Monday Reads

Posted: February 14, 2011 Filed under: Food, hunger, morning reads, The Media SUCKS | Tags: Any Human Heart, food inflation, Google Searches, Masterpiece Theatre, Nouriel Roubini, the Big Bird Amendment 50 Comments Good morning!

Good morning!

It’s another one of those holidays where we’re heels if we don’t go out and spend some cash on cards, bad food, and overpriced flowers. If all else fails, you can celebrate birthdays of dead presidents and buy a mattress! So, I did one thing dealing with a ‘heart’ last night and I didn’t even have to pay. I watched Masterpiece Theatre. This is something I’ve done for decades. My mother and I conspired to tape all the Upstairs Downstairs when I had a Beta player. What a valuable collection that’s turned out to be!! Anyway, this new one is by William Boyd who chronicles the life of writer Logan Gonzago Mountstuart. It’s called ‘Any Human Heart’. I enjoyed the first part so I’ll undoubtedly watch more. It included Hemingway reading poetry and Edward and Mrs. Simpson playing through during a game of golf. It was introduced by the usual announcement of the attempt by the Republicans to kill this type of programming and Big Bird. I already know the Louisiana contingent of Republicans will all say yes to offing Big Bird and the two remaining Democrats will say no. No point in my writing any of them. I’d like to have my own version of the Hyde amendment where I get to defund the department of defense and the pentagon and fund anything PBS and planned parenthood want to do. Wanna join my movement to pass the Big Bird Amendment?

So, my fear of future food prices has been matched by that of Nouriel Roubini. I just read today that food inflation in India was reaching somewhere between 18-19% annually. I guess it’s getting worse for food importing Japan.

Yes, rising costs for commodities such as wheat, corn and coffee might do what trillions of dollars of central-bank liquidity couldn’t.

Yet the economic consequences of food prices pale in comparison with the social ones. Nowhere could the fallout be greater than Asia, where a critical mass of those living on less than $2 dollars a day reside. It might have major implications for Asia’s debt outlook. It may have even bigger ones for leaders hoping to keep the peace and avoid mass protests.

What a difference a few months can make. Back in, say, October, the chatter was about Asia’s invulnerability to Wall Street’s woes. Now, governments in Jakarta, Manila and New Delhi are grappling with their own subprime crisis of sorts. This one reflects a toxic mix of suboptimal food stocks, exploding demand, wacky weather and zero interest rates around the globe.

It’s not hyperbole when Nouriel Roubini, the New York University economist who predicted the U.S. financial crisis, says surging food and energy costs are stoking emerging-market inflation that’s serious enough to topple governments. Hosni Mubarak over in Egypt can attest to that.

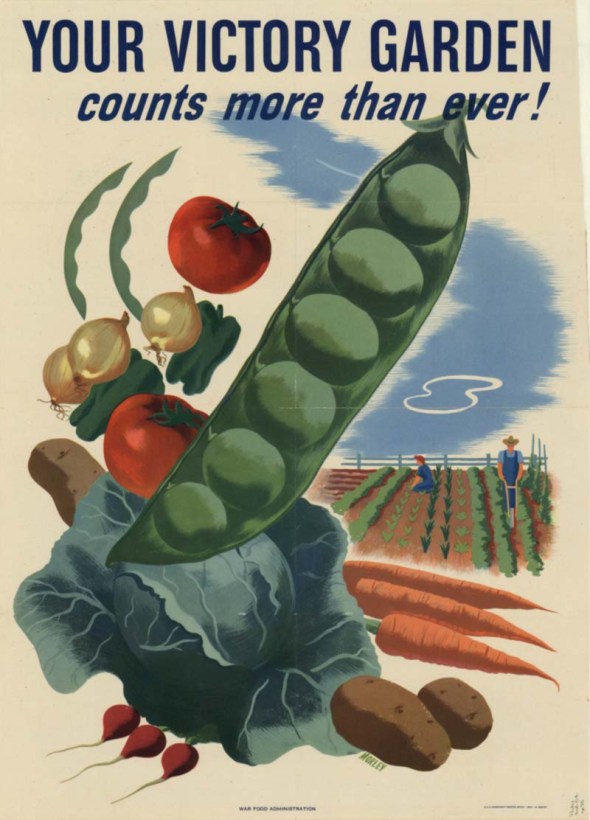

Revolution any one? Since it’s hitting 70 this week, it’s time to start up the garden and the green house again. The frost really did the banana trees in so I’ll likely be out in the back with a machete and odd straw hat while you’re reading this. Hopefully, this time I won’t be buzzed by spy planes and stealth choppers. I still haven’t forgotten the black Apache helicopters overhead two years ago–way too close to my martial law Katrina experience–testing out a more of the same thing drill. That will stay with me for some time. I guarantee. That was the same time congress introduced a law to set up FEMA camps too. (See all the links.) I wonder how long before they try a few more of those ideas out again.

The NYT shared ‘The Dirty Little Secrets of Search’ yesterday. I thought I’d share them today.

The New York Times asked an expert in online search, Doug Pierce of Blue Fountain Media in New York, to study this question, as well as Penney’s astoundingly strong search-term performance in recent months. What he found suggests that the digital age’s most mundane act, the Google search, often represents layer upon layer of intrigue. And the intrigue starts in the sprawling, subterranean world of “black hat” optimization, the dark art of raising the profile of a Web site with methods that Google considers tantamount to cheating.

Despite the cowboy outlaw connotations, black-hat services are not illegal, but trafficking in them risks the wrath of Google. The company draws a pretty thick line between techniques it considers deceptive and “white hat” approaches, which are offered by hundreds of consulting firms and are legitimate ways to increase a site’s visibility. Penney’s results were derived from methods on the wrong side of that line, says Mr. Pierce. He described the optimization as the most ambitious attempt to game Google’s search results that he has ever seen.

“Actually, it’s the most ambitious attempt I’ve ever heard of,” he said. “This whole thing just blew me away. Especially for such a major brand. You’d think they would have people around them that would know better.”

Media Matters reports that Shirely Sherrod will sue Andrew Brietbart for his role in her firing at the U.S. Department of Agriculture. You may recall that his organization significantly edited a speech she gave to make her sound racist. Sherrod’s attorneys are arguing that he damaged her reputation. She needs to sue him down here in New Orleans where we don’t cap damages and she’s likely to find a sympathetic jury. Breitbart one bit of pond scum I’d like to see drained from the pool.

Breitbart, who first posted the clip on July 19, 2010, at his BigGovernment.com site, had been under scrutiny after it was revealed the clip misrepresented Sherrod’s message during a speech in March 2010 before a group of NAACP members.

Fox then posted an online article reporting on the clip, linking to Breitbart’s video. Breitbart did not seek comment from Sherrod prior to his report; Fox News also gave no indication that they had done so. She was forced to resign later that day.

Breitbart has recently claimed that Sherrod was not fired because of his video but because of her part in the 11-year-old Pigford case, in which black farmers sued for discrimination against the Agriculture Department.

He stated such a claim again on Thursday in an interview with Media Matters, in which he admitted he had no proof of the assertion, revealing it was a theory.

Sigh. He’s also committed my most pet pet peeve. Yet another idiot that doesn’t know the difference between a hypothesis and a theory. Don’t they teach the Scientific method any more? Couldn’t they put out an idiots guide out so folks like this can buy a clue? Hey, Andrew!! Here’s something for Your Idiot’s 3X5 card.

- S: (n) hypothesis, possibility, theory (a tentative insight into the natural world; a concept that is not yet verified but that if true would explain certain facts or phenomena) “a scientific hypothesis that survives experimental testing becomes a scientific theory”; “he proposed a fresh theory of alkalis that later was accepted in chemical practices”

Yes. A Scientific hypothesis that survives experimental testing becomes a scientific theory. Could we please stop using these words as interchangeable please?

So, speaking of a hypothesis and scientific testing, every wonder what kinds of things extra testosterone can do for some one? Science Daily reports that a new study published in Proceedings of the National Academy of Sciences. shows it reduces empathy.

Professor Jack van Honk at the University of Utrecht and Professor Simon Baron-Cohen at the University of Cambridge designed the study that was conducted in Utrecht. They used the ‘Reading the Mind in the Eyes’ task as the test of mind reading, which tests how well someone can infer what a person is thinking or feeling from photographs of facial expressions from around the eyes.

Mind reading is one aspect of empathy, a skill that shows significant sex differences in favour of females. They tested 16 young women from the general population, since women on average have lower levels of testosterone than men. The decision to test just females was to maximize the possibility of seeing a reduction in their levels of empathy.

The researchers not only found that administration of testosterone leads to a significant reduction in mind reading, but that this effect is powerfully predicted by the 2D:4D digit ratio, a marker of prenatal testosterone. Those people with the most masculinized 2D:4D ratios showed the most pronounced reduction in the ability to mind read.

Jack van Honk said: “We are excited by this finding because it suggests testosterone levels prenatally prime later testosterone effects on the mind.”

Simon Baron-Cohen commented: “This study contributes to our knowledge of how small hormonal differences can have far-reaching effects on empathy.”

I wonder what impact that will have on those new drugs pushing for testosterone therapy? How many women and gay men may want the men in their lives to just say no?

Okay, so I saved the worst for last. I was watching Candy Crowley yesterday sorta, kinda. When I got back from making another cup of coffee there was this face on the screen on the screen blathering one of my other pet peeves. (See picture on the right.) Within about 2 minutes, I was mumbling to myself wondering where these dumba$$ republicans get their complete and total lack of information on the economy. He was on about the usual STUPIDa$$ meme that the federal government has to get its budget in order like a household. So, completely stupid! Households can go bankrupt. Their debts come due. Governments of stable, developed nations are assumed to operate in perpetuity plus they have the ability to goose the economy through job initiatives which can take care of budgets really quickly. Then, there’s the fact we have general price deflation right now and they could still print up money. Governments are NOT households, idiot!! So, much to my chagrin and naivete, the dude I was ready to toss nerf balls at was actually Obama’s new Budget Director, Jacob Lew. I swear, he sounded like some Republican Congressman. He was defending these cuts in terms I wouldn’t believe could come from a Democratic pol. Later on Sunday, I found out they were Obama’s cuts and then later than that, I found it Obama’s budget Direct that was defending them on State of the Union. I guess every other Democratic pol was embarrassed to defend these kinds of stupid cuts.

Within about 2 minutes, I was mumbling to myself wondering where these dumba$$ republicans get their complete and total lack of information on the economy. He was on about the usual STUPIDa$$ meme that the federal government has to get its budget in order like a household. So, completely stupid! Households can go bankrupt. Their debts come due. Governments of stable, developed nations are assumed to operate in perpetuity plus they have the ability to goose the economy through job initiatives which can take care of budgets really quickly. Then, there’s the fact we have general price deflation right now and they could still print up money. Governments are NOT households, idiot!! So, much to my chagrin and naivete, the dude I was ready to toss nerf balls at was actually Obama’s new Budget Director, Jacob Lew. I swear, he sounded like some Republican Congressman. He was defending these cuts in terms I wouldn’t believe could come from a Democratic pol. Later on Sunday, I found out they were Obama’s cuts and then later than that, I found it Obama’s budget Direct that was defending them on State of the Union. I guess every other Democratic pol was embarrassed to defend these kinds of stupid cuts.

“What [the budget] says is that we really do what every American family does: we have to start living within our means,” Lew said on CNN’s “State of the Union.”

Lew outlined a series of targeted cuts including $125 million from a fund to restore the Great Lakes. He also said graduate student loans would accrue interest while students are in school. As it stands now, interest doesn’t start accruing until after a graduate student completes his or her program.

Lew stressed that while interest will accrue while a student attends graduate school, the student will not have to pay that interest until he or she graduates. “Interest will build up, but students won’t have to pay until they graduate,” Lew said. “It will not reduce access to education.”

“It’s not possible to do this painlessly,” Lew said. “We made some tough choices.”

I’ll repeat what I said last night. How about we get rid of abstinence ‘education’? How about all those subsidies to religious organizations who try to ungay gays and try to covert alcoholics from substance abuse to religious abuse? Can we please close down all of the military bases in Europe and Japan now? I think both WW2 and the Cold War are over. How about we just leave Iraq and Afghanistan? Can we defund anything that creates a check for GE, Halliburton, or KBR? Hell, I have a $Billions of them … just ask me.

Oh, and here’s something from NPR on ‘The Dark Origins of Valentine’s Day’. It was a pretty bizarre Roman mating and fertility ritual in its earliest days. They don’t have any cards that reflect this, however. As per usual, the Roman Catholic church later co-opted it as an excuse to promote one of its numerous celebrity martyrs.

From Feb. 13 to 15, the Romans celebrated the feast of Lupercalia. The men sacrificed a goat and a dog, then whipped women with the hides of the animals they had just slain.

The Roman romantics “were drunk. They were naked,” says Noel Lenski, a historian at the University of Colorado at Boulder. Young women would actually line up for the men to hit them, Lenski says. They believed this would make them fertile.

The brutal fete included a matchmaking lottery, in which young men drew the names of women from a jar. The couple would then be, um, coupled up for the duration of the festival – or longer, if the match was right.

So, what’s on your reading and blogging list today?

Gambling with Hunger

Posted: February 4, 2011 Filed under: Human Rights, hunger | Tags: food, gambling, Global hunger, Islamic Banking, Shari'a finance, Speculation in food 28 Comments During the wind down of the financial crisis several years ago, a few people that read my more wonky threads asked me where I thought the next speculative bubble would develop. I answered food more from intuition than any hard core evidence that I had at the time. Now there is plenty of hard core evidence that validates my intuition.

During the wind down of the financial crisis several years ago, a few people that read my more wonky threads asked me where I thought the next speculative bubble would develop. I answered food more from intuition than any hard core evidence that I had at the time. Now there is plenty of hard core evidence that validates my intuition.

Farm land and Ag. prices have been fairly stable since the 80s and represented some of the few markets that proved relatively resistant to the Global Financial Crisis. However, there was a period of time–2007 through 2008– when some speculative practices influenced food markets. That is why I thought it was likely to recur. Food is, of course, a necessity so that always gives a market a degree of persistence during downturns. It does not make it safe from speculation. The deal is that speculators made a lot of money from their counterbets to the mortgage bubbles and that money had to go some where. I thought it likely they would head for the commodities markets since they did that before with oil, cooper, and food. Since these investors are by nature speculators, they have similar investment behaviors and profiles. The movement of a large number of large dollar investors from one specific clientele into any market is going to have an impact. Speculators moved to commodities and they moved on food. You could see the momentum build and you could trace momentum riders as they entered the market.

Before I get started on the main thrust of this post, I’d like to mention that I know a lot about Shari’a compliant finance and banking because my major professor is one of its leading authorities. Because this discussion is going to include countries where Islam is a major religion, I would like to say a few things about how Shari’a is applied to stock markets, banks, and ‘financial engineering’ in countries where populations may be pushing for these kinds of laws. I’d also like to say that Islamic economists share my concerns even though those concerns are rooted in different philosophies.

It is important to point out that Islamic banks and investment funds were found to be resistant to the global recession compared to their conventional counterparts. This is because gambling and speculation is outlawed in Islamic texts and therefor not allowed in Shari’a compliant institutions. The current U.S. and European corporate form is problematic under Shari’a. The Qu’ran is very specific about the nature of doing business. Most of this is based on the old testament prohibition against usury but the haddith and Q’uran go further. However, the shared old testament roots makes a lot of Islamic financial institutions similar to the ones you find in New York with special banks run by the Orthodox Jewish communities there. We already have religious financial institutions that follow Old Testament prescriptions. I’ve had Jewish students from Orthodox congregations provide me similar information that’s rooted in the Talmud. (Yes, I’m an atheist which makes me extra suspicious of any religious text.)

The Qur’an also promotes shared partnership/ownership and responsibility within a business as a moral imperative between all owners of that business. It does not promote any governmental ownership. It is considered immoral to operate a business with a never-ending, always changing ownership pool like that present in the business form of a public corporation. Preferred stock is strictly prohibited. All owners must have a shared responsibility for the business. That includes the concept of ‘negative’ profits and any negative results. If the business does something immoral or wrong, all of the owners and decisions makers owe the societal retribution and share in the shame and negative profits. No one owner can walk away from illegal activities.

Contracts that are compliant to the Shari’a are written clearly and monitored against gharar (disception) so that gambling and speculation cannot occur and so that any thing bad the business does comes back on all the owners/investors in a business. They all hang or thrive together over long periods of time. That is because a business and trade are supposed to bring good results for the entire community. It’s like the idea of karma. If you do good, every thing thrives. If you do harm, the poison spreads and you are held to account. The contracts are enforceable in courts. In this case, an Islamic jurist and an angry sky god will hold you to account. You’ve undoubtedly read exactly how old testament angry that punishment can be be in the version of Shari’a practiced by the extreme Shia Islam of Iran. Fortunately, most adherents to Islam–like the majority of adherents to Christianity and Judaism–do not adhere to literal interpretations of Old Testament prohibitions and punishments. They hold to the underlying moral view and practices.

Shari’a compliance means no corporate form like we use here with its limited liability financiers and assumed perpetuity. This is probably why you’ve got so many people calling Islam ‘anti-capitalist’ now. It’s not anti-capitalist at all. In fact, it exhorts people to share and run businesses as a moral activity. It’s the speculation and the ability to walk away from liability that is prohibited. It is not about government takeover of private property. It is about holding private property owners to account for the damage they may do to society and preventing that when possible. Of course, the plutocracy hates this.

I want to explain what this means because it’s not a Marxist form or a planned market form like you saw in the Soviet Union. This is not a ‘communist under the bed’ situation. Derivatives and financial engineering are being vigorously discussed by Islamic economists and financiers right now. They are separating out the forbidden, speculative activities. This means that many hedge funds would not be able to get into projects where the owners follow Shari’a because speculation is strictly prohibited. All investments must be matched to “real” assets. Assets cannot be created out of thin air. So, in this situation, forward contracts or futures contracts are allowed. Some of the synthetic deals that characterized the pre-crisis time cannot be used by firms providing investment fund opportunities to people concerned their monies be placed in Shari’a compliant ways. Additionally, the Q’uran has a strict prohibition on hording money. The rich must keep their funds active in the economy to please God. Another edict is that all activities must put aside a portion for charitable activities that support widows and orphans. I hope this gives you enough understand to place this next discussion in context and why some people may find this appealing.

So, maybe you can understand why gambling with food assets is a big concern on many levels for developing nations. First, you have an incredible amount of hungry people. There are tales of hungry people in Africa watching boats be loaded with food they grew being shipped to rich, developed countries. Then, you have a number of regions where gambling is basically seen as doing harm to people and is prohibited by God. I would like to remind you that most fundamentalist Christians and Orthodox Jewish Congregations believe this too. It’s clearly part of the old testament prohibitions. So, modern finance is running headlong into development economics as well as people with literal old testament-based religions. Again, Orthodox Jewish congregants have a separate banking system in New York that would be considered Shari’a compliant. I cannot emphasize this enough.

So with this in mind, there is increasing evidence that ‘Rampant Speculation Inflated Food Price Bubble”. You can see what excessive speculation is now doing to food markets.

Recent Comments