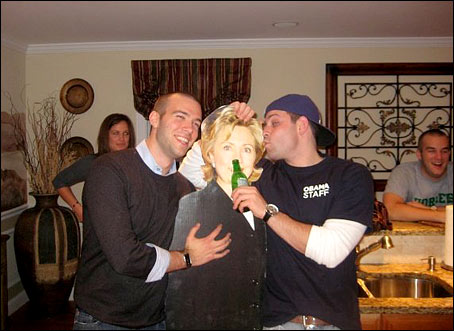

Does this offend you NOW?

Posted: December 6, 2008 Filed under: No Obama, president teleprompter jesus, Uncategorized, Women's Rights | Tags: Obama Chief Speech Writer Jon Favreau, Obama Speech writers 6 Comments Obama Chief Speech Writer Jon Favreau

in yet another one of those ‘innocent’ frat boy moments for Team Obama.

in yet another one of those ‘innocent’ frat boy moments for Team Obama.

What does it take to get men to understand that acting out rape fantasies is not funny? Swanspirit did a little photoshop with the offending facebook photo and I want you to play a little infinite regress … will it offend you now? Start putting the heads of your mothers, your daughters, and other women you know in the shot and ask yourself is this offensive?

Riverdaughter’s been on roll about this and I suggest you check it out.

update: Oh, jon’s a busy boy …

Does it offend you now?

UPDATE: oh, no, they struck again … and yet again!

Postscript: We think we’ve identified the entire Obama speech writing team:

Adam Frankel … kissy guy on the right

Sarah Hurwitz in the back left

Ben Rhodes in the back right

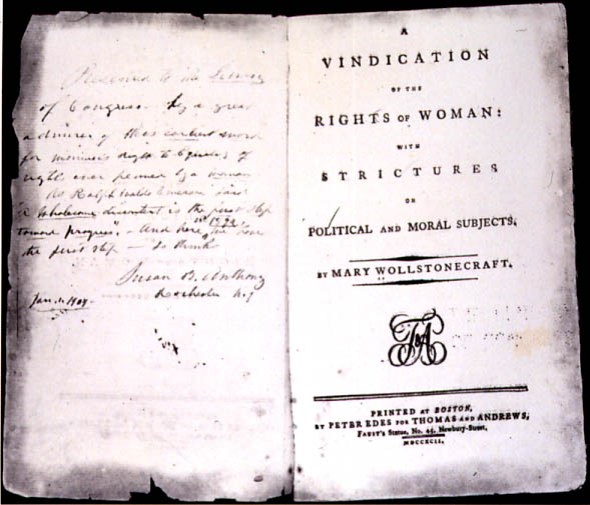

Another Straw Man Down

Posted: December 4, 2008 Filed under: Uncategorized | Tags: abortion, abortion rights, and depression, mega study on women, no evidence of depression after abortions. 2 Comments Any one who has dealt with anti-choice zealots knows they will say and do anything to stop a woman from exercising her right to terminate pregnancies. This includes the use of a number of number of pseudoscientific studies that supposedly justify what is essentially their narrow religious viewpoints with facts and the scientific method. Today, one more scientific study has shown yet another religious right talking point on abortion supposedly backed by scientific study is just that, a talking point, with no basis in fact. It’s time for women’s rights advocates to get this information out so we reframe this in terms of science and not patriarchal religious tomes.

Any one who has dealt with anti-choice zealots knows they will say and do anything to stop a woman from exercising her right to terminate pregnancies. This includes the use of a number of number of pseudoscientific studies that supposedly justify what is essentially their narrow religious viewpoints with facts and the scientific method. Today, one more scientific study has shown yet another religious right talking point on abortion supposedly backed by scientific study is just that, a talking point, with no basis in fact. It’s time for women’s rights advocates to get this information out so we reframe this in terms of science and not patriarchal religious tomes.

Abortion not seen linked with depression

Review of studies found no evidence of emotional harm after procedure

Where’s the Lone Ranger when you need him?

Posted: November 22, 2008 Filed under: Uncategorized Comments Off on Where’s the Lone Ranger when you need him?We have not entered uncharted territory in the economy yet. I suppose that should be reassuring in a world where uncertainty seems to rule the day. The deal is this, while economists have charted the territory, we’ve never be in the position of stopping so many things from heading that direction. That is what is worrying me right now. That is also why I am relieved that among the advisers the next president has picked is Hillary Clinton and some very good economists. I’m not sure how much good this is going to do because I still am not sure if President Elect Barrack Obama is going to be up to the task, but I think that the measure of how huge of task lies ahead of him might be sinking in. I think there’s a realization that he’s going to need a lot of help. That in itself says something. After a few inklings of Pritzker for Commerce Secretary or Larry Summers for a repeat performance as Treasury, President Obama changed direction. To me, that was a good thing.

I keep looking at the volatility in the market, the problems that face the dollar as the world’s currency, the collapse of GM, and the challenges that face us globally, and I’m glad Hillary is there at the table. I’m glad some of the best bureaucrats that came up in the Clinton Administration will be there too. I may not like Barrack Obama, but I certainly do not want him to fail. If he is smart enough to realize that what is going on is far bigger than anything he is prepared to handle, than that is good first step to regaining some solid ground.

There is realization that the Fed can no longer wonk the economy into a stable state. Its primary tools are the dollar and interest rates. Interest rates are so low they have lost their ability to translate stimulus into the part of the economy where jobs are created and food is bought. The dollar is facing its own set of challenges. Due to the enabling of export economies like Saudi Arabia, Japan, and China, the United States has been able to avoid tax increases, support growing wealth among its richest citizens, and preserve the dollar as the international currency. This has been true since the Reagan years. Countries like these have given us money so we can turn around and buy their products. They have basically agreed to lower living standards in their countries so that they could hook into the benefits of a stable US economy with its safe financial system and lack of financial dramas. This is no longer the case.

There has been a huge accumulation of dollars in these countries. There has also been a huge foreign investment in the Treasury bills and bonds that have funded two wars (with no tax increases) as well created an extremely well-paid financial sector. Meanwhile, we’ve agreed to seeing manufacturing jobs transferred abroad while replacing those jobs with low-paying service jobs. We do not have a free market or a free trade system with floating currencies (even though they like to tell us we do). We have a bunch of countries holding informal agreements to rules that have sustained us for maybe 20 years. The US has huge trade deficits while they fund our budget deficits. The export countries accept a low standard of living so they can grow the countries with exports using the drama-free dollar.

Is this situation on the verge of a game change? I think it is. Who better to work these issues out than Hillary Clinton and a team of first rate economists. If we have to endure fireside chats with Obama to get the Treasury and the State department out there ahead of this disaster, than I say, fine … I’ll just change the channel and hope she gets the job done. Meanwhile Richardson can negotiate the next industry looking for a hand out. That’s going to be the real dirty job. What a great person to get the blame for the next taxpayer’s check to a Corporate Welfare Queen.

Meanwhile, I’m glad to see the appointment of Tim Geithner at Treasury. As the president of the NY Fed, he’s already been a part of the team carrying out monetary policy and the Wall Street Rescue and is already on the ground running. He’s worked in the gut operations of both the IMF and the Treasury. From folks that know him, I hear that he’s not a person that ever feels the need to prove himself and is a person that does not make judgements until he understands the situation.

It’s a grim situation out there in both the equity and the credit markets. Last week, we broke thru two ‘psychological’ levels in the markets. The situation with the S&P 500 is beyond troublesome. Many of these stocks are so cheap now that institutional traders will no longer be allowed to hold them in portfolios. They’ll be forced to sell. We’re seeing the lowest treasury yields ever. There’s not just a flight to quality, there’s a stampede. I’m glad to see the main team for the next administration on deck. What we need now is both the Bush and the Obama administration to work together and show some leadership and announce some joint policies as well as folks that will work to transition together. Obama cannot afford to sit in Chicago and look pensive nor can Bush sit in Crawford and look any more lame.

This is getting more serious by the day. I’ve been avoiding the “d” word because I know we know what it takes to fend that off. I just need to see movement by the folks in charge right now that shows they know it too. We do need some major stimulus and the two camps better sit down and get it started right now.

Slowing the Downward Slide

Posted: November 14, 2008 Filed under: U.S. Economy, Uncategorized | Tags: policy, recession, stimulus, tax cuts Comments Off on Slowing the Downward SlideI’d like to focus on some potential policies that could see us through this difficult economy. It should be apparent that we’re in for a period of time where uncertainty will cause a lot of stress in the financial markets. The uncertainty has bled into the ‘real’ economy where we’re seeing increasingly higher levels of unemployment and distress in industries outside the banking world. If you haven’t noticed, the Fed has been actively working on this for some time. It’s major tools indirectly impact the real economy by influencing the credit markets and the availability of loans. It’s pretty straight forward actually, in a normal economy, low interest rates would cause banks to lend to more businesses and households and this would stimulate the economy out of a recession. The problem right now is that losses from loans are creating such problems for bank profitability, banks are holding the money. We have extremely low interest rates right now. This is a situation that we saw in Japan during the 1990s. It took a decade for the Japanese economy to snap out of it. The Fed’s rate to banks is 1% right now. It is cheap for them, and now many other financial institutions to borrow from the Fed. There is still some constipation, if you will, in the banking system. What is worse, some of the money sent to these banks that has gone to healthy banks is going into buying other banks. None of this will help stimulate the economy. So how do we avoid Japan’s stagnant decade?

If you know me, you know I do not favor bailing out the automobile industry. We have a system to help corporations rearrange their obligations and make themselves more able to carry on in the future. It is called bankruptcy. We’ve watched the airline industry go into the bankruptcy process and come out as healthier companies. Usually, all contracts between debtors and the companies are either renegotiated or foregiven. The stockholders lose their stake. The Unions will have to scale back on their contracts. This will all happen in a very structured manner and all will have to sacrifice for the companies to survive. I’m afraid that if we do not force them into this circumstance that we will find that we lend them money, only to have them pay creditors at the same losing level with the same bad managers. The folks we could spend the money on would be the folks that do lose their jobs. We can provide them with extended unemployment insurance and with job retraining. We’ve seen the Treasury’s deal with bank result in outcomes we did not want: no credit going to main street, bonuses and dividends still in tact, and buy-outs. We do not need to repeat this mistake.

Do we need another stimulus package or do we need tax cuts? If so, who should be the focus? Short term tax stimulus is probably in order. However, if we spend all of this money, we will grow the deficit. Growing the deficit is not a bad thing during recessions, however, we already are running a huge deficit and it’s getting bigger because of two wars and the Bush tax cuts. If we continually push 10 year bonds out to the market, there will be a point where the big money (mostly soveign wealth funds) will begin to balk. Rates could go up which means that we could spend a huge amount of money just servicing the debt. Any stimulus should be short-lived and should focus on the middle and working class. Tax increases, even on the wealthy and on corporations, should be avoided for several years. The adminstration will have to scale back on its offerings of new benefits and programs. I don’t think we’ll see work on the health care system right now because other things will take priority.

There are two areas where new spending should be encouraged. These are energy independence and infrastructure rebuilding. This does not mean building new bridges to nowhere, but fixing our aging infrastructure. This expenditures will create future economic growth and can provide jobs during the recession. Grants to states for specific purposes can be used so that states with the biggest problems can get the highest priority. There are challenges to this, however. The biggest problem with major programs like this is getting them to move out of congress and committees. This can take so much time that the projects may never have an impact. Since the Democrats have strong majorities in both houses, they should be able to usher through these types of programs. These need to be expedited. The one big thing I worry about here is that they will not focus on what is best, but will focus on enriching groups that supported election winners. Projects providing jobs that focus on building our future potential would be a lot better use of funds than just giving folks extended unemployment benefits. Hillary Clinton’s green jobs program and McCain’s cap and trade system to reduce green house gases are both good programs. Jobs could include retrofitting existing houses to be more energy efficient. The focus needs to be on the underlying capital that leads to future growth so that even if some of them are slow to develop, there will be economic development.

The focus during the rest of this year and into the next will undoubtedly be dealing with the ongoing slow- down in the economy. We will soon see if we will get real change or just a bigger deficit with spending that accomplishes little. I’m worried about the quality of the spending, because as I said, most of our debt is financed by the international community. There are many other places to park their wealth. If they pull it, U.S. citizens will not be able to come up with the difference without getting use to much higher taxes.

down in the economy. We will soon see if we will get real change or just a bigger deficit with spending that accomplishes little. I’m worried about the quality of the spending, because as I said, most of our debt is financed by the international community. There are many other places to park their wealth. If they pull it, U.S. citizens will not be able to come up with the difference without getting use to much higher taxes.

It’s one of those rare things in New Orleans. It snowed like crazy this morning and I essentially had a blizzard vacation today. My campus had about 7 inches of snow and the power went off in Hammond. Down here in NOLA, there were these big huge wet flakes that dropped for several hours. They iced up my hibiscus, my bananas, my avocado tree, and the roads. My 12 year old lab-mix Karma was a pain to try to walk today because she’s not used to snow. Actually, she wouldn’t walk at all. She just stood there wondering why the sky was falling.

It’s one of those rare things in New Orleans. It snowed like crazy this morning and I essentially had a blizzard vacation today. My campus had about 7 inches of snow and the power went off in Hammond. Down here in NOLA, there were these big huge wet flakes that dropped for several hours. They iced up my hibiscus, my bananas, my avocado tree, and the roads. My 12 year old lab-mix Karma was a pain to try to walk today because she’s not used to snow. Actually, she wouldn’t walk at all. She just stood there wondering why the sky was falling. This guy may have been a close associate of Obama, Rezko, Axelrod, and Emmanuel (and basically all part of the Daley Machine) but I’m thinking the press will be shy to admit they were wrong and could reconsider their fluffing for Obama during the entire election and now. Also, I can’t imagine any savvy pol that was not careful about what they said to Governor Number 1 when they spoke to him because it was well known the FBI were after evidence for years. If Blagovich just refuses to go any where and continues to stay on the front page, will it help or hurt Obama? Does it detract from all the problems confronting him or add to them?

This guy may have been a close associate of Obama, Rezko, Axelrod, and Emmanuel (and basically all part of the Daley Machine) but I’m thinking the press will be shy to admit they were wrong and could reconsider their fluffing for Obama during the entire election and now. Also, I can’t imagine any savvy pol that was not careful about what they said to Governor Number 1 when they spoke to him because it was well known the FBI were after evidence for years. If Blagovich just refuses to go any where and continues to stay on the front page, will it help or hurt Obama? Does it detract from all the problems confronting him or add to them?

Recent Comments