Posted: July 11, 2011 | Author: bostonboomer | Filed under: income inequality, jobs, Medicare, Psychopaths in charge, Republican politics, Social Security, the villagers, U.S. Economy, U.S. Politics, voodoo economics | Tags: Barack Obama, Federal debt ceiling, jobs, John Boehner, lying liars, medicare, Social Security, taxes |

President Obama at his press conference this morning, responding to a question by Ben Feller of the Associated Press (emphasis added):

Q Thank you very much, Mr. President. Two quick topics. Given that you’re running out of time, can you explain what is your plan for where these talks go if Republicans continue to oppose any tax increases, as they’ve adamantly said that they will? And secondly, on your point about no short-term stopgap measure, if it came down to that and Congress went that route, I know you’re opposed to it but would you veto it?

THE PRESIDENT: I will not sign a 30-day or a 60-day or a 90-day extension. That is just not an acceptable approach. And if we think it’s going to be hard — if we think it’s hard now, imagine how these guys are going to be thinking six months from now in the middle of election season where they’re all up. It’s not going to get easier. It’s going to get harder. So we might as well do it now — pull off the Band-Aid; eat our peas. (Laughter.) Now is the time to do it. If not now, when?

We keep on talking about this stuff and we have these high-minded pronouncements about how we’ve got to get control of the deficit and how we owe it to our children and our grandchildren. Well, let’s step up. Let’s do it. I’m prepared to do it. I’m prepared to take on significant heat from my party to get something done. And I expect the other side should be willing to do the same thing — if they mean what they say that this is important.

That’s pretty insulting. We’re not children after all. I guess the President was aiming his remarks at Congress, but really we serfs are the ones who will have to face the pain of these decisions aren’t we? That’s the real issue here.

President Obama has made some kind of proposal to the Republicans and hasn’t shared the details with us or with his fellow Democrats, as far as I know. All we know for sure is that two programs that we pay for with a separate revenue stream are on the table–Social Security and Medicare. Well, as of today, we know a little more. Sam Stein reports that Obama offered to raise the Medicare eligibility age to 67.

According to five separate sources with knowledge of negotiations — including both Republicans and Democrats — the president offered an increase in the eligibility age for Medicare, from 65 to 67, in exchange for Republican movement on increasing tax revenues.

The proposal, as discussed, would not go into effect immediately, but rather would be implemented down the road (likely in 2013). The age at which people would be eligible for Medicare benefits would be raised incrementally, not in one fell swoop.

Sources offered varied accounts regarding the seriousness with which the president had discussed raising the Medicare eligibility age. As the White House is fond of saying, nothing is agreed to until everything is agreed to. And with Republicans having turned down a “grand” deal on the debt ceiling — which would have included $3 trillion in spending cuts, including entitlement reforms, in exchange for up to $1 trillion in revenues — it is unclear whether the proposal remains alive.

Social Security and Medicare are vital programs that no one should be talking about cutting, especially now when unemployment is at levels not seen in this country since the Great Depression. Furthermore, we pay into these programs with our hard-earned money–they are not “entitlements.” But that’s mostly what we’re hearing about from the President and his Republican buddies–they are just drooling over the prospect of slashing the social safety net.

This isn’t a joking matter, Mr. Obama. Show a little respect for the people who pay your salary. Actually, one group liked the President’s remark about eating our peas, The Peat and Lentil Council.

A spokesman for the pea council said it wasn’t interpreting the remarks in a negative context.

“We take President Obama’s comment on the need to ‘eat our peas’ as a reference to the first lady’s push to get all Americans to eat a more healthy diet as part of the Let’s Move campaign,” Pete Klaiber, the council’s director of marketing.

“We know that if tasty and nutritious meals featuring peas are served more frequently in the White House and in the cafeterias of both Houses of Congress, it will contribute to a balanced diet, if not a balanced budget.”

Klaiber added, “Eating more lentils couldn’t hurt, either.”

If the President is really serious about “sharing the pain,” perhaps he should tell the White House chef to serve split pea soup and lentil loaf at his next dinner party.

Now to House Speaker John Boehner’s remarks.

Read the rest of this entry »

Did you like this post? Please share it with your friends:

Posted: July 10, 2011 | Author: bostonboomer | Filed under: Corporate Crime, Economy, Psychopaths in charge, Republican politics, the villagers, U.S. Economy, U.S. Politics | Tags: AQR Capital, Barack Obama, Bistro Bis, Brad De Long, Clifford Asness, Elizabeth Fama, Eugene Fama, freshwater economists, Goldman Sachs, hedge fund managers, Jayer-Gilles 2004 Echezeaux Grand Cru, John Cochrane, Paul Krugman, Paul Ryan, Susan Feinberg, Talking Points Memo, University of Chicago, wine |

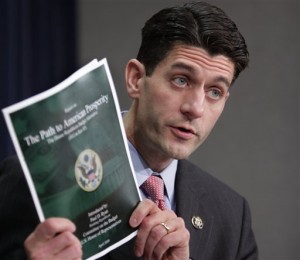

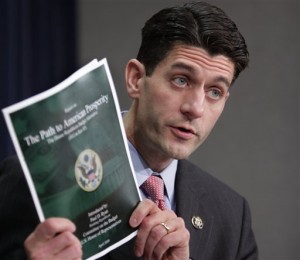

Paul Ryan hawking his plan to throw grandma from the train

You may have seen this gossipy story about Rep. Paul Ryan at Talking Points Memo on Friday. I’ve been meaning to post something about it but just haven’t found the time. Now TPM has a very interesting update. Here’s the background:

Rep. Paul Ryan (R-WI), a leading advocate of shrinking entitlement spending and the architect of the plan to privatize Medicare, spent Wednesday evening sipping $350 wine with two like-minded conservative economists at the swanky Capitol Hill eatery Bistro Bis.

[….]

Susan Feinberg, an associate business professor at Rutgers, was at Bistro Bis celebrating her birthday with her husband that night. When she saw the label on the bottle of Jayer-Gilles 2004 Echezeaux Grand Cru Ryan’s table had ordered, she quickly looked it up on the wine list and saw that it sold for an eye-popping $350, the most expensive wine in the house along with one other with the same pricetag.

Feinberg, an economist by training, was even more appalled when the table ordered a second bottle. She quickly did the math and figured out that the $700 in wine the trio consumed over the course of 90 minutes amounted to more than the entire weekly income of a couple making minimum wage.

Feinberg took some photos with her cell phone, approached the table and asked whether the two men with Ryan were lobbyists. One of the men responded by saying, “F&ck her.” Ryan claimed the two men were economists but refused to provide their names. Ryan then paid for one of the bottles of wine, but when asked about the appropriateness of spending so much when he was going all Dickensian on old people, Ryan avoided answering.

Today, TPM learned the identity of the two men who wined and dined Ryan on Friday night.

TPM has confirmed that the two other men with Ryan were Cliff Asness and John Cochrane. Both men have doctorate degrees in economics and are well-known in the conservative media world as die-hard proponents of the free market’s ability to right itself without government bailouts when the crisis hit in late 2008.

Asness, who ordered the wine and who, according to Feinberg was the one who said “Fuck her,” is better known as a high-profile hedge fund manager. Asness founded and runs AQR Capital, which manages an estimated $26 billion in a variety of traditional products and hedge funds, and his life story has been the subject of numerous books and articles about the rise and fall of Wall Street. He’s also grabbed headlines for being one of the most voluble opponents of President Obama’s economic policies.

[….]

Cochrane, the other, more tempered dinner companion, is the AQR Capital Management Distinguished Service Professor of Finance at the University of Chicago, an apparent tip of the hat to the contributions Asness’ AQR Capital Management has made to the Booth School of Business there.

Before launching AQR Capital in 1997, Asness worked for Goldman Sachs, the most profitable securities firm in Wall Street history, as the director of quantitative research for its Asset Management Division.

Via TPM, in 2009, Asness wrote an open letter to Barack Obama in which he (Asness) complained bitterly about some mildly critical remarks the President had made about hedge fund managers who refused to help out by buying Chrysler bonds. From New York Magazine:

Clifford Asness, the filthy-stinking-rich quant behind AQR Capital Management, [is] publicly engaging with a formidable opponent: The president of the United States. Asness, who supported Obama during the election, was appalled by Obama’s treatment of his colleagues during the Chrysler situation, and although he was not personally involved, he felt he had to make a stand.

Here is a portion of the letter:

Here’s a shock. When hedge funds, pension funds, mutual funds, and individuals, including very sweet grandmothers, lend their money they expect to get it back. However, they know, or should know, they take the risk of not being paid back. But if such a bad event happens it usually does not result in a complete loss. A firm in bankruptcy still has assets. It’s not always a pretty process. Bankruptcy court is about figuring out how to most fairly divvy up the remaining assets based on who is owed what and whose contracts come first. The process already has built-in partial protections for employees and pensions, and can set lenders’ contracts aside in order to help the company survive, all of which are the rules of the game lenders know before they lend. But, without this recovery process nobody would lend to risky borrowers. Essentially, lenders accept less than shareholders (means bonds return less than stocks) in good times only because they get more than shareholders in bad times.

The above is how it works in America, or how it’s supposed to work. The President and his team sought to avoid having Chrysler go through this process, proposing their own plan for re-organizing the company and partially paying off Chrysler’s creditors. Some bond holders thought this plan unfair. Specifically, they thought it unfairly favored the United Auto Workers, and unfairly paid bondholders less than they would get in bankruptcy court. So, they said no to the plan and decided, as is their right, to take their chances in the bankruptcy process. But, as his quotes above show, the President thought they were being unpatriotic or worse.

Well, Duh! But if “filthy, stinking rich” guys like Asness were patriotic, we probably wouldn’t have had a financial meltdown in the first place, now would we?

The other guy with Ryan on Friday, Professor John Cochrane of the University of Chicago, is a freshwater economist and follower of Eugene Fama AKA “the father of modern finance,” and Robert R. McCormick Distinguished Service Professor of Finance a the University of Chicago. Cochrane is also married to Fama’s daughter Elizabeth.

In early 2009, Cochane and Nobel Prize-winning economist Paul Krugman engaged in a legendary on-line debate that also involved Brad De Long and Eugene Fama. The whole thing was too wonky for me, but I gather it had something to do with Fama and Cochrane critiquing the use of fiscal stimulus and Krugman saying that the two freshwater economists wanted to return to the “Dark Ages of macroeconomics.” Here’s Krugman’s introductory paragraph:

Brad DeLong is upset about the stuff coming out of Chicago these days — and understandably so. First Eugene Fama, now John Cochrane, have made the claim that debt-financed government spending necessarily crowds out an equal amount of private spending, even if the economy is depressed — and they claim this not as an empirical result, not as the prediction of some model, but as the ineluctable implication of an accounting identity.

Maybe Daknikat can explain what the “cage match” was all about.

I think Paul Ryan is going to need to be a little more careful in the future if he is going to continue promoting the end of Medicare as we know it.

Did you like this post? Please share it with your friends:

Posted: July 8, 2011 | Author: bostonboomer | Filed under: 2012 presidential campaign, Barack Obama, Democratic Politics, Economy, Psychopaths in charge, Surreality, Team Obama, the villagers, U.S. Economy, U.S. Politics, unemployment, voodoo economics, We are so F'd | Tags: Andy Taylor, Barack Obama, Barney Fife, David Plouffe, Debt Ceiling, deficit, economy, Gomer Pyle, jobs, Social Security, stupid villiagers, Tim Geithner, unemployment, voodoo economics, William Daley |

Barack O'Gomer and Deputy "Barney" Geithner*

This morning Sky Dancing’s resident economist Dakinikat wrote about Tim Geithner’s latest trial balloon about maybe stopping Social Security checks in August if Congress refuses to raise the debt ceiling. That’s right, he wants to use the trust fund that elderly people paid into all their working lives to pay China and other foreign debtors. Now that’s a brilliant plan boys–throw grandma and grandpa out in the streets to starve and die. It’s genius!

Then while we were all commiserating in the comment thread, we got the jobs report for June: only 18,000 jobs were added, and the phonied-up unemployment rate is now at 9.2%.

O’Gomer dragged his sorry a$$ out to the Rose Garden in late this morning to mumble a few weak excuses.

“Today’s job report confirms what most Americans already know,” Obama said. “We still have a long way to go and a lot of work to do to give people the security and opportunity that they deserve.”

The president tried to lay some blame at Congress’ feet. He said lawmakers could pass a handful of policies today to create jobs. His list included an infrastructure bank, free trade deals and patent reform.

“There are bills and trade agreements before Congress right now that could get all these ideas moving,” he said. “All of them have bipartisan support, all of them could pass immediately, and I encourage Congress not to wait.”

Yeah, patent reform, that’s the ticket! And more trade agreements to create more outsourcing of American jobs. Brilliant! And cutting off Social Security checks! That’s really gonna give Americans “the security and opportunity they deserve.” Who is advising this guy anyway?

Well, one of O’Gomer’s top advisers, David Plouffe, made an unfortunate remark before the jobs report came out. Minkoff Minx wrote about it in her SDB reads earlier this evening. From The Christian Science Monitor:

David Plouffe, Mr. Obama’s top political adviser, got things started Thursday at a breakfast sponsored by Bloomberg News.

“The average American does not view the economy through the prism of GDP or unemployment rates or even monthly jobs numbers,” Mr. Plouffe said. “People won’t vote based on the unemployment rate; they’re going to vote based on: ‘How do I feel about my own situation? Do I believe the president makes decisions based on me and my family?’ ”

Ask yourself, Mr. Plouffe, how do you think most ordinary Americans feels about their situation right about now? O’Gomer’s buddy Timmy Geithner is talking about cutting off Social Security payments. O’Gomer himself is trying to talk the Republicans into cutting Social Security, Medicare, and Medicaid. This administration hasn’t done diddly-squat about jobs except occasionally have O’Gomer mention that we need to create them. Talk is cheap, Mr. Plouffe. Actions speak louder than words as my mom used say.

According to Julian Brookes at Rolling Stone, Plouffe also made this odd assessment:

the president, says Plouffe, has a good shot with independent voters, who’ll reward his bipartisan, bend-over-backwards approach the debt talks; is a seasoned campaigner with a huge war chest; has moved to the center without losing the base (the oft-noted “enthusiasm gap” seems to have closed); and has demographic trends working in his favor (he won big with minorities in 08, and they’ll make up a larger share of the electorate next year). Plus, of course, the GOP field is weak: Frontrunner Mitt Romney is the most formidable of the bunch, but he’s nobody’s idea of a galvanizing standard bearer.

What is wrong with this guy? Does he really believe that Independents like politicians who “bend over backwards” instead of showing some strength? Does he really believe O’Gomer hasn’t lost his base? And the center? O’Gomer has gone so far right he’s out-crazying the Tea Party!

Then there’s William M. Daley, the White House chief of staff. Check out what he recently had to say about Americans’ attitudes about the crappy economy. According to Peter Nicholas at the LA Times, O’Gomer’s main defense is that the middle class was already suffering under Bush, so it’s not really his fault. Never mind that unemployment has gone from 7.8% to 9.2% on his watch. So O’Gomer is asking for more time:

Speaking at a fundraising dinner in Philadelphia last week, he said that the nation’s challenges “weren’t a year in the making or two years in the making, but are actually 10 years in the making.”

But Obama’s nuanced message isn’t breaking through. A Gallup Poll last month showed that Americans’ economic confidence was near its low for the year.

For the White House, it’s tough to get the public to pay attention to anything else.

A Democratic senator spoke by phone recently with White House Chief of Staff William M. Daley. “He said, ‘Honest to goodness, if we’re not talking about jobs and the economy, nobody is listening,’” recalled the senator.

Surprise, surprise, surprise!!

Gee, do you think maybe you ought to stop talking and actually DO something then? Just wait until Grandma finds out she might not get her Social Security check in August. Maybe O’Gomer and his advisers need to get a clue. And find O’Gomer a couple of advisers who know something about economics, Mr. Daley.

*NOTE: The graphic at the top of this post is the work of our old friend StateOfDisbelief.

Did you like this post? Please share it with your friends:

Posted: July 8, 2011 | Author: dakinikat | Filed under: John Birch Society in Charge, Psychopaths in charge, The Media SUCKS, We are so F'd | Tags: betting against America, Eric Canttor, hedge funds, TPS |

Just about the time I think I’ve seen about the worst of the worst coming out of the US congress, another Congressman finds a new bottom. The WSJ has reported that House Majority Whip Eric Cantor stands to gain financially from a U.S. default on the debt ceiling . (Basically, he’s shorted Treasuries). That’s something Cantor seems hellbent on happening. Congressman Cantor has made bets against US Treasury bonds that stand to pay if he can make it happen. Unfugginbelievable!

Just about the time I think I’ve seen about the worst of the worst coming out of the US congress, another Congressman finds a new bottom. The WSJ has reported that House Majority Whip Eric Cantor stands to gain financially from a U.S. default on the debt ceiling . (Basically, he’s shorted Treasuries). That’s something Cantor seems hellbent on happening. Congressman Cantor has made bets against US Treasury bonds that stand to pay if he can make it happen. Unfugginbelievable!

Putting his money where his mouth is? Eric Cantor, the Republican Whip in the House of Representatives, bought up to $15,000 in shares of ProShares Trust Ultrashort 20+ Year Treasury ETF last December, according to his 2009 financial disclosure statement. The exchange-traded fund takes a short position in long-dated government bonds. In effect, it is a bet against U.S. government bonds—and perhaps on inflation in the future.

Salon‘s Jonathan Easley looked into the potential financial windfall for Cantor right after Cantor shut down talks with Biden and other Democrats on the budget and the debt ceiling. Cantor is the House Majority Leader so he plays an important role in getting the majority to vote for any potential deal. Even if a deal can be reached, Cantor could stall it and make money.

Unless an agreement can be reached, the U.S. could begin defaulting on its debt payments on Aug. 2. If that happens and Cantor is still invested in the fund, the value of his holdings would skyrocket.

“If the debt ceiling isn’t raised, investors would start fleeing U.S. Treasuries,” said Matt Koppenheffer, who writes for the investment website the Motley Fool. “Yields would rise, prices would fall, and the Proshares ETF should do very well. It would spike.”

The fund hasn’t significantly spiked yet because many investors believe Congress will eventually raise the debt ceiling. However, since Cantor abruptly called off debt ceiling negotiations last Thursday, the fund is up 3.3 percent. Even if an agreement is ultimately reached before Aug. 2, the fund could continue to benefit between now and then from the uncertainty. (One tactic some speculators are using is to “trade the debt ceiling debate” — that is, to place short-term bets on prices as they fluctuate with the news out of Washington.)

A Completely Unofficial Blog About Eric Cantor has more information on the disclosure statements filed by Cantor that indicates he has taken multiple positions against the U.S. Government. Besides buying into a vanilla mutual fund, Cantor specifically went after investments that would pay if U.S. Government finances were troubled.

Picking individual financial products is more trouble than buying mutual funds. When Eric Cantor took the trouble to pick individual investments, he chose the following:

$1-15,000 ProShares Trust Ultrashort 20+ Year Treasury ETF (TBT)

$1-15,000 iShares Barclays TIPS Bond Fund (TIPS)

$1-15,000 WisdomTree International Basic Materials (DBN)

$1-15,000 SPDR SP Metals Mining (XME)

So yeah, that acronym TIPS ring a bell? It should if you read Paul Krugman..

TIPS, as I read it is basically the interest difference between nominal U.S. Bonds and Treasury Inflation-Protected Securities.

Eric Cantor’s bet on the iShares Barclay’s TIPS Bond Fund is ANOTHER bet that U.S. Treasury Bonds will lose value (relative to inflation). That story from last year is actually twice as bad as it sounds.

There are huge implications here:

1. When Eric Cantor had a spare $2,000 to $30,000 laying around, he didn’t just go and buy some extra shares of Exxon or FOX stock or gold or whatever average wingnuts buy, he actively sought out a way to bet that U.S. Treasury Bonds would decline in value. He literally bet against America.

2. Eric Cantor is in the Republican leadership, and has been making open threats that he may push the United States toward defaulting on their bond obligations. If he does this, he has set himself up to profit from it. This is a really big conflict of interest.

You can learn more about how this deal works at Seeking Alpha. Hedging and speculating with these kinds of funds is not exactly a beginning investor operation.

PoliticusUSA draws the logical conclusion.

Cantor has a history of betting against America. The difference is that in 2011, he now has the power make sure that his bets pay off.

Conflict of interest, abuse of power, it doesn’t matter what you call it. Eric Cantor’s desire to make a profit based on the pain and misery of very people that he has taken an oath to represent is just plain wrong.

Eric Cantor is the Republican House leader who can’t wait to see America fail.

In fact, he’s counting on it.

Your financial destruction will be Eric Cantor’s gain.

I guess this is what Republicans mean when they refer to one of their own as a “Real American.”

So, while the country was obsessed with sexted pictures of Anthony Wiener’s junk, Eric Cantor was putting the country in the position where could make money and the rest of us could suffer. Who has the real ethics problem here?

Update: From Amanda Terkel at HuffPo

House Democrats are circulating a resolution accusing House Majority Leader Eric Cantor (R-Va.) of having a conflict of interest in the debt ceiling debate, a move that could provide an awkward C-SPAN moment for one of the lead Republicans in the budget negotiations.

The resolution goes after Cantor’s investment in ProShares Trust Ultrashort 20+ Year Treasury ETF, a fund that “takes a short position in long-dated government bonds.”

The fund is essentially a bet against U.S. government bonds. If the debt ceiling is not raised and the United States defaults on its debts, the value of Cantor’s fund would likely increase.

The Democratic resolution, obtained by The Huffington Post from a Democratic source on the Hill, argues that Cantor “stands to profit from U.S. treasury default, which thereby raises the appearance of a conflict of interest,” and that he “may be sabotaging [debt ceiling] negotiations for his own personal gain.” It’s not clear how widely the measure was being circulated, with a House Democratic aide saying they hadn’t seen the resolution or heard it being discussed.

“Majority Leader Cantor has compromised the dignity and integrity of the Members of the House by raising the appearance of a conflict of interest in negotiations with the executive branch over raising the debt ceiling,” adds the measure.

Did you like this post? Please share it with your friends:

Posted: July 7, 2011 | Author: dakinikat | Filed under: Barack Obama, Catfood Commission, Democratic Politics, Economy, Federal Budget, Federal Budget and Budget deficit, Global Financial Crisis, John Birch Society in Charge, legislation, Psychopaths in charge, Surreality, The Great Recession, U.S. Economy, voodoo economics | Tags: 14th amendment, austerity, Chuck Schumer, Debt ceiling negotiations, Federal Deficit, Medicaid, medicare, Social Security, voodoo economics |

So, you know me. I’m out looking for exactly how bad this debt ‘deal’ is going to austere our economy in to the Great Recession Redux. BostonBoomer has been writing about President Hornswoggle putting Medicare, Medicaid, and Social Security–not even part of the federal budget–on the table. I’ve searched and searched and can’t find the details on the great American Give Away other than a few articles showing a beaming Boehner saying we’re at a 50-50 chance of reaching a deal now. If Boehner is beaming, all but the richest among us should be holding on to our personal liberties and wallets.

So, you know me. I’m out looking for exactly how bad this debt ‘deal’ is going to austere our economy in to the Great Recession Redux. BostonBoomer has been writing about President Hornswoggle putting Medicare, Medicaid, and Social Security–not even part of the federal budget–on the table. I’ve searched and searched and can’t find the details on the great American Give Away other than a few articles showing a beaming Boehner saying we’re at a 50-50 chance of reaching a deal now. If Boehner is beaming, all but the richest among us should be holding on to our personal liberties and wallets.

We know that the President has caved on a bunch of things during both the HRC negotiations and the extension of the Dubya Tax Breaks for Billionaires pogrom. However, the Democratic leadership was aware of this, grumbled some, and backed his usurpation of responsibility for our future. Imagine my surprise when I watched Chuck Schumer on Andrea Mitchell say that he had no idea about the details of the current deal so he couldn’t really comment on it. The most noticeable detail was his face that said “I’ve got a sick tummy, mommy”. Senator Schumer is on the Senate Committee on Finance that handles all of these things and is supposedly a key person on the budget deal. You would think he would know. But, he doesn’t and neither does any other Democratic Senator or Congressman. It appears the press told them what Obama was handing over to the Republicans.

Senate Democrats reacted angrily Thursday to a report that President Obama has proposed significant cuts to Medicare and Social Security in closed-door talks with GOP leaders.

Democratic lawmakers said they were dismayed to read about Obama’s offer in the press rather than hearing it from the president himself. Their frustration is exacerbated by Obama’s snub of their invitation to speak to the Senate Democratic caucus Wednesday.

Instead, Obama is meeting with Democratic and Republican leaders from both chambers Thursday morning.

“We would have preferred to hear it from the president instead of from the press,” said Sen. Barbara Mikulski (Md.), a senior member of the Senate Democratic conference. “We first have to go after tax earmarks.”

Mikulski said cuts to Medicare and Social Security should be a solution of last resort. She said closing tax loopholes and pulling back from Libya should be considered before entitlement cuts.

She said Obama should not assume Democratic support for a deficit reduction plan that cuts entitlements.

I now fully expect President Cave-in to hand the keys to the nation over to a bunch of punch-drunk Republicans. What I don’t get is why the Democratic members of Congress continue to let him get away with it. They are the very face of “sound and fury signifying nothing”. Let me ask you if you’d want to be a congress member from some solid Democratic district facing re-election by having to defend a Democratic President that’s happy to cut Medicare and Social Security? Social Security doesn’t even need to be on the table. He’s just offered it up for some reason that I can’t fathom. How on earth could you face your electorate and back such a deal?

Let me remind you, all of the economic data gathered in the last 80 years tells us that this austerity agenda is just going to tank the economy. We continue t0 enact the very same crap that put us in the worst economic position we’ve seen since the Great Depression. Why oh why are they doing this to us? Here’s a taste of Noble Prize winning Joseph Stiglitz for some perspective.

A decade ago, in the midst of an economic boom, the United States faced a surplus so large that it threatened to eliminate the national debt. Unaffordable tax cuts and wars, a major recession, and soaring health care costs—fueled in part by the commitment of George W. Bush’s administration to giving drug companies free rein in setting prices, even with government money at stake—quickly transformed a huge surplus into record peacetime deficits.

The remedies to the U.S. deficit follow immediately from this diagnosis: Put America back to work by stimulating the economy; end the mindless wars; rein in military and drug costs; and raise taxes, at least on the very rich. But the right will have none of this, and instead is pushing for even more tax cuts for corporations and the wealthy, together with expenditure cuts in investments and social protection that put the future of the U.S. economy in peril and that shred what remains of the social contract. Meanwhile, the U.S. financial sector has been lobbying hard to free itself of regulations, so that it can return to its previous, disastrously carefree, ways.

Here’s a thorough, peer-reviewed, strong methodology-based IMF study–cited by Paul Krugman–that provides evidence that austerity programs are recessionary and bring on worse budget problems.

The paper corrects this by using the historical record to identify true examples of deliberate austerity — and it turns out that they are contractionary. The multiplier is less than one, but that may reflect the fact that these austerity programs did not take place in the face of a zero lower bound, so they were partly offset by monetary expansion.

The paper also provides a tentative answer to the apparent tendency of spending cuts to be less contractionary than tax increases: it looks as if central banks take more aggressive action to offset spending cuts than tax hikes, reflecting some combination of inflation concerns, belief that spending cuts are more durable, and (the paper doesn’t say this) bankerly ideology.

If we were discussing a politically neutral subject, the evidence here would long since have been considered definitive: expansionary austerity is a doctrine that failed. But since we’re in the political realm, of course, such a convenient doctrine can’t be abandoned. On the contrary, it now seems to be the official doctrine of both the GOP and the White House.

Also, let me remind you that Medicare, Medicaid, and Social Security are very successful programs. They have successfully stopped the elderly from being the poorest segment of society. Just as an example, the majority of single, elderly women would be in poverty without Social Security.

Elderly unmarried women — including widows — get 51 percent of their total income from Social Security. Unmarried elderly men get 39 percent, while elderly married couples get 36 percent of their income from Social Security. For 25 percent of unmarried women, Social Security is their only source of income, compared to 9 percent of married couples and 20 percent of unmarried men. Without Social Security benefits, the elderly poverty rate among women would have been 52.2 percent and among widows would have been 60.6 percent.

Here’s a recent, powerful, academic study showing the benefits of providing Health Insurance for the poor.

When poor people are given medical insurance, they not only find regular doctors and see doctors more often but they also feel better, are less depressed and are better able to maintain financial stability, according to a new, large-scale study that provides the first rigorously controlled assessment of the impact of Medicaid.

While the findings may seem obvious, health economists and policy makers have long questioned whether it would make any difference to provide health insurance to poor people.

It has become part of the debate on Medicaid, at a time when states are cutting back on this insurance program for the poor. In fact, the only reason the study could be done was that Oregon was running out of money and had to choose some people to get insurance and exclude others, providing groups for comparison.

I continually feel as though we’ve all been drug down the rabbit hole. It is like the President is purposefully enabling joblessness, poverty, and public health problems. No amount of research, historical data, and polls appear to be able to penetrate the Washington, D.C. group think these day. The biggest issue is that the President himself believes in the confidence fairy, the bipartisan elves, and the high priests of voodoo economics. He’s not just part of the problem, he is THE problem. Can just one or two members of the Democratic caucus please stand up to this man and his notion that bipartisanship that surrenders the country to right wing reality-deniers is better than any form of principled leadership? Can at least one of the please be brave and start talking some sense and representing the will of the people for a change?

Invoke the 14th Amendment and end the damned sell outs now!

Did you like this post? Please share it with your friends:

Just about the time I think I’ve seen about the worst of the worst coming out of the US congress, another Congressman finds a new bottom. The WSJ has reported that House Majority Whip Eric Cantor stands to gain financially from a U.S. default on the debt ceiling . (Basically, he’s shorted Treasuries). That’s something Cantor seems hellbent on happening. Congressman Cantor has made bets against US Treasury bonds that stand to pay if he can make it happen. Unfugginbelievable!

Just about the time I think I’ve seen about the worst of the worst coming out of the US congress, another Congressman finds a new bottom. The WSJ has reported that House Majority Whip Eric Cantor stands to gain financially from a U.S. default on the debt ceiling . (Basically, he’s shorted Treasuries). That’s something Cantor seems hellbent on happening. Congressman Cantor has made bets against US Treasury bonds that stand to pay if he can make it happen. Unfugginbelievable!

Recent Comments