Super Cat Food Commission may have reached a Deal

Posted: November 15, 2011 Filed under: Catfood Commission, Economy | Tags: austerity, cat food commission, deficit hawks, Super Committee 47 CommentsThere are nine days left until November 23rd and automatic spending cuts that are supposed to punish deadlock. Our economy is weak. Exactly how much recessionary  pressure will the austerity pogrom inflict on the country? Exactly how much will the unemployment rate go up and the economic growth go down when we do the exact opposite thing that all accepted and proven economic theory would have us do? Well, there’s hints at a deal. Get ready for a double dipper!

pressure will the austerity pogrom inflict on the country? Exactly how much will the unemployment rate go up and the economic growth go down when we do the exact opposite thing that all accepted and proven economic theory would have us do? Well, there’s hints at a deal. Get ready for a double dipper!

The panel needs seven votes on a deal to force at least $1.2 trillion in deficit reduction over the next 10 years. Sen. Pat Toomey (R) of Pennsylvania last week broke with his party’s anti-tax pledge to propose some $300 billion in new tax revenues. Democrats are said to be on the verge of a counterproposal, as early as today, to include new cuts in entitlement spending likely to offend their party’s base.

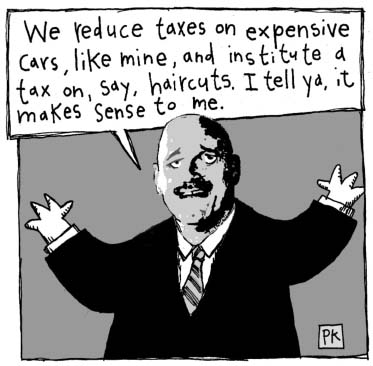

Tax increases and entitlement spending cuts = decreases in aggregate demand = decreases in prices and wages and decrease in economic growth/GDP/Income = more unemployment. Exactly who are they pleasing with this policy? Themselves? Their Wall Street Overlords? The Grinch?

There’s a lot of ignorance built in to this group.

Based on what we do know, however, both sides are playing big time budget baseline games. When they talk taxes, Republicans start by assuming the 2001/2003/2010 tax cuts will all be extended indefinitely. From there, they talk about cutting rates across the board and reducing tax preferences (perhaps with some cap on these breaks). All of this, it is reported, would boost revenue by a few hundred billion dollars over 10 years.

Sounds promising. But by starting by extending the Bush era tax cuts, the Rs would reduce revenues by $4 trillion compared to what would happen if Congress simply lets them expire as scheduled a year from now. So, Republicans would add $4 trillion to the deficit before cutting a paltry $200-$300 billion. In anyplace but Washington this would add up to another $3.7 or $3.8 trillion in red ink. Here, it counts as deficit reduction. Worse, even those dollars appear to result from presumed economic growth rather than policy changes. The wonders of dynamic scoring!

Democrats are playing their own games. While Politico reports this morning that they are proposing $400 billion in Medicare and Medicaid cuts (most of which would come out of the hides of doctors, hospitals, nursing homes, and other providers), the Dems also start by assuming a fix to the ongoing battle over Medicare reimbursements to physicians. Straightening out this mess could cost as much as $300 billion over the next 10 years. The Ds do say they’d pay for the fix—but with money from the drawdown of troops from Iraq and Afghanistan. This money is fiscal pixie dust, since the troops are already coming home and those funds were never going to be spent.

If the built-in assumption is indefinite extension of those reckless Bush tax cuts, we might as write the nation off as a banana republic right now. This is especially true when you consider what will be downsized in response to rewarding the rich for moving jobs overseas, gambling in the Wall Street Casino, and not expanding business here because the economic outlook will continue to be glum. There are a few hints on what has to go in order to extend these indefensible tax cuts. What will the Dems trade in order to get some tax revenues placed on the table?

Democrats aren’t offering to simply take the GOP at their word. Their plan is to make any cuts to programs like Medicare and Social Security part of a trigger that would only be pulled if and when Congress passes hundreds of billions of dollars in new revenue.

Multiple Democratic aides confirm their strategy hasn’t changed: Dems will only support this sort of two-step tax reform process if there are serious revenue guarantees and the deal includes a trigger to make sure the revenue materializes.

If that sounds a little Rube Goldbergish to you, it is. But both parties have basically agreed that the Super Committee wouldn’t have enough time between its launch and its deadline to write a full overhaul of the tax code. So Dems are privately insisting that any future promised revenue come with more than a promise. If the GOP can’t deliver the votes for it, then the safety net cuts they want disappear. That’s not to predict that they’ll stick with this demand until the bitter end — for liberal groups, vigilance is key.

Ever heard of out of sight, out of mind? If the Repubs delay the tax details and the Dems still try to eek something out, how will this work? Follow that link to a bunch of other links with this short intro.

As the panel’s Nov. 23 deadline approaches and doubts about its ability for success persist, a new approach is emerging in which the panel may opt to postpone politically difficult decisions by deciding the amount of new revenue their deficit-reduction plan would require, but leaving specifics to Congress’ tax-writing committees to fill in next year.

So is this a deal or a punt?

It seems that K Street isn’t giving up on keeping all the lights lit on the tree for their special interests. This doesn’t bode well. The meat may get thrown out while the fat and grizzle are still on the plate.

And 125 companies and groups made another pitch to the super committee on the importance of setting aside additional unlicensed spectrum for new technologies like ultra-fast Wi-Fi.

Google, Hewlett-Packard, Microsoft and others said they worry that if the panel gives the Federal Communications Commission authority to conduct incentive auctions, that the FCC’s move last year to open up the spaces between television channels for unlicensed use could be derailed.

“We urge Congress to give the FCC the flexibility to preserve TV band spectrum for unlicensed super Wi-Fi devices and deliver innovation to American consumers and economic growth to our nation,” they wrote in the letter to the co-chairs of the super committee, Rep. Jeb Hensarling, R-Texas, and Sen. Patty Murray, D-Wash.

Yup. That’s so much more important than feeding hungry children, creating jobs, and fulfilling our obligations to seniors. It seems that most people will have to search out the bags of dry food while a whole lot of businesses that don’t seem to be able to function without subsidies will still be dining on fancy feast.

Thursday Reads

Posted: October 27, 2011 Filed under: #Occupy and We are the 99 percent!, Catfood Commission, Super Committee | Tags: derivatives, Dodd Frank, Euro, Euro Debt Crisis, Herman Cain, Right Wing Lies, Super Committee, Tax Dodging, Volcker Rule, Wall Street 27 CommentsIt’s amazing what kind of nonsense the right wing can come up with when their interests and myths are threatened. Here’s the latest Faux News canard about Occupy. It’s an ACORN plot! If any one believes that, I have a few bridges across the Mississippi I’d like to sell them. The Crescent City Connection even comes with tolls!!

How can a group that folded 19 months ago secretly conspire to bolster Occupy protests? Apparently, “sources tell” Fox News that people who used to work for ACORN have now taken on roles helping organize Occupy protests. In fact, Fox News reports that the former director of New York ACORN and his aides are now working for New York Communities for Change (NYCC), which is turn supporting demonstrations.

I’m not sure why this would be especially interesting if true — if folks who used to be involved with one group then started playing a role with another, who cares? — but as it turns out, a spokesperson for Occupy Wall Street said the NYCC isn’t playing a role in the protests anyway. But don’t worry, Fox News’ unnamed “source” said the group really is up to secret misdeeds, adding, “And yes, we’re still ACORN, there is a still a national ACORN.”

It’s safe to assume that Fox News has reliable contacts among progressive activist organizations, right? There’s bound to be plenty of former ACORN staffers and Occupy activists eager to dish to the Republicans’ cable news outlet, right?

Please. It’s really no wonder at all why Fox News’ audience ends up believing so much nonsense.

They do believe the nonsense, which makes Fox News watchers very dangerous in the voting booth.

Dems on the Super Committee are offering up Medicaid and other ‘entitlements’ in order to get tax increases from Republicans. It didn’t work, but you have to wonder exactly what all they’re willing to put on the table.

Republicans have pressured supercommittee members to reject any deficit-reduction deal that raises taxes — including stimulus spending for the economy would almost certainly be a non-starter for most in the party.

Democrats have said from the beginning that the supercommittee should produce a “jobs plan” that includes “investments” to help the economy.

The supercommittee is charged with devising a plan that will cut at least $1.2 trillion over 10 years from annual deficits, but deep divisions exist on the panel over whether to raise taxes and cut entitlements to meet that goal.

The members met again Wednesday afternoon and Democrats were looking to see if the GOP would present an alternative path to the grand bargain.

You may recall that the grand bargain was the giveaway President Obama offered to Boehner last summer during the debt ceiling talks. More details are available at this WAPO link.

The panel has floundered since meetings began in September. If the supercommittee fails to reach agreement to trim borrowing by at least $1.2 trillion through 2021, automatic spending cuts of an equal amount would be triggered in January 2013. These cuts would strike especially hard at the Pentagon, an outcome that Republicans are eager to avoid.

Ralph B posted this tidbit downthread last night. Chelsea Clinton is said to be considering a congressional run.

Clinton has been approached by “the right people” in the New York Democratic Party, according to one source in Albany. While no decision has been made, Clinton is said to be “actively considering” a Congressional run from New York State in 2012.

Chelsea Clinton, 31, is the only child of former U.S. President Bill Clinton and U.S. Secretary of State Hillary Rodham Clinton.

The discussions of running Chelsea Clinton for a house seat grew out of the redistricting plans currently underway in the New York State legislature in Albany.

The plan is to identify an open seat for Clinton in or around New York City where she currently resides with her husband, Marc Mezvinsky. While no specific district has been determined, New York City and Westchester are said to be the focus with New York’s 18th District considered a strong possibility. The 18th encompasses much of Westchester County, just south of where her parents have maintained a home for the past 12 years.

The Daily Beast reports that Herman Cain was delinquent in paying taxes in 2006. Additionally, he fought paying the bill.

According to court documents obtained by The Beast, Cain and his wife, Gloria, were served in February 2008 with a tax lien totaling $8,558.46 for unpaid income taxes and penalty due for the 2006 calendar year.

Gordon said Cain had filed with the IRS and won a six-month reprieve in paying his 2006 federal taxes as he was undergoing his treatment for stage four lymphoma and believed that filing should also have bought him time with the state of Georgia. “In Georgia, a taxpayer can submit a copy of his federal extension to request an extension of state income taxes,” Gordon said.

But instead, the state sent a notice of overdue taxes in October 2007, and then proceeded with the tax lien four months later, he said.

Cain’s accountant fought the Georgia Department of Revenue on behalf of his client well into 2008 and the two sides finally settled the matter in November 2008. A court formally withdrew the state tax lien on Dec. 8, 2008, court records show.

Gordon said the campaign was researching the exact date on which Cain made the payment to extinguish the lien

Robert Reich thinks that Wall Street is still out of control.

Dodd-Frank is rife with so many loopholes and exemptions that the largest Wall Street banks – larger by far then they were before the bailout – are back to many of their old tricks.

It’s impossible to know, for example, the exposure of the Street to European banks in danger of going under. To stay afloat, Europe’s banks will be forced to sell mountains of assets – among them, derivatives originating on the Street – and may have to reneg on or delay some repayments on loans from Wall Street banks.

The Street says it’s not worried because these assets are insured. But remember AIG? The fact Morgan Stanley and other big U.S. banks are taking a beating in the market suggests investors don’t believe the Street. This itself proves financial reform hasn’t gone far enough.

If you want more evidence, consider the fancy footwork by Bank of America in recent days. Hit by a credit downgrade last month, BofA just moved its riskiest derivatives from its Merrill Lynch unit to a retail subsidiary flush with insured deposits. That unit has a higher credit rating because the Federal Deposit Insurance Corporation (that is, you and me and other taxpayers) are backing the deposits. Result: BofA improves its bottom line at the expense of American taxpayers.

Wasn’t this supposed to be illegal? Keeping risky assets away from insured deposits had been a key principle of U.S. regulation for decades before the repeal of Glass-Steagall.

The so-called “Volcker rule” was supposed to remedy that. But under pressure of Wall Street’s lobbyists, the rule – as officially proposed last week – has morphed into almost 300 pages of regulatory mumbo-jumbo, riddled with exemptions and loopholes.

It would have been far simpler simply to ban proprietary trading from the jump. Why should banks ever be permitted to use peoples’ bank deposits – insured by the federal government – to place risky bets on the banks’ own behalf? Bring back Glass-Steagall.

The MSCI Asia Pacific Index gained 0.9 percent to 120.25 as of 11 a.m. in Tokyo, set for the highest close since Sept. 9. Standard & Poor’s 500 Index futures added 0.8 percent. The 17- nation euro climbed 0.5 percent to $1.3979 and rose 0.3 percent to 106.26 yen. Treasury 10-year notes erased earlier gains. Copper, zinc and lead jumped more than 1.4 percent in London and crude climbed 1.9 percent in New York.

French President Nicolas Sarkozy said the euro region’s bailout fund will be leveraged by four to five times, and investors have agreed to a voluntary writedown of 50 percent on Greek debt. Sarkozy plans to call Chinese leader Hu Jintao today to discuss contributions from the Asian nation to a fund European leaders may set up to fight the crisis, a person familiar with the matter said.

The news of a deal is “certainly mildly positive news for markets,” Adarsh Sinha, head of strategy for Group of 10 foreign exchange at Bank of America, said in a Bloomberg Television interview in Hong Kong. “We have got a plan out but a lot of the details aren’t in place.”

CNN announced the details late last night.

French President Nicolas Sarkozy said Greek bondholders voluntarily agreed to write down the value of Greek bonds by 50%, which translates to €100 billion and will reduce the nation’s debt load to 120% from 150%.

Sarkozy said the leaders agreed to boost the firepower of the EU bailout fund, known as the European Financial Stability Facility, “by four or five fold.” He added that officials have negotiated additional funding from the International Monetary Fund.

The writedowns were one of three inter-related problems political leaders must solve to devise a comprehensive solution to Europe’s debt crisis. They must also determine how to leverage a government-backed bailout fund and stabilize the banking sector.

EU leaders had pledged to resolve these issues Wednesday at their summit in Brussels. But given the bondholders’ resistance, it was unclear until the early hours of Thursday if the leaders would be able to follow through.

Earlier, the European Council issued a statement saying heads of state had agreed to raise capital requirements for banks vulnerable to losses on euro-area government bonds.

Under the terms outlined by EU officials, banks would be required to sharply increase core capital levels to 9% to create a buffer against potential losses. The amount to be raised would be determined after accounting for declines in the value of euro-area government bonds, including debt issued by Greece.

Based on market rates in September, banks will need to raise a total of €106 billion to meet the new targets, according to the European Banking Authority.

So, that’s the headlines that have grabbed my attention today. What’s on your blogging and reading list today?

Friday Reads

Posted: July 8, 2011 Filed under: abortion rights, black women's reproductive health, Catfood Commission, Democratic Politics, Economy, Federal Budget and Budget deficit, fetus fetishists, fundamentalist Christians, John Birch Society in Charge, morning reads, religious extremists, Reproductive Health, Reproductive Rights, Republican presidential politics, right wing hate grouups, U.S. Economy, We are so F'd | Tags: Christianist extremists, Debt, Debt Ceiling, deficit, planned parenthood of North Carolina, Rick Perry, warren buffett 51 Comments Good Morning!!

Good Morning!!

It’s hard not to be be completely discouraged these days. Our Washington deal-makers are permanently stuck in opposites day. No amount of reality is going to bring the lot of them out of whatever place they strategically reside. This Reuters piece stands as a hallmark to the current lunacy. We shouldn’t have any financial problems. Social Security is solvent and it’s not part of the federal budget are deficit problem. Why am I reading this then?

If Treasury were to decide to delay some payments, one option could be to postpone a disbursement of more than $49 billion to Social Security recipients that is due on August 3.

It would be a politically explosive step but one that could allow the government to temporarily pay bondholders to try to avoid foreign investors dumping U.S. Treasuries and the dollar.

The administration has warned that any missed payments, including those to retirees, veterans and contractors, would be default by another name, and the Treasury team still has concerns that any contingency plan would prove unworkable.

Steve McMillin, a former deputy director of the White House Office of Management and Budget under Bush, said Treasury has options but most of them are “pretty ugly.”

If Treasury were to decide to delay payments, it would need to re-program government computers that generate automatic payments as they fall due — a massive and difficult undertaking. Treasury makes about 3 million payments each day.

Do they figure that seniors aren’t going to riot in the streets effectively like that episode de of South Park called Grey Dawn? I can pretty well imagine that they won’t stop payments to their corporate bosses. After all, that option would soothe the bond vigilantes.

de of South Park called Grey Dawn? I can pretty well imagine that they won’t stop payments to their corporate bosses. After all, that option would soothe the bond vigilantes.

Here’s the issues under study now according to that same Reuter’s article.

– Whether the administration can delay payments to try to manage cash flows after August 2

– If the U.S. Constitution allows President Barack Obama to ignore Congress and the government to continue to issue debt

– Whether a 1985 finding by a government watchdog gives the government legal authority to prioritize payments.

The Treasury team has also spoken to the Federal Reserve about how the central bank — specifically the New York Federal Reserve Bank — would operate as Treasury’s broker in the markets if a deal to raise the United States’ $14.3 trillion borrowing cap is not reached on time.

I’m teaching an MBA Corporate Finance seminar this summer. Every single asset pricing model that prices securities, bonds, loans,options or whatever basically uses the US treasury bond as the risk-free asset. I feel like I have to asterisk everything I’m teaching right now which is basically the same thing that was taught to me back in the 1980s. It’s like these folks are purposefully trying to tank the financial markets and bring on another crisis. If they manage to raise the debt ceiling, then it appears likely to be done by ‘austerity’ measure like $4 trillion dollars in cuts. Start your backyard gardens now. The next depression is bound to be a big one. I have just have no idea why they’re trying to blow up our economy. It’s just frigging unbelievable. Of course, Orrin Hatch wants us all to suffer more, because after all, people that aren’t filthy rich are obviously defective in gawd’s eyes.

So, here’s a nifty graph on the left from Ezra Klein showing the mix of spending cuts vs. tax increases the last few times we’ve had these debt and deficit discussions. Looks like the real practitioner of voodoo economics wasn’t Ronald Reagan but is Barrack Obama. Just more of the alternate reality forced on us by media and politicians that make up news, history, and economic theory.

As you can see on the graph, in each case, taxes were at least a third of the total, and in Reagan’s case, his massive tax cuts were followed by deficit-reduction deals that actually relied on tax increases. Today, tea party conservatives would be begging Sen. Jim DeMint to primary the Gipper.

Bush also included taxes in his deal, and Clinton relied heavily on taxes in his first deficit-reduction bill, which passed without Republican votes. In 1997, when he was working with Republicans, he actually cut taxes slightly while passing spending cuts. But of course the economy was in much better shape then, and Clinton had already increased revenues substantially.

The one-third rule doesn’t break down until you get to the deal Obama reportedly offered Republicans in the first round of debt-ceiling talks: $2 trillion in spending cuts for $400 billion in taxes, or an 83:17 split. And that, if anything, understates how good of a deal Republicans are getting. Tax revenues and rates are much, much lower than they were under Reagan, Bush or Clinton. And next year, Obama is pledging to extend most of the Bush tax cuts, which amounts to a $3 trillion-plus tax cut against current law.

Meanwhile, the polls–like this one from Pew Research–show that people overwhelmingly want to maintain social security, medicaid and medicare and would support tax increases to do so. So much for government of, for, and by the people.

As policymakers at the state and national level struggle with rising entitlement costs, overwhelming numbers of Americans agree that, over the years, Social Security, Medicare and Medicaid have been good for the country.

But these cherished programs receive negative marks for current performance, and their finances are widely viewed as troubled. Reflecting these concerns, most Americans say all three programs either need to be completely rebuilt or undergo major changes. However, smaller majorities express this view than did so five years ago.

The public’s desire for fundamental change does not mean it supports reductions in the benefits provided by Social Security, Medicare or Medicaid. Relatively few are willing to see benefit cuts as part of the solution, regardless of whether the problem being addressed is the federal budget deficit, state budget shortfalls or the financial viability of the entitlement programs.

Jim DeMint is one of the people that should be the first in line to be charged with treason and gross stupidity. Where was Senator DeMint when all the votes were taken to spend all this money to start out with? Plus, all those irresponsible revenue cuts back in the early 2000s when we basically had a balanced budget? He was a congressman from 1999-2005 so certainly he must’ve tried to stop Dubya Bush from all that spending!

Sen. Jim DeMint (R-S.C.) said Wednesday night that Republicans should maintain their hardline position in the debt-ceiling debate even if it results in “serious disruptions” to the economy.

“What I’m advocating here is, let’s use this as a point of leverage, give the president an increase, but don’t come away without real cuts from real caps and spending, and without a balanced budget,” DeMint said on FOX Business Network.

“We’re at the point where there would have to be some, you know, some serious disruptions in order not to raise [the debt ceiling],” he said. “I’m willing to do that.”

The president pushed the economy into “crisis” mode, according to DeMint. He said the president has been “burning time” with the deficit negotiations led by Vice President Biden, when the looming debt ceiling and budget deficit could have been addressed last year.

DeMint, well-known for speaking out in favor of limited government and balancing the budget, told host Andrew Napolitano that if Republicans and Democrats couldn’t vote in “something permanent” that would limit government spending, “we’re going to continue to spend [until] the total country collapses.”

Warren Buffet says the GOP is Threatening To ‘Blow Your Brains Out’ Over Debt Ceiling

Republicans are playing a dangerous game by refusing to raise the debt ceiling, according to Berkshire Hathaway CEO Warren Buffett.

“We raised the debt ceiling seven times during the Bush Administration,” Buffett told CNBC on Thursday. Now, the Republican-controlled Congress is “trying to use the incentive now that we’re going to blow your brains out, America, in terms of your debt worthiness over time.”

If Congress fails to raise the borrowing limit of the federal government by August 2, the date when the U.S. will reach the limit of its borrowing abilities, it will likely begin defaulting on its loans.

Buffett, who according to the Washington Post has helped raise money for Democratic candidates like Hilary Clinton in the past, has been highly critical of the actions of the Republican-controlled Congress. In May, Buffett stated at a Berkshire Hathaway shareholder’s meeting that if the Congress failed to raise the debt ceiling, it would constitute “the most asinine act” in the nation’s history, reports Reuters.

Other political news is equally disheartening. Most of the governments in the states are as crazy–if not crazier–than the US Congress. Planned Parenthood in North Carolina is suing the state over budget cuts designed to cut access to much used and cost saving preventive health care.

One of North Carolina’s two Planned Parenthood affiliates filed a federal lawsuit Thursday to invalidate part of the new state budget that cuts it off from federal or state funds for family planning.

The budget, written by Republicans in control of the General Assembly for the first time in more than a century, states that Planned Parenthood and its affiliates are forbidden from receiving any contracts or grants from the state health agency. The lawsuit filed in Greensboro’s federal court by Planned Parenthood of Central North Carolina contends the group is being punished for its abortion-rights advocacy, saying that violates its free-speech protections.

The organization is barred by law from using public money to perform abortions and uses the government contracts to provide family planning or teen pregnancy prevention services, yet is being singled out because Planned Parenthood supports abortion rights, the lawsuit said. Efforts to cut off funds to Planned Parenthood affiliates in North Carolina are similar to those in Kansas and Indiana, which were also met with federal lawsuits, the group’s attorneys said.

“Their sole purpose is to single out, vilify, and punish Planned Parenthood as a particularly visible provider and advocate — even though, ironically, the eliminated funds have nothing to do with abortion, but will only deprive low-income people of desperately needed health services and teen pregnancy prevention programs,” the lawsuit said.

Planned Parenthood of Central North Carolina received $287,000 in federal, state and matching local funds in the year that ended last week for teen pregnancy prevention and family planning programs that provided contraceptives to poor women, according to the state Department of Health and Human Services. The non-profit operates from locations in Chapel Hill, Durham, and Fayetteville.

Some of the most extremist pastors are signing on to Texas Governor Rick Perry’s Pray-a polooza. Talk about a hater-thon. Remember, Perry is supposed to be the ‘electable’ Republican.

And we already knew Perry didn’t care much about including, or even not offending, non-Christians: his personal letter announcing the event calls on the entire nation to pray to Jesus Christ. But the news, reported by Right Wing Watch, that a radical pastor named C. Peter Wagner has signed on as an official endorser of The Response deserves more attention.

The Colorado-based Wagner, who is featured on the website of The Response, is the head of Global Harvest Ministries.

His brand of evangelicalism, known as the New Apostolic Reformation, is characterized by extreme hostility to other religions. In this passage from his book “Hard-Core Idolatry: Facing the Facts,” Wagner praises the burning of Catholic saints, copies of the Book of Mormon, voodoo dolls, and other “idols”

Yup, welcome to the new surreality. All we need is Rod Serling introducing the morning reads today and I’d say that would be about right.

What’s on your reading and blogging list today?

Recent Comments