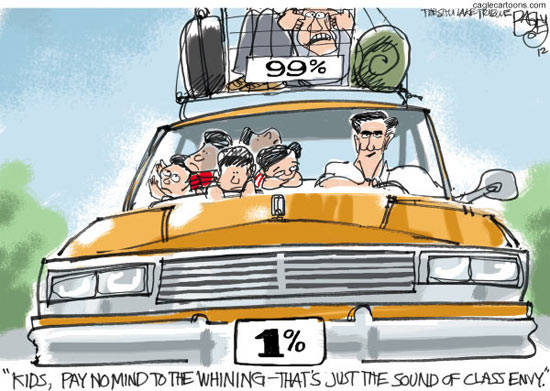

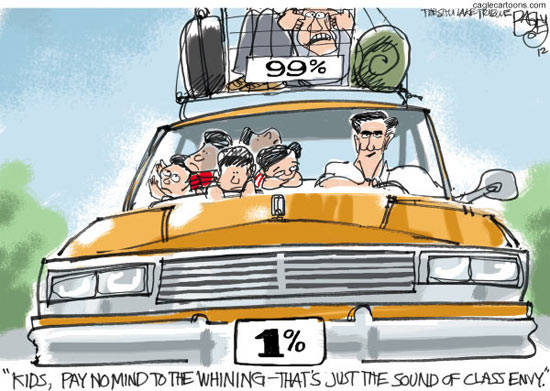

Posted: July 3, 2012 | Author: bostonboomer | Filed under: Mitt Romney, open thread, U.S. Politics | Tags: Alan Stanford, Bain Captal, fetus disposal, Ponzi Schemes, Solamere, Stericycle, Tagg Romney, tax havens |

This is going to be a quickie, because I have to go out pretty soon. I just posted a lot of this in a comment on the morning thread, but I was thinking I should do it as a post in case anyone wants to investigate further on some of the Romney news that has broken over the past few days.

Vanity Fair has a new article on Romney’s finances that is a must read: Where the Money Lives.

It’s all about Romney’s secrecy about his fortune and his many offshore holdings. He may actually have much more money than we know, because most of it is hidden in tax havens around the world. I repeat: this is a must read!

Then there’s Romney’s engineering of Bain Capital’s $75 million investment in Stericycle, a corporation that disposes of medical waste, including aborted fetuses. Bain and Romney “cleaned up” on that one. David Corn had an investigative piece on it at Mother Jones yesterday, but Sam Stein actually reported on it in January. It went nowhere then, but now it could catch on. When will the corporate media start reporting on it?

Well, here’s something at MSNBC on why we shouldn’t believe Romney’s claims that he wasn’t involved with Bain when the deal happened. David Corn addresses this at Mother Jones also.

Romney has never really left Bain. He still gets most of his income from Bain investments. Are we supposed to believe he has no say in their activities? Give me a break! Jezebel has a post on Romney’s lies about his investment in fetus disposal.

Until I read that Vanity Fair piece and started googling, I didn’t realize that Tagg Romney’s investment firm, Solamere, was originally a subsidiary of Alan Stanford’s Stanford Capital. Stanford is now in jail for the huge ponzi scheme he ran there.

Mitt and Tagg both claim they haven’t been investigated for their involvement with Stanford’s ponzi scheme, but in fact they are still being investigated.

Finally, another of Mitt’s cronies got into trouble today. Robert Diamond was forced to resign from Barclays today and then called off a planned fundraiser for Romney in London. More on this from Bloomberg.

It’s a big day for embarrassing Romney news. The Obama campaign and the DNC need to get on this stuff stat!

Did you like this post? Please share it with your friends:

Posted: September 10, 2011 | Author: dakinikat | Filed under: Social Security | Tags: Insurance, Ponzi Schemes, Risk Management, Risk mitigation, Social Security |

I’m getting more than a little tired of right wingers who think they can redefine words, rewrite history, and basically lie through their teeth free from accountability. I agree with Paul Krugman who once said that if reactionaries–not conservatives because conservatives conserve institutions not destroy them–wanted to say the earth wasn’t round that the press would merely print up the headline saying there are differing opinions on the shape of the earth. The Republican Party is continuing to produce flat earthers. Rick Perry and Michelle Bachmann both appear to live in a world where they feel free to create their own facts and know that very few people will actually call them out on it. Today, I’m going to correct one of Governor Goodhair’s egregious and pejorative lies.

I’m getting more than a little tired of right wingers who think they can redefine words, rewrite history, and basically lie through their teeth free from accountability. I agree with Paul Krugman who once said that if reactionaries–not conservatives because conservatives conserve institutions not destroy them–wanted to say the earth wasn’t round that the press would merely print up the headline saying there are differing opinions on the shape of the earth. The Republican Party is continuing to produce flat earthers. Rick Perry and Michelle Bachmann both appear to live in a world where they feel free to create their own facts and know that very few people will actually call them out on it. Today, I’m going to correct one of Governor Goodhair’s egregious and pejorative lies.

Perry stuck to a metaphor outlined in his “book” that couldn’t be more wrong during what Republicans called a debate on Monday. I rather thought it more like the Mad Hatter’s Tea Party but we won’t revisit that. I’ve done series of articles explaining Social Security in the past–link to first in series here— so I don’t want to revisit the entire system. The legacy debt, the growing number of retirees, increased life spans, and the shrinking US workforce are all issues but not issues that are insurmountable compared to the benefits derived from the program. What I want to do is tell you why the social security system is not a “Ponzi Scheme” with out reverting to the magical thinking typical of libertarians used in this article printed earlier this week by a rag called Reason that doesn’t seem to know what that word means.

It’s amazing to me that such a popular and successful program is still victim to right wing muddled and nonfactual information. Social Security is basically longevity insurance and was never designed to replace pensions or even private retirement savings. All three–albeit pensions are hard to come by these days–are an important part of being able to get through old age. Social Security works because the majority of people are placed into the system. This is important for two big economic reasons. The first is that any risk management (e.g. insurance) program is most cost effective with a huge risk pool. That’s basic insurance theory 101 or spread the risk around common sense theory.

The reason private insurance is so expensive is that unless the company is able to sort out all the ” bad” risks or charge exorbitantly for it, they will leave the social costs of the event of that “bad” risk to society (e.g. taxpayers). This is generally what corporations try to do these days. They won’t cover the overall risk. They cherry pick the low probably events or low probability people. Corporations are interested only in profits. They like to privatize profits and force risks and costs onto other folks if they can get away with it.

The second thing is that you get economies of scale (i.e. the process becomes cheapest) when you have a standard contract that’s applied in a standard way to the risk pool. Having a public insurance program–this would work for a health insurance or flood/hazard insurance–basically lets a country handle its risk in the most cost effective and efficient way. It takes care of the basic risk problem that would create social costs should the risk not be covered and the event occurs. A for profit scheme usually covers only people and things with minimal risk. A basic public offering lets the private sector create specialized programs to fill in gaps without leaving lots of people exposed to the worst risk.

I realize that not a lot of people know a lot about risk and insurance theory because it takes lots of math skills. Economic decisions under risk, information asymmetry, and moral hazard are probably the toughest areas to study other than derivatives which are another form of risk and return management in an advanced degree program. Hence, most people without advanced degrees don’t even get a whiff of the real stuff. I’m just hoping to give enough of the intuitive stuff here without going into all the models and theorems.

So, any insurance or risk management contract is very different from a Ponzi Scheme. Their pricing is generally based on the level of risk, the chance it will happen to the entity in question, and the potential amount of the loss. Also, once the event happens, everyone gets paid that experiences the event. How you pay for the plan doesn’t make something a Ponzi Scheme. Ponzi Schemes are fraudulent by definition and aren’t designed to pay anyone but the originator. They are also not anything resembling a risk management tool. They are an investment scheme set up to benefit the originators at the cost of new suckers. They are also voluntary. They prey on people who tend to not know or care to know about the details of a financial scheme and sucker them in by offering them high profits on small initial payments.

Here’s some information on Ponzi Schemes from the FBI. You can read about Bernie Madoff at the site as well as read up on typical red flags for Ponzi schemes. It’s not rocket science, really.

A Ponzi scheme is an investment fraud that involves the payment of purported returns to existing investors from funds contributed by new investors. Ponzi scheme organizers often solicit new investors by promising to invest funds in opportunities claimed to generate high returns with little or no risk. In many Ponzi schemes, the fraudsters focus on attracting new money to make promised payments to earlier-stage investors and to use for personal expenses, instead of engaging in any legitimate investment activity.

Social Security Trust funds are invested in Treasury Bills. Information on the funds holding is readily available and audited continually by all kinds of interested parties. Our FICA taxes do not disappear into a rabbit hole. Also, Social Security has a history of paying benefits to whoever has paid into it, so it has no features at all qualifying it as a Ponzi Scheme. The deal is that Wall Street wants its hands on that money and the fees resulting from investing it. Also, libertarians just think that people should be left to the wolves if they’re not clever enough to cover their asses. Unfortunately, they forget that social costs that implies. We have a right to protect our country from acts of reckless individuals. That includes corporations that ruin our public resources and individuals whose actions eventually cause costly problems. Damage done to society is sourced in more things than wars and bar fights. There are many ways to rob a bank.

So, here’s a Bloomberg article that’s a little more germane to the conversation at hand.

“Ponzi schemes are, by definition, fraud,” said Mitchell Zuckoff, author of “Ponzi’s Scheme: The True Story of a Financial Legend.”

“Social Security is above board,” he added. “We can argue about whether it’s a good system. But you can’t call it a fraud.”

…

Zuckoff says there’s a big difference between tricking innocents into making doomed investments and a social insurance program that has benefitted millions of Americans. In December 2010, 54 million Americans received either retirement or disability payments under the Social Security program.

The Wall Street Journal does a pretty good job of disabusing Governor Goodhair of his absurd notions of Ponzi schemes if he’d every bother to read it. I was glad to see that Mittens went after him. Even Ronald Reagan understood the importance of this form of public insurance.

Strictly speaking, the metaphor is misleading. A Ponzi scheme, named after Boston conman Charles Ponzi, is a fraudulent investment operation. In its essential design it’s a con. Investors don’t earn interest and instead are paid off by other dupes. Because these schemes require an ever-increasing number of new participants to pay off earlier investors, they inevitably collapse.

Social Security isn’t an individual investment plan. It’s a government insurance plan that offers seniors a predictable income. Retirees do indeed depend on future workers to pay their Social Security benefits, though unlike a Ponzi scheme, nobody pretends otherwise. The notion of this kind of inter-generational transfer is baked into the policy.

And unlike regular investments, participants in Social Security don’t own their accounts (although many conservatives would like to see such a change). If you die before you become eligible, your estate doesn’t get the money. If you live longer than average, you get more.

The deal is that fixing the program wouldn’t be difficult. The idea that people should have a minimum amount of insurance against events in their life isn’t radical at all. None of this is much different from telling people that drive that they have to have a minimum amount of coverage so that if they hurt some one in an accident they cause, they need to be able to cover the potential damage to the other parties. Again, when you spread the risk among a huge number of people and make the coverage and the claim procedures standard, the costs and the management become efficient. Also, it’s not really any kind of ‘socialism’ because these are financial contracts. It’s not like the government is usurping any kind of private property or factor of production. There’s actually state offered housing liability insurance in Louisiana for people that can’t get coverage from private companies. There’s lots of examples–like FEMA flood insurance–besides social security or medicare. Like all insurance programs and policies, they just need to be updated ever so often and people need to be reminded that this is basic, vanilla, minimal coverage and its unlikely to be the be-all and end-all to most people’s overall needs. It just exists to cover society from the worst risks that could eventually create extremely high social costs and havoc when the event occurs and the people impacted aren’t adequately covered.

Did you like this post? Please share it with your friends:

Recent Comments