US Economic Malaise

Posted: February 8, 2011 Filed under: Economic Develpment, Global Financial Crisis, U.S. Economy, We are so F'd | Tags: economic outlook 2011, joseph stiglitz, Nouriel Roubini 15 Comments I happened across the latest outlook for the global economy by Dr. Doom–Nouriel Roubini–over at Project Syndicate. We must share the same depressed muse. His outlook is very similar to mine although he’s crunching numbers in computer models that I can only dream about. It’s also a similar outlook to what Joseph Stiglitz indicated while in Davos. You will not need sunglasses while facing the future if you’re in Europe or North America. This will most likely be the decade of developing nations. I don’t have the sophisticated programs available to Roubini but his forecasts seem reasonable.

I happened across the latest outlook for the global economy by Dr. Doom–Nouriel Roubini–over at Project Syndicate. We must share the same depressed muse. His outlook is very similar to mine although he’s crunching numbers in computer models that I can only dream about. It’s also a similar outlook to what Joseph Stiglitz indicated while in Davos. You will not need sunglasses while facing the future if you’re in Europe or North America. This will most likely be the decade of developing nations. I don’t have the sophisticated programs available to Roubini but his forecasts seem reasonable.

The outlook for the global economy in 2011 is, partly, for a persistence of the trends established in 2010. These are: an anemic, below-trend, U-shaped recovery in advanced economies, as firms and households continue to repair their balance sheets; a stronger, V-shaped recovery in emerging-market countries, owing to stronger macroeconomic, financial, and policy fundamentals. That adds up to close to 4% annual growth for the global economy, with advanced economies growing at around 2% and emerging-market countries growing at about 6%.

The word anemic is never one you want to see when talking economic forecasts. Roubini does identify a few possible black swan events related to things like the deterioration of the Spanish economy that could make anemic sound like a good thing. His comments on the US economy indicate more of the same. None of the same is pleasant.

The United States represents another downside risk for global growth. In 2011, the US faces a likely double dip in the housing market, high unemployment and weak job creation, a persistent credit crunch, gaping budgetary holes at the state and local level, and steeper borrowing costs as a result of the federal government’s lack of fiscal consolidation. Moreover, credit growth on both sides of the Atlantic will be restrained, as many financial institutions in the US and Europe maintain a risk-averse stance toward lending.

There’s some indication of our potential black swans in that paragraph. Every economist is attuned to the solvency problems in states like Illinois, New Jersey, and California. There is also no faith in the federal government’s ability to bail out any one but political donors. The only hope I have for the situation is that it’s an election year and those do tend to be important states electorally for presidential wannabes.

The other trends that worry me are the trends in oil and food prices which could mean that huge countries like China may have to readjust their plans with their sovereign wealth funds. Countries that import a lot of these items are going to be in for hefty bills. China is already experience inflation and has upped its interest rates. Roubini is watching for further signs that they recognize the potential problem. He also believes these tensions will further fuel currency tensions.

Roubini actually sees some upside risks and believes that we will slowly pull out of things. He believes that all sectors are still engaging in balance sheet repair with the exception of the US government. This is especially significant for the potential for jobs creation. If corporations are lean and mean and things do improve, this could create some much needed labor demand.

Joseph Stiglitz wrote a column for the UK Guardian after his Davos trip for the World Economic Forum. He may actually need to take the Dr Doom title from Robini. He focused on some systemic things that you might find interesting. Once again, we see an evaluation of the Efficient Market Hypothesis (EMH). This is something that should’ve happened years ago. He also mentions some skepticism of the monetarist (aka Milton Friedman) positions of central banks on inflation.

But this time, as business leaders shared their experiences, one could almost feel the clouds darkening. The spirit was captured by one speaker who suggested that we had gone from “boom and bust” to “boom and Armageddon”. The emerging consensus was that the International Monetary Fund (IMF) forecast for 2009, issued as the meeting convened, of global stagnation – the lowest growth in the post-war period – was optimistic. The only upbeat note was struck by someone who remarked that Davos consensus forecasts are almost always wrong, so perhaps this time it would prove excessively pessimistic.

Equally striking was the loss of faith in markets. In a widely attended brainstorming session at which participants were asked what single failure accounted for the crisis, there was a resounding answer: the belief that markets were self-correcting.

The so-called “efficient markets” model, which holds that prices fully and efficiently reflect all available information, also came in for a trashing. So did inflation targeting: the excessive focus on inflation had diverted attention from the more fundamental question of financial stability. Central bankers’ belief that controlling inflation was necessary and almost sufficient for growth and prosperity had never been based on sound economic theory; now, the crisis provided further scepticism.

Empowering a Failed Hypothesis

Posted: December 20, 2010 Filed under: Global Financial Crisis, The Great Recession, U.S. Economy, WE TOLD THEM SO | Tags: Allan Blinder, joseph stiglitz, Paul Krugman, Perversions of economics, Reaganomics, START TREATY, Supply Side Economic hypothesis 58 Comments One of my neighbors is a public defender who is a New Orleanian by birth and fits all the standard eccentricities of New Orleanians. He spent some time in the Navy during the Vietnam period. Now my friend is very liberal, but one of his buddies from the Navy time that visits frequently is not. The buddy lives in rural Washington state and teaches in a small college there. How he every managed to get a gig teaching economics with just an MBA still boggles my mind, but that is the deal. When you do a stint in actual economics–not just managerial economics and your basic theory classes–you spend a lot of time proving theoretical models. By the time you get farther in a program and have completed your first few econometrics courses, you’re taught how to empirically validate or destroy other folk’s academic work and their models.

One of my neighbors is a public defender who is a New Orleanian by birth and fits all the standard eccentricities of New Orleanians. He spent some time in the Navy during the Vietnam period. Now my friend is very liberal, but one of his buddies from the Navy time that visits frequently is not. The buddy lives in rural Washington state and teaches in a small college there. How he every managed to get a gig teaching economics with just an MBA still boggles my mind, but that is the deal. When you do a stint in actual economics–not just managerial economics and your basic theory classes–you spend a lot of time proving theoretical models. By the time you get farther in a program and have completed your first few econometrics courses, you’re taught how to empirically validate or destroy other folk’s academic work and their models.

One of the easiest groups of hypotheses to shoot down empirically came from the Reagan years. The results were pretty astounding–we would call that highly significant to what ever statistic was used–so much that David Stockman and Bruce Bartlett gave those hypotheses up rather quickly and they were key architects of the Reagan Economic Revolution. You can’t find a’ conservative’ economist in the sense of Reaganomics unless it’s one at the Heritage Foundation that is paid to deliberately ignore the facts. In which case, that explains why they’re no place else BUT the Heritage Foundation.

Or they’re like my friend’s buddy who still goes back to the 1980s and pulls out old articles about things like the Laffer curve and teaches it because he wants to show all “opinions”. That’s what he says to me any way, when I ask him why he teaches a failed hypothesis. Frankly, he teaches it because he wants others to share his hopes and wishes that the silly thing is true. Because he’s not had the rigorous training to prepare to do actual economics, he just teaches want he wants to teach. He also hasn’t gone through publish or perish where you don’t get to have opinions without peer-reviewed facts. This drives me nuts. You can’t teach theory or empirical evidence or the scientific approach by clinging to a failed hypothesis. This makes you an intellectual flat earther.

What we currently have right now is a president that is giving the Flat Earth Society the primary voice in NASA policy and funding when it comes to economic policy. Paul Krugman has an op-ed from this weekend that firmly states that Obama has empowered the economics version of the Flat Earth Society. His op ed is called ‘When Zombies Win.’ It’s exactly what needs to be said.

First, the original Obama stimulus plan was anything but text book Keynesian economics and can’t be seen as a way to shout fail on Keynesian theory. It was more based in Reagan philosophy and those failed hypotheses than any neoKeynsian model. While I’ve continually called the Supply Side wishful thinking as a failed hypothesis, Krugman is more direct. He refers to it as failed doctrine.

For the fact is that the Obama stimulus — which itself was almost 40 percent tax cuts — was far too cautious to turn the economy around. And that’s not 20-20 hindsight: many economists, myself included, warned from the beginning that the plan was grossly inadequate. Put it this way: A policy under which government employment actually fell, under which government spending on goods and services grew more slowly than during the Bush years, hardly constitutes a test of Keynesian economics.

Now, maybe it wasn’t possible for President Obama to get more in the face of Congressional skepticism about government. But even if that’s true, it only demonstrates the continuing hold of a failed doctrine over our politics.

I wrote repeatedly at the time–no Nobel winning economist am I either–that the stimulus was bound to be way too little to be of any use. You can read me screaming ‘Tax Cuts Don’t Cut It or Cure It’ from January 2006, 2009 where I quote John Mishell’s study that talks about how the Bush tax cuts didn’t grow jobs and didn’t grow the economy. As a matter of fact I have many posts up along that line. Here’s one covering the FT’s Martin Wolf where I talk about the same thing and it’s even called ‘Still Too Little and WAY TOO Republican” from January 17, 2009. You can search my archives during that time period and find I’m very consistent at writing how the Obama stimulus would fail and that it was primarily because it was based on tax cuts.

It’s really quite a logical situation and one the most flawed precepts sits right there in the Obama-McConnell tax travesty. There’s a huge tax write off in the bill for companies buying new equipment. This is something completely ineffective because it just helps the few companies that would’ve done that any way. The majority of companies are hurting for customers. No amount of tax write offs for equipment or even employees is going to make them expand if they don’t have customers or revenue. In fact, my guess will be that an academic study some where down the line will show that the majority of those tax cuts were used by corporations who expanded in emerging markets instead of here. That’s because that’s where the inflation, growth and action is and there’s nothing in the bill that says tax benefits stay here.

Krugman also talks about something I spoke to recently in that nearly every Republican put in charge of some committee dealing with some aspect of the economy is so far out there on doctrine and short on economic theory and evidence that we’re bound to see more of the same stuff that tanked us the last time out. The Republicans sitting on the Financial Crisis panel just put out their financial version of the Earth is Flat manual last week. They said it was too much regulation which is pretty much the exact opposite of everything that every empirical study has shown us. Here’s one I keep pushing called “Slapped in the Face by the Invisible Hand” because it’s nontechnical in nature. Krugman called the release of the document ‘Wall Street Whitewash’.

So, Krugman’s op ed from this weekend isn’t astounding in that we all know what neoKeynisans like Stiglitz, and Blinder, Sachs and Krugman have been saying for months now. Now that I’ve read BB’s morning links, I’m even getting a better feel for the source of my weekend wonderment on Krugman’s bottom line. Krugman was one of a group called before the President in an attempt to get them to STFU. The deal is this. The Nobel Peace Prize may now be given on an ‘aspirational’ basis, but the Nobel Prize for economics is not. Stiglitz and Krugman earned their Nobel Prizes. I admit to having empirically tested some of Blinder’s models doing my first Masters in Economics so I’m very familiar with his contributions to the literature. These economists live in a world of peer review where there’s a very dim view of people who cling to failed hypotheses.

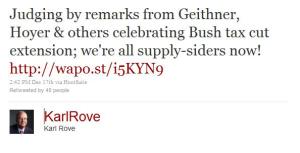

So, here’s the wonderment from Krugman’s December 19, 2010 op-ed.

President Obama, by contrast, has consistently tried to reach across the aisle by lending cover to right-wing myths. He has praised Reagan for restoring American dynamism (when was the last time you heard a Republican praising F.D.R.?), adopted G.O.P. rhetoric about the need for the government to tighten its belt even in the face of recession, offered symbolic freezes on spending and federal wages.

None of this stopped the right from denouncing him as a socialist. But it helped empower bad ideas, in ways that can do quite immediate harm. Right now Mr. Obama is hailing the tax-cut deal as a boost to the economy — but Republicans are already talking about spending cuts that would offset any positive effects from the deal. And how effectively can he oppose these demands, when he himself has embraced the rhetoric of belt-tightening?

Yes, politics is the art of the possible. We all understand the need to deal with one’s political enemies. But it’s one thing to make deals to advance your goals; it’s another to open the door to zombie ideas. When you do that, the zombies end up eating your brain — and quite possibly your economy too.

What is even more significant is that this horrible tax bill was put forward so as not to stall things like START. So, what is the status of the START Treaty and the Republicans who said they’d play ball if the Tax Cuts for Billionaires program was passed. Has this eased the hostage crisis?

Well, the vote is supposed to be held tomorrow so we shall see. But, this is quote is fresh from the AFP 4 hours ago from the moment I’ve hit the publish button.

Democrats expressed astonishment that top Republicans continued to oppose ratification when virtually every present and past foreign policy or national security heavyweight backed the move, regardless of their political stripes.

In that same announcement, Mitch McConnell was quoted as saying he’d vote against it the ratification. So is John Kyl. Collin Powell and Condoleeza Rice support the ratification of this treaty. This is what you get when you negotiate with terrorists; domestic or otherwise.

This President has consistently used the failed dogma of Reaganomics in economic policy. It makes no difference if the wackiest of the right wing say he is a socialist. The evidence clearly points to his obsession with failed tax cut dogma. I don’t know if his reasons are political or if–deep down–he is a Republican in Democrat Clothing. All I know is that we can no longer empower a failed hypothesis. I certainly hope that Michael Hirsch’s list of ‘Disillusionati’ continue to expose this economic policy for what it really is.

UPDATE via commenter waldenpond at TL.

File this under we told you so,

love, the Sky Dancing Cassandras

Thursday Morning Reads

Posted: December 2, 2010 Filed under: morning reads | Tags: Afghan atrocities, Bush tax cuts, Catfood Commission, elimination of house committe on global warming, Failure to extend unemployment benefits, joseph stiglitz, Middle East wiki cables, offshore drilling ban, Robert Fisk, The Kennedy Detail, There's still oil here 49 Comments good morning!!!

good morning!!!

In an interesting on-and-off again policy, the Obama administration announced an offshore drilling ban. This has heads spinning down here in the Gulf.

“We are adjusting our strategy in areas where there are no active leases,” Salazar told reporters in a phone call, adding that the administration has decided “not expand to new areas at this time” and instead “focus and expand our critical resources on areas that are currently active” when it comes to oil and gas drilling.

In March–less than a month before the BP oil spill–Obama and Salazar said they would open up the eastern Gulf and parts of the Atlantic, including off the coast of Virginia, to offshore oil and gas exploration. On both of those new areas, the administration said it would start scoping to see if oil and gas drilling would be suitable. The eastern Gulf remains closed to drilling under a congressional moratorium, but the White House indicated it would press to lift the moratorium if necessary.

Wednesday’s announcement is sure to please environmentalists while angering oil and gas companies as well as some lawmakers from both parties who have pressed for continued offshore energy exploration in the wake of massive Gulf of Mexico spill.

While the Democratic administration pleases environmentalists with the ban, Agent Orange probably has them unhappy with this move.

Created in 2007 by House Speaker Nancy Pelosi (D-Calif.) to draw attention to the causes and effects of climate change, the committee didn’t have much of a chance to survive the upcoming Republican takeover. Wednesday, the axe fell.

“We have pledged to save taxpayers’ money by reducing waste and duplication in Congress,” said Michael Steel, spokesman for incoming Speaker John Boehner (R-Ohio). “The Select Committee on Global Warming – which was created to provide a political forum to promote Washington Democrats’ job-killing national energy tax – was a clear example, and it will not continue in the 112th Congress.”

With the end in sight, Committee Chairman Ed Markey (D-Mass.) organized what was billed as an “all-star” cast of witnesses to testify Wednesday on the dangers posed by climate change.

If you’d like to see what the government considers ‘no oil left’ in the Gulf, here’s a good place to start. The blog The Gulf Oil Project, has some brand new photos up today. I see oil; lots of it.

The longtime residents of Perdido Beach are angry and frustrated; others just bury their heads in the sand and pray BP will go away. In Gulf shore sands stretching from Louisiana to Florida amphipods are hopping mad, isopods are flatly frustrated and mobile-home dragging hermit crabs are conspicuously absent this winter. They are just a few of the local folks that share theses beaches; make it what it is, and have become collateral damage in the war in the Gulf.

The normally tranquil beaches of the Gulf barrier islands are the kind of idyllic place where northerners flock by the thousands in winter. They have been coming here for generations – Sanderlings and Sandpipers from the Arctic, Turnstones from Maine, Plovers from Hudson Bay, Willets from the central grasslands – all have seen there seasonal beaches turned into a battle field; a mechanical minefield for those that work the tide-line for their very lives.

Robert Fisk looks at the diplomatic cables and into U.S. attitudes towards the Middle East in this provocative piece in The Independent.

It’s not that US diplomats don’t understand the Middle East; it’s just that they’ve lost all sight of injustice. Vast amounts of diplomatic literature prove that the mainstay of Washington’s Middle East policy is alignment with Israel, that its principal aim is to encourage the Arabs to join the American-Israeli alliance against Iran, that the compass point of US policy over years and years is the need to tame/bully/crush/oppress/ ultimately destroy the power of Iran.

There is virtually no talk (so far, at least) of illegal Jewish colonial settlements on the West Bank, of Israeli “outposts”, of extremist Israeli “settlers” whose homes now smallpox the occupied Palestinian West Bank – of the vast illegal system of land theft which lies at the heart of the Israeli-Palestinian war. And incredibly, all kinds of worthy US diplomats grovel and kneel before Israel’s demands – many of them apparently fervent supporters of Israel – as Mossad bosses and Israel military intelligence agents read their wish-list to their benefactors.

He goes through a lot of the best cables from the region so you don’t have to. There’s some other news from the middle east. The first of a group of soldiers accused of killing of Afghans–for sport–has been sentenced. I’m kind’ve speechless here on the sentence but, maybe I’m missing something.

The first soldier to face a court martial in connection with alleged sport killings of Afghan citizens pleaded guilty to four of five charges against him Wednesday and was sentenced to nine months in military confinement.

Staff Sgt. Robert G. Stevens was also reduced in rank to private — the lowest grade in the Army — and ordered to forfeit all pay and allowances during his imprisonment.

The investigating officer, Lt. Col. Kwasi Hawks, accepted Stevens’ plea and imposed sentence Wednesday night.

Stevens had asked the court to allow him to stay in the Army; the prosecution had asked for a dishonorable discharge.

Stevens is one of seven soldiers “facing charges of serious misconduct while deployed in Afghanistan,” the Army said in a statement.

The Catfood Commission report has got seven vote of confidence now. Senate Budget Committee Chairman Kent Conrad (D-N.D.) and retiring ranking Republican Sen. Judd Gregg (N.H.) said they would back the proposal. Getting it any where still appears to be a long shot, but they are trying.

To appeal to Democrats on the commission, the chairmen eliminated a provision that converted the federal share of Medicaid payments to a block grant. This would have prevented federal spending from increasing alongside rising Medicaid costs.

The new proposal also does more to spur on the short-term economic recovery by proposing $22 billion less in domestic spending cuts in 2013.

In a nod to Republicans, the chairmen proposed a temporary payroll tax holiday.

But the chairmen also retained a number of politically unpalatable provisions, including the proposed elimination of popular tax provisions like the mortgage interest tax break. They also kept a proposal to reduce Social Security benefits by gradually raising the retirement age to 68 by 2050 and to 69 by 2075.

The WSJ reports that the Bush Tax Cuts will likely be extended temporarily. There’s a lot of cyber ink being written on this topic. It appears to be the Republican Rubicon.

…conversations, described as preliminary, have taken place over the past few weeks. They have considered short-term extensions of a number of business and individual tax provisions that are expired or expiring, such as a popular research credit and middle-class protection from the alternative minimum tax. A likely outcome includes a one- to three-year extension of the Bush-era income tax rates and a two-year extension of the business provisions, according to aides. The package could include Democratic priorities such as extension of tax breaks that benefit the working poor, as well as further extension of unemployment benefits for the long-term jobless.

An agreement on temporary extension of all the current rates and breaks would represent a breakthrough after months of partisan infighting. It would signal lawmakers’ intent to avoid the public outrage that could result if the two sides failed to reach a tax deal this month. Many retailers and economists worry that the tax increase could tamp down household spending and further weaken employment and the fragile recovery.

Underscoring that risk, the commissioner of the Internal Revenue Service, Douglas Shulman, sent a letter to lawmakers on Wednesday, warning that postponing extension of some breaks, such as a measure to diminish the bite of the alternative minimum tax, could be “extremely detrimental” and risk significantly delaying refunds.

The CSM reports that any extension of unemployment benefits will be held hostage until the Republican give rich people their tax cuts.

Efforts in the Senate to extend the unemployment benefits were trapped in a procedural wrangle and never allowed on the floor for consideration. It fell to Sen. Scott Brown (R) of Massachusetts to object on behalf of the Republican Party to one proposed measure that required unanimous consent to move to the floor.

“We are in the midst of a historic economic crisis. I realize that,” he said. But to avoid ”burdening future generations,” the $56.4 billion measure must be offset with cuts elsewhere, he said. Senator Brown proposed tapping unspent federal dollars in other programs, such as the 2009 Obama stimulus plan.

Senator Reed objected, noting that the Republican plan to permanently extend the Bush tax cuts gives the wealthiest Americans a $700 billion tax cut that is also not offset – and, unlike the employment benefit, would not expire.

I can’t put the video here, but I can link to it. The Economist interviewed my economist hero Joseph Stiglitz over a hot cuppa. Stiglitz says were a ‘long way’ from back to normal and has concerns that we may have a very inadequate new normal. He doesn’t think unemployment will come down any time soon. He sees 5-10 years of a “Japanese-style malaise” especially because of austerity cuts being suggested by policy makers. He labels this “fiscal madness”. Stiglitz also says that “banks are undermining the rule of law in America” and that “bad mortgages still fester”. You’ll notice he’s not blaming the FED because that’s a red herring.

As you may know, I’m not much for TV. But, I may try to watch ‘The Kennedy Detail’ series starting on the Discovery Channel. The program features interviews with JFK and Jackie Kennedy’s secret service detail. It’s based on the book by Gerald Blaine.

Well, that’s enough from me this morning.

What’s on your reading and blogging list today?

The Economic Troika Seems Confused

Posted: November 28, 2010 Filed under: U.S. Economy | Tags: joseph stiglitz, Mark Thoma, Obama and Unemployment, Paul Krugman 42 Comments There are three economists that I read almost every day because I share a lot in common with their value system and their approach to the subject area. That would be Brad DeLong, Paul Krugman, and Mark Thoma. The three are probably the most visible group of liberal economists on the web with the exception of Joseph Stiglitz. All three of them just don’t seem to get why President Obama does what he does given that he said what he said during the election.

There are three economists that I read almost every day because I share a lot in common with their value system and their approach to the subject area. That would be Brad DeLong, Paul Krugman, and Mark Thoma. The three are probably the most visible group of liberal economists on the web with the exception of Joseph Stiglitz. All three of them just don’t seem to get why President Obama does what he does given that he said what he said during the election.

Now I admit to being a relative newcomer to academia compared to these three. I’m old and will never garner the prestige they’ve achieved. I spent most of my career in financial institutions and the FED so maybe that’s where the difference comes. I don’t know. But all three of them were on the same track today and the centralized blog theme began on Thoma’s Economist’s View where the topic germinated.

Is giving some one an overly generous portion of the benefit of the doubt something that liberals academics do? I’m beginning to wonder. All this year, the troika appeared to be baffled by the continuing not democratic, not progressive/liberal, and not wise economic policy coming out of the District. Did they listen to the same presidential primary debates that I listened to? Did they watch the appointments of folks like Austin Goolsbee and just miss something? Is it just me?

From the keyboard and fingers of Mark Thoma comes a series of not so rhetorical questions and a thought. The title of the thread is The Administration’s “Communication Problem”.

I find it incredible and disturbing that on the eve of the recent election in which Democrats got trounced, the administration was still trying to figure out if the unemployment problem is structural or cyclical.

Chiming in with a reply–even quoted by Thoma–is Delong. (They all obviously read each other too.) He titled his thread ‘Mark Thoma Watches Barack Obama and His Political Advisors Go Off Message Yet Again…Can we please get the White House back on message?’

Okay, so now we come full circle as Paul Krugman also responds to Thoma with his NYT blog and this title: Lacking All Conviction.

“Now”, I thought as I braced for the read, “we might be getting a little closer to the true source of this ‘communication’ or ‘message’ problem.” But, Krugman’s take on the meeting was concern that POTUS is just getting bad advice. I’m going to bold Krugman’s relevant assertion.

What I want to know is, who was arguing for structural? I find it hard to think of anyone I know in the administration’s economic team who would make that case, who would deny that the bulk of the rise in unemployment since 2007 is cyclical. And as I and others have been trying to point out, none of the signatures of structural unemployment are visible: there are no large groups of workers with rising wages, there are no large parts of the labor force at full employment, there are no full-employment states aside from Nebraska and the Dakotas, inflation is falling, not rising.

More generally, I can’t think of any Democratic-leaning economists who think the problem is largely structural.

Yet someone who has Obama’s ear must think otherwise.

No wonder we’re in such trouble. Obama must gravitate instinctively to people who give him bad economic advice, and who almost surely don’t share the values he was elected to promote. That’s what I’d call a structural problem.

Okay, there are two prominent Noble Prize winners that I’ve mentioned in this thread. Krugman is one and Stiglitz the other. Any truly Democratic President seeking a Roosevelt/Kennedy Style economic program would call on Stiglitz in a minute’s notice. Krugman’s the obvious choice for trade and international economics under similar policy goals. There is a rich legacy of Paul Samuelson acolytes out there. Heck, Samuelson only died a year ago, so he was even available for some time; especially during the historic ‘transition’ presidency when we even got that new fangled seal. Samuelson even went to the University of Chicago and Harvard. Samuelson was the consummate neoKeynesian. He was the yang to the Milton Friedman yin. He was friggin’ brilliant.

other. Any truly Democratic President seeking a Roosevelt/Kennedy Style economic program would call on Stiglitz in a minute’s notice. Krugman’s the obvious choice for trade and international economics under similar policy goals. There is a rich legacy of Paul Samuelson acolytes out there. Heck, Samuelson only died a year ago, so he was even available for some time; especially during the historic ‘transition’ presidency when we even got that new fangled seal. Samuelson even went to the University of Chicago and Harvard. Samuelson was the consummate neoKeynesian. He was the yang to the Milton Friedman yin. He was friggin’ brilliant.

Now, I’m feeling a bit like Inigo Montoya here except that it’s not the word inconceivable that’s confusing me. What’s confusing me is that I keep reading these guys. These guys work with models and data. They also–of course–make assumptions. I think the models are okay, but they keep using the wrong assumptions. After two years, you have to question the assumptions when the data results keep confusing you, guys!!

Let’s start with some fresh assumptions that don’t start with he said this, yet he’s doing this, it must be the message, the adviser, or the communication style. Let’s try, he said what it took to get elected. Now, he’s doing what he believes in. If he was all that interested in being the next FDR, at least one of you and Joseph Stiglitz would be on the CEA right now. He’s just not that into you, Keynes, or unemployment unless he thinks it’s going to help in 2012.

M’kay?

Susie at Suburban Guerilla had a slightly different take but with a somewhat similar line of thought.

Obama would rather preside over a graduate seminar than make hardnosed political decisions, and that continues to be a major flaw.

I think it runs even deeper than that. I think the ‘graduate seminar’ was a public relations exercise.

Digby at Hullabaloo has a little stronger sentiment than that.

If anyone’s wondering why the administration hasn’t been able to get on message about jobs and unemployment, it might be because they just don’t know what the hell they are doing.

Well, that too.

Recent Comments