Mitt Romney Gets Kiss of Death from Al Gore

Posted: June 15, 2011 Filed under: 2012 presidential campaign, Environment, Republican presidential politics, U.S. Politics | Tags: 2012 presidential election, Al Gore, Climate change, global warming, Mitt Romney, New Hampshire, Republicans, Rush Limbaugh 13 CommentsVia the Atlantic Wire, today Al Gore wrote a brief post on his blog in which he praised Mitt Romney for not changing his stance on global warming.

Gore linked to this story at the Washington Post

From the Washington Post dealing with a question asked at a town hall meeting in New Hampshire on June 3.

It seemed like a straightforward question on a second-tier issue: Would Mitt Romney disavow the science behind global warming?

The putative Republican presidential front-runner, eager to prove his conservative bona fides, could easily have said what he knew many in his party’s base wanted to hear.

Instead, the former Massachusetts governor stuck to the position he has held for many years — that he believes the world is getting warmer and that humans are contributing to that pattern.

Good for Mitt Romney — though we’ve long passed the point where weak lip-service is enough on the Climate Crisis.

While other Republicans are running from the truth, he is sticking to his guns in the face of the anti-science wing of the Republican Party.

The question of candidates’ views on global warming didn’t come up in the debate on Monday, but a number of conservatives took note of Romney’s comments. They aren’t happy, to put it mildly. Here’s what Rush Limbaugh had to say:

“Bye-bye, nomination,” Rush Limbaugh said Tuesday on his radio talk show after playing a clip of Romney’s climate remark. “Another one down. We’re in the midst here of discovering that this is all a hoax. The last year has established that the whole premise of man-made global warming is a hoax, and we still have presidential candidates that want to buy into it.”

It appears that Romney has decided that avoiding flip flops is going to help him more than kowtowing to the right-wing crazies.

“The fact that he doesn’t change his position . . . that’s the upside for us,” said one Romney adviser….“He’s not going to change his mind on these issues to put his finger in the wind for what scores points with these parts of the party.”

Good luck with that, Mitt.

America’s Housing Problem

Posted: June 15, 2011 Filed under: The DNC, unemployment | Tags: Foreclosures, home prices, US housing market, US jobs market 11 CommentsThe global financial crisis that resulted from a housing bubble may be over for U.S. banks and financial institutions but the  crisis is worsening for U.S. homeowners. Many mortgage holders still have underwater loans. Many home owners have absolutely no chance of selling their homes for any reasonable amount of money in a market that is now worse than the similar conditions present during The Great Depression. For many, the dream of home ownership has turned into a nightmare.

crisis is worsening for U.S. homeowners. Many mortgage holders still have underwater loans. Many home owners have absolutely no chance of selling their homes for any reasonable amount of money in a market that is now worse than the similar conditions present during The Great Depression. For many, the dream of home ownership has turned into a nightmare.

Prices have fallen some 33 percent since the market began its collapse, greater than the 31 percent fall that began in the late 1920s and culminated in the early 1930s, according to Case-Shiller data.

The news comes as the Federal Reserve considers whether the economy has regained enough strength to stand on its own and as unemployment remains at a still-elevated 9.1 percent, throwing into question whether the recovery is real.

“The sharp fall in house prices in the first quarter provided further confirmation that this housing crash has been larger and faster than the one during the Great Depression,” Paul Dales, senior economist at Capital Economics in Toronto, wrote in research for clients.

According to Case-Shiller, which provides the most closely followed housing industry data, prices dropped 1.9 percent in the first quarter, a move that the firm interpreted as a clear double dip in prices.

Moreover, Dales said prices likely have not completed their downturn.

“The only comfort is that the latest monthly data show that towards the end of the first quarter prices started to fall at a more modest rate,” he said. “Nonetheless, prices are likely to fall by a further 3 percent this year, resulting in a 5 percent drop over the year as a whole.”

Home equity has traditionally been a source of wealth and retirement savings for generations of Americans. Falling house prices not only have a negative impact on American wealth, they may be impacting the ability of American households to move where the jobs may be. The ability to move–called labor mobility by economists–is important in a recovery because it leads to stronger job markets.

Economists Colleen Donovan and Calvin Schnure have written an interesting new paper examining whether the fall in house prices since 2007 in the US — which has left many home-owners owing more on their house than it is worth — created a lock-in effect that depressed labor mobility.

This question has significance far beyond either the real estate market or the labor market, because there has been a persistent line of argument from some that the US’s current unemployment problem is not the result of insufficient demand, but is instead a “structural” problem resulting from the inability of the US economy to properly match people with available jobs. A frequent explanation for why it suddenly became difficult to match people with jobs in 2008 is that underwater mortgages have locked people in to their houses, reducing labor mobility and making job-matching more difficult.

The evidence presented in this paper indicates that the fall in house prices has indeed caused a “lock-in” effect, but has not significantly impacted labor market efficiency.

This may be an important factor in explaining persistent unemployment. There has been an argument out there that unemployment is due to ‘structural’ problems which would imply that government programs may not be effective as possible in solving job market issues. This study implies–along with recent data on falling household consumption–that the U.S. continues to have a demand problem. This means that traditional fiscal stimulus and programs could be an effective way to stop both the freefall in home prices and improve the employment outlook. Housing affordability is not an issue in this market. Home prices and mortgage interest rates are have made affordability metrics reach near-historic levels. Other factors are constraining the market.

More than four in every five mortgages now require a down payment of 20 percent, and credit history standards have tightened. At the same time, foreclosures continue at a brisk pace, pushing more supply onto the market and pressuring prices downward.

Then there is the issue of underwater homeowners—those who owe more than their house is worth—representing another 23 percent of homeowners who cannot leave or are in danger of mortgage default.

Indeed, the foreclosure problem is unlikely to get any better with 4.5 million households either three payments late or in foreclosure proceedings. The historical average is 1 million, according to Dales’ research.

We’re basically a situation where the Freddie and Fannie situation is unresolved. The historically low interest rates and high availability of cheap money means that huge institutions are making money from arbitrage and investing rather then lending and investing in non-financial projects. Small-to-medium sized businesses do not have the same funds availability of large corporations. Neither do consumers. Clearly, the Fed is going to start increasing interest rates as signs of price inflation appear on the horizon. This may wring the arbitration profit-seeking behavior of larger firms, but it will further squeeze consumers and small-to-medium businesses that have been hanging on waiting for increased demand.

This is a clear signal that the economy is experiencing demand-side problems which require fiscal policy solutions that stimulate demand. Meanwhile, Washington DC policy makers are focused on the long-term issue of fiscal sustainability. Republicans are still discussing debt default to the point that Fed Chairman Ben Bernanke made a point of mentioning the detrimental impact of that move in a recent speech. The strategy of playing chicken with the federal debt for personal political gain is a form of unpatriotic gamemanship.

Failing to raise the debt ceiling in a timely way would be self-defeating if the objective is to chart a course toward a better fiscal situation for our nation. The current level of the debt and near-term borrowing needs reflect spending and revenue choices that have already been approved by the current and previous Congresses and Administrations of both political parties. Failing to raise the debt limit would require the federal government to delay or renege on payments for obligations already entered into. In particular, even a short suspension of payments on principal or interest on the Treasury’s debt obligations could cause severe disruptions in financial markets and the payments system, induce ratings downgrades of U.S. government debt, create fundamental doubts about the creditworthiness of the United States, and damage the special role of the dollar and Treasury securities in global markets in the longer term. Interest rates would likely rise, slowing the recovery and, perversely, worsening the deficit problem by increasing required interest payments on the debt for what might well be a protracted period.

The focus of fiscal policy discussions should be to relieve downward price pressure in the housing market and provide job creation. Again, there are many ways to do this. The federal government can provide funds to states to keep up levels of public employment. They can fund law enforcement, public health, and education positions for states and municipalities to weather the prolong, slow recovery. These types of initiatives reduce the need for unemployment, medicaid, and other public services. They also maintain people in jobs that pay taxes and will feel safe enough to sustain household spending. This, in turn, creates customers for those small and medium-sized local businesses. It is clear that funding large corporations does not create local jobs. Funding small and medium-sized business through targeted loan programs in either community banks or the SBA could be used to direct monies to businesses that do hire locally rather than use their funds to expand global business.

Additionally, something must be done to help home owners in difficult positions. There appears to be no end to falling real estate prices. The government could help bottom out the market by providing more direct refinancing to under-water homeowners and those home owners who face foreclosure due to prolonged unemployment.

Clearly, the problem is political will. Nearly every administration–Republican or Democrat–facing similar poor economic conditions in the past has realized the gravity of these kinds of situation and have tailored fiscal programs to meet the challenges. This even includes the Reagan administration in the early to mid 1980s. No where in the beltway is there a discussion of policies that have been successfully used to solve these problems in the past. This isn’t even a case of dithering. This is a clear case of willful and deliberate ignorance.

Here’s a good example of the problem.

The dismal housing market news was compounded Wednesday by the National Association of Home Builders’ release of its monthly Housing Market Index. The index, which measures builder sentiment on the market, fell to a level of 13 on its 100-point scale. That’s three points below the previous month and the lowest level since September 2010. Any reading below 50 indicates negative sentiment about the market.

With fewer homes being built, fewer jobs are available and less revenue is generated for local, state and federal governments. Each new home built creates an average of three jobs for a year and generates about $90,000 in taxes, according to the group.

On the bright side, the NAHB noted that a poll it took of 2,000 2012 voters found that housing is still considered by the largest plurality of homeowners as their biggest investment.

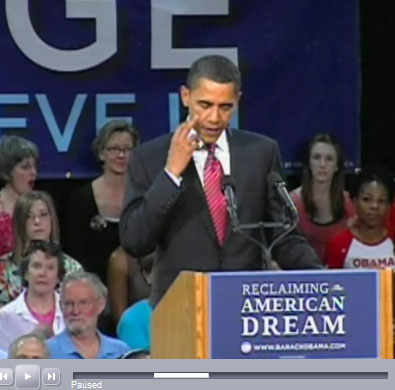

Amid the troubling developments in housing, labor and elsewhere, the Obama administration has tried to push several new economic proposals, ranging from new training programs to tax relief.

President Obama is pleading for patience on the economy while at the same time urging the public to stay positive.

“The sky is not falling,” the president said during a stop in North Carolina two days ago.

“If this is transparency, who needs it?”

Posted: June 14, 2011 Filed under: just because | Tags: Bradley Manning, government whistle blowers, Obama Administration, Thomas Drake, transparency 7 Comments“If this is transparency, who needs it?” Steven Aftergood, Director of the Project on Government Secrecy at the Federation of American Scientists, speaking of the Obama Administration’s White House visitor log policy, the results of which he labeled “very thin gruel” (Apr. 13, 2011).

“A White House official conceded the system has limitations, asserting it was designed not as an archive but ‘first and foremost to protect the first family, second family and White House staff while imposing the smallest administrative burden possible.'” POLITICO, “White House Visitor Logs Leave Out Many” (Apr. 15, 2011).

from the site “Quotes of the Month” hosted by American University’s Washington College of Law, Collaboration of Government secrecy.

One of the major Obama campaign promises was to bring more transparency to governing. The English/international version of Speigel on line has a compelling series up this week called “Disingenuous Transparency”focusing on how government whistle blowers have suffered under the Obama administration. The series is extremely relevant given that the U.S. government has finally “officially” released the Pentagon Papers on the Vietnam War as a show of ‘openness’. The article accuses Obama and the administration of stonewalling and basically ignoring court instructions. The sad thing is that the compelling article filled with compelling examples will probably never reach a large audience.

One of the major Obama campaign promises was to bring more transparency to governing. The English/international version of Speigel on line has a compelling series up this week called “Disingenuous Transparency”focusing on how government whistle blowers have suffered under the Obama administration. The series is extremely relevant given that the U.S. government has finally “officially” released the Pentagon Papers on the Vietnam War as a show of ‘openness’. The article accuses Obama and the administration of stonewalling and basically ignoring court instructions. The sad thing is that the compelling article filled with compelling examples will probably never reach a large audience.

I have been following the case of Thomas Drake–a former employee of NSA–who is accused of providing the Baltimore Sun with internal information on government wiretapping. Drake’s case predates the more famous case of Bradley Manning and Wikileaks. There have been other cases.

In May 2010, a court convicted former FBI interpreter Shamai Leibowitz was sentenced to 20 months in prison for providing government information to a blogger. Another prosecuted whistle blower of Stephen Kim who was a North Korea expert at the State Department. Kim supposedly supplied state secrets to Fox News. Another high profile case is that of former CIA agent Jeffrey Sterling who allegedly provided information to author James Risen a 2006 exposé entitled “State of War.” The Obama Justice Department has prosecuted these cases to the fullest extent possible.

The Drake case fell apart in a similar way that the charges of Oliver North fell apart during the Iran-Contra Scandal of the 1980s. It was felt that the prosecution of Drake would expose too much national security information. Drake accepted a plea of misdemeanor charges for “exceeding his authorized use of a government computer”. Again, the tie back to Daniel Ellsberg and the Pentagon Papers is relevant.

But the government withdrew the evidence supporting several of the central charges after a judge ruled Drake would not be able to defend himself unless the government revealed details about one of the National Security Agency’s telecommunications collection programs. On two other counts, documents the government had claimed were classified have either been shown to be labeled unclassified when Drake accessed them or have since been declassified. Faced with the prospect of trying to convict a man for leaking unclassified information, the government frantically crafted a plea deal in the last days before the case was due to go to trial.

The collapse of the case against Drake may have repercussions beyond just this one case.

This is the third time the government’s attempt to use the Espionage Act to criminalize ordinary leaking has failed in spectacular fashion. The first such example—against Pentagon Papers leaker Daniel Ellsberg—got dismissed when the government’s own spying on Ellsberg was exposed.

Spiegal characterizes this case as “an embarrassing setback for the White House”. It seems that the candidate that promised translucency is fighting to keep secrets at a pace previously never experienced. That says a lot given the paranoia of Nixon and the fierce defense of the so-called imperial presidency by the Bush/Cheney administration.

Under Obama, more whistleblowers are being held accountable than in all previous decades. Lucy Dalglish, executive director of the Reporters Committee for Freedom of the Press, told the Associated Press that the US government is going after whistleblowers “very, very aggressively.”

Government whistle blowers are supposedly protected by an act of Congress passed in 1989 called The Whistle Blower’s Protection Act. It was designed to encourage government employees to step forward with instances of government abuse that they’ve witnessed. You’ll notice the date roughly corresponds to the time the Iran-Contra situation was fresh. Since then, the law has been weakened.

“It is no surprise that honest citizens who witness waste, fraud and abuse in national security programs but lack legal protections are silenced or forced to turn to unauthorized methods to expose malfeasance, incompetence or negligence,” Stephen Kohn, the executive director of the National Whistleblowers Center wrote in an op-ed contribution to the New York Times on Monday.

He wrote that Congress and the executive branch would be well advised to follow the example of their predecessors. In fact, the first protective law in the US for “whistleblowers” is almost as old as the country itself — it originated in 1778.

Speigal characterizes the Obama administration as having an active policy of “stonewalling” and “blocking” any avenue that would provide a safe path for federal whistle blowers.

The Obama administration also uses other avenues for stonewalling and blocking. At times, those efforts take on grotesque dimensions, as in the case the Pentagon’s September order to pulp the entire first printing run of “Operation Dark Heart.” The memoir by army officer Anthony Shaffer over his time in the Afghanistan war contained what were alleged to be military secrets. The destruction of the 9,500 books cost taxpayers an estimated $47,300. When the second edition was released, 250 passages were blacked out.

This pressure clashes with the increasing openness of the Internet age. Four decades ago, Daniel Ellsberg had to photocopy selected passages from the “Pentagon Papers.” Today, WikiLeaks indiscriminately places tens of thousands of documents on the Web. “It revels in the revelation of ‘secrets’ simply because they are secret,” well-regarded attorney Floyd Abrams, who represented the New York Times in its “Pentagon Papers” case against the government, wrote six months ago in the Wall Street Journal.

Recent Comments