Perspective

Posted: March 5, 2010 Filed under: Bailout Blues, Global Financial Crisis, The Bonus Class, The Great Recession, U.S. Economy | Tags: Financial Crisis, securitization, Subprime market, unemployment 1 Comment The WSJ has an interesting list of folks contributing to “Academics on What Caused the Financial Crisis“. You’ll find a lot of the usual suspects that we’ve talked about around here. There’s some interesting comments on the housing and subprime bubbles, the increased use of exotic financial instruments, and our old friend moral hazard. I’m going to a highlight just a few for you.

The WSJ has an interesting list of folks contributing to “Academics on What Caused the Financial Crisis“. You’ll find a lot of the usual suspects that we’ve talked about around here. There’s some interesting comments on the housing and subprime bubbles, the increased use of exotic financial instruments, and our old friend moral hazard. I’m going to a highlight just a few for you.

Some of the more interesting comments focused on how the housing bubble was enabled by government. Some blame low interest rates by the FED, others see that it wasn’t just a U.S. phenomenon and look for bigger reasons. Many folks see securitization and the pass-the-trash loan model as the big factors.

Dwight Jaffee, Haas School of Business, University of California at Berkeley

On the government’s role in creating the housing bubble: “I find the GSEs [government sponsored enterprises including Freddie Mac and Fannie Mae] to have been a significant factor in expanding the mortgage crisis as a result of their high volume of high-risk mortgage purchases and guarantees. Furthermore, I find that the GSE housing goals for lending to lower-income households and in lower-income regions were secondary to profits as a factor motivating the GSE investments in high-risk mortgages.

…

Christopher Mayer, Columbia Business School

On the housing bubble: “For the housing market, the picture is much more complex than it might first appear. The housing bubble was global in nature and also included commercial real estate, so simple explanations that rely solely on predominantly American institutions like subprime lending or highly structured securitizations cannot be the only factor leading to real estate market excesses. …My own research shows the important role played by declining long‐term, real interest rates in helping drive real estate prices to high levels, at least up to 2005. However, at some point, speculation by both borrowers and lenders took over, leading to excessive appreciation in many parts of the United States and the rest of the world.”

…

Pierre-Olivier Gourinchas, University of California at Berkeley:

How did subprime bust trigger a financial tsunami? “Three factors ensured that the collapse in what was a minor segment of the U.S. financial markets turned into a global financial conflagration. First, profound structural changes in the banking system, with the emergence of the ‘originate-and-distribute’ model, coupled with an increased securitization of credit instruments, led to a decline in lending standards and a general inability to re-price complex financial products when liquidity dried-up.

Randall Kroszner, University of Chicago Booth School of Business and a former Fed governor:

On reducing moral hazard: “Given the extent of interventions world-wide, issues of moral hazard will remain. The Rubicon cannot be uncrossed and financial market behavior will surely anticipate the return of the “temporary” programs and guarantees in the event of another crisis. To maintain the stability of the system and to protect taxpayers, the “too interconnected to fail” problem needs to be addressed in two ways: through improvements in the supervision and regulation framework as well as improvements in the legal and market infrastructure to make markets more robust globally.”

“Ultimately, to mitigate the potential for moral hazard, policy makers must feel that the markets are sufficiently robust that institutions can be allowed to fail with extremely low likelihood of dire consequences for the system.”

These are just a few brief excerpts from a few of the contributors. You should really go check out the full article.

In the same vein, I wanted once again to go behind the unemployment number released to day and the WSJ has a pretty good explanation of the figure that I follow closely. It is called the U-6 unemployment rate. It not only focuses on people without jobs but people that are ‘underemployed’. This rate, unlike the unemployment rate itself which is staying around 9.7%, went up last month.

The U.S. jobless rate was unchanged at 9.7% in February, following a decline the previous month, but the government’s broader measure of unemployment ticked up 0.3 percentage point to 16.8%.

The comprehensive gauge of labor underutilization, known as the “U-6″ for its data classification by the Labor Department, accounts for people who have stopped looking for work or who can’t find full-time jobs. Though the rate is still 0.6 percentage point below its high of 17.4% in October, its continuing divergence from the official number (the “U-3″ unemployment measure) indicates the job market has a long way to go before growth in the economy translates into relief for workers.

You can read more at NYT in a thread called “Is the Recovery Losing Steam?”

Again and despite what AZ Senator John Kyle says–as highlighted in Krugman’s recent op-ed “Bunning’s Universe”–most folks cannot make ends meet on unemployment benefits and must find jobs that are way beneath their job skills, their income requirements, or the lower the number of hours they wish to work. This more realistic rate accounts also for people who simply have given up on finding a job. These folks don’t even collect unemployment benefits. Just to remind you on Kyle’s priorities, here’s a good bit of prose from Krugman.

Consider, in particular, the position that Mr. Kyl has taken on a proposed bill that would extend unemployment benefits and health insurance subsidies for the jobless for the rest of the year. Republicans will block that bill, said Mr. Kyl, unless they get a “path forward fairly soon” on the estate tax.

Now, the House has already passed a bill that, by exempting the assets of couples up to $7 million, would leave 99.75 percent of estates tax-free. But that doesn’t seem to be enough for Mr. Kyl; he’s willing to hold up desperately needed aid to the unemployed on behalf of the remaining 0.25 percent. That’s a very clear statement of priorities.

You can see from various folks quoted on top (some from liberal and some from staunchly conservative b-schools), they do not place the blame for the last financial catastrophe on folks who don’t want to work and simply want to sit around collecting government money. Yet, if you look at today’s unemployment numbers, it’s just plain working folks that are not recovering from the financial global crisis. They are not getting the policy or money to deal with what the crisis did to them. Instead, the people who cause it are the one’s getting giant bonuses, boosts in stock prices, and continued government goodies.

Life isn’t necessarily fair, but does macroeconomic policy have to be so too during a Democratically led Congress and White House?

Behind the Unemployment Rate

Posted: February 21, 2010 Filed under: U.S. Economy | Tags: duration, structural unemployment, unemployment, Unemployment figures, Unemployment Rate 1 Comment We’ve discussed this before. The unemployment rate that is used as the benchmark of the state of the job market by the mainstream media does not contain the full story. It’s missing the faces of people that have given up on the job market and are considered ‘outside’ the labor force. It considers any one employed that one works one paid hour per week even though those people want 40 hour a week jobs and maybe working multiple part time or temporary jobs to make ends meet because unemployment insurance only goes so far. It doesn’t give you information on how persistent that unemployment is and there’s no inference of where the unemployment is the worst. It’s just an average of every one who is actively looking for work and is not currently employed at least one hour a week as a percentage of the total labor force.

We’ve discussed this before. The unemployment rate that is used as the benchmark of the state of the job market by the mainstream media does not contain the full story. It’s missing the faces of people that have given up on the job market and are considered ‘outside’ the labor force. It considers any one employed that one works one paid hour per week even though those people want 40 hour a week jobs and maybe working multiple part time or temporary jobs to make ends meet because unemployment insurance only goes so far. It doesn’t give you information on how persistent that unemployment is and there’s no inference of where the unemployment is the worst. It’s just an average of every one who is actively looking for work and is not currently employed at least one hour a week as a percentage of the total labor force.

It is the flows in out and out of employment and unemployment and the labor force itself that gives you more information. It is the stratification of that unemployment by race, by industry sector, by region, by sex, by age and by education that gives you an idea of the faces behind the unemployment rate. It is also the source of unemployment and the duration or length of time out of a job that provides the detail that you must have to develop a successful unemployment policy.

I’ve mentioned that the duration of unemployment in this recession and its root in structural unemployment is what is so worrisome about the unemployment we have today. It appears that many of the jobs lost over the last decade are gone permanently. The financial crisis put a large number of these folks on the unemployment roles. Their benefits are running out and there are basically no jobs for them any more. Worse yet, states are cutting their budgets which mean job training and education are less available and will continue to become more personally expensive and less available. They will be unreasonable choices for older, unemployed Americans with only high school degrees and job skills that only China requires.

The article in the NY Times today called “The New Poor- Millions of Unemployed Face Years Without Jobs” is a good overview of what we’ll look forward to as we creep out of the recession. I was struck by the stories of the people profiled in the piece as well as the candid discussion that most of these folks will never know what it is to be middle class again.

Large companies are increasingly owned by institutional investors who crave swift profits, a feat often achieved by cutting payroll. The declining influence of unions has made it easier for employers to shift work to part-time and temporary employees. Factory work and even white-collar jobs have moved in recent years to low-cost countries in Asia and Latin America. Automation has helped manufacturing cut 5.6 million jobs since 2000 — the sort of jobs that once provided lower-skilled workers with middle-class paychecks.

“American business is about maximizing shareholder value,” said Allen Sinai, chief global economist at the research firm Decision Economics. “You basically don’t want workers. You hire less, and you try to find capital equipment to replace them.”

This is a radical change from a country that prior to this century was a job creation machine for every one. Bostonboomer discussed the dark side of this change in her morning news thread on Saturday morning. We can look at the unemployment number and realize that it serves its role as barometer of bad numbers. It has some Cassandras–like Yves Smith of Naked Capitalism–wondering how these people will take their status as permanent underclass. Will it be with quiet resignation or more teaparties with more pitchforks and rifles?

Every downturn pushes some people out of the middle class before the economy resumes expanding. Most recover. Many prosper. But some economists worry that this time could be different. An unusual constellation of forces — some embedded in the modern-day economy, others unique to this wrenching recession — might make it especially difficult for those out of work to find their way back to their middle-class lives.

What does it mean when so many Americans are so visibly losing the American promise? What will it mean if–in order to continue  replenishing necessary campaign coffers–American politicians continually sell out the American labor class for the American capital class? Obviously, in a democracy, those of us that rely on paychecks instead of dividend checks and capital gains can out vote them the bonus class. But can we achieve any real change when the two major parties continually move towards the same policies with only the only difference being which industry sponsors which version of the rhetorical spin?

replenishing necessary campaign coffers–American politicians continually sell out the American labor class for the American capital class? Obviously, in a democracy, those of us that rely on paychecks instead of dividend checks and capital gains can out vote them the bonus class. But can we achieve any real change when the two major parties continually move towards the same policies with only the only difference being which industry sponsors which version of the rhetorical spin?

Traditionally, three sectors have led the way out of recession: automobiles, home building and banking. But auto companies have been shrinking because strapped households have less buying power. Home building is limited by fears about a glut of foreclosed properties. Banking is expanding, but this seems largely a function of government support that is being withdrawn.

At the same time, the continued bite of the financial crisis has crimped the flow of money to small businesses and new ventures, which tend to be major sources of new jobs.

I think I mentioned before that my laugh line from the State of the Union Address was the one where POTUS said he wanted to double exports and make us an export driven economy. Most of us had the same reaction WTF are we going to export? Disneyland? Yellowstone Natinoal Park? Old Arnold Schwarzenegger movies? Where are the jobs coming from? What do we produce any more? Much of our economy seems based on manipulation of information to disenfranchise many and benefit a few or feeding, massaging, and entertaining the bonus class or giving sophisticated medical procedures to people with Cadillac insurance plans. Many of these folks worked with their hands. They made cars or houses or sewed clothing. We now have too many houses and we prefer cars from elsewhere. All of our clothes are made by the indentured servants in third world countries now.

What are these people to do? Our safety net programs have been gutted and the states are now in the position of gutting education and training. That link is from CNN.

States face combined remaining budget gaps of $134 billion over the next three years, the report said.

It said there has been no leveling of state revenues and most states are seeing monthly totals that are lower than recent forecasts.

Citing the Rockefeller Institute of Government, the report said that state tax collections have declined for four consecutive quarters, beginning in 2009’s third quarter.

Meanwhile, Medicaid costs have grown, the report said. And states continue to lose jobs. In January alone, states eliminated 18,000 jobs, and will continue to shed jobs, the report said.

Because states are required to balance their budgets, they will “continue to cut spending and increase taxes, which will also weaken the economy and, thus, its ability to generate private sector jobs,” it said

This is back from the NY TImes:

Some poverty experts say the broader social safety net is not up to cushioning the impact of the worst downturn since the Great Depression. Social services are less extensive than during the last period of double-digit unemployment, in the early 1980s.

On average, only two-thirds of unemployed people received state-provided unemployment checks last year, according to the Labor Department. The rest either exhausted their benefits, fell short of requirements or did not apply.

“You have very large sets of people who have no social protections,” said Randy Albelda, an economist at the University of Massachusetts in Boston. “They are landing in this netherworld.”

…

“We have a work-based safety net without any work,” said Timothy M. Smeeding, director of the Institute for Research on Poverty at the University of Wisconsin, Madison. “People with more education and skills will probably figure something out once the economy picks up. It’s the ones with less education and skills: that’s the new poor.”

The majority of people in this country rely on their jobs for everything. The majority of business in this country (in terms of numbers) rely on customers who pay for their products and services with their pay checks. When the money is sucked out of this process to a few people, the house of card falls. Income inequality is not good for the country at all, but that’s been the increasing story since the 1980s. Here’s another disturbing headline from FT Alphaville: “The US is not a viable concern anymore”. The thread is based on an interview with Richard Duncan, partner at Blackhorse Asset Management and author of The Dollar Crisis. He’s written a new book called The Corruption of Capitalism.

The point being: the world’s largest economy and engine of global economic growth — the United States — is simply not a viable concern any more. As Duncan explained it:

The country is de-industrializing because wages in the US are up to 40 times higher than those in developing countries like China. Therefore, the United States makes very little that the rest of the world cannot buy somewhere else much more cheaply.

And so, like any troubled company, the US too must restructure itself if it is to remain operational, says Duncan. How it goes about it, though, will be crucial to its success. The best policy according to the author would be heavy government investment in so-called ‘future’ industries — everything from solar, biotech, nano-technology and so on. Trouble is, a move like that would take more government spending not less.

What kind of future does this leave us with? That is why BB’s self-titled “incoherent ramblings” were not the least bit incoherent. It’s just very hard to grasp losing the promise. Suicides will go up as well as murder-suicides. More and more people will have to find other ways to get what they need outside of the traditional job structure. Read into that what you will.

Is the American Dream over?

Some times being Right doesn’t always make you Feel Good

Posted: October 3, 2009 Filed under: Global Financial Crisis, Team Obama, The Bonus Class, The Great Recession, The Media SUCKS, U.S. Economy, Voter Ignorance | Tags: balanced budget amendment, DeLong, Krugman, Obamanomics, Reaganomics, Stiglitz, stimulus plan, unemployment Comments Off on Some times being Right doesn’t always make you Feel Good You may remember back in January that I was not happy and very outspoken about the size of the Obama Stimulus plan. I was not impressed by the content or with the mix between tax cuts and direct government spending. You may recall that the Blue Dogs interminable resistance to do anything that might wake their sleeping Republican voters and the desire on the part of POTUS to appease the unappeasable remnants of the Republican party led to a very watered down plan. At the time, all that I could hope was that it might be enough to get the ball rolling. However, I felt that the historical multiplier –especially for taxes– was not going to kick in the way it had in the past.

You may remember back in January that I was not happy and very outspoken about the size of the Obama Stimulus plan. I was not impressed by the content or with the mix between tax cuts and direct government spending. You may recall that the Blue Dogs interminable resistance to do anything that might wake their sleeping Republican voters and the desire on the part of POTUS to appease the unappeasable remnants of the Republican party led to a very watered down plan. At the time, all that I could hope was that it might be enough to get the ball rolling. However, I felt that the historical multiplier –especially for taxes– was not going to kick in the way it had in the past.

The release of the miserable unemployment data yesterday (not all that unexpected as you’ll recall) as well as an estimate of our output gap now clearly squares with my earlier view as well as the earlier views of Brad deLong, Paul Krugman, Mark Thoma and Joseph Stiglitz among others. The stimulus was clearly not the blue pill the economy needed. (That last link is from me saying this same thing in July.)

The Washington Monthly says the decision to appease centrists and Republicans looks even worse in retrospect. Now, the media gets it. Color me completely unsurprised because I told you so back then that it wasn’t going to be enough. I even mentioned it recently when it appeared the stimulus plans of German, France, and Japan had already lifted those economies from the worst of it last spring. These countries emphasized direct government spending. We mostly shuffled a few funds as stop gaps and the created a bunch of tax cuts that no one really needs right now.

In February, when the debate over the economic stimulus package was at its height, a handful of “centrist” Senate Republicans said they’d block a vote on recovery efforts unless the majority agreed to slash over $100 billion from the bill.

The group, which didn’t have any specific policy goals in mind and simply liked the idea of a small bill, specifically targeted $40 billion in proposed aid to states. Helping rescue states, Sen. Collins & Co. said, does not stimulate the economy, and as such doesn’t belong in the legislation. Democratic leaders reluctantly went along — they weren’t given a choice since Republicans refused to give the bill an up-or-down vote — and the $40 billion in state aid was eliminated.

At the time, it seemed like a very bad idea. That’s because it was a very bad idea.

In the past, government hiring had managed to somewhat offset losses in the private sector, but government jobs declined by 53,000, with the biggest number of cuts on the local and state levels. Even the Postal Service, which is included in the public-sector job statistics, dropped 5,300 jobs.

“The major surprise came from the public sector, where every level of government cut back,” Naroff said. “The budget crises at the state and local levels have caused an awful lot of belt-tightening.”

It’s still about the Jobs!

Posted: October 2, 2009 Filed under: Global Financial Crisis, The Great Recession, U.S. Economy | Tags: discouraged workers, Paul Krugman, Robert Riech, Underemployment, unemployment Comments Off on It’s still about the Jobs! I keep repeating this like a mantra, but an economy that relies on households buying 70% of it’s production, and households that rely on wages for 67% of their income, is not going to get healthy until it creates more jobs. That’s why Robert Riech, Paul Krugman, and this Cajun Country Economist are still stuck on job creation and the unemployment rate. It appears the DJ and other stock indexes are taking notice too. This is from today’s Gray Lady.

I keep repeating this like a mantra, but an economy that relies on households buying 70% of it’s production, and households that rely on wages for 67% of their income, is not going to get healthy until it creates more jobs. That’s why Robert Riech, Paul Krugman, and this Cajun Country Economist are still stuck on job creation and the unemployment rate. It appears the DJ and other stock indexes are taking notice too. This is from today’s Gray Lady.

The American economy lost 263,000 jobs in September — far more than expected — and the unemployment rate rose to 9.8 percent, the government reported on Friday, dimming prospects of any meaningful job growth by the end of the year.

The Labor Department’s monthly snapshot of unemployment dashed hopes that the pace of job losses would continue to slow as the economy clawed its way back from a deep recession. Economists had expected 175,000 monthly job losses.

“People have been celebrating that we’re through the financial crisis, but the underlying issues are all still there,” said Dean Baker, co-director of the Center for Economic and Policy Research. “We’ve lost trillions of dollars in housing wealth, and consumption’s going to be weak. It’s not the ’30s, but there’s really nothing to boost the economy.”

You’ll recall that it’s been two years since the NBER dated the beginning of this Great Recession. That means the U.S. economy has been hemorrhaging jobs for TWO years now. We’ve got it bad and that ain’t good. Robert Reich, President Clinton’s former Labor Secretary has the “Truth about Jobs” in his blog entry today.

Unemployment will almost certainly in double-digits next year — and may remain there for some time. And for every person who shows up as unemployed in the Bureau of Labor Statistics’ household survey, you can bet there’s another either too discouraged to look for work or working part time who’d rather have a full-time job or else taking home less pay than before (I’m in the last category, now that the University of California has instituted pay cuts). And there’s yet another person who’s more fearful that he or she will be next to lose a job.

In other words, ten percent unemployment really means twenty percent underemployment or anxious employment. All of which translates directly into late payments on mortgages, credit cards, auto and student loans, and loss of health insurance. It also means sleeplessness for tens of millions of Americans. And, of course, fewer purchases (more on this in a moment).

Unemployment of this magnitude and duration also translates into ugly politics, because fear and anxiety are fertile grounds for demagogues wielding the politics of resentment against immigrants, blacks, the poor, government leaders, business leaders, Jews, and other easy targets. It’s already started.

That’s right! Because of the way we actually count the unemployed, there are actually a lot more problems out there  than the unemployment rate measures. All you have to be is employed 1 hour of paid work and that dumps you into the ranks of employed. So that means if you’ve been furloughed, had your hours cut, or had to take up part time employment, you may be miserably underemployed, but your still employed. You also have to be have been actively searching for a job if you don’t have one for the last four weeks to stay in the ranks of the unemployed. You start giving up, you’re considered not in the labor force and by definition not eligible to join the numbers of the unemployed. (These are so-called discouraged workers.)

than the unemployment rate measures. All you have to be is employed 1 hour of paid work and that dumps you into the ranks of employed. So that means if you’ve been furloughed, had your hours cut, or had to take up part time employment, you may be miserably underemployed, but your still employed. You also have to be have been actively searching for a job if you don’t have one for the last four weeks to stay in the ranks of the unemployed. You start giving up, you’re considered not in the labor force and by definition not eligible to join the numbers of the unemployed. (These are so-called discouraged workers.)

A Dismal Labor Market

Posted: September 28, 2009 Filed under: The Great Recession | Tags: NAIRU, natural rate of unemployment, Phelps, unemployment 4 Comments

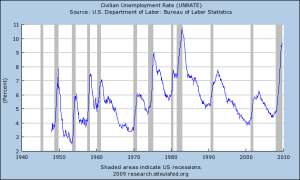

The Big Picture c/o FRED

I started the big lecture in macroeconomics on unemployment with a very out of date textbook. It isn’t even that old in terms of textbook cycles. It’s just the world economy has changed; really changed. The last unemployment data I was looking at came from 2007 and a world of hurt and CHANGE (TM) stands between that year and today.

One of my students noticed that the overall pattern of unemployment (and you can see it in the FRED graph above) showed a drift up of the central tendency or mean from a lower looking central tendency in the 1950s and 1960s to a higher one in the 1970s and 1980s. I did the happy dance because I really like it when students actually notice these things. It makes my life a lot easier when I don’t have to point every little thing like that out. The deal is if you look around the 1990s it seems to drift a little downwards again before that last gray bar representing this last recession dated by the NBER. That would be our current Great Recession. Notice how the downward drift in the series could potentially have stopped and it appears there could be a slight updrift? Again, that’s in the central tendency or what you might call the mean, the median, or the mode depending on how you want to measure the statistic.

That momentum and drift around that central tendency in the unemployment series represents flows above and around what we call the Natural Rate of Unemployment. People used to set up all kinds of policy goals after the Great Depression to get to a zero unemployment rate. Actually, they did it with the Humphrey Hawkins Full Employment bill in the 1970s too because the wish was to get every one unemployed into a job. We’ve learned quite a bit more about what is and isn’t possible now.

In the 1960s, Milton Friedman and Edmund Phelps begun to study the unemployment rate carefully to see if there was any structural or natural rate of unemployment that was related to what was going on with an economy and more important, if the goal of 0% unemployment was ever going to be more than a great wish. They also wanted to study the relationship between inflation and unemployment. Well, it turns out that there is a hypothetical rate of unemployment associated with certain things going on in the economy, like inflation, recession, or a slow economic recovery. This natural rate corresponds to the best case scenario given the set of circumstances going on in the larger economy and we’ve found that the level can go up or down, depending on that set of circumstances.

Recent Comments