When Corporations Mutate Into A Super Race

Posted: March 12, 2012 Filed under: corporate money, corporatism, Economy, energy, Environment, Environmental Protection, Environmentalists, fracking, Regulation, toxic waste 12 CommentsWe all remember Mitt Romney’s public and awkward statement that ‘Corporations are people, too.”

But Romney was underplaying the reality of American life in 2012.

Corporations are not mere people. They have morphed into a Super Race, ready to conquer what’s left of our disintegrating democracy. If you think this is liberal hysteria or rank hyperbole, I give you Pennsylvania’s newly passed Act 13. Bad number. But the scope of this foolish and utterly destructive state giveaway is far worse.

Act 13 is a massive gift to the oil and gas companies, which overturn property rights, strips municipal communities of zoning law protection and turn environmental and health compromises into considerations we can no longer afford. It reduces the citizens of Pennsylvania to 3rd world colony status, ripe for exploitation and extraction. Welcome to the New World of Corporate Rule where natural gas extraction is the profitable prize and quality of life is a thing of the past.

And the reaction?

“Now I know what it feels like to live in Nigeria,” said recently retired Pittsburgh City Council President Doug Shields. “You’re basically a resource colony for multi-national corporations to take your natural resources, take them back to wherever they are at, add value to them, and then sell them back to you.”

Yup. This is the neoliberal dream. Steal, add value and then sell back at an exorbitant price tag. The whole world is nothing more than a resource colony so the corporate Super Race can turn a mind-boggling profit. On the backs of the natives. Water safety and/or depletion, health, wildlife? All expendable in this great push for growth and ever-increasing profit. Moral considerations? Please, haven’t you gotten the email? Corporations don’t do morality. They’re too big for that.

Why did this happen in Pennsylvania? Because of the enormous layer of shale deposits known as the Marcellus formation, resting like a slumbering giant beneath the state’s surface. But there’s more! That would be the gargantuan amount of natural gas to be had at a stunning profit—as much as 70-99% some managers of earlier drill wells have boasted.

How could investors resist?

But then, there are the rising concerns of the fracking process itself, the public’s growing awareness of water and air pollution, the niggling problem of toxic wastewater disposal and those bothersome legal suits from citizens with lame health issues.

What to do, what to do?

Act 13 is the perfect response to investor skittishness. It removes all complaint and whining by simply supplanting existing law—the kind that protects the citizen—with corporate friendly law that recognizes the global reality—everyone is for sale and everything can be exploited.

To keep tempers in check, the best PR in the world is dished out, promises of jobs and prosperity, spinning dialogues about energy independence [at any cost] and patriotic flag-waving—how tearing up the earth, polluting our waterways and compromising the public’s health is good for America. After all, in times of crisis, sacrifices need to be made, even when it means overriding the civil rights of people and communities.

That is exactly what Act 13 addresses.

Courts in the Great State of New York upholding community rights to block fracking dreams is simply unacceptable. Act 13 revokes those rights. The Lakota people in South Dakota blocking TransCanada truck transports across Native territory? We can’t have that. Act 13 clearly empowers a corporation to seize property that impacts any stage of the drilling process. And those possible health considerations? Got it covered, boys and girls. Act 13 prohibits physicians from discussing medical impacts from chemical contaminations. The Halliburton Loophole in all its malicious splendor comes back to haunt us.

This is what happens when corporations are declared ‘people.’ This is what happens when legislators sell their souls for 30 pieces of silver. I do not care if Republican Governor Corbett and his Republican dwarves truly believe this is good for Pennsylvania. This is a betrayal of American law and her people on a massive scale. The good citizens of Pennsylvania might look at the situation in Ohio, where Governor Kasich opened the state’s doors for business, any business, and Ohio became the dumping ground for fracking wastewater disposal and deep ground injection wells. We now know those earthquakes were not coincidental events. No wonder Republicans hate science!

Hattip to Alternet on this rant. I’d recommend reading the article ‘Fracking Democracy: Why Pennsylvania’s Act 13 May Be the Nation’s Worst Corporate Giveaway’ by Steven Rosenfeld in its entirety with the first link I provided. It’s a chilling, mind-blowing report.

Act 13 is expected to take effect on April 14th. We better pray [regardless of what state we live in] that the groups now amassing in Pennsylvania are able to halt or at least slow down this corporate monstrosity.

Because if not, we can say ‘adios’ to the shredded remnants of our Republic.

As for Pennsylvania? My heart goes out because I lived and worked in the state for over a dozen years and still have family in the area. The economy has been raked over the coals, so the promise of jobs and money injected into struggling municipalities and rural communities is a huge seduction. But we’ve seen this movie before. It does not end well. Here’s hoping that flesh and blood citizens get a chance to write a far better script for themselves and their future. Here’s hoping the rest of the country wakes up to what can only be called a corporate takeover.

The Cantor Cartwheel On Insider Trading

Posted: February 11, 2012 Filed under: Congress, corporate money, corruption, Democratic Politics, ethics, legislation, Politics as Usual, Republican politics, Senate, Stock Market, U.S. Politics, We are so F'd 22 CommentsWhile our eyes and fury were directed on the birth-control-is-evil crowd and the ludicrous threats of the National Razor coming to a town near

you, the insider trading bill wended its merry way through Congress. Only a provision in the Senate version of STOCK [Stop Trading on Congressional Knowledge Act] was stripped from the House version. The bill will return to the Senate, and then most likely go into conference committee to iron out differences.

The deletion of the provision is curious since it would have required Washington insiders, those who sell political intelligence to corporate America [financial institutions], to register in advance like any lobbyist, thereby making their identities and purpose transparent.

One senator reacted to the provision’s removal this way:

It’s astonishing and extremely disappointing that the House would fulfill Wall Street’s wishes by killing this provision. The Senate clearly voted to try to shed light on an industry that’s behind the scenes. If the Senate language is too broad, as opponents say, why not propose a solution instead of scrapping the provision altogether? I hope to see a vehicle for meaningful transparency through a House-Senate conference or other means. If Congress delays action, the political intelligence industry will stay in the shadows, just the way Wall Street likes it.

That would be a Democrat complaining, right?

Wrong.

That would be Republican Senator Chuck Grassley from Iowa protesting House member Eric Cantor for removing the provision [Grassley’s add on], ultimately making the bill substantially weaker than it could have been.

And ‘political intelligence industry?’ Sounds like something straight out of an Ian Fleming novel. Turns out this shadowy practice is a $100 million industry, employing 2000 people who sneak around Congress to pick up investment tips for Wall Street.

You cannot make this stuff up!

In any case, it was Eric Cantor who tabled the original effort to suspend insider trading back in December. Also removed was a bipartisan amendment by Senators Patrick Leahy [D VT] and John Cornyn [R TX] made to crack down on officials ‘self-dealing,’ that is, enriching themselves through their positions.

The question is: why the not-so-clever foot dragging on this bill, something that makes perfect sense to the American public? Why ditch Grassley’s provision or the Leahy/Cronyn amendment, which would have added additional teeth?

As in, make it better.

According to initial comments, Cantor claimed the language too broad and the additional provisions ‘needed more study.’ Seems to me the study-until-we-drop reason was cited back in December.

But Cantor did add a touch of his own that would restrict legislators from participating or benefiting from IPOs. This addition quickly became tagged the ‘Pelosi provision,’ inspired by the suggestion that Pelosi’s husband had taken advantage of insider information when he bought into a VISA public offering, making a tidy profit [230% increase, by some accounts]. Pelosi has denied this accusation, insisting that her husband’s buys were directed by a traditional Wells Fargo broker.

Wish my broker was that good!

Cheap political tricks and posturing happen all too frequently but why would Cantor be so adamant in weakening a bill the public and a surprising number of Congressional members favor?

Republic Report suggests we look at Cantor’s history, specifically the issue of mortgage cram down in 2009.

Eric Cantor led the Republican refusal to consider the mortgage cramdown proposals in 2009, a measure that would have permitted homeowners to negotiate lower interest rates and avoid foreclosure. However, what was not common knowledge [see Open Secrets. org] was that Cantor’s personal wealth was heavily involved in the mortgage industry itself. From RR:

Cantor invested in several mortgage banks, and owned a portion of a Cantor-family run mortgage company. According to Cantor’s 2009 personal disclosure, Cantor owned up to a $500,000 share of a mortgage company called TrustMor run by his brother.

While Cantor blocked a fix to the foreclosure crisis, his wife Diane Cantor served as the managing director of a bank with a high foreclosure rate. Diane Cantor at the time worked as a managing director to New York Private Bank & Trust, a major mortgage bank and TARP recipient. SNL Financial reported that Cantor’s bank was among the top three banks in the mortgage business “with thegreatest percentage of family loans in the foreclosure process.

There was also the dustup during the debt ceiling debate last year when a revealed fund Cantor was invested in, stood to make a sizeable profit if the US actually defaulted on its debt. If the country tanked, Cantor stood to win.

Such loyalty!

Personally, I liked Cantor’s chest thumping after wicked storms savaged the South and East Coast last spring [my house and property suffered nearly $20,000 in damages with 1600+lbs of debris dragged from the front and back yard]. For his Tea Party audience, Cantor tried bucking disaster relief until expenses [like unemployment checks and food stamps] were cut elsewhere. But then amazingly, Cantor made a sharp pivot and complained FEMA was far too slow in addressing damage relief in his own Virginia district.

Consistency is a beautiful thing!

So, we have the Pelosi Provision and the Cantor Cartwheel, anything to stall a DC scrub down, the disinfectant treatment that the American public demands [at the very minimum] from their representatives–abiding by the laws, standards and a sense of ‘doing the right thing.’ You know, those principles that presumably apply to everyone.

BTW, the Sunlight Foundation has provided the House/Cantor Version of the STOCK bill with edits [strikeouts] included. Most instructive!

Don’t you love the Internet??? Bet Cartwheel Cantor doesn’t.

And though I would have nominated Eric Cantor for Sellout of the Week, Republic Report has chosen President Obama, primarily based on his recent decision to embrace Super PAC money [though I suspect we could all come up with other examples]. However, the President opened himself up to this chastising because he warned about unlimited campaign spending in 2008:

Let me be clear — this isn’t just about ending the failed policies of the Bush years; it’s about ending the failed system in Washington that produces those policies. For far too long, through both Democratic and Republican administrations, Washington has allowed Wall Street to use lobbyists and campaign contributions to rig the system and get its way, no matter what it costs ordinary Americans.

That was then, this is now.

Did you know that one of the collective nouns used to describe a group of weasels is . . . SNEAK. How perfect is that?

Is This the Conversation We’ve Been Waiting For . . . Or Not?

Posted: January 14, 2012 Filed under: #Occupy and We are the 99 percent!, 2012 primaries, Banksters, Congress, Corporate Crime, corporate money, Economy, income inequality, Regulation, Republican Tax Fetishists | Tags: crony capitalism, Financial Crisis, Mitt Romney, Newt Gingrich, U.S. Economy 22 CommentsThe recent brouhaha over Newt Gingrich and Mitt Romney locking horns over Romney’s involvement [I created 100,000 jobs] at Bain Capital  has raised speculation that a conversation about capitalism, the way it’s been practiced these last 30-40 years, is about to commence, a conversation that is way overdue.

has raised speculation that a conversation about capitalism, the way it’s been practiced these last 30-40 years, is about to commence, a conversation that is way overdue.

The irony is that the issue has been brought to the fore by Republican candidates, none of whom questioned the blowback of leveraged buyouts [LBO] and private equity firms in the past or even whispered the traitorous phrases–crony capitalism, vulture capitalism–in public. In fact, the centerpiece of GOP economic theory is free market fundamentalism—set the market free, unfetter business from governmental regulation and Heaven’s Gate will open.

Not quite.

There’s the 2008 meltdown to contend with, the abuses of Wall Street and a clear example that Greenspan’s ‘self-regulating’ market theory was a cruel and greedy joke. Following the meltdown, Greenspan himself glumly admitted his worldview was incorrect.

In addition, we have plenty of evidence that the so-called Trickle-Down philosophy has not ‘raised all ships’ as heralded by the true believers but rather led to huge income disparities, flat wages and the death-rattle of the middle-class.

Yes, there is the question of globalization. Like it or not, we have grown interconnected. But when decisions are made purely on profit, the quicker the better, then transferring manufacturing abroad, exploiting cheap foreign labor, taking advantage of lax worker safety rules and nonexistent environmental regulations begins to make a twisted sort of sense. So, too with trade agreements made deliberately lopsided and unfair because these ‘deals’ have no national loyalty. Profit is king; all else is subservient.

The long-term damage is massive. We don’t have to speculate about this. The evidence is everywhere in our unemployment numbers [which are far worse than reported] and the slide into poverty for alarming numbers of Americans. Add in the housing crisis, still escalating health care costs, the Gulf oil spill, endless wars, the battles over extracting oil, coal and natural gas while refusing to work on rational and workable alternative energy policies, and . . .

Well, it’s enough to make your head explode.

But suddenly, the door has flown open for a conversation on what it means to be a shareholder capitalist. The unquestioned virtue of profit over all else has begun to raise its ugly head.

For instance, what value [if any] is created for a society when money is valued above all else, valued over the welfare of fellow citizens–the sick, the disabled, even our children. What value is maintained when corners are cut, laws rewritten, ridiculous tax policies hyped as necessary for growth and future job creation? But the mythical jobs, positions offering a living wage, never come. What does it mean when massive profits stream only to the top tier of the population, the so-called job creators, while everyone and everything else is left to flounder?

I call it a no-value deal–a lie, a theft–the magnitude of which hollows out a society, sucks it dry.

For too long Newt Gingrich [for all his caterwauling now] and his like-minded buddies have called it the free enterprise system. Free for whom? Certainly not for the families who have lost their homes, seen their jobs exported and have no reasonable expectation that their own children will ever see better times. Not with the continuation of what Dylan Ratigan has termed Extractionism, a system that takes money from others without offering anything of value, anything that actually promotes growth or improves society. This is a system that merely fills the coffers of the Extractionists, while they play a heady game of King of the Mountain and continue to spread the folklore that this is what freedom and liberty look like.

But let’s be fair. Mitt Romney is not the devil incarnate, nor is Bain Capital the worst of the worst. Much of what Newt Gingrich’s SuperPac is selling to the electorate conveniently let’s Wall Street and multinational corporations off the hook. The ads fail to mention the cushy collusion of legislators who push laws and tax breaks to keep the circle spinning. And Washington Democrats who may be dancing the happy dance now are just as guilty of supporting the status quo, going along to get along, eagerly taking campaign donations from their own smiling Extractionists.

But let’s be fair. Mitt Romney is not the devil incarnate, nor is Bain Capital the worst of the worst. Much of what Newt Gingrich’s SuperPac is selling to the electorate conveniently let’s Wall Street and multinational corporations off the hook. The ads fail to mention the cushy collusion of legislators who push laws and tax breaks to keep the circle spinning. And Washington Democrats who may be dancing the happy dance now are just as guilty of supporting the status quo, going along to get along, eagerly taking campaign donations from their own smiling Extractionists.

Is this the conversation Republicans are offering?

Sorry, no.

Rush Limbaugh has been apoplectic on the issue. According to Limbaugh, Gingrich has ‘Gone Perot.’

So you might say that Newt now has adopted the Perot stance, because he just said it: ‘I’m gonna make sure that Romney doesn’t come out of New Hampshire with any momentum whatsoever.’ And he’s using language that the left uses, and he’s attempting to make hay with this. You know, he’s trying to dredge up and have long-lasting negatives attach to Romney [this is what’s so unsettling about this] in the same way the left would say it. You could, after all these bites, say, “I’m Barack Obama, and I approve this message.

Rudy Giuliani also weighed in.

What the hell are you doing, Newt?” Giuliani said this morning on “Fox and Friends.” “The stuff you’re saying is one of the reasons we’re in this trouble now.

This whole ignorant populist view of the economy that was proven to be incorrect with the Soviet Union with Chinese communism.

Oh yes, the ‘ignorant populist’ view that has beamed a light on business as usual. Which btw, is not working, except for a tiny fraction of the American public. If anything, Uncle Newt has pulled back the curtain and revealed an unsettling truth.

This might not be the full-throated conversation Americans need to engage in. Still it’s a beginning from a most unexpected quarter, whose raison d’etre is as caught up in short-term results as are its economic principles. Almost Occupy Wall St. in nature, the conversation is now in the open. This is a conversation that defies Mitt Romney’s suggestion that sensitive subjects are better left to the privacy of ‘quiet rooms.’

This is the conversation of the moment. The first word, the opening sentence. It has just begun.

Update: Under the Big Sky of Montana

Posted: January 6, 2012 Filed under: corporate money, court rulings, SCOTUS 14 CommentsWord is out that American Tradition Partnership will, in fact, appeal Montana’s Supreme Court decision last Friday on the question of  upholding the state’s 100-year ban on direct corporate funding in state elections. The Montana decision was the first shot across the bow to the contentious SCOTUS Citizen United v. Federal Election Commission ruling in 2010, whereby money was equated to free speech and the virtual floodgates opened to corporate funds, influencing [corrupting] our electoral processes [see GOP primaries/clown show for a clear example of the corrosive nature of this decision].

upholding the state’s 100-year ban on direct corporate funding in state elections. The Montana decision was the first shot across the bow to the contentious SCOTUS Citizen United v. Federal Election Commission ruling in 2010, whereby money was equated to free speech and the virtual floodgates opened to corporate funds, influencing [corrupting] our electoral processes [see GOP primaries/clown show for a clear example of the corrosive nature of this decision].

John Bonifaz, the director of Free Speech for People, stated that he sees the appeal as a win/win situation.

“We believe there’s a win-win situation here,” said John Bonifaz, the co-founder and director of Free Speech for People. If the high court refuses to address the decision, he said, it could give a green light to other states to limit corporations’ political spending.

“If they take it up, there will be a new opportunity to push forward all the arguments as to why the court got it wrong,” he said. And if they reaffirm their prior decision, “that will only fuel the efforts further to allow a constitutional amendment,” he said, noting that he would expect the court to make a decision by late June or early July.

Judge Nelson, who wrote a principled dissent in the Montana case [mentioned in an earlier post on Sky Dancing] has indicated that he expects SCOTUS to take the case up and reverse Montana’s decision on the merits. He reiterated his position that Citizens United is the Law of the Land. However, Judge Nelson made clear in his original dissent that he found the theory of corporate personhood highly offensive and false.

Frankly, we need more judges like this, those with the courage to express their extreme distaste for a ruling, while standing on the firm conviction that the Rule of Law has meaning and purpose. This is what a principled stand is all about, frequently neither easy nor comfortable. We have watched a cascade of politicians giving lip service to ‘following the law,’ while doing just the opposite. Or the appalling examples down in Florida, the rocket dockets where judges merely rubberstamped decisions for mortgage servicers in fraudulent home foreclosure cases.

This is a case to keep an eye on. Either way it goes, I think John Bonifaz is correct—it’ a moment where an odious decision is being forced into the spotlight for reexamination. It’s an inflection point where the rights of people push hard against the ridiculous and destructive notion that corporations, artificial entities, are equal to human beings, afforded with the same natural rights while not being bound [as Judge Nelson clearly stated] “to the same code of conduct, decency and morality.”

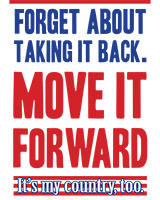

One of my favorite Occupy Wall St. signs shouted out this same sentiment.

So keep those lips puckered for a cowboy. I may be forced to buy myself a cowboy hat! You rock, Montana!

Let’s Hear It for the Little Guy . . . Oh Hell, Let’s Hear It for Montana

Posted: January 3, 2012 Filed under: corporate money, corruption, court rulings, SCOTUS 8 CommentsWhile awaiting the results of the Iowa Ugly Contest, we can rejoice in an example of American common sense and respect for the electoral process.

process.

From the land of the Ponderosa Pine, from the state where the official flower is bitterroot [oh, how appropriate], we have the first challenge to SCOTUS’s reprehensible 2010 decision in Citizens United. From the Daily Agenda:

The Montana Court vigorously upheld the state’s right to regulate how corporations can raise and spend money after a secretive Colorado corporation, Western Tradition Partnership, and a Montana sportsman’s group and local businessman sued to overturn a 1912 state law banning direct corporate spending on electoral campaigns.

What does this mean? A first shot across the bow to one of the most contentious Supreme Court decisions in the last decade, a decision that has flooded elections with corporate money and influence and threatens to undermine the very nature and foundation of our democratic electoral processes.

There are national movements afoot, calls for Constitutional Amendments to remove the corrosive effects of corporate money and influence through Dylan Ratigan’s political action group. Bernie Sanders and his pragmatic Yankee constituents in Vermont are working to the same end. I reported before the holiday that Tammy Baldwin, House Rep from WI, introduced a resolution calling for aggressive investigation and prosecution of TBTF banks involved in the housing debacle. At last look, Baldwin had attracted 70 cosponsors to the proposed legislation. There’s a ‘fight ‘em on the beaches’ spirit rising on the wind. It’s a good sign.

And now Montana has entered the fray, where the State Supreme Court overturned a lower court’s decision to allow direct spending in state electoral campaigns.

This case wended its way through the judicial process and the decision to uphold the 100-year old state ban was ultimately supported in a 5-4 decision last Friday. John Bonifaz spokesman for Free Speech For People, a group pushing to overturn the Citizens United decision, said in a statement:

With this ruling, the Montana Supreme Court now sets up the first test case for the U.S. Supreme Court to revisit its Citizens United decision, a decision which poses a direct and serious threat to our democracy.

Not to get too heady about this decision [we are talking about bucking a ruling by SCOTUS, always considered The Rule of the Land], the dissenting opinion by Montana Judge Nelson, the main points picked up by Alternet, made my heart soar for its principled stand. Yes, it sounds like a contradiction because I think Citizens is an odious and destructive ruling. But so does Nelson, which he explains below. Btw, I would suggest reading the full post over at Alternet because it gives a good summary of the historical background in Montana, the reason the state ban on direct corporate funds was originally imposed and the smarmy games the lawyers [representing Western Tradition Partnership] have been playing in Montana.

Not to get too heady about this decision [we are talking about bucking a ruling by SCOTUS, always considered The Rule of the Land], the dissenting opinion by Montana Judge Nelson, the main points picked up by Alternet, made my heart soar for its principled stand. Yes, it sounds like a contradiction because I think Citizens is an odious and destructive ruling. But so does Nelson, which he explains below. Btw, I would suggest reading the full post over at Alternet because it gives a good summary of the historical background in Montana, the reason the state ban on direct corporate funds was originally imposed and the smarmy games the lawyers [representing Western Tradition Partnership] have been playing in Montana.

But here are few of Judge Nelson’s statements pertaining to his dissent:

Nelson closed by slamming the legal theory of corporate personhood—that corporations, because they are run and owned by people, should have the same constitutional freedoms as individuals under the Bill of Rights. Corporatist judges, such as the Roberts Court, believe that corporations and people are indistinguishable under the law. In contrast, constitutional conservatives know very well that the framers of the U.S. Constitution distrusted large economic enterprises and drafted a document to protect individual businessmen, farmers and tradespeople from economic exploitation.

“While I recognize that this doctrine is firmly entrenched in law,” Nelson began, “I find the concept entirely offensive. Corporations are artificial creatures of law. As such, they should enjoy only those powers—not constitutional rights, but legislatively-conferred powers—that are concomitant with their legitimate function, that being limited liability investment vehicles for business. Corporations are not persons. Human beings are persons, and it is an affront to the inviolable dignity of our species that courts have created a legal fiction which forces people—human beings—to share fundamental natural rights with soulless creations of government. Worse still, while corporations and human beings share many of the same rights under the law, they clearly are not bound equally to the same codes of good conduct, decency, and morality, and they are not held equally accountable for their sins. Indeed, it is truly ironic that the death penalty and hell are reserved only to natural persons.”

As Nelson said, ending his dissent, “the [U.S.] Supreme Court has spoken. It has interpreted the protections of the First Amendment vis-a-vis corporate political speech. Agree with its decision or not, Montana’s judiciary and elected officers are bound to accept and enforce the [U.S.] Supreme Court’s ruling…”

This is what it means to stand on principle, even when you vehemently disagree. It’s not a matter of stretching out and letting the 18-wheeler  have its way. This is an honorable dissent, one to be proud of because it’s firmly entrenched in the American tradition.

have its way. This is an honorable dissent, one to be proud of because it’s firmly entrenched in the American tradition.

So while Michelle Bachmann awaits a miracle and we’re inundated with the results of today’s Ugly Contest think about Judge Nelson’s stand and words.

I don’t know about you but I’m ready to kiss a cowboy!

Recent Comments