Chapter 3: In which Kat joins the Pigou Club

Posted: December 17, 2008 Filed under: Environmental Protection, president teleprompter jesus, U.S. Economy | Tags: energy policy, Oil Tax, Pigou Tax on Energy, steven Chu 5 Comments This thread is going to speak to solving several major problems we have in our Economy in a way that is not going to be highly popular with folks outside the Pigou Club. If you slept during or avoided your microeconomics course, or blocked the bad memories the minute you finished the course, you undoubtedly are asking yourself wtf is the Pigou Club? If you do remember who Pigou is and what he suggested, you’re asking yourself, why would any economist suggest raising taxes on anything during a major recession? Well, get ready to discuss using a tax to shape social behavior because that’s what Pigou suggested and that’s what we now do on things like alcohol and cigarettes.

This thread is going to speak to solving several major problems we have in our Economy in a way that is not going to be highly popular with folks outside the Pigou Club. If you slept during or avoided your microeconomics course, or blocked the bad memories the minute you finished the course, you undoubtedly are asking yourself wtf is the Pigou Club? If you do remember who Pigou is and what he suggested, you’re asking yourself, why would any economist suggest raising taxes on anything during a major recession? Well, get ready to discuss using a tax to shape social behavior because that’s what Pigou suggested and that’s what we now do on things like alcohol and cigarettes.

Arthur Cecil Pigou was a Brit economist who was part of the Cambridge school that also produced John Maynard Keynes. Pigou’s major work was in an area that we call welfare economics. You can read more about him if you’d like but this is from Wikipedia and gives you the major idea.

Pigou’s major work, Wealth and Welfare (1912, 1920), brought welfare economics into the scope of economic analysis. In particular, Pigou is responsible for the distinction between private and social marginal products and costs. He originated the idea that governments can, via a mixture of taxes and subsidies, correct such perceived market failures — or “internalize the externalities“. Pigovian taxes, taxes used to correct negative externalities, are named in his honor.

So what do the members of Greg Mankiw’s Pigou Club want to tax? Well, the answer is that now is the perfect time for a federal tax on gasoline and other petroleum products. It appears that the incoming energy secretary, Steven Chu, is also a member of the Pigou Club. Another Obama appointee, Lawrence Summers also supports the idea. Here is a description of Chu’s idea from the WSJ.

In a sign of one major internal difference, Mr. Chu has called for gradually ramping up gasoline taxes over 15 years to coax consumers into buying more-efficient cars and living in neighborhoods closer to work.

“Somehow we have to figure out how to boost the price of gasoline to the levels in Europe,” Mr. Chu, who directs the Lawrence Berkeley National Laboratory in California, said in an interview with The Wall Street Journal in September.

But Mr. Obama has dismissed the idea of boosting the federal gasoline tax, a move energy experts say could be the single most effective step to promote alternative energies and temper demand.

That last sentence is the important argument is signficant. A Pigou tax on gasoline, heating oil, and other petroleum products would, in fact, be extremely effective in promoting alternative energies, decreasing dependence on foreign sources of the products, and giving us more leverage in the world with countries we have to endure just because they have oil. Check out today’s Market Watch and the new threat from OPEC. Threats from OPEC are nothing new, we’ve been dealing with them since the 1970s, but ineffectively, because they can negatively impact our economyand the way we deal with certain oil exporting countries with terrorist tendencies. We also know they loosen up the supply and let prices drop anytime we threaten energy independence which causes auto companies and stupid americans who love big vehicles to buy them.

NEW YORK (MarketWatch) — The Organization of Petroleum Exporting Countries has decided to cut its oil output by 2.2 million barrels a day from current output, or 4.2 million barrels a day from September levels, the Wall Street Journal reported on its Web site Wednesday.

…OPEC faces a world where oil prices are set by factors outside of the traditional supply and demand. Currency and interest rate moves, as well as jitters tied to the global economic crisis, have pushed oil prices down precipitously of late.Analysts at Pritchard Capital Partners noted that the lowered production target is expected to take effect on Jan. 1, with actual cuts coming mostly from Saudi Arabia, United Arab Emirates and Kuwait

Who Really Supports the Bush-Cheney Energy Plan?

Posted: August 7, 2008 Filed under: No Obama, U.S. Economy | Tags: energy ads, energy policy, mccain, Obama, obama voted for bush cheney energy plan 1 Comment John McCain seems to be gaining traction on Barack Obama in a large part due to the energy crisis. Senator Obama stumbled by suggesting that we could save the amount of fuel generated by new off-cost drilling simply by maintaining the correct tire pressure for our cars. I remember this energy saving tip was provided as a public service announcement by Mario Andretti back in the day. For some one who is running to solve some of our country’s biggest problems, it simply didn’t seem too, well presidential. It seems more like a topic for Hints from Heloise.

John McCain seems to be gaining traction on Barack Obama in a large part due to the energy crisis. Senator Obama stumbled by suggesting that we could save the amount of fuel generated by new off-cost drilling simply by maintaining the correct tire pressure for our cars. I remember this energy saving tip was provided as a public service announcement by Mario Andretti back in the day. For some one who is running to solve some of our country’s biggest problems, it simply didn’t seem too, well presidential. It seems more like a topic for Hints from Heloise.

The Obama campaign must have gotten the message that these household hints during speeches aren’t a substitute for specifics on national energy policy when the McCamp camp started handing out tire gauges with ‘Obama’s energy plan’ emblazoned on the sides. Obama immediately responded with both an ad and a very long speech. The few specifics layed out by the plan aren’t very earthshattering. I already attacked one of his suggestions as simply bad economics in my blog yesterday. Any tax placed on the sellers of a price-sensitive product will be passed on immediately to the buyers. So, the suggestion of a $1000 tax rebate to the taxpayers based on windfall profits will just eventually come from higher prices at the pump. So, you get a rebate with one hand and you get higher gas prices with the other hand. Since we’ve never seen an Obama transcript, I’ll just have to speculate that he never took Economics 101 or 102. I should know because I’m a professor of economics and I teach those classes.

I reviewed Obama’s ad yesterday and found one attack on McCain. This was the charge that McCain is simply supporting the Bush-Cheney Energy plan. I checked into the voting records for the 2005 Bush Cheney Energy plan and found something astounding. McCain voted against it. Obama voted for it. It didn’t take long for McCain to pick up on this. i heard a McCain speach today in Lima, Ohio pointing out that Obama voted FOR the Bush-Cheney Energy plan while he voted against it. The Bush-Cheney Energy plan was generally seen at the time as a series of huge handouts to petroleum interests. So, how is it that Obama voted for it and McCain voted against it?

McCain policy advisor Dough Holtz-Eaken had this to say in a press release reprinted by the Chicago Sun-Times.

While distorting John McCain’s vision for energy independence, Barack Obama is also misleading the American people when he says John McCain supported the Bush-Cheney energy policy. Let there be no mistake: the only candidate who voted to give tax breaks to Big Oil is Barack Obama when he supported the 2005 Bush-Cheney energy bill that gave $2.8 billion in subsidies to the oil companies. John McCain voted against this bill for the very reason that he opposed these tax breaks to oil companies and as president he will ensure their repeal. While he may decry them on the campaign trail, Barack Obama had no problem standing side-by-side with the oil companies while in the United States Senate.

http://blogs.suntimes.com/sweet/2008/08/mccain_policy_advisor_doug_hol.html

I’ve seen the ad playing on CNN. This has to be a misstep by the Obama campaign. Why would you actually bring attention to such an obviously questionable charge? A quick check of campaign contributors also shows that Obama has also taken a lot of money from Big Oil as has the McCain campaign. Why would you charge your opponent with being in the pocket of big oil with such an obvious elephant in your own room? (And this could be that Obama, at the time, voted more Republican than McCain) Senator Obama must think the press will cover for him by not pointing out the obvious about the contradictions in his behavior and campaign rhetoric.

Taking on high oil prices is going to play much better in Peoria and Omaha than giving speeches in front of German Victory monuments shouting out with “I am a citizen of the world”. I can really see a McCain ad coming with this contrast set out for those of us living in the big fly over.

Once again, we see the Audacity of Hype.

The McCain Ad:

and the Obama response:

Again, linking McCain to the Bush-Cheney Energy plan when McCain voted against it and Obama voted for it, seems an odd tactic. I think this will back fire big time if there’s actually some discussion of the facts-on-the ground. I’m sure the RNC is just waiting for the DNC convention to nominate this clearly in-over-his head candidate before the attack ads start in full.

Please, delegates, run away from an Obama nomination as quickly as possible.

McCainonomics: Red faces, voters who Whine, and Blue homeowners

Posted: July 11, 2008 Filed under: U.S. Economy | Tags: Economic policy, energy policy, global economics, Gramm, mccain, whining US Voters 9 CommentsWhile John McCain is calling the U.S. economy a shambles, Economic Adviser Phil Gram says buck up  America and quit whining. He says it’s ALL in our head.

America and quit whining. He says it’s ALL in our head.

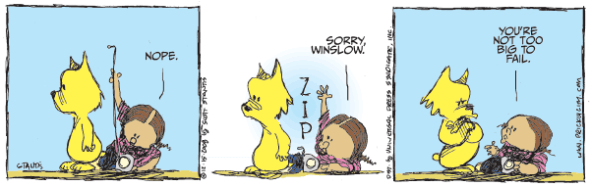

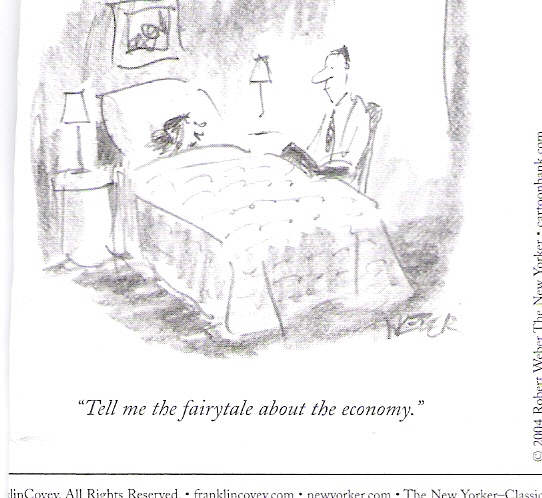

So which of these guys has the correct answer? Well, on the one hand there’s this guy trying to get elected president, so what else is he going to say? Then on the other hand, we’re really not technically in a recession yet so Phil has a point. They are both right and they are both wrong which is something only an economist could say and I couldn’t resist living up to the old joke. Okay, I’ll break it down into a few more stylized facts.

Our growth rates is somewhere between 0 and 1, our unemployment rate is pretty much where it should be, and most of the economic indicators are mixed, at best. We’re in a very slugglish growth period, but there still some major economic indicators that are showing neutral or positive. That doesn’t mean that all of us are living the same reality, however. The real answer to the question depends on WHO you are and WHERE you live. The economy is stagnant at the moment, and we’re in for a period of time where Americans are going to have to get use to making some tough choices and not seeing forward momentum. We’re basically all working and staying pretty much in the same place. Our clothing is costing us a lot less. We’ve got electronic gadgets galore and they are all really cheap. Have you priced computers, dvd players, or stereos recently? They’re all pretty cheap and just about any one can get to them. However, health care, driving, and eating are going from cheap to pricey.

The question of high energy prices and the segments of America that aren’t doing so well come mostly from globalization of the world economy that brings both good developments and bad. This is not going to reverse. As the economy adjusts, all buyers will win from global trade but those whose jobs go abroad will loose, and some will loose big time. We buy cheap stuff from the Chinese, they turn around and buy cars and they want gas. This increased demand for gas means higher gas prices. The Chinese also take jobs away from the manufacturing sector because Chinese labor comes extremely cheap and doesn’t require a pension or health plan. Those folks working for those companies that are outsourcing to other countries are miserable. While the USA has a relatively low unemployment rate of around 5%, places like Michigan and Pennsylvania have 10% unemployment rates. They are suffering. So, if you’re in the medical sector, you’re going to be happy as a clam. If you’re in manufacturing, prepare for a new career. Also, the government has grants out there to retrain folks loosing jobs from NAFTA. If you can prove it’s from NAFTA, go get it now!

438,000 jobs have been lost bringing unemployment to 5.5 percent. This is not a bad situation now, but if it continues, chances are we will be looking more like recession. Economists consider this rate to be close to the rate that represents what it should be if we are operating at capacity. The big question is: WILL IT GO UP?

So what about the financial crisis? How widespread is the mortgage problem? The housing crunch is wrecking the construction industry in places like Miami, Las Vegas, and Los Angeles. However, down here in New Orleans, the construction industry can’t find enough workers and is booming like never before. So Housing Foreclosures are a major problem in places like California, Nevada, and Florida. Many of these foreclosures are for house flippers. These folks are speculators and can whine all they want but that’s business and that’s what you get when the market moves against you. However, folks that were suckered into bad loans by mortgage brokers are a different matter. These folks are loosing their homes for banks that were looking for high fee income and basically put people into mortgages they couldn’t handle. Government regulation and help is required here. We’re not likely to get that as long as Dubya is in office. He’s threatening to veto the current bill. (All of the sudden our prez (the BIG spender) goes fiscally responsible on us!) I’m waiting for both McCain or Obama to come up with specific plans here. Hillary Clinton was the only one who spoke to this situation and her answer was a moratorium on rates. I think we’re going to need some federal bonds to fund some of these folks. It’s something similiar to what we did during the Great Depression to keep families in their homes and off the street.

So there are several markets that are a huge mess. The automobile industry and some sectors of manufacturing and the financial industry which has spilled into the housing industry, But again, most of the impact from these sectors is hitting some states hard and other states not so much at all.

Unfortunately, a lot of the higher prices are due to those high food and gas prices which are not a function of a bad U.S. economy, they are a function of problems in the global economy. There is also a continuing pattern since the 1980s that has left the rich getting richer and the poor and middle class getting poorer. The income inequality problem is worsening in this country and it looks as though it will continue. This is why it is essential that everyone has access to quality education at all levels. We should consider allowing more students attend university on the taxpayer’s dollar. Aid should definitely be mean income tested. It is much cheaper to send a teenager to school than it is to house him in a jail for the rest of his life.

These are some steps we can take to solve some of these things. First, as long as U.S. business has to pick up the tab for worker’s health insurance, the U.S. worker will not be competitive. We need universal health care paid for by individuals/taxpayers on an ability-to-pay basis. Second, all agriculture price supports, set aside programs, and subsidies, especially to ethanol, should be halted. Third, we all need to conserve energy and switch to other fuels sources (with the exception of ethanol made from things that are food). If we are making biofuels, then we need to use garbage or chicken fat or some byproduct, not food itself.

So, which of the candidates are up to the challenge? I don’t think either of them are, but I’m waiting.

Recent Comments