the political influence which accompanies too much power in too few hands is dangerous for free markets.

We’ve known for hundreds of years that trust is vital for a healthy economy.

We’ve known since the 1930s Great Depression that separating depository banking from speculative investment banking is key to economic stability. See this, this, this and this.

We’ve known since 1988 that quantitative easing doesn’t work to rescue an ailing economy.

We’ve known since 1993 that derivatives such as credit default swaps – if not reined in – could take down the economy. And see this.

We’ve known since 1998 that crony capitalism destroys even the strongest economies, and that economies that are capitalist in name only need major reforms to create accountability and competitive markets.

We’ve known since 2007 or earlier that lax oversight of hedge funds could blow up the economy.

And we knew before the 2008 financial crash and subsequent bailouts that:

- The easy credit policy of the Fed and other central banks, the failure to regulate the shadow banking system, and “the use of gimmicks and palliatives” by central banks hurt the economy

- Anything other than (1) letting asset prices fall to their true market value, (2) increasing savings rates, and (3) forcing companies to write off bad debts “will only make things worse”

- Bailouts of big banks harm the economy

- The Fed and other central banks were simply transferring risk from private banks to governments, which could lead to a sovereign debt crisis

Given the insane levels of debt, rampant inequality, currency debasement, failure to punish financial fraud, growth of the too big to fails, repeal of Glass-Steagall, refusal to rein in derivatives, crony capitalism and other shenanigans … the financial crisis was entirely foreseeable.

Okay, so let’s just end that last part by taking out “the financial crisis was entirely foreseeable” and by replacing it with “the next big financial crisis is entirely foreseeable and getting more likely every day”. If you need any proof of further inevitability just listen to ANY Republican these days and most of the Democratic Caucus. They are resplendent with VooDoo Economics and Finance believers and enablers. It’s just like with climate science and evolution. An entire group of people who embrace ideology over reality just can’t seem to get out of the flat earth theories. Watching the Republican debates alone has been like watching the march of ignorance personified. I’m waiting for them to start announcing the earth is only a few thousand years old, gravity doesn’t exist or need to because god’s hand holds us in place, and 1 + 1 is really 3. If only the media would act like the set of fact checkers they could be instead of mouthpieces for corporate interests we might actually be able to get through to a few zombies and bring them back to life. Until then, get ready for the next big one.

EuroZone Woes

Posted: November 27, 2011 Filed under: Economy, financial institutions, Foreign Affairs, Global Financial Crisis | Tags: Euozone, Financial Union 8 CommentsThere’s been a number of interesting things coming out of Europe this weekend that will undoubtedly impact US Financial Markets and probably the economy since they are a  significant trading partner as well as investor in US businesses. The adoption of the Euro and the expansion of the trade zone area has generally been shown to be a huge boon to the European Economy. It’s really hard for me to imagine the collapse of the Euro since it has been so successful that a variety of countries through out the world are in the process of adopting their own versions. There have been a lot of people against the arrangement primarily because they’re still in nationalist mode and dislike the idea of any kind of cooperation that looks like ‘collectivism’. The astounding economic results have been difficult to rebut however.

significant trading partner as well as investor in US businesses. The adoption of the Euro and the expansion of the trade zone area has generally been shown to be a huge boon to the European Economy. It’s really hard for me to imagine the collapse of the Euro since it has been so successful that a variety of countries through out the world are in the process of adopting their own versions. There have been a lot of people against the arrangement primarily because they’re still in nationalist mode and dislike the idea of any kind of cooperation that looks like ‘collectivism’. The astounding economic results have been difficult to rebut however.

There are two items that generally are considered problematic for some countries that join a monetary union. The first is the loss of independent monetary policy including the ability to debase your currency as a means to stimulating your economy. The offset to that is that if you’re a country like Greece that has had incredible issues with inflation stemming from politicized monetary policy, you pick up credibility when you outsource that function to a shared central bank. That’s especially the case when you share your central bank with the Germans who have been inflation wary since the Weimar Republic. The Japanese central bank and the German central bank are well known for controlling inflation over just about any other economic priority. The second problem is the potential need for cross country fiscal policy. That has never been much of an issue in the EU until now. That is why there is talk of an IMF rescue of countries like Greece. Also, there’s some talk of hurrying fiscal integration or giving some entity the ability to float “eurobonds” specifically for countries that are in trouble right now like Italy. The problem right now is that many of the weaker EU countries were allowed to borrow substantially and with a credit crisis and banking troubles that led to recession, the bonds from those countries (sovereign debt) have no lost their value.

There are some that think the Eurozone will fall apart. I find that hard to accept given the substantial boost that the zone has been to many economies in the form of trade and direct financial investment. This benefit has gone to all countries and is called the “Rose Effect”. I’ve spent the last three years of my life studying all of this in great detail. I am as vested in any one in the outcome. Here’s a few items that have been going on as we watch Eurozone brinkmanship play out. Reuters reports that Germany and France are forming a “Stability Pact” and hoping to get the European Central Bank leaders will act more like Bernanke’s Fed.

Echoing a Reuters report on Friday from Brussels, the Sunday newspaper said the French and German leaders were prepared to back a deal with other euro countries that might induce the ECB to intervene more forcefully to calm the euro debt crisis.

The newspaper report quoted German government sources as saying that the crisis fighting plan could possibly be announced by German Chancellor Angela Merkel and French President Nicolas Sarkozy in the coming week.

In an advance release before publication, Welt am Sonntag said that because it would take too long to change existing European Union treaties, euro zone countries should just agree among themselves on a new Stability Pact to enforce budget discipline – possibly implemented at the start of 2012.

It could be similar to the Schengen Agreement which applies to EU countries that choose to take part and enables their citizens to enjoy uninhibited cross border travel. Among the countries in the Stability Pact, there would be a treaty spelling out strict deficit rules and control rights for national budgets.

Reports from AFP show that the IMF may be planning a 600 billion Euro rescue plan for Italy. Italy is the world’s 8th largest economy. It’s the 4th largest in Europe. Needless to say, this is highly irregular.

The IMF could bail out Italy with up to 600 billion euros ($794 billion), an Italian newspaper reported on Sunday, as Prime Minister Mario Monti came under pressure to speed up anti-crisis measures.

The money would give Monti a window of 12 to 18 months to implement urgent budget cuts and growth-boosting reforms “by removing the necessity of having to refinance the debt,” La Stampa reported, citing IMF officials in Washington.

The IMF would guarantee rates of 4.0 percent or 5.0 percent on the loan — far better than the borrowing costs on commercial debt markets, where the rate on two-year and five-year Italian government bonds has risen above 7.0 percent.

The size of the loan would make it difficult for the IMF to use its current resources so different options are being explored, including possible joint action with the European Central Bank in which the IMF would be guarantor.

“This scenario is because resistance from Berlin to a greater role for the ECB in helping states in difficulty — starting with Italy — could be overcome if the funds are given out under strict IMF surveillance,” the report said.

The European Union and the ECB have sent auditors to check Italy’s public accounts this month and the IMF is set to send experts soon under a special surveillance mechanism agreed at the G20 summit in France earlier this month.

The WSJ reports that a number of countries are pressuring ECB for concessions. The worry is that these same economies that have always had weaker economies and lax fiscal constraint will continue on that path. (These countries include Portugal, Spain, Greece, Italy and Ireland which have been sarcastically given the acronym PIIGS.)

While the ECB has so far said that it won’t beef up its limited bond buying, a growing number of governments are lobbying it to change its stance. A green light from Berlin for a bigger ECB role is seen by many euro-zone policy makers as a political necessity if the ECB is to act. Although the bank is politically independent, it has also paid close attention to the debate in Germany, where the government has so far rejected a bigger role for the central bank.

A new, binding fiscal regime would not be enough to justify the creation of collective euro-zone bonds, German officials say. But it might be enough to justify ECB action to stabilize bond markets that policy makers view as increasingly dysfunctional, some in Berlin say.

Other German officials remain skeptical about a greater ECB role—including Bundesbank President Jens Weidmann, who sits on the ECB’s governing council. Germany’s central bankers have been outvoted by the ECB majority before, however, including this August, when Mr. Weidmann opposed the decision to make limited purchases of Italian and Spanish bonds.

German Chancellor Angela Merkel said last week that she wants EU treaty changes to make the bloc’s fiscal rules legally enforceable by European authorities, in the same way that EU antitrust rules are.

European Council President is going to meet with Treasury Secretary Geithner on Monday at the US Treasury. Both Germany and Italy have had bond auction failures within the last week. This is causing the situation to look more dire. FT’s Wolfgang Munchau says the Eurozone has about 10 days before it collapses. His analysis borders on the sanguine.

Last week, the crisis reached a new qualitative stage. With the spectacular flop of the German bond auction and the alarming rise in short-term rates in Spain and Italy, the government bond market across the eurozone has ceased to function.

High quality global journalism requires investment. Please share this article with others using the link below, do not cut & paste the article. See our Ts&Cs and Copyright Policy for more detail. Email ftsales.support@ft.com to buy additional rights. http://www.ft.com/cms/s/0/d9a299a8-1760-11e1-b00e-00144feabdc0.html#ixzz1exnj0HAB

The banking sector, too, is broken. Important parts of the eurozone economy are cut off from credit. The eurozone is now subject to a run by global investors, and a quiet bank run among its citizens.

This massive erosion of trust has also destroyed the main plank of the rescue strategy. The European Financial Stability Facility derives its firepower from the guarantees of its shareholders. As the crisis has spread to France, Belgium, the Netherlands and Austria, the EFSF itself is affected by the contagious spread of the disease. Unless something very drastic happens, the eurozone could break up very soon.

Technically, one can solve the problem even now, but the options are becoming more limited. The eurozone needs to take three decisions very shortly, with very little potential for the usual fudges.

All eyes and much money is on the European Central Bank right now. Watch the equity markets. They will probably represent the collective guess on the end of the world as we know it.

Thursday Reads

Posted: November 17, 2011 Filed under: #Occupy and We are the 99 percent!, China, Foreign Affairs, Global Financial Crisis, morning reads, Psychopaths in charge, The Media SUCKS, U.S. Economy, U.S. Military, U.S. Politics, voodoo economics | Tags: assassination jokes, australia, China, crime, European Central Bank, European debt crisis, Karl Rove, Lauren Pierce, Maxine Waters, Nobel Peace Prize, occupy Wall Street, Oscar Ramiro Ortega-Hernandez, University of Texas Austin 18 CommentsGood Morning!

You know the Occupy Movement is having an effect when the propaganda patrol starts trying to pin the “TERRORIST” label on them. From Politico:

If confirmed, this will likely be a much, much bigger image problem than the reports of crime in Occupy encampments:

Authorities suspect [Oscar Ramiro] Ortega-Hernandez] had been in the area for weeks, coming back and forth to the Washington Mall. Before the shooting, he was detained by local police at an abandoned house. U.S. Park Police say Ortega-Hernandez may have spent time with Occupy D.C. protesters.

Ooops! In an update, Politico has to take it back–it turns out authorities couldn’t find a connection. But you just know they’re going to keep trying. And ABC News reported it. Lots of people will take that as gospel and never hear that it wasn’t true.

However a GOP campus leader at the University of Texas Austin responded on Twitter to the news of shots fired at the White House.

Hours after Pennsylvania State Police arrested a 21-year-old Idaho man for allegedly firing a semi-automatic rifle at the White House, the top student official for the College Republicans at the University of Texas tweeted that the idea of assassinating President Obama was “tempting.”

At 2:29 p.m. ET, UT’s Lauren E. Pierce wrote: “Y’all as tempting as it may be, don’t shoot Obama. We need him to go down in history as the WORST president we’ve EVER had! #2012.”

Pierce, the president of the College Republicans at UT Austin, told ABC News the comment was a “joke” and that the “whole [shooting incident] was stupid.” Giggling, she said that an attempted assassination would “only make the situation worse.”

Tee hee hee… this is the future of the GOP?

Maxine Waters is still number one voice of reason in Washington DC. When the propaganda merchants tried to get her to say something disparaging about OWS, here’s how she handled it.

When asked to comment Wednesday about the deaths and crimes that have occurred around Occupy protests being held across the country, Rep. Maxine Waters said “that’s life and it happens.”

“That’s a distraction from the goals of the protesters,” Waters, who says she supports the Occupy movement, told CNSNews.com after an event at the Capitol sponsored by the Congressional Progressive Caucus.

I love that woman!

“Let me just say this: Anytime you have a gathering, homeless people are going to show up,” said Waters. “They will find some comfort in having some other people out on the streets with them. They’re looking for food. Often times, the criminal element will invade. That’s life and it happens, whether it’s with protesters or other efforts that go on in this country.

“So I’m not deterred in my support for them because of these negative kinds of things,” said Waters. “I just want them to work at doing the best job that they can do to bring attention to this economic crisis and the unfairness of the system at this time.”

Way to go, Maxine!

In contrast, Republican ratf^^ker Karl Rove isn’t quite so mature. He really lost his cool on Tuesday night when he was targeted by Occupy protesters and ended up acting pretty childish.

Former Bush political adviser Karl Rove seemed a bit flustered Tuesday night after his speech to Johns Hopkins University was interrupted by a group of about 15 protesters connected to “Occupy Baltimore,” who got under his skin enough to get him cursing.

As he spoke about public debt and attempted to pin America’s economic pain on the Obama administration, a woman shouted out, “Mic check?”

A chorus of voices replied, “Mic check!”

“Karl Rove! Is the architect!” they shouted. “The architect of Occupy Iraq! The architect of Occupy Afghanistan!”

“Here’s the deal,” he replied. “If you believe in free speech then you had a chance to show it.”

“If you believe in right of the First Amendment to free speech then you demonstrate it by shutting up and waiting until the Q & A session right after,” Rove trailed off as supporters applauded.

“You can go ahead and stand in line and have the courage to ask any damn question you want, or you can continue to show that you are a buffoon…” he said, as the group of protesters descended into random shouting. One woman called him a “murderer, ” while others chanted, “We are the 99 percent!”

“No you’re not!” Rove replied, chanting it back at them. “No you’re not! No you’re not! No you’re not!”

Gee, that was fun to watch.

Not that any of the European elites will listen, but Brad Plummer at Wonkbook talked to a number of experts and came to the conclusion that the whole story about it not being legal for the ECB to rescue the European financial system is a bunch of hooey.

European officials keep insisting that the ECB isn’t legally allowed to play savior. On Tuesday, the head of Germany’s Bundesbank called it a violation of European law. The Wall Street Journal argued Wednesday that the European Union’s founding treaty would need to be revamped before the ECB could act as a lender of last resort to countries like Italy. So is this true? Could Europe really melt down because of a few legal niceties?

Not really, say experts. It’s true that the Treaty of Lisbon expressly forbids the European Central Bank from buying up debt instruments directly from countries like Italy and Spain. But, says Richard Portes of the London Business School, there’s nothing to prevent the central bank from buying up Italian and Spanish bonds on the secondary market from other investors.

“If that’s illegal, then officials should already be in jail,” says Portes. “Because they’ve been doing it sporadically since May of 2010.” The problem is that the bank’s current erratic purchases only seem to be creating more uncertainty in the market. “Right now,” says Portes, “nobody’s buying in that market except the ECB.”

Instead, what many experts want the European Central Bank to do is to pledge, loudly and clearly, that it will buy up bonds on the secondary market until, say, Italy’s borrowing costs come down to manageable levels. In theory, says Portes, the central bank wouldn’t even have to make many purchases after that, because expectations would shift and become self-fulfilling. In the near term, investors would stop worrying about whether they’d be repaid for loaning money to countries like Italy, and Italy’s borrowing costs would drop — giving it room to figure out its debt woes. (Granted, that latter step is a daunting task.)

But as Dakinikat wrote a couple of days ago, we’ll probably just have to wait and see what happens when the psychopaths in charge do exactly the opposite of what they should do.

The New York Times has a story this morning about Obama’s commitment of troops to Australia: U.S. Expands Military Ties to Australia, Irritating China.

CANBERRA, Australia — President Obama announced Wednesday that the United States planned to deploy 2,500 Marines in Australia to shore up alliances in Asia, but the move prompted a sharp response from Beijing, which accused Mr. Obama of escalating military tensions in the region.

The agreement with Australia amounts to the first long-term expansion of the American military’s presence in the Pacific since the end of the Vietnam War. It comes despite budget cuts facing the Pentagon and an increasingly worried reaction from Chinese leaders, who have argued that the United States is seeking to encircle China militarily and economically.

“It may not be quite appropriate to intensify and expand military alliances and may not be in the interest of countries within this region,” Liu Weimin, a Foreign Ministry spokesman, said in response to the announcement by Mr. Obama and Prime Minister Julia Gillard of Australia.

Attention Nobel committee: Isn’t it about time to rescind that Peace Prize?

OK, that’s it for me. What are you reading and blogging about today?

Recent Comments