Dismal Economists: Getting Real on those Green Shoots

Posted: June 18, 2009 Filed under: Bailout Blues, Economic Develpment, Equity Markets, Global Financial Crisis | Tags: Depression, Federal Deficit, Green shoots, Health care reform, Obama Poll Numbers Comments Off on Dismal Economists: Getting Real on those Green Shoots I’ve been concerned about the lack of real evidence for the administration’s green shoot hypothesis. It seems that I’m not the only one. A new Wall Street Journal Poll shows that Americans are increasingly ‘wary’ of the deficit and Obama’s economic intervention as Obama’s poll number’s slip.

I’ve been concerned about the lack of real evidence for the administration’s green shoot hypothesis. It seems that I’m not the only one. A new Wall Street Journal Poll shows that Americans are increasingly ‘wary’ of the deficit and Obama’s economic intervention as Obama’s poll number’s slip.

But the poll suggests Mr. Obama faces challenges on multiple fronts, including growing concerns about government spending and the bailout of auto companies. A majority of people also disapprove of his decision to close the military prison at Guantanamo Bay, Cuba.

Nearly seven in 10 survey respondents said they had concerns about federal interventions into the economy, including Mr. Obama’s decision to take an ownership stake in General Motors Corp., limits on executive compensation and the prospect of more government involvement in health care. The negative feeling toward the GM rescue was reflected elsewhere in the survey as well.

A solid majority — 58% — said that the president and Congress should focus on keeping the budget deficit down, even if takes longer for the economy to recover.

Laura Zamora, 40, of Orange, Calif., voted for Mr. Obama but says she is frustrated by the economy and finds her support for the president waning. She says she’s facing a possible layoff as a local government worker in California.

“He’s bailing out the private sector. He’s putting all kinds of money into the private sector,” says Mrs. Zamora. “The money should be going to social programs, not to bailing out banks and GM. It should go to people who are unemployed.”

The survey of 1,008 adults, conducted Friday to Monday, had a margin of error of plus or minus 3.1 percentage points for the full sample.

The poll shows as the economy really worsens, people are becoming more reality-based. Speaking of reality based, let’s get back to numbers that show the public’s concerns are much warranted. You will not want to miss this VOXEU study showing what two economists have found when comparing the Great Depression with the current Great Recession. They’ve charted the numbers back-t0-back and are even going as far as saying that we are in a Global economic Depression. You really need to check the graphs and the analysis out in “A Tale of Two Depressions”. Dr. Barry Eichengreen and Dr. Kevin O’Rourke are both research/historical economists and bring the stylized facts home.

This is an update of the authors’ 6 April 2009 column comparing today’s global crisis to the Great Depression. World industrial production, trade, and stock markets are diving faster now than during 1929-30. Fortunately, the policy response to date is much better. The update shows that trade and stock markets have shown some improvement without reversing the overall conclusion — today’s crisis is at least as bad as the Great Depression.

New findings:

- World industrial production continues to track closely the 1930s fall, with no clear signs of ‘green shoots’.

- World stock markets have rebounded a bit since March, and world trade has stabilised, but these are still following paths far below the ones they followed in the Great Depression.

- There are new charts for individual nations’ industrial output. The big-4 EU nations divide north-south; today’s German and British industrial output are closely tracking their rate of fall in the 1930s, while Italy and France are doing much worse.

- The North Americans (US & Canada) continue to see their industrial output fall approximately in line with what happened in the 1929 crisis, with no clear signs of a turn around.

- Japan’s industrial output in February was 25 percentage points lower than at the equivalent stage in the Great Depression. There was however a sharp rebound in March.

Greenshoots or False Spring?

Posted: April 6, 2009 Filed under: Equity Markets, Festivities, Global Financial Crisis, U.S. Economy | Tags: altman, bernanke, cowen, Depression, greenshoot, recession, recovery, thoma Comments Off on Greenshoots or False Spring?

Miss Strawberry with the Winners of the Strawberry Bakeoff

I woke up this morning to a chill in the air. When I came back home from university today it was a chilly 60 in the house. There’s a frost warning for the North Shore and I had to put the heater back on and pull at the flannels. I walked the dog in a fleece jacket and had to put socks on. This weekend was just warm, sunny, and great and the Strawberry Festival was in full swing? WTF happened here in Southeastern Louisiana? One day I’m basking in the first hint of a warm sun enjoying fresh strawberry shortcake and the next I’m hoping that the magnolia blossoms are safe. Yes, there’s a Strawberry Queen, a Strawberry Ball, and Strawberry Royalty. If you gotta work somewhere, it might as well be the Strawberry Capitol of the Word.

So, having been raised in the Great Flyover and spent most of my childhood watching my Dad’s business sell F-150s to the local farmers, I know a lot about a false spring. That’s when Mother Nature messes with you by giving you just enough spring to think the worst of winter is over and then hits you with the cold blast of reality. Thankfully, my cold blast didn’t include the blizzard that hit the heartland, but it is a cold blast. That’s why I’m having so much fun with the economic word-de-jour. That would be Ben Bernanke’s “green shoots”. An Ivy-leaguer from South Carolina should know about about false springs. Bloomberg picks at the analogy too in Bernanke ‘Green Shoots’ May Signal False Spring Amid Job Losses.

April 6 (Bloomberg) — It will be months before it’s clear whether what Federal Reserve Chairman Ben S. Bernanke calls the U.S. economy’s “green shoots” represent the early onset of recovery, or a false spring.

The Labor Department’s April 3 report that the economy shed an additional 663,000 jobs last month, while the unemployment rate rose to 8.5 percent, will be followed by months more of bad-news headlines, economists say. The recession, now in its 17th month, has already cost 5.1 million Americans their jobs, the worst drop in the postwar era; unemployment may hit 9.4 percent this year, according to the median estimate in a Bloomberg News survey, and may top out above 10 percent in 2010.

The risk is that the jobs picture turns even more bleak than forecast or the drumbeat of bad news still to come causes consumers, whose spending has firmed up in recent months, to hunker down again.

“If something happens to spook consumers and they crawl back into their tortoise shells, that would be terrible news,” says Alan Blinder, former Fed vice chairman and now an economics professor at Princeton University.

Consumer spending, which accounts for more than 70 percent of the economy, rose 0.2 percent in February after climbing 1 percent in January, breaking a six-month string of declines.

Is this ANY way to run an Economy?

Posted: April 4, 2009 Filed under: Equity Markets, Global Financial Crisis | Tags: bailout, DeLong, Depression, Financial Crisis, Krugman, Obama/Geithner Bailout Plan, recession, Stiglitz, Summers Hedge Fund Salary, unemployment 4 Comments The US economy is in a fragile state right now which begs the question: Why do our policy makers seem oblivious to lessons from the great meltdowns of the past? Adam Posner of the Daily Beast asks the question out right: Does Obama Have a Plan B? Posner asserts that the administration appears to be hellbent on recreating the Japanese Lost Decade. This is something that I’ve been harping on for months as has Paul Krugman and Joseph Stiglitz–two big brained economists with Nobel prizes.

The US economy is in a fragile state right now which begs the question: Why do our policy makers seem oblivious to lessons from the great meltdowns of the past? Adam Posner of the Daily Beast asks the question out right: Does Obama Have a Plan B? Posner asserts that the administration appears to be hellbent on recreating the Japanese Lost Decade. This is something that I’ve been harping on for months as has Paul Krugman and Joseph Stiglitz–two big brained economists with Nobel prizes.

So it is with some irony if not humility that we should approach Treasury Secretary Geithner’s Public Private Investment Plan presented on March 23. A number of major American banks have lost huge amounts of money, and clearly have insufficient capital if they are not literally insolvent. Why else would they be pushing so hard to change the accounting rules to avoid showing what they really have on their books instead of raising private capital? Why else is the U.S. government taking so long to perform “stress tests” and trying to get expectations of overpayment for some of the bad assets on the banks’ books before the test results are out? In short, the U.S. government is looking to shovel capital into the banks without sufficient conditions, hiding rather than confronting the actual situation.

That is just like the Japanese government in their lost decade, or the U.S. officials during the 1980s before they really tackled the savings-and-loan crisis. In those cases, the delay simply made the problem worse over time and in the end the government had to put more money into the troubled banks directly, taking over or shutting down the weakest of them. Whatever the political culture, it would seem we have not learned from experience. Or perhaps we cannot act on our learning. The universal barrier would appear to be the political difficulty of recapitalizing banks. That seems obvious, but the constraint it puts on good policy is enormous.

That is why the Geithner plan is so complex and jury-rigged, to avoid the need for public requests for more money for banks. Unfortunately, it is unlikely to succeed absent additional public money and more-intrusive government action. The plan will buy some time and certainly some appreciation in bank share prices. Current shareholders will be getting a new lease on life with subsidies from taxpayers. For that reason alone, the plan certainly will cost the taxpayer more in the end than a more direct recapitalization with public control would have.

Obama Team Announces TARP Plan: Market Crashes

Posted: February 10, 2009 Filed under: Equity Markets, Global Financial Crisis, New Orleans, president teleprompter jesus, Team Obama, U.S. Economy | Tags: Depression, Geithner, Obama presser, Obamanomics, TARP 2 CommentsI hope you weren’t planning on using any of those savings that you may still have left sitting out there in anything market-related soon. The Dow Jones ( at this writing) is off over 350 points. All of the blue chip components tumbled. The S&P and OTC markets aren’t faring any better. This is how Market Watch sees it right now:

The recent strength shown by U.S. stocks vanished on Tuesday as the government unveiled a new bank-rescue plan and congressional action neared on a fresh round of fiscal stimulus for the wheezing U.S. economy.

That basically amounts to a reaction of last night’s speechification and presser and this morning’s announcement of thunderous boos. Fed Chair Ben Bernanke is speaking right now and that’s not really helping either. The investment/business community doesn’t think any of the largess from either the TARP or the Stimulus Plan are really going to do anything. Treasury Bond prices are dropping also. This additional snippet from Market Watch sums it up well.

“First, we’re going to require banking institutions to go through a carefully designed comprehensive stress test, to use the medical term. We want their balance sheets cleaner, and stronger. And we are going to help this process by providing a new program of capital support for those institutions which need it,” said Geithner.

Despite the forceful words, Geithner noted his office was still exploring options and details for an asset value program, with little answer on what to do about banks’ toxic assets.

That last paragraph is basically at the crux of the problem. The current administration is bringing no plan to the table to actually deal with the problem. Perhaps because Geithner was so instrumental in the original TARP, he’s just sticking with what already didn’t work rather than trying to think outside of the box. The market has lost around 3-4% already and there’s several more hours of trading to go. Hang on to your cookie jars kids, you’re going to need them as a stable replacement for your local bank.

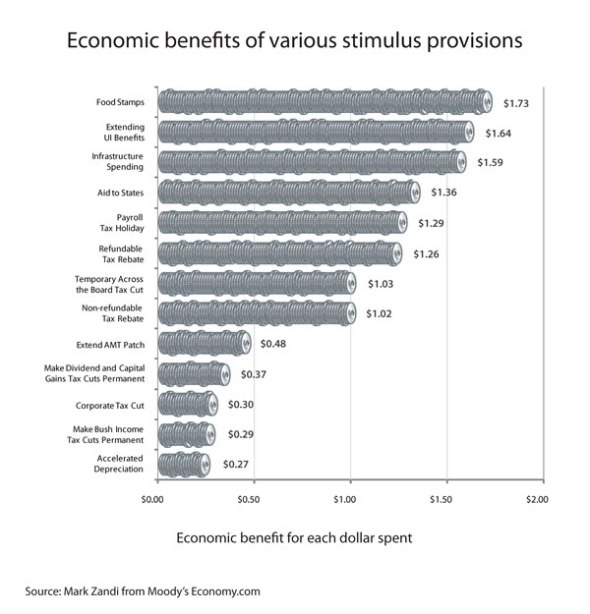

Meanwhile, the senate managed to pass that the stimulus bill 61-37. That’s way shy of the 80 votes that Obama had wanted. The final bill has $838 billion worth of stuff that includes a lot of tax cuts (not likely to stimulate anything but Grover Norquist and The Club for Growth) and money for cash strapped states. I’ve brought up links to the Economic Policy Institute earlier but I really like this graph that even my freshmen could grasp about what works and doesn’t work in stimulus plans.

You can see the difference between the items where you get more bang than a buck and less than a buck’s worth of bang while contributing to the deficit. Notice those tax cuts that wind up costing more than they stimulate and think the last eight years of Dubya of which we seem to be repeating.

You can see the difference between the items where you get more bang than a buck and less than a buck’s worth of bang while contributing to the deficit. Notice those tax cuts that wind up costing more than they stimulate and think the last eight years of Dubya of which we seem to be repeating.

Here’s one that I picked up from Brad DeLong’s Grasping Reality with Both Hands that had my Freshman gasping as I was trying to set their hair afire. (I think it worked, btw.) Any one facing this job market should panic. Just anecdotal, but in the market for finance professors, this year universities were taking resumes only at the last two conferences. Last year, the best people had been hired up before either of the conferences were held and only the marginal remained. The hottest academic jobs are definitely on hold. In my years of both public and private sector economisting, I’ve NEVER seen anything like this.

Please notice the incredible level of job losses. If you’ve managed to get through a calculus course, you’ll see that the first, second and third derivatives are negative which is not true on the other series at similar points. Basically, for you nonmath types, this indicates nothing but a downward trend or as I like to put it, straight off a cliff.

Please notice the incredible level of job losses. If you’ve managed to get through a calculus course, you’ll see that the first, second and third derivatives are negative which is not true on the other series at similar points. Basically, for you nonmath types, this indicates nothing but a downward trend or as I like to put it, straight off a cliff.

So, President Obama rambled an economics lecture last night that made me happy that he was getting all those economics briefings. It was also pretty obvious that most of his advisers must have their hair on fire too, because he did have a sense of edgy panic when he talked about the situation. However, ‘edgy panic’ is not what I want in a president. I want a president to talk about we have nothing to fear but fear itself who then says something to the effect of let’s do what works instead of bargaining away what will with folks that aren’t interested in watching you succeed.

I have to say, last night over Margaritas with my neighbors, I was searching for folks that wanted to diversify their food options with neighborhood gardening. I had a lot of takers. After all, when the army and your police force spend a good amount of time and money flying sleek black helicopters around the skies of your city practicing for food riots, it’s kind of one of those wake up moments. That goes for sleepy freshmen and drunk Cajuns. Is your hair on fire yet? Because if it isn’t, you haven’t been listening.

Meanwhile, I’m adding a page to my own blog for sharing sustainability and survival stories. Feel free to visit and contribute.

Recent Comments