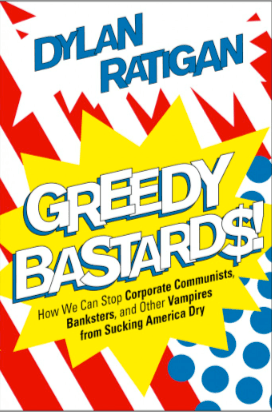

Greedy Bastards

Posted: January 26, 2012 Filed under: Banksters, commercial banking, Corporate Crime, corruption, financial institutions, Global Financial Crisis, investment banking, lobbyists, U.S. Economy, U.S. Politics | Tags: Dylan Ratigan, extractionism vs capitalism, Greedy Bastards 15 CommentsNo, I am not making an editorial comment.

But after nonstop blathering served up by the GOP, only to be followed by President Obama’s Teddy Roosevelt impersonation [although I have to admit—the State of the Union was a surprisingly good speech], I thought a moment of palate cleansing might be in order. In this case Dylan Ratigan offers up the sorbet.

Ratigan is someone willing to call out the shysters, the casino players and shakedown artists, including their political handmaidens for what they truly are, and ‘Greedy Bastards’ is the title of his newly released book. The author’s name may ring a bell because Dylan Ratigan has a public platform on MSNBC, an hour-long show Monday through Friday. The program airs at 4:00 pm, EST, in my neck of the woods.

Ratigan’s slant focuses on the collision of worlds, that of finance and politics, how the incestuous relationship is literally squeezing the life out of the United States. His take is not an indictment of capitalism. Rather it is an indictment of what is posing as capitalism, a system he refers to as ‘extractionism.’

Ratigan is not a newcomer or a pundit simply reading a script. He worked the financial beat with Bloomberg News, serving as Global Managing Editor to Corporate Finance until 2003. He’s also the former anchor and co-creator of CNBC’s Fast Money. He has launched and anchored a number of financially-related broadcasts over the years but decided to leave Fast Money after the 2008 financial meltdown. Ratigan has publicly stated that he was personally disgusted by the Wall Street banking sector’s shakedown of the American public. The Dylan Ratigan Show was launched to provide discussion and analysis of the financial/government intersection, a system that has acquiesced to the wanton theft of the Nation’s wealth and resources by . . . Greedy Bastards, of course.

Though the show has been on air for three years, Ratigan has admitted that his voice was finally heard after an infamous meltdown last August. It was an on-air rant that would have made Patty Chayefesky proud, a Howard Beale moment.

That woke people up! It also led to Ratigan’s Get the Money Out [of politics] Movement, working towards a Constitutional Amendment to remove the corrosive element of money in the political sphere. And then, there’s the book.

One thing I liked about Ratigan’s approach is that instead of pointing out one segment of the population for public pillorying, his title basically refers to a state of mind and the all too frequent way of doing business and politics in the 21st century.

For instance, in the case of capitalism, Ratigan uses the example of venture capital, a subject that has come up in reference to Romney’s connection to Bain & Company, specifically Bain Capital. From Chapter 1:

If I start a venture capital firm that lends out money to drug researchers trying to find new cures for disease, and I get rich doing it, then I made my money by investing in the productive future of the country. I used my money in a way that facilitated scientific innovation and a cure. I’m what the director of the Havas Media Lab Umair Haque a ‘capitalist who makes.’ But instead, if I take the same money and use it to lobby for changes in government regulation—changes that help me trick a union into investing its retirement savings in flawed investments so that I can collect the commissions—then I may move as many dollars into my bank account as someone who funded cures for diseases, but I haven’t made anything. I’m a ‘capitalist who takes,’ exploiting my power to influence the government for my own private gain, no matter the harm to anyone else. I’m a greedy bastard.

The latter example, taking money from others without providing anything of value is, according to Ratigan, the opposite of capitalism. An extractionist system loses increasing value over time until there’s nothing left. Call it the vampire or vulture model. A system based on the extractionist principle, provides no incentive for people to make good deals, where both sides benefit. Instead, it rewards those who take and give nothing in return.

Sound familiar?

Ratigan covers the areas that have pushed the extractionist model to the max: banking, education, healthcare, energy, trade negotiations and the unholy alliance of government and big money fueling the feeding frenzy of the Nation’s resources and our future. But unlike many gloom and doom tomes, Ratigan offers solutions and brings an optimism to the subject, namely that we have the ideas, the people and yes, even the money to solve what at times seems insolvable. He concludes in a rather convincing way that what is needed is a realignment between investment and the needs of capable, innovative people. If loans and investments offered the highest returns when they provided the highest value as opposed to simply taking the highest risk, then prevailing attitudes and business practices would shift and win/win deals would be created.

Sound like pie in the sky? I don’t think so. Yes, it’s a matter of will, public pressure to exact the necessary changes but this realignment idea is possible by citing the goals first, and then targeting the resources to get there. Ratigan refers to this as hotspotting—zeroing in on the problem, determining what methodology provides the best results, and then aiming resources to match those needs.

Sound like pie in the sky? I don’t think so. Yes, it’s a matter of will, public pressure to exact the necessary changes but this realignment idea is possible by citing the goals first, and then targeting the resources to get there. Ratigan refers to this as hotspotting—zeroing in on the problem, determining what methodology provides the best results, and then aiming resources to match those needs.

Though some critics have dismissed this idea, it is very attuned to what Bill Clinton recently suggested in his Esquire interview about highlighting the successes and needs across the country, and then linking them, matching them up. Just another turn on the realignment idea:

. . . the two best things you could do are the infrastructure bank and a simple SBA-like loan guarantee for all building retrofits, where the contractor or the energy-service company guarantees the savings. So that allows the bank to loan money to let a school or a college or a hospital or a museum or a commercial building or factories for lease unencumbered by debt to loan it on terms that are longer, so you can pay it back only from your utility savings. You could create a million jobs doing that because of the home models that are out there now.

There are these two guys on Long Island who started a little home-repair deal. They got thirty-five employees now, and they’re — they can go in, tell you how much they’ll save you. There’s an operation in Nebraska that’s in and out in a day, and they’re averaging more than 20 percent savings, and conservative Republican Nebraska is the only state in the country that has 100 percent publicly owned power.

And,

You’ve got Orlando with those one hundred computer-simulation companies. They got into computer simulation because you have the Disney and Universal theme parks, and Electronic Arts’ video-games division. And the Pentagon and NASA desperately need simulation, for different reasons. So there you’ve got the University of Central Florida, the biggest unknown university in America, fifty-six thousand students, changing curriculum, at least once a year, if not more often, to make sure they’re meeting whatever their needs are, and they’re recruiting more and more professors to do this kind of research that will lead to technology transfers to the companies. You’ve got Pittsburgh actually becoming a real hotbed of nanotechnology research. You’ve got San Diego, where there are more Nobel-prize-winning scientists living than any other city in America. You’ve got the University of California San Diego and other schools there training people to do genomic work. Qualcomm is headquartered there, and there are now seven hundred other telecom companies there, and you’ve got a big private foundation investing in this as well as the government, and nobody knows who’s a Republican or who’s a Democrat, they’re just building this networking.

We have fabulously innovative, creative people working on all kinds of things. Our true wealth is in our people; our true value is . . . us.

Ratigan is now on a 30-million jobs tour showcasing business enterprises that are, in fact, answering a need, offering value to their communities, providing jobs and in the best capitalist tradition—making a profit.

The endnote is that the country hasn’t lost its edge. We’ve lost the path that works, the one that values quality and integrity. Greedy Bastards will always exist, those hoping to make a quick buck [or trillions of bucks] off the backs of others. They have no shame. The goal is to make them and their thievery the exception, not the rule.

Btw, Ratigan’s book is highly readable, written for the layperson. No economic degrees required. If you’ve been following the financial blowout and/or Ratigan’s show, this will be a fast review. If you’re just starting to pay attention, consider the book a primer—what the country underwent and where we need to go. The sooner, the better. Ratigan encourages us to reclaim our voice, demanding that our people and country come first.

It’s a worthy message. Read the book. Get the word out.

Forget Texas, check out North Dakota

Posted: December 26, 2011 Filed under: commercial banking, financial institutions | Tags: Bank of North Dakota, North Dakota, State Bank 12 CommentsThe problem with a market-based system is the variety of ‘frictions’ that exist when a specific good or service doesn’t line up with the conditions that need to exist in a perfect market. The  assumptions for perfect market capitalism are rather daunting. They are nearly as daunting as the conditions for a centrally planned government like that tried by the Soviets. There have to be thousands–if not millions–of buyers and sellers who have no control over the market’s price or quantity produced. This pretty much rules out all our nation’s markets with the exception of a few commodities. These buyers and sellers produce and sell products and services that are all the same so no one cares who they buy from or sell to because it’s all the same. This means no product or service differentiation. Advertising does no good because there’s nothing that separates one good or service from any other. Labels don’t matter. Sizes, shapes, and colors are all uniform. There is no difference between the information available to buyers and sellers. That means there’s no insider information on any one’s part. There is also no way to cheat or beat a market. The only thing you can compete on if you’re a business is productivity and cost curves. That’s the kind of markets that may have existed some 200 years ago when commodities ruled the planet but it in no way reflects any market today.

assumptions for perfect market capitalism are rather daunting. They are nearly as daunting as the conditions for a centrally planned government like that tried by the Soviets. There have to be thousands–if not millions–of buyers and sellers who have no control over the market’s price or quantity produced. This pretty much rules out all our nation’s markets with the exception of a few commodities. These buyers and sellers produce and sell products and services that are all the same so no one cares who they buy from or sell to because it’s all the same. This means no product or service differentiation. Advertising does no good because there’s nothing that separates one good or service from any other. Labels don’t matter. Sizes, shapes, and colors are all uniform. There is no difference between the information available to buyers and sellers. That means there’s no insider information on any one’s part. There is also no way to cheat or beat a market. The only thing you can compete on if you’re a business is productivity and cost curves. That’s the kind of markets that may have existed some 200 years ago when commodities ruled the planet but it in no way reflects any market today.

Because frictions exist, a role for government in markets exists. It can be one of regulator or one of service/good provider. There is a branch of economics that specifically studies which kinds of goods and services must be provided by government because otherwise they would be provided to only the very rich–like education or health services–or they wouldn’t be provided at all because there is no profit in providing the good. There are also goods that once they are provided for one person are used by many others. This is the so-called free rider problem and the provision of military defense is usually the prime example of this type of government good. Another problem deals with the idea of “the commons” which basically led to an old problem in North Dakota like over hunting and near extinction of the American Bison.

The provision of a public payment system–much like a mail system–is one such good that many economists feel has a public good component. This is why many countries supplement private banking systems with government banks. Blended banking systems are pretty common in the Asian countries. Interestingly enough, there is one state with a state bank. It’s the one state in the union that made it through the global recession relatively unscathed. That would be North Dakota.

North Dakota has been called an economic miracle. It has outpaced every other state during the worst of the recession. North Dakotaas the lowest unemployment rate and the fastest job growth rate in the country. This data is provided in a NYT article by Catherine Rampell.

According to new data released by the Bureau of Labor Statistics today, North Dakota had an unemployment rate of just 3.3 percent in July — that’s just over a third of the national rate (9.1 percent), and about a quarter of the rate of the state with the highest joblessness (Nevada, at 12.9 percent).

North Dakota has had the lowest unemployment in the country (or was tied for the lowest unemployment rate in the country) every single month since July 2008.

Its healthy job market is also reflected in its payroll growth numbers. North Dakota had 19,700 more jobs in July than it did during the same month last year.

That probably sounds like small potatoes when you look at Texas, which had 269,500 more jobs last month than it did a year earlier. But Texas is a much bigger, more populous state, and had many more jobs to begin with. In terms of percentage growth, North Dakota has a better record: year over year, its payrolls grew by 5.2 percent. Texas came in second, with an increase of 2.6 percent.

There are some more interesting facts here. Yes, there is oil in North Dakota but that’s not the only thing driving its economy.

Alaska has roughly the same population as North Dakota and produces nearly twice as much oil, yet unemployment in Alaska is running at 7.7 percent. Montana, South Dakota, and Wyoming have all benefited from a boom in energy prices, with Montana and Wyoming extracting much more gas than North Dakota has. The Bakken oil field stretches across Montana as well as North Dakota, with the greatest Bakken oil productioncoming from Elm Coulee Oil Field in Montana. Yet Montana’s unemployment rate, like Alaska’s, is 7.7 percent.

A number of other mineral-rich states were initially not affected by the economic downturn, but they lost revenues with the later decline in oil prices. North Dakota is the only state to be in continuous budget surplus since the banking crisis of 2008. Its balance sheet is so strong that it recently reduced individual income taxes and property taxes by a combined $400 million, and is debating further cuts. It also has the lowest foreclosure rate and lowest credit card default rate in the country, and it has had NO bank failures in at least the last decade.

If its secret isn’t oil, what is so unique about the state? North Dakota has one thing that no other state has: its own state-owned bank.

Access to credit is the enabling factor that has fostered both a boom in oil and record profits from agriculture in North Dakota. The Bank of North Dakota (BND) does not compete with local banks but partners with them, helping with capital and liquidity requirements. It participates in loans, provides guarantees, and acts as a sort of mini-Fed for the state.

Yes, you read that right. North Dakota is the only state in the union that has a mini-Fed. It’s one of the reasons that the credit crunch didn’t impact the state the way it didn’t the rest of the country. North Dakota’s Banker stepped in when other banks didn’t or couldn’t to help the state’s businesses.

Over the last two years officials and advocacy groups in more than 30 states have called the Bank of North Dakota, where he is chief executive officer, to ask: How does the country’s only state-owned bank work? “As the financial crisis deepened and there were liquidity issues around the country,” says Hardmeyer, “our model was looked at a little bit deeper than it ever had been before.”

The Bismarck-based bank was founded in 1919 to lend money to farmers, then the state’s biggest economic contributors, and retains its socially minded ethic by subsidizing loans for those it believes will stimulate growth: startup businesses and beginning farmers and ranchers. The borrowers apply for the loans through one of the state’s 100-plus local banks and credit unions. If they qualify, the community lender issues the loans at the market rate; the borrowers pay a fraction of the interest, with the Bank of North Dakota covering most of the difference. How can the state bank afford the subsidies? Profit isn’t its first priority. “We have a specific mission that we’re trying to achieve,” says Hardmeyer, “that’s not necessarily bottom-line driven.”

Which is not to say the bank, which has assets of $5 billion, isn’t a moneymaker. Much of its income comes from helping local banks extend credit to borrowers. If a bank wants to share the risk of a loan, the Bank of North Dakota will cover part of it. The state bank then collects interest from the commercial bank at the going rate. In 2010 its profit hit $61.85 million, up 44.3 percent from 2006.

That’s nice, but here’s the real reason politicians across the country are contacting Hardmeyer: North Dakota’s legislature has the authority to tap the bank’s profits to fund government programs during tough times. Since 1945 the state has collected $555 million from the bank.

Of course, the bank has many Republicans crying “Socialism” and the usual hubris you get from bank that really don’t like competition and prefer bonuses and bail outs. The problem is that it’s difficult to argue with results. That is why 13 states–including California–are seriously studying setting up their own state banks. What many critics refuse to discuss is that this institution is not meant to supplant the private banking system. Modified market systems work well with varying degrees of government participation. Some markets function extremely well with a limited government role. The financial system is unique. The finance literature argues that if markets were perfect, banks wouldn’t actually exist. There would be no reason for them. Most of the research tries to actually find meaning in the existence of banks because they are essentially a parasite that attaches to a dysfunctional market that’s riddled with poor information and risk. They can improve both situations or they can exacerbate them. That is why there is some government role and arguably, some government functions within financial markets. The challenge is to find which things the market can do well and the circumstances where the markets function and keep the government role active where failures and frictions create the need for a government role.

It’s possible that North Dakota has found the golden mean.

Why Occupy Wall St. Should Bother

Posted: November 6, 2011 Filed under: #Occupy and We are the 99 percent!, Austerity, Baby Boomers, Bailout Blues, Banksters, commercial banking, Corporate Crime, Human Rights, income inequality, investment banking, poverty | Tags: 2011: days of revolt, Financial Crisis, U.S. Economy 4 CommentsHere’s a message that should go viral for all the doubters and naysayers and critics of the Occupy Wall St. Movement. Why should we bother as one poster at Sky Dancing asked this morning? Why should Occupy beam in on the Koch brothers or Lloyd Blankfein or any of the infamous 1% that have brought the United States and the world to its knees?

Watch and listen. And then ask: how can we or Occupy or any rational, reasonable human being not be bothered?

The Beginning Is Near

Posted: November 3, 2011 Filed under: #Occupy and We are the 99 percent!, American Jobs Act, Baby Boomers, Bailout Blues, Banksters, Black Agenda Report, commercial banking, Economy, income inequality, investment banking, jobs, unemployment 27 CommentsMaybe it’s my age [and no, I’m not telling] but I find great promise is those four words scrawled on a makeshift sign.

I’m sure–in fact, I know–there are others of my generation [Boomers] who look at the Occupy Wall St. [OWS] Movement, read the signs and scratch their heads. Or more likely they criticize the primarily young protesters as naïve, idealistic, disorganized, wanting something for nothing. Why don’t they just get a job? many say.

These reactions miss the point, as far as I’m concerned. These youngsters want something all right. They want their futures. They want to control their own destinies with a measure of integrity, a sense of possibility rather than bending to the yoke of a failing system, one that only works for those on the top of the heap. The statistics are there for everyone to read. No mystery! Wages of ordinary Americans have been stagnant, while the rich have become richer than Midas. Jobs have been sent willy-nilly beyond our shores but the trade-off [we’ve been told numerous times] are cheap consumer goods, the more the better.

He who has the most stuff wins. Many people bought into that. For a while.

Throw in 9/11, multiple wars, massive unemployment, rising health care costs, climate-related weather events, the negligence in the Gulf of Mexico, etc. and the shine has definitely come off the latest gadgets and toys. As an electorate, we’ve had a slap upside the head.

What I find astounding is people blaming this particular group—the OWS protesters, primarily the Millennials–for what is clearly our responsibility, a product of our refusal to hold our politicians accountable and demand justice–a return to the Rule of Law–instead of foisting the unpleasant, annoying task on our children [or grandchildren, as the case may be]. We’re the ones who bought into the Big Lie. Or worse, pretended it didn’t exist. These young students and 20-somethings had no hand in what we watched and allowed to develop.

The kids are making us look bad. They’ve endured dismissal, ridicule, concrete beds and lousy weather. And they’re called the slackers?

Nor should we forget that Boomers are running things right now. Our generation sits in the halls of Congress and refuses to pass legislation to put the country back to work. Boomers sit in the offices of the White House and pretend to hold a populist agenda, while doing the bidding of their monied benefactors. They sit on the Supreme Court and try to convince us that corporations = personhood. And they certainly populate Corporate America and Wall St., where repeated decisions and deals have been made to maximize profits at the expense of ordinary citizens. Not all Boomers, of course. But our generation is well represented in the lever pushing–the Make Love Not War crowd. Time to own it.

But even if we’re far, far removed from the corridors of power, just living our lives, I would suggest quiet acquiescence of the status quo isn’t working either. Hello, Boomers. The confidence fairy that has been running [ruining] our financial system will not be coming to spread pixie dust over the wreckage and make things right.

Not going to happen. And the young? They see right through it.

For over thirty years, corporate greed has grown, metastasized to the point that nothing is sacred—not the health or education of our people, not the environment [on which we depend to exist], not our principles of equal opportunity, not even our insistence that The Rule of Law is imperative for our Democratic Republic to survive.

And what was the trade? Constant debates that American health care is the best in the world without adding the qualification: only if you can afford it. The refusal to admit that the decreasing quality of our primary and secondary educational systems condemns many of our citizens to poverty and the staggering increase in university tuition costs and subsequent debt saddles our college graduates to years of unmanageable debt. The reckless and short-sighted risk-to-wreckage of our environment be it through fracking or drilling or proposed tar sand pipelines, while we turn up our noses to promoting and supporting green technology. The cruel pretense that all our citizens start off on a ‘level-playing’ field, while the evidence of privilege and influence-driven access to favors are as acute now as during the Gilded Age. The unwillingness to investigate and prosecute those involved in the biggest heist in history, the very same financiers and corporate bigwigs, who continue to exert control over our political system.

Two years ago, Dick Durbin stood before Congress and said: The banks own the joint.

We should have listened or turned up our hearing aides. Because sadly, the man spoke  the truth. See no evil, hear no evil, speak no evil is not a strategy for the future. It’s unsustainable.

the truth. See no evil, hear no evil, speak no evil is not a strategy for the future. It’s unsustainable.

So, when I look at the live streams of the cross-country demonstrations, read the twitter feeds, I don’t think slackers. I think of a generation who has said what we, the grownups, should have said quite some time ago: Enough is enough. Or as Bill Moyers said recently: “People are occupying Wall St. because Wall St has occupied the country.”

Yesterday, between 7 to 10,000 people took part in a general strike in Oakland. They shut down the port of Oakland, a major access for Chinese goods, the 5th busiest port in the country. Local businesses shut down in support of the effort. To its credit, the protest has remained remarkably peaceful although early morning reports indicate that violence did break out before sunrise. Unfortunately, the authorities in Oakland nearly cost the life last week of a young Marine vet, Scott Olsen. Discontent can have consequences.

But attitudes are shifting and changing. Voices are being heard.

Last April with little fanfare, Joseph Stiglitz stated in a Vanity Fair article:

“The top 1 percent have the best houses, the best educations, the best doctors, and the best lifestyles, but there is one thing that money doesn’t seem to have bought: an understanding that their fate is bound up with how the other 99 percent live.”

Since the Occupy Movement started, this sentiment has been echoed, magnified:

On October 22, Noam Chomsky gave a speech on Dewey Square in Boston and said:

“I’ve never seen anything quite like the Occupy movement in scale and character, here and worldwide. The Occupy outposts are trying to create cooperative communities that just might be the basis for the kinds of lasting organizations necessary to overcome the barriers ahead and the backlash that’s already coming.”

At Black Agenda Report, Glen Ford recently wrote:

“There comes a time of awakening. We are now in that time – although some Black folks are not yet awake. Our job is to wake our people up, so that we don’t sleep through this moment.

The young people that began this Occupation Movement less than two months ago are not “us,” but they have done all of us a great service. They have shouted out the name and address of the enemy – the enemy of all humanity. The enemy’s name is Finance Capital, and the address is Wall Street, and that is the truth.”

Chris Hedges recently stated on Truthdig radio:

“But this is a widespread movement; it’s decentralized; it takes on its own coloring and characteristics, depending on the city that it’s in; and so there will be, you know—as you point out, I mean, movements are by their very nature messy and make steps forward and steps back. But I think that there is a resiliency to this movement because it articulates a fundamental truth of inequality that hits the majority of American citizens.”

Even House Speaker John Boehner remarked in a recent speech at the University of Louisville:

“I understand people’s frustrations,” he said. “The economy is not producing jobs like they want and there’s lot of erosion of confidence in our government and frankly, under the First Amendment, people have the right to speak out … but that doesn’t mean they have the permission to violate the law.”

Hey, it’s a start. Certainly better than designating OWS as ‘The Mob.’

People are rousing from their long, restless slumber. The conversations have begun and are different from what we’ve heard or read before. The protesters persist. They march, they endure.

The Beginning is Near.

Recent Comments