Iraq isn’t costing three trillion dollars

Posted: December 15, 2011 Filed under: Federal Budget and Budget deficit, Iraq, U.S. Politics 8 CommentsRemember when Bilmes and Stiglitz published The Three Trillion Dollar War: The True Cost of the Iraq Conflict in early 2008? There was much discussion about how it wasn’t true, how they’d overcounted this, and undercounted that. (E.g. 1)

Well, it turns out it was indeed not true.

It’s costing four trillion dollars. ($4,000,000,000,000. Actually, with those sorts of numbers, you’re really supposed to use scientific notation: $4 x 1012.)

That’s just the loss for the USA. It doesn’t count the cost for the troops of other nations. It doesn’t include the costs in Iraq. All told, six or seven trillion dollars’ worth of smoke and rubble is probably a cautious and conservative estimate.

The good news is there was nothing else that needed doing, so it’s not as if it matters.

Super Committee Calvin Ball

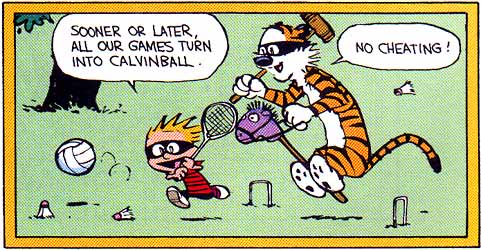

Posted: November 20, 2011 Filed under: #Occupy and We are the 99 percent!, Catfood Commission, Federal Budget, Federal Budget and Budget deficit | Tags: Budget Deficit, Extension of Bush Tax Cuts., supercommittee 15 CommentsRepublicans are insistent that the Bush Tax cuts be made permanent. With that stroke of lunacy, we have the imminent and predictable meltdown of the super committee.  So, what happens when the minority party doesn’t get it’s way on everything? It either holds the economy hostage or changes the rule. Republicans in Congress are playing Calvin Ball to avoid the cuts that super committee failure is supposed to bring to the defense budget. They’re changing their own rules, yet again.

So, what happens when the minority party doesn’t get it’s way on everything? It either holds the economy hostage or changes the rule. Republicans in Congress are playing Calvin Ball to avoid the cuts that super committee failure is supposed to bring to the defense budget. They’re changing their own rules, yet again.

Plus, we’re getting another contradictory argument on taxes. Let the Bush tax cuts expire is “raising taxes”. Letting the payroll tax holiday expire is not raising taxes. How do these folks get through the day without a complete synaptic breakdown? Here’s some details from Reuters. The Murray quoted here is Senator Patty Murray from Washington State.

Murray said Republicans want to extend tax cuts that lowered individual rates — reductions that originated under former Republican President George W. Bush. Those tax cuts run out at the end of 2012.

Republicans have pushed for a permanent extension. Democrats want the tax cuts for the rich to expire.

“In Washington, there are folks who will not cut a dollar unless we raise taxes,” said Kyl, sparking an exasperated reaction from Kerry who noted that Congress has cut about $1 trillion from the budget without any tax hikes.

Republicans want Democrats to agree to do more to find long-term savings in the growing costs of government retirement and healthcare programs.

If no deal is reached by a simple majority of the super committee, automatic spending cuts would start in 2013 — two months after presidential and congressional elections.

Those cuts would be evenly divided between domestic and defense programs. Some Republican members of Congress already are talking about dismantling the automatic cuts to protect the Defense Department from deep reductions.

No serious discussion on deficits can occur without ending the Bush Tax cuts and seriously putting the Pentagon budget on the table. Representatives of the super committe were out full force on the Sunday Morning Talk Show. John Avlon at The Daily Beast points to the political posturing that’s likely still the root of the entire problem. No Republican is willing to compromise any more. Democrats and the President continue to grant many concessions on social programs that leave little left for continuing battle. No where is this more noticeable when the congress passed the old John Chaffee/Bob Dole Republican Health plan under the guise of ObamaCare. The contentious mandate originally came from the Republican side of the aisle from the American Heritage Institute. The twist of facts into partisan narratives has never been worse.

But pervasive hyperpartisan positional bargaining seems to have carried the day. Pessimism has clouded late-inning negotiations. Supercommittee Democrats have offered to put entitlement reforms on the table, but offered few specifics. Republicans have offered limited revenue increases, but tied those to the cutting the top tax rate to 28 percent from 35 percent and permanently extending the contentious Bush tax cuts. Distrust and brinksmanship pollutes the process.

Ironically, but perhaps appropriately, the dysfunctional debate seems to be based around what the term “fair and balanced” actually means.

For Democrats it means a 1-to-1 ratio of tax hikes to spending cuts. For bipartisan groups like the Gang of Six and Bowles Simpson, it means a 3-to-1 ratio. But for too many Republicans, “fair and balanced” means no tax revenues raised at all—a handful of loopholes closed as concessions, like $3 billion from private jets, and the rest collected from spending cuts. The basic dynamic of both sides being willing to slaughter sacred cows is missing despite an avalanche of “more bipartisan than thou” press releases.

The core problem comes from antitax pledges that have dislodged the basic nature of balance sheets in the collective conservative mind—it is all spending, no revenue. Fiscal responsibility has been replaced by fiscal conservatism. Reducing the deficits and debts is no longer the overriding goal, despite Tea Party rhetoric about generational theft or even the balanced-budget-amendment attempt this past week. Instead, keeping tax cuts in place is the one true grail—ignoring the overwhelming popularity of provisions like raising the top rate on people making more than a million dollars a year.

Sane people continue to ask what type of Svengali powers the insane Grover Norquist holds over Republicans? If you want to learn about “The Billionaire’s Best Friend”  who “hijacked the Republican party on behalf of the rich”, go no further than TIm Dickinson’s article in this month’s Rolling Stone. This man continues to hold sway over the Republican congress critterz despite overwhelming public polls that show even Republicans and Independent rank and file don’t support his agenda. Norquest comes from two Republican institutions. He was originally in the Chamber of Commerce which is one organization that has no problem seeing lies and half baked arguments printed in newspapers around the country. Ronald Reagan used him to push his tax reform measures. It’s been one power grab after another backed by nothing more than dogma and a huge budget since then.

who “hijacked the Republican party on behalf of the rich”, go no further than TIm Dickinson’s article in this month’s Rolling Stone. This man continues to hold sway over the Republican congress critterz despite overwhelming public polls that show even Republicans and Independent rank and file don’t support his agenda. Norquest comes from two Republican institutions. He was originally in the Chamber of Commerce which is one organization that has no problem seeing lies and half baked arguments printed in newspapers around the country. Ronald Reagan used him to push his tax reform measures. It’s been one power grab after another backed by nothing more than dogma and a huge budget since then.

Over the past 25 years, Norquist has received funding from many of America’s wealthiest corporations, including Philip Morris, Pfizer and Microsoft. To build a farm team of anti-tax conservatives, Norquist shrewdly took the pledge to state legislatures across the country, pressuring up-and- coming Republicans to make it a core issue before they’re called up to the big leagues. “We’re branding the whole party that way,” Norquist says. “The people who are going to be running for Congress in 10 or 20 years are coming out of state legislatures with a history with the pledge.”

Norquist also built the anti-tax pledge into the DNA of the GOP by hosting weekly Wednesday meetings that enable activist groups representing everyone from gun nuts to home-schoolers to mix with top business lobbyists and conservative officials. The meetings, which began shortly after Bill Clinton was elected, turned Norquist into the Republican Party’s foremost power broker – and gave him a forum to enforce the no-new-taxes pledge as the centerpiece of the GOP’s strategy. “The tax issue,” he says, “is the one thing everyone agrees on.”

Norquist cemented his influence by forging an early alliance with Karl Rove and setting himself up as a gatekeeper to George W. Bush’s inner circle. Then, after Obama was elected, this ultimate Washington insider positioned himself as a leader of the anti-establishment Tea Party, complete with financial support from the billionaire Koch brothers. “These Tea Party people, in effect, take their orders from him,” says Bruce Bartlett, an architect of the Reagan tax cuts. “He decides: This is a permissible tax action, or this is not a permissible tax action. And of course, anything that cuts taxes is per se OK.”

Today, GOP politicians who have signed Norquist’s anti-tax pledge include every top Republican running for president, 13 governors, 1,300 state lawmakers, 40 of the 47 Republicans in the Senate, and 236 of the 242 Republicans in the House. What’s more, the GOP’s Tea Party foot soldiers are marshaled by House Majority Leader Eric Cantor – a veteran of Norquist’s farm team, who first signed the pledge as an ambitious member of the Virginia legislature. Under Cantor’s leadership, Norquist’s anti-tax pledge was directly responsible for last summer’s debt-ceiling standoff that wrecked the nation’s credit rating by leading the nation to the brink of default. “Congress was willing to cause severe economic damage to the entire population,” marvels Paul O’Neill, Bush’s former Treasury secretary, “simply because they were slaves to an idiot’s idea of how the world works.”

Yup. Bush’s former Treasury secretary thinks Norquist has congress hostage to the point that they are “willing to cause severe economic damage to the entire population simply because they were slaves to an idiot’s idea of how the world works.” The result of the work of Norquist and the Republican party has been staggering income inequality.

“The Republican Party has totally abdicated its job in our democracy, which is to act as the guardian of fiscal discipline and responsibility,” says David Stockman, who served as budget director under Reagan. “They’re on an anti-tax jihad – one that benefits the prosperous classes.”

Notice here that I’m quoting Republicans that have had extensive experience in economics, finance, and policy. Funny thing is that the most of these folks aren’t really worried about tanking the economy. What they are worried about is this. If you haven’t read Cannonfire today, you should. First, Cannon points to this. MSNBC got a hold of a memo from a lobbying firm spelling out its plan to use any propaganda means necessary to destroy OWS. The lobbying firm is associated with the American Banker’s Association.

CLGC’s memo proposes that the ABA pay CLGC $850,000 to conduct “opposition research” on Occupy Wall Street in order to construct “negative narratives” about the protests and allied politicians. The memo also asserts that Democratic victories in 2012 would be detrimental for Wall Street and targets specific races in which it says Wall Street would benefit by electing Republicans instead.

According to the memo, if Democrats embrace OWS, “This would mean more than just short-term political discomfort for Wall Street. … It has the potential to have very long-lasting political, policy and financial impacts on the companies in the center of the bullseye.”

The memo also suggests that Democratic victories in 2012 should not be the ABA’s biggest concern. “… (T)he bigger concern,” the memo says, “should be that Republicans will no longer defend Wall Street companies.”

Two of the memo’s authors, partners Sam Geduldig and Jay Cranford, previously worked for House Speaker John Boehner, R-Ohio. Geduldig joined CLGC before Boehner became speaker; Cranford joined CLGC this year after serving as the speaker’s assistant for policy. A third partner, Steve Clark, is reportedly “tight” with Boehner, according to a story by Roll Call that CLGC features on its website.

Another interesting association is noted in the memo.

The CLGC memo raises another issue that it says should be of concern to the financial industry — that OWS might find common cause with the Tea Party. “Well-known Wall Street companies stand at the nexus of where OWS protestors and the Tea Party overlap on angered populism,” the memo says. “…This combination has the potential to be explosive later in the year when media reports cover the next round of bonuses and contrast it with stories of millions of Americans making do with less this holiday season.”

Yup, it’s the divide and conquer strategy again. Since Wall Street can’t make the case, it’s going to use proxies like the Tea Party to do its dirty work. This should be no problem given the astroturf leadership put in place by folks like Dick Armey and Matt Kibbe. These guys are longstanding Republican Beltway insiders. The interesting thing comes in some of the rumors coming out from the committee itself. Supposedly, Boehner had actually agreed to put revenues on the table and provide cover to Republicans that feared Norquist and the Tea Party. Some Democrats never really engaged, some republicans refused to even discuss anything that didn’t include making the Bush Tax cuts permanent for every one, and there was some feeling that the next election would give some indication of which way the wind blows.

A Democratic aide had this eulogy for the supercommittee: “The worm has turned a little bit. The national conversation now is about income inequality and about jobs, and it’s not really about cutting the size of government anymore or cutting spending. 2010 gave one answer to that question. But 2012 will give another, and we’ve got to see what it is.”

I still think economist Jeffrey Sachs has the best take on what the real role of Congress should be in an schizophrenic economy like ours. This is what OWS is trying to point out but is getting blasted for by concentrated efforts in corporate media to publish propaganda. (I have quoted this before, but I’m quoting Sachs again.)

The big political lie of the Super-Committee is that the deficit must be closed mainly by cutting government spending rather than by raising taxes on corporations and the super-rich. Both parties are complicit. The Republicans want to close the deficit entirely by cutting spending; Obama has brandished the formula of $3 of cuts for every $1 of tax revenues. On either approach, the poor and middle class would suffer grievously while the rich and powerful would win yet again (at least until the social pressures boil over).

The key to understanding the U.S. economy is to understand that we have two economies, not one. The economy of rich Americans is booming. Salaries are high. Profits are soaring. Luxury brands and upscale restaurants are packed. There is no recession.

The economy of the middle-class and poor is in crisis. Poverty and near-poverty are spreading. Unemployment is rampant. Household incomes have been falling sharply. Millions of discouraged workers have dropped out of the labor force entirely. The poor work at minimum wages to provide services for the rich.

Until we have some realization that laws put into place for the last 30 years have created markets that are distorted, functional only for a few, and not the least bit reflective of anything remotely “free market”, a portion of the public is going to be willing to vote for people that spread lies. This is why the credibility of any one associated with OWS must be destroyed. The minute a huge portion of us wake up to the lies–much like what happened after publication of the Pentagon Papers and the invasion of Cambodia after Nixonian promises of winding the Vietnam War down–we’re not going to get the policy we need to put things right again. We desperately need to put things right again.

Another Standoff

Posted: September 23, 2011 Filed under: Federal Budget, Federal Budget and Budget deficit, U.S. Politics | Tags: FEMA funding, government shutdown, Harry Reid, John Boehner 14 CommentsLet’s see. Selling out on tax cuts to millionaires was supposed to be the end all to all stand offs. Didn’t  happen. Putting together a likely unconstitutional supercongress was supposed to be the end all to all stand offs. Yeah. That really worked well, didn’t it?

happen. Putting together a likely unconstitutional supercongress was supposed to be the end all to all stand offs. Yeah. That really worked well, didn’t it?

Things in our federal government are so broke and so dysfunctional that the day-to-day business of governing is threatened on a quarterly basis. This is nuts. Republicans offered up a bandage approach in the House. Harry Reid’s gone Dirty Harry on them.

Washington lurched toward another potential government shutdown crisis Friday, as the House approved by a 219-203 vote a GOP-authored short-term funding measure designed to keep the government running through Nov. 18 and Democrats in the Senate immediately vowed to reject the bill.

“We expect a vote fairly quickly,” said Senate Majority Leader Harry Reid (D-Nev.) on Friday morning.

In an after-midnight roll call, House Republican leaders persuaded conservatives early Friday morning to support a stop-gap measure nearly identical to one they had rejected just 30 hours earlier. By a narrow margin, 213 Republicans supported the plan, along with six Democrats; 179 Democrats opposed it, joined by 24 Republicans.

The bill, which will keep federal agencies funded through Nov. 18, passed over staunch objections from House Democrats, who opposed a provision that would pair increased funding for disaster relief with a spending cut to a program that makes loans to car companies to encourage energy efficient car production.

But House Speaker John Boehner’s (R-Ohio) victory is likely to be short-lived. Reid said late Thursday that the measure could not pass his chamber, with a vote expected sometime Friday. A Senate defeat would leave Congress at a new standoff.

“It fails to provide the relief that our fellow Americans need as they struggle to rebuild their lives in the wake of floods, wildfires and hurricanes, and it will be rejected by the Senate,” Reid said of the House bill.

Without a resolution, the Federal Emergency Management Agency’s disaster relief fund will run out of money early next week and the rest of the government would be forced to shutdown Oct. 1.

What exactly did Agent Orange and the Rindettes offer up that made Harry mad?

On Wednesday night, House Republicans failed to pass a continuing resolution to keep the government funded beyond Sept. 30, as 48 Republicans cut ranks with their leadership and voted against the measure (as did all but six Democrats, who object to the bill’s level of disaster aid and cuts to a clean vehicle manufacturing program). House Speaker John Boehner (R-OH) was reportedly incensed at the members who abandoned him on the vote, deriding them as “know-it-alls who have all the right answers.”

But early this morning, the House was able to pass a CR, after Boehner and the Republican leadership added a $100 million cut to a Department of Energy clean-energy loan program. Other than that cut, the bill was exactly the same as the one the House defeated on Wednesday. But the additional cut was enough to entice 23 Republican members into flipping their votes.

Boehner has to be one of the worst Speakers in history. He couldn’t walk a dog through the house successfully. Here’s more on Reid’s response.

Democrats opposed the GOP bill en masse because it partially offsets $3.65 billion in funding for the Federal Emergency Management Agency (FEMA) with a $1.5 billion cut to a separate Department of Energy manufacturing loan program.

“The bill the House will vote on tonight is not an honest effort at compromise. It fails to provide the relief that our fellow Americans need as they struggle to rebuild their lives in the wake of floods, wildfires and hurricanes, and it will be rejected by the Senate,” Senate Majority Leader Harry Reid (D-Nev.) said in a statement Thursday night before the House vote.

“I was optimistic that my House Republican colleagues would learn from their failure yesterday and move towards the middle. Instead, they moved even further towards the Tea Party.”Reid said the Senate was ready to stay in session next week, potentially canceling its scheduled recess. The House bill would fund the government through Nov. 18.

By pushing ahead with a tweaked version of his original bill, Boehner is hoping to jam the Senate with time running out.

It hasn’t even been a year yet and we’ve already had three hostage taking situations. WTF is wrong with our country? We can’t even help our own people any more that have been devastated by flooding, tornadoes, wild fires and hurricanes with out turning in to a government is the problem moment?

update: Bohner lies in press conference.

“With FEMA expected to run out of disaster funding as soon as Monday, the only path to getting assistance into the hands of American families immediately is for the Senate to approve the House bill,” Boehner said in an official statement Friday morning.

Well, that’s not exactly true. The House legislation received only 36 votes in the Senate. As noted above, the Senate passed a stand-alone disaster bill last week, which the House could take up and pass instead of scattering to the four winds.

On the Senate floor just after the House bill was tabled, Reid and Senate Minority Leader Mitch McConnell (R-KY) reluctantly agreed to hold a Monday vote on compromise legislation to top-off FEMA’s disaster account, and keep the federal government funded. McConnell urged Reid to hold a Friday vote, but Reid asked for delay, with the expectation that cooler heads will prevail over the weekend. McConnell, Reid, Boehner and House Minority Leader Nancy Pelosi (D-CA) will negotiate through the weekend to break the gridlock.

Recent Comments