Finally Friday Reads: Backpfeifengesicht

Posted: March 7, 2025 Filed under: Economy, Equity Markets, FARTUS, kakistocracy, MAGA Assholes, MAGA Political Carnage, Polycrisis, Psychopaths in charge | Tags: a face worthy of being slapped, Backpfeifengesicht, CryptoCurrency Ponzi Scheme from Trump and Musk, Declaration of Independence, FARTUS, martial-law, People are not Illegal, Space X explosion, The Insurrection Act, White Male Christian Supremacists 8 Comments

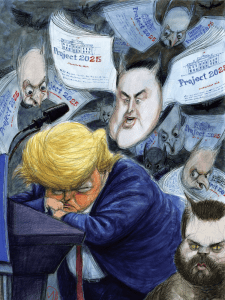

“EEK!” John Buss, @repeat1968, @johnbuss.bsky.social

Good Day, Sky Dancers!

Backpfeifengesicht is the German word for “a face worthy of being slapped.” That might be the most usable word in the dark timeline, which is the second term of #FARTUS (Felon, Adjudicated Rapist, Traitor of the United States). JJ found this sweet article at The Guardian and shared it with BB and me this morning. It’s an Op-Ed written by Marina Hyde about JD Vance, but it could apply to any subhuman of the modern MAGA movement. “There are 1,000 grotesque memes of JD Vance – and they’re all more likable than the real thing. Angry, rude and addicted to web troll-ery, the vice-president has the Make America Awful Again portfolio. Seems a perfect fit.” Ayup.

You may well be aware that Backpfeifengesicht is the German word for a face that is worthy of being slapped. Even so, how has this not been internationalised? Or at the very least Americanised, where its dictionary definition would presumably be adorned by a picture of the face of US vice-president JD Vance – already faultlessly playing the role of worst American at your hotel. You can immediately picture him at breakfast, can’t you? Every single other guest on the terrace with their shoulders up round their ears, just thinking: “Where is he now? How unbearable is he being NOW?” Next, imagine breakfast lasting four years.

I say the Backpfeifengesicht definition would be accompanied by JD Vance’s face … but then again, what is the face of JD Vance? The internet is awash with people suffering an acute case of not being able to remember it any more, having seen so many hideous comic distortions of Vance that those meme versions are not simply the only results on the first page of your own mental Google search, but stretch deep beyond the second and into the third. Somewhere on page four, where you might as well publish the nuclear codes or pictures of Taylor Swift giving cocaine to babies, is an unmodified snap of what JD Vance actually looks like. Or at least what he looks like with eyeliner.

Before you get there – and you don’t, really – your synaptic filing systems throw up every variety of Photoshopped Vancefake: swollen manboy, face wearing a Minion suit, a bearded egg … I’m hoping that sooner or later, an American news outlet will accidentally use a modified photo, because even the picture editor has forgotten what the vice-president looks like, and then we can have one of those massively self-regarding legacy media-blow-ups, where the entire staff has to resign after a remorseless investigation by the executive editor reveals Vance isn’t actually a big purple grape. “This is a stain on our newspaper’s history. A big purple stain.”

Vance is more meme than man, now, and it is, of course, something of a consolation that he is so extremely online that he can’t help but have noticed this. The VP is like a one-man government troll-feeding programme – please don’t cut him, Elon! – which is probably why people have become so heroically committed to taking the piss. The probability of the vice-president seeing you insulting him is basically one.

Just as previous holders of his office like Teddy Roosevelt and Richard Nixon once did, Vance spent a notable amount of this week both denying he suggested Britain and France were random countries that hadn’t fought a war in 40 years, and replying to random X posters called things like “Jeff Computers” to counter the suggestion that he wasn’t loved and feted on his recent skiing holiday.

While JJ found that amusing read today. BB brought home the rancid bacon. This is an op-ed by Brett Wagner in The San Francisco Chronicle today. “Is Trump preparing to invoke the Insurrection Act? Signs are pointing that way. A joint Department of Defense and Homeland Security report will soon recommend whether or not to invoke the Insurrection Act over illegal migration.”

While JJ found that amusing read today. BB brought home the rancid bacon. This is an op-ed by Brett Wagner in The San Francisco Chronicle today. “Is Trump preparing to invoke the Insurrection Act? Signs are pointing that way. A joint Department of Defense and Homeland Security report will soon recommend whether or not to invoke the Insurrection Act over illegal migration.”

The clock is ticking down on a crucial but little-noticed part of President Donald Trump’s first round of executive orders — the one tasking the secretaries of the Department of Defense and Department of Homeland Security to submit a joint report, within 90 days, recommending “whether to invoke the Insurrection Act.”

Many of us are now holding our collective breath, knowing that the report and what it contains could put us on the slippery slope toward unchecked presidential power under a man with an affinity for ironfisted dictators.

Adding to the suspense was the recent “Friday Night Massacre” at the Pentagon — the firing of the nation’s top uniformed officer and removing other perceived guardrails (i.e., the top uniformed lawyers at the Army, Navy and Air Force) standing between the president and his long-stated intention to declare martial law upon returning to power.

Coincidence?

As we wait to find out, this would be a good time to take a closer look.

Say, for example, that Trump were to invoke the Insurrection Act and declare martial law. He wouldn’t even be required, by the letter of the law, to allege an “insurrection.” All that would be required is to assert that “unlawful obstruction” has made it “impracticable to enforce the laws of the United States” (as President Dwight D. Eisenhower did when he ordered the Arkansas National Guard to enforce the desegregation of Little Rock, Ark., schools).

This is where all the false claims and outright lies Trump and his political allies have been pushing will come into play: Trump falsely alleging, for example, that an entire city in Colorado has been taken over by Venezuelan street gangs, that a city in Ohio has been overrun by Haitian refugees who are eating all the cats and dogs, and other vague assertions that “millions and millions” of “illegals” are pouring into our country every week (or “day” depending on who’s telling the lie at the moment).

Each of these false claims and outright lies could be distilled, to declare martial law, into catchy phrases (beginning with the legalese word “Whereas”) to establish the legal premise for invoking the Insurrection Act, and to lay the predicate to begin going door-to-door, wherever they please, under the pretense of searching for undocumented immigrants who don’t exist.

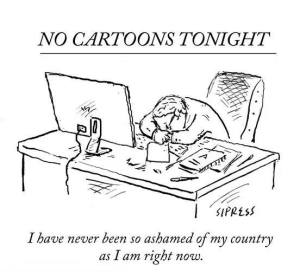

I bring you the reality on the ground from Joy Reid on Threads. “This is inhumane, hideous and repugnant. If this is what MAGA America is, count me out. I’m ashamed that this is what our government is doing. Shame on them. Shame.” What it is is a 21-year-old girl with cancer who relies completely on her immigrant mother, who is in no way a criminal or bothering anyone. When protesters came to protest, they were arrested. How many laws and constitutional rights can this miserable administration break before they completely break all of us? This story comes from El Monte, California. You can read the hatred of the MAGA monsters in the threads below on YouTube. I’ve gotten to the point where I don’t want to leave the house and take a chance at seeing a FARTUS supporter in my neighborhood. I’m fine with all the immigrants, though. Everything they do makes my neighborhood a better place.

“I can’t even wake up properly… she helps me, she bathes me, she changes me, she makes my food.”Deportation didn’t protect anyone it only stole a mother from the child who needs her most-Blake Coronadowww.threads.net/@blakecorona…

— Audrey (@parickards.bsky.social) 2025-03-06T23:59:31.294Z

The US Military and US Vets are under attack from this Administration. This cannot be denied. This is from the AP this morning. FARTUS has always had a thing against military service and those who fight for values that he seems to hate very much. “War heroes and military firsts are among 26,000 images flagged for removal in Pentagon’s DEI purge.” So much of this just comes as an attack against the diversity of our nation being represented in all of its institutions. But is that really it? Why the disappearance of all people of color, women, and the LGBTQ community? Are white cis men really that sensitive?

The US Military and US Vets are under attack from this Administration. This cannot be denied. This is from the AP this morning. FARTUS has always had a thing against military service and those who fight for values that he seems to hate very much. “War heroes and military firsts are among 26,000 images flagged for removal in Pentagon’s DEI purge.” So much of this just comes as an attack against the diversity of our nation being represented in all of its institutions. But is that really it? Why the disappearance of all people of color, women, and the LGBTQ community? Are white cis men really that sensitive?

References to a World War II Medal of Honor recipient, the Enola Gay aircraft that dropped an atomic bomb on Japan and the first women to pass Marine infantry training are among the tens of thousands of photos and online posts marked for deletion as the Defense Department works to purge diversity, equity and inclusion content, according to a database obtained by The Associated Press.

The database, which was confirmed by U.S. officials and published by AP, includes more than 26,000 images that have been flagged for removal across every military branch. But the eventual total could be much higher.

One official, who spoke on condition of anonymity to provide details that have not been made public, said the purge could delete as many as 100,000 images or posts in total, when considering social media pages and other websites that are also being culled for DEI content. The official said it’s not clear if the database has been finalized.

Defense Secretary Pete Hegseth had given the military until Wednesday to remove content that highlights diversity efforts in its ranks following President Donald Trump’s executive order ending those programs across the federal government.

The vast majority of the Pentagon purge targets women and minorities, including notable milestones made in the military. And it also removes a large number of posts that mention various commemorative months — such as those for Black and Hispanic people and women.

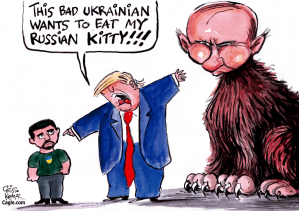

Are they just trying to up their odds that one will be less likely to disrupt the plan when martial law is declared? Everything they’ve been doing shows their delight in being the worst kind of bullies. Just yesterday, they announced they will deport Ukrainians who fled to the US for safety. We are no longer a safe harbor. Not even close. Heather Cox Richardson discusses this in detail this morning in her Substack Letters from an American.

Are they just trying to up their odds that one will be less likely to disrupt the plan when martial law is declared? Everything they’ve been doing shows their delight in being the worst kind of bullies. Just yesterday, they announced they will deport Ukrainians who fled to the US for safety. We are no longer a safe harbor. Not even close. Heather Cox Richardson discusses this in detail this morning in her Substack Letters from an American.

This morning, Ted Hesson and Kristina Cooke of Reuters reported that the Trump administration is preparing to deport the 240,000 Ukrainians who fled Russia’s attacks on Ukraine and have temporary legal status in the United States. Foreign affairs journalist Olga Nesterova reminded Americans that “these people had to be completely financially independent, pay tax, pay all fees (around $2K) and have an affidavit from an American person to even come here.”

“This has nothing to do with strategic necessity or geopolitics,” Russia specialist Tom Nichols posted. “This is just cruelty to show [Russian president Vladimir] Putin he has a new American ally.”

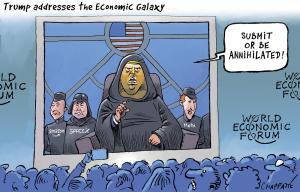

The Trump administration’s turn away from traditional European alliances and toward Russia will have profound effects on U.S. standing in the world. Edward Wong and Mark Mazzetti reported in the New York Times today that senior officials in the State Department are making plans to close a dozen consulates, mostly in Western Europe, including consulates in Florence, Italy; Strasbourg, France; Hamburg, Germany; and Ponta Delgada, Portugal, as well as a consulate in Brazil and another in Turkey.

In late February, Nahal Toosi reported in Politico that President Donald Trump wants to “radically shrink” the State Department and to change its mission from diplomacy and soft power initiatives that advance democracy and human rights to focusing on transactional agreements with other governments and promoting foreign investment in the U.S.

Elon Musk and the “Department of Government Efficiency” have taken on the process of cutting the State Department budget by as much as 20%, and cutting at least some of the department’s 80,000 employees. As part of that project, DOGE’s Edward Coristine, known publicly as “Big Balls,” is embedded at the State Department.

As the U.S. retreats from its engagement with the world, China has been working to forge greater ties. China now has more global diplomatic posts than the U.S. and plays a stronger role in international organizations. Already in 2025, about 700 employees, including 450 career diplomats, have resigned from the State Department, a number that normally would reflect a year’s resignations.

Shutting embassies will hamper not just the process of fostering goodwill, but also U.S. intelligence, as embassies house officers who monitor terrorism, infectious disease, trade, commerce, militaries, and government, including those from the intelligence community. U.S. intelligence has always been formidable, but the administration appears to be weakening it.

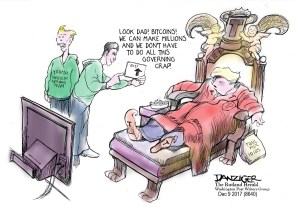

Trump, bitcoin, political cartoon

We’re being turned into part of the Trump Grift Mafia. Nothing will be left standing of any of the good we have done in the world. This is neocolonialism and neomercantilism. We’ve retreated to some of the worst historical ideologies ever. The most symbolic thing happened yesterday. The latest Space X project blew up in the sky and shut down many flights yesterday. “Breakup of SpaceX’s Starship Rocket Disrupts Florida Airports. The video showed the upper stage of the most powerful rocket ever built spinning out of control in space, a repeat of an unsuccessful test flight in January that led to debris falling over the Caribbean.” This is what we’re spending money for? Elonia is pushing his company to the brink of getting to Mars and looking down at the rest of us. The report is from The New York Times‘s Kenneth Chang.

Starship — the huge spacecraft that Elon Musk says will one day take people to Mars — failed during its latest test flight on Thursday when its upper stage exploded in space, raining debris and disrupting air traffic at airports from Florida to Pennsylvania.

It was the second consecutive test flight of the most powerful rocket ever built where the upper-stage spacecraft malfunctioned. It started spinning out of control after several engines went out and then lost contact with mission control.

Photographs and videos posted on the social media site X by users saying they were along the Florida coast showed the spacecraft breaking up. The falling debris disrupted flights at airports in Miami, Orlando, Palm Beach and Fort Lauderdale, and as far away as Philadelphia International Airport.

The Starship rocket system is the largest ever built. At 403 feet tall, it is nearly 100 feet taller than the Statue of Liberty atop its pedestal.

It has the most engines ever in a rocket booster: The Super Heavy booster is powered by 33 of SpaceX’s Raptor engines. As those engines lift Starship off the launchpad, they will generate 16 million pounds of thrust at full throttle.

The upper part, also called Starship or Ship for short, looks like a shiny rocket from science fiction movies of the 1950s, is made of stainless steel with large fins. This is the upper stage that will head toward orbit, and ultimately could carry people to the moon or even Mars.

The rocket lifted off a little after 6:30 p.m. Eastern time on Thursday from the SpaceX site known as Starbase at the southern tip of Texas near the city of Brownsville.

Starship’s mammoth booster again successfully returned to the launchpad, just as it had during the previous test flight. In the last half minute before the upper-stage engines were to shut off, several of them malfunctioned. Video from the rocket showed a tumbling view of Earth and space until it cut off.

Ashley Parker and Michael Scherer wrote this analysis for The Atlantic. “Trump’s Own Declaration of Independence. The president, who has flirted with regal rhetoric, wants a historic copy of America’s founding document placed in the Oval Office.”

Long live the king!

Down with the king!

President Donald Trump sees the appeal of both.

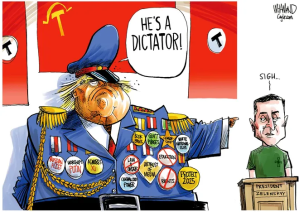

Trump jokingly declared himself a sovereign last month, while his advisers distributed AI-generated photos of him wearing a crown and an ermine robe to celebrate his order to end congestion pricing in New York City. “He who saves his Country does not violate any Law,” he’d decreed a few days earlier, using a phrase sometimes attributed to Napoleon Bonaparte, the emperor of the French.

I had no idea one of my greats who signed the Declaration had made of the copies of it. But the weird thing here is that Trump seriously wants the document to hang in the Oval Office. My question is, why take it from the people who can see it in the archives?

I had no idea one of my greats who signed the Declaration had made of the copies of it. But the weird thing here is that Trump seriously wants the document to hang in the Oval Office. My question is, why take it from the people who can see it in the archives?

Since returning to power, Trump has moved quickly to redesign his working space. He has announced plans to pave over the Rose Garden to make it more like the patio at his private Mar-a-Lago club, as well as easier to host events with women wearing heels. He has also revived planning for a new ballroom on the White House grounds. “It keeps my real-estate juices flowing,” Trump explained in a recent interview with The Spectator.

Golden trophies now line the Oval Office’s mantlepiece. Military flags adorned with campaign streamers have returned. And portraits of presidents past now climb the walls—George Washington, Thomas Jefferson, John Adams, Martin Van Buren, Theodore Roosevelt, Franklin D. Roosevelt, and Ronald Reagan, among others. Gilded mirrors hang upon the recessed doors. A framed copy of his Georgia mug shot appears in the outside hallway. And the bright-red valet button, encased in a wooden box, is back on the desk.

In addition to the National Archives’ original Declaration, the government has in its possession other versions of the document. The collection includes drafts by Jefferson and copies of contemporaneous reprintings, known as broadsides, that were distributed among the colonies.

Alarmed by the deterioration of the original Declaration in the 1820s, Secretary of State John Quincy Adams commissioned William J. Stone to create an engraving of it with the signatures appended. That version forms the basis of the document since reproduced in school history books—the one with which most Americans are familiar. Adams tasked Stone with engraving 200 copies—but in what passes for a mini 19th-century scandal, Stone made an extra facsimile to keep for himself, the documents dealer and expert Seth Kaller told us.

Many of those Stone copies of the document have now been lost; roughly 50 are known to survive, Kaller said. The White House already has in its archives at least one of the Stone printings. Kaller told us that one of his clients who had recently purchased a Stone facsimile was visiting the White House when President Barack Obama asked him whether he could help procure a Stone printing for the White House.

“The client called me, and I said, ‘I can’t—because, one, there aren’t any others on the market right now, and two, the White House already has one,’” Kaller told us. In 2014, Kaller visited the White House to view the Stone Declaration, which the curator displayed for him in one of the West Wing’s rooms. (The White House curator’s office did not respond to multiple requests for comment, including on whether the Stone copy still resides under its purview.)

It is unclear where Trump first got the idea to add a Declaration to the Oval Office’s decor. Since returning, Trump has shown interest in the planning for celebrations next year of the 250th anniversary of the document’s signing. Days after taking office, he issued an executive order to create “Task Force 250,” a White House commission that will work with another congressionally formed commission to plan the festivities.

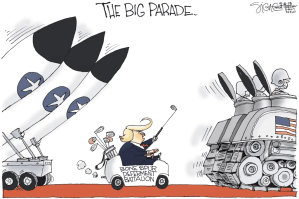

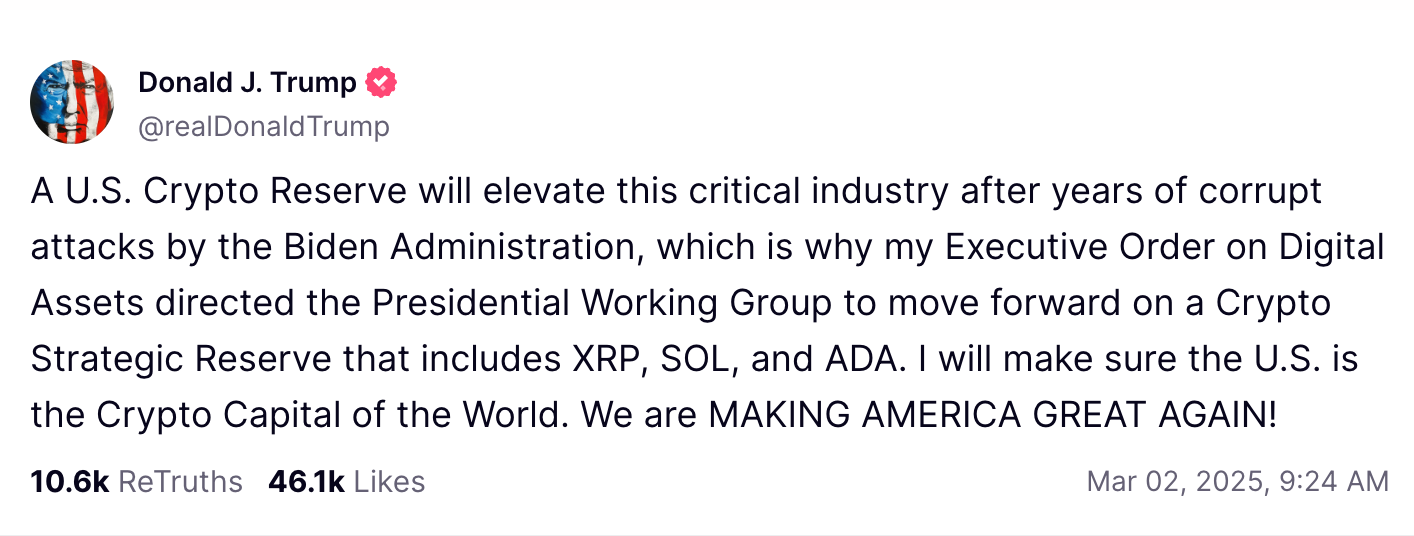

I hope he’s not trying to go with one of those grandiose military parades again. And if he does, will he eliminate everyone but the white guys? It can’t be anything other than another way for him to get attention, that’s for sure. Again, this all continues to be an appalling cosplay of how FARTUS wants to view himself in relation to his imagined ideas of American History. I can’t even with the economy today. Just know he’s changed his mind on tariffs again for Canada and Mexico, and employment figures are worsening. He’s turned a strong economy into a weak one in a matter of weeks. He’s also shaken the Equity markets to their core. What’s on is this: “Trump’s “Crypto Reserve” is a world historical grift. Corruption doesn’t get much more blatant than this.” My Finance Daughter and I both find crypto to be a huge Ponzi scheme. I lecture against it. She doesn’t consider it a product that brokers should be involved in. In short, we stay as far away as possible. But, you know, grifters gotta grift. This is from Public Notice.

Authoritarian regimes by definition have no accountability to voters or the public. That means autocrats and their cronies can gorge themselves at the public trough and blatantly steal from taxpayers with few if any consequences.

It’s not really a surprise, then, that as part of his authoritarian power grab, Trump has embraced brazen and open self-dealing. The most ludicrous example of this is the scheme he announced last Sunday for a national crypto reserve.

As with many of Trump’s big orange dreams, it’s not exactly clear what the crypto reserve will entail or how it will work. But the brilliance of the half-baked idea is that Trump and his cronies can make bank just by talking about it. The president can use his bully pulpit to manipulate markets. And who’s going to stop him?

Trump, fresh off avoiding 88 felony charges, obviously feels confident that the answer is “no one.”

Government on the blockchain

Crypto refers to digital currencies which are generated and stored in a digital ledger, or blockchain. In theory, cryptocurrencies do not rely on a central government authority. Proponents say they are useful for quick or anonymous transactions. Critics point out that cryptocurrency seems designed for hiding illegal transactions and/or creating what are essentially Ponzi investment schemes.

Because of the downsides, President Biden created moderate guidelines to try to regulate some of the worst excesses of the industry, which made him an enemy of hardcore crypto boosters. But Trump in his first term expressed even deeper skepticism about cryptocurrencies, saying they are based on “thin air.”

During the 2024 election, though, crypto investors spent tens of millions on Republican campaigns. Trump, who never saw a quid pro quo he didn’t love, changed his tune, embracing crypto-friendly policies. After his victory, he followed through by appointing venture capitalist and Elon Musk crony David Sacks as a White House crypto czar.

Another reason Trump flip-flopped on crypto is that his family figured out how to cash in. Following the election, Trump squandered some of the goodwill he had built up with the crypto industry when he and his wife Melania launched memecoins — essentially valueless crypto confidence games — that both surged in value, making the Trumps billions (but undermining the credibility of crypto in the process). That came after his two adult sons, Eric and Don Jr, launched their own crypto company during the campaign called World Liberty Financial. Boosting crypto as president, then, allows Trump and his family to profit directly from his public office.

Trump announced his thank you to the industry last Sunday, when he declared that he would create a “Crypto Strategic Reserve” in order to make the US “the Crypto Capital of the World.” He of course claimed the move is part of “MAKING AMERICA GREAT AGAIN.”

But the actual point of the crypto reserve, much less the details, are sketchy at best. Proponents argue crypto is a store of value, like gold, and could help damp inflation. But the major cryptocurrencies tend to rise and fall in value based on broader macroeconomic sentiment. And since crypto is volatile and, unlike gold, has no intrinsic value, it’s hard to credit its usefulness as a currency stabilizer.

If you have any questions about any of this, I’d be glad to try to answer them. Seeing such craziness in our economic policy has been hard on me. I’m just waiting for the major attack on the Federal Reserve Bank. They’re the only ones that bring credibility to the dollar these days, and I’m afraid he’ll have a go at them. The mess at the Treasury is already impacting the banking business. Don’t even get me started on the Budget Crisis, either. I’m tired of the repeats of that one by disingenuous Republicans.

I hope all of you can close your doors and stay sane inside the one place you can control, home. I have a few more tests next week, so I will be out at clinics again, being poked and prodded. This weekend, I will just relax and try to avoid the ever-changing Trump Surreality Show.

What’s on your reading and blogging list today?

My Jaded Crystal Ball

Posted: May 11, 2012 Filed under: Bailout Blues, Banksters, Equity Markets, financial institutions | Tags: Credit Default swaps, financial innovation, financing outside of TRACE, securitization 11 Comments Okay, this is wonky. I’ve been avoiding writing about securitization for awhile because it can even get the best of people that know financial markets. You may remember that some one asked me where the next bubble lurked and I said commodities. Now, that’s actually a dangerous place for a bubble because commodities are things you eat and things that make your house light up and your car run. The housing bubble pretty much wiped out middle class wealth in the west. What would a commodities bubble burst do in the right markets? Well, think Mad Max or at least The Grapes of Wrath. Conversely, it could lead to a massive drop in key prices like that of oil. Imagine that one!

Okay, this is wonky. I’ve been avoiding writing about securitization for awhile because it can even get the best of people that know financial markets. You may remember that some one asked me where the next bubble lurked and I said commodities. Now, that’s actually a dangerous place for a bubble because commodities are things you eat and things that make your house light up and your car run. The housing bubble pretty much wiped out middle class wealth in the west. What would a commodities bubble burst do in the right markets? Well, think Mad Max or at least The Grapes of Wrath. Conversely, it could lead to a massive drop in key prices like that of oil. Imagine that one!

Here’s some interesting finds from FT Alphaville on the securitization of commodities. It’s titled “The subpriming of commodities” for effect.

It’s always been common practice for commodity inventory to be financed by banks by being pledged as security for the loans in question.

The problem comes if such enterprises, instead of using the inventory for general business purposes, are encouraged to stockpile for the sole purpose of liquidity provision and the opportunity to punt on the underlying commodities themselves. It’s a process which arguably artificially pumps up demand for the underlying inventory.

Bundle all those loans together, meanwhile — ideally into a product that can be sold to buyside investors seeking exposure to commodities — and suddenly you’ve got a direct source of funding for an ever-more speculative game.

When it comes to the larger players, meanwhile, this arguably transcends ‘trade finance’ even further — especially if it involves the setting up of a large number of special purpose vehicles to accomplish the process.

Here, for example, are the thoughts of Brian Reynolds, chief market strategist at Rosenblatt Securities, regarding what’s going on:

A little more than a year ago we picked up on a trend that we termed the “sub-priming” of commodities. Wall Street has been increasingly been doing structured finance deals wrapped around commodities, and this has added a bid for them while also making them vulnerable to downdrafts.

We know that many equity investors think (or at least hoped) that, after the disastrous record of wrapping pipeline and telecom assets in the 1990’s and sub-prime housing in the last decade, financial market reforms such as Dodd-Frank would have eliminated structured finance as a macro driver. When Dodd-Frank was proposed it envisioned standardized derivatives being placed on exchanges and clearinghouse. We felt it would encourage more non-standardized, exotic, and opaque structures to be created, and in the two years since it was enacted that’s what seems to have happened.

Important trends indeed. Yet, as Reynolds also notes, they’re also very hard to quantify given they mostly occur off-balance sheet:

This process is virtually impossible to quantify. We know that’s a disappointment to equity investors who are used to dealing with voluminous information, but that’s the nature of structured finance. Many structured finance deals are private in nature. As such most people, even those in the credit markets, did not know the full extent of the structuring going on in the 1990’s or the last decade until those firms, which were trapped by “Special Purpose Vehicles” (SPVs), such as Enron, WorldCom and Citigroup, became forced sellers. But over the last year we’ve heard more and more anecdotal evidence of Wall Street increasingly structuring commodity deals, such as structured notes and swaps and even using commodities as collateral.

In Reynold’s opinion — even though he’s not a commodity expert per se — this activity significantly increases the risk of a sharp drop in oil in the coming year, especially since structured finance transactions usually come with caps and floors, which act as important support and resistance levels.

That’s an interesting analysis for oil or copper. However, what happens if the commodities in question happen to be food? The only place this used to happen significantly was the gold market. Actually, it’s understandable for oil too. But is Wall Street so hungry for financial innovation that they’re willing to bet the world’s food supply on it? Yes, of course. They’ve already done it several times. History teaches us that it drives the prices up to unreasonable and unsustainable levels that take all kinds of people down when prices collapse.

Here’s an interesting bit on a contango that happened in the wheat market that already led to a food price crisis in 2007-2008. This one had the Goldman Sachs brand all over it. Last year, a similar situation occurred with the Oil Market and the same player.

On Monday, April 11, Goldman Sachs told its clients to sell commodities, and the market reacted with a $4 tumble in the price of West Texas Intermediate (WTI) crude oil and sell offs in other commodities.

On Thursday, April 14, the leaders of the “BRICS” nations (Brazil, Russia, India, China and South Africa), meeting in Sanya, China, continued to press for a new world monetary system that has a much lower reliance on the dollar, and called for stronger regulation of commodity derivatives to dampen excessive volatility in food and energy prices.

We are in another commodity price run up, like that experienced in the 2005-2008 period. Such commodity price frenzies have devastating consequences for the world’s poor who, in some instances, already spend half of their income on food. Today, in the U.S. itself, the rise in the price of gasoline to more than $4 per gallon threatens an economy still struggling to free itself from the still lingering effects of the last bursting bubble.

It appears that the Western economic systems have become ever more volatile over the past decade. That is, bubbles, followed by severe contractions, are appearing more often and with increased severity. This is in stark contrast to the dampening of the business cycle we observed, and celebrated, in the 1980s and 1990s. So, what changed?

In Harper’s last July, Fredrick Kaufman wrote an article entitled The Food Bubble, which explained the reasons for the run up in agricultural commodity prices just prior to the ’08 financial meltdown and worldwide recession. The popular business media gave the article short shrift. But, most of what Kaufman observed as the causes of the commodity price run up in the ’05-’08 period is now being repeated, a short three years later.

I’m finding all this interesting as I watch Jamie Dimon squirm on the big hedge loss reported by JP Morgan. That’s the $2 billion mark to market loss that makes me thing we’re on the verge of 2007 redux. Specifically, the market concentration is incredible because “the whale” created a huge problem for tons of hedge funds. Also, the regulator appeared to be asleep at the switch. You remember are old friends the Credit Default Swaps?

99 per cent of all CDS trades live in an information warehouse called DTCC, to which the regulators of the banks have access in however much detail they want!!! What kind of regulator doesn’t go and look at the that, when the mere public, aggregated info shows this?

Go check out the accompanying graph.

Anyway, I’m not going to get long winded and all financial economist on you, but sheesh, how many times does history have to repeat itself in markets before we get some one to do something useful? I’m just reminded of all the little canaries that died on the way to the big 2007 blow up that people ignored. How many canaries have to die this time out before we get another big one

Vegas Gambling vs Wall Street Gambling

Posted: November 23, 2011 Filed under: Banksters, Economy, Equity Markets, financial institutions 5 CommentsOne of the things that has always struck me about folks that treat the financial sector like any other business venture is the lack of  understanding of what the finance sector really does. There are several basic functions if you read the literature. The banking industry originally evolved from goldsmiths that would safekeep gold for people. This eliminated the need for every one to keep a small army with them at all times to stop robbers from stealing all their gold. Goldsmiths eventually learned that a fairly sizable chunk of that gold never left their premises and found out they could lend some of it out for a return and not be caught short. That eventually lead them from being gold babysitters to lenders. Then, we eventually got around to trying to find some financial contracts that would help us if the worst happened by buying insurance. From these sets of agreements, we now have exotic derivatives, financial innovations, credit default swaps, and a host of other banking services. The basics things that the banking sector does is help you save or store up future purchasing power, borrow or lend purchasing power, and help move money around from place to place via the payment systems. That would be check clearing and ATMs and things like that. The Federal Reserve Bank was set up to handle that latter function but most of that function has been privatized since regional banks now clear checks and there are private clearing houses for Automated Payments. The Fed’s role is now fairly small. It still pushes cash from the US Mint/Treasury into the banking system and its FedWire system still handles a huge number of wire transfers between banks. If banks won’t lend to each other via the Fed Funds market, it is also available to lend money at the discount window. That used to be only available to member banks but it’s now open to a lot more institutions.

understanding of what the finance sector really does. There are several basic functions if you read the literature. The banking industry originally evolved from goldsmiths that would safekeep gold for people. This eliminated the need for every one to keep a small army with them at all times to stop robbers from stealing all their gold. Goldsmiths eventually learned that a fairly sizable chunk of that gold never left their premises and found out they could lend some of it out for a return and not be caught short. That eventually lead them from being gold babysitters to lenders. Then, we eventually got around to trying to find some financial contracts that would help us if the worst happened by buying insurance. From these sets of agreements, we now have exotic derivatives, financial innovations, credit default swaps, and a host of other banking services. The basics things that the banking sector does is help you save or store up future purchasing power, borrow or lend purchasing power, and help move money around from place to place via the payment systems. That would be check clearing and ATMs and things like that. The Federal Reserve Bank was set up to handle that latter function but most of that function has been privatized since regional banks now clear checks and there are private clearing houses for Automated Payments. The Fed’s role is now fairly small. It still pushes cash from the US Mint/Treasury into the banking system and its FedWire system still handles a huge number of wire transfers between banks. If banks won’t lend to each other via the Fed Funds market, it is also available to lend money at the discount window. That used to be only available to member banks but it’s now open to a lot more institutions.

Bankers usually make money by charging fees on their services, interest rates on their loans, and then they make arbitrage profits if they invest. For years, that last function wasn’t a big deal for bankers because laws stopped them from investing in anything very creative. Laws have changed a lot over the last 10-20 years and even if commercial banks can’t make risky investments, they are likely to be part of a bank holding company that owns some subsidiary that can. Allowing banks–who basically still have the role of “safekeeping”–to gamble has been a huge mistake. Besides the lax laws, they have had a lot of cheap cash available because of Greenspan’s relatively lose monetary policy during the last years of his tenure and they’ve been able to reduce their risk by having deposit insurance which covers their deposits in case of default. There has also been an increase in “financial innovations” and techniques which serve as pseudo insurance but generally come in the form of very hard-to-price assets so they can be risky. Many banks don’t use them just for hedging which is this risk management approach to their use. A lot of banks just plan gamble. We’ve definitely seen banks misjudge risk and rely heavily on what I would consider gambling activities.

So, I’ve worked back of the house at a casino and I’ve worked in banking and of course, I’m a financial economist so I’ve got a little knowledge and experience on all fronts. The one thing that I will say about gambling in a casino is that a good time is had by all, every one understands it’s gambling, and the gambling industry hires a lot of people in the process that do fairly straightforward jobs. They only get tips if the customers say so. Bonuses for random wins are de rigueur in the finance sector. Silly thing is that most financiers think they’ve actually earned those bonuses for doing some miracle. There’s a few good reads to let you know exactly how misguided they are on their opinions of their skills. The first is anything by Nassim Nicholas Taleb who is a practitioner of financial mathematics and a former Wall Street trader. His book “Fooled by Randomness” is just full of examples of the fallacies that drive Wall Street Bankers into thinking too highly of themselves and paying themselves based on gambling and randomly hitting the jackpot. You can also read anything by Nobel Prize winner Daniel Kahneman. Actually, you can watch them both talk about these things in a video at Edge in a program called Reflections on a Crisis.

Kahneman explains why there are bubbles in the financial markets, even though everyone knows that they eventually burst. The researchers used the comparison with the weather: If there is little rain for three years, people begin to believe that this is the normal situation. If over the years stocks only increase, people can’t imagine a break in this trend.

Taleb speaks out sharply against the bankers. The people in control of taxpayer’s money are spending billions of dollars. “I want those responsible for the crisis gone today, today and not tomorrow,” he says, leaning forward vigorously. The risk models of banks are a plague, he says, the bankers are charlatans.

It is nonsense to think that we can assess risks and thus protect against a crash. Taleb has become famous with his theory of the black swan described in his eponymous bestsellers described. Black swans, which are events that are not previously seen–not even with the best model. “People will never be able to control a coincidence,” he says.

Okay, so that’s actually the background to something I want to point you to on VOXEU called “What is the contribution of the financial sector?” by Andrew Haldane. I think it’s a good thing to look at because we need to establish some basic knowledge and laws that separate the speculative activities from the banking activities that actually may provide value. (Although I still could argue that privatizing the payments system may prove risky and foolish some day, there are some things that banks do that are useful.) This way we can see the damage done when so many politicians essentially empower the gambling aspects. Another offshoot is our tax policy which favorably treats capital gains without any reference to the source of the profit. People that run businesses that enhance economic welfare of every one are taxed at the same favorable rate as those that basically gamble resources away. That’s a very bad incentive system. Haldane points out the difference between managing risk of financial contracts and risk-taking that is basically gambling and how much of the Western nation’s financial sector has morphed more into a gambling sector than a financial services provider.

But crisis experience has challenged this narrative. High pre-crisis returns in the financial sector proved temporary. The return on tangible equity in UK banking fell from levels of 25%+ in 2006 to – 29% in 2008. Many financial institutions around the world found themselves calling on the authorities, in enormous size, to help manage their solvency and liquidity risk. That fall from grace, and the resulting ballooning of risk, sits uneasily with a pre-crisis story of a shift in the technological frontier of banks’ risk management.

In fact, high pre-crisis returns to banking had a much more mundane explanation. They reflected simply increased risk-taking across the sector. This was not an outward shift in the portfolio possibility set of finance. Instead, it was a traverse up the high-wire of risk and return. This hire-wire act involved, on the asset side, rapid credit expansion, often through the development of poorly understood financial instruments. On the liability side, this ballooning balance sheet was financed using risky leverage, often at short maturities.

This is an important statement because not only did political institutions loosen laws or not put in place laws to stop this from happening, but when it happened, we all paid and they’ve ignored how costly this was to every one else. Plus, they keep wanting us to sacrifice instead of the people that broke the economic growth machine. The basic narrative is that these folks gambled with others’ money and the government had to pay the house. This is wrong in every sense of what is and isn’t moral. Haldane argues that risk-taking is not a value-added activity for banks and backs it up with empirical evidence.

The financial system provides a number of services to the wider economy, including payment and transaction services to depositors and borrowers; intermediation services by transforming deposits into funding for households, companies or governments; and risk transfer and insurance services. In doing so, financial intermediaries take on risk. For example, when they finance long-term loans to companies using short-term deposits from households, banks assume liquidity risk. And when they extend mortgages to households, they take on credit risk.

But bearing risk is not, by itself, a productive activity. The act of investing capital in a risky asset is a fundamental feature of capital markets. For example, a retail investor that purchases bonds issued by a company is bearing risk, but not contributing so much as a cent to measured economic activity. Similarly, a household that decides to use all of its liquid deposits to purchase a house, instead of borrowing some money from the bank and keeping some of its deposits with the bank, is bearing liquidity risk.

Neither of these acts could be said to boost overall economic activity or productivity in the economy. They re-allocate risk in the system but do not fundamentally change its size or shape. For that reason, statisticians do not count these activities in capital markets as contributing to activity or welfare. Rightly so.

What is a demonstrably productive economic activity is the management of risk. Banks use labour and capital to screen borrowers, assess their creditworthiness and monitor them. And they spend resources to assess their vulnerability to liquidity shocks arising from the maturity mismatches on their balance sheets. Customers, in turn, remunerate banks for these productive services.

The current framework for measuring the contribution of financial intermediaries captures few of these subtleties. Crucially, it blurs the distinction between risk-bearing and risk management. Revenues that banks earn as compensation for risk-bearing – the spread between loan and deposit rates on their loan book – are accounted for as output by the banking sector. So bank balance-sheet expansion, as occurred ahead of the crisis, counts as increased value-added. But this confuses risk-bearing with risk management, especially when the risk itself may be mis-priced or mis-managed.

Markets (e.g. Herds of PEOPLE) aren’t very Rational a Lot of the Time

Posted: September 24, 2011 Filed under: Economy, Equity Markets | Tags: behavioral economics, behavioral finance, rational markets 7 CommentsOne of the primary reasons I didn’t do an investments specialization for my PHD in financial economics is the overwhelming and pervasive group think on Rational Expectations or what’s called the Efficient Market Hypothesis. I’ve never really bought into this. I think it is more an occasional circumstance or specific market behavior at that point when everything is going just dandy which is why I am more the sunspot equilibrium type. I never found compelling reasons for the efficient markets view to be considered an overarching framework for all circumstances. That kind of unorthodox outlook doesn’t buy you much print space in finance journals which means no tenure for you cupcake!! (Although for some reason I can get it passed reviewers when it’s couched in the term “bubble” which is so very sunspot.)

Economists have become a little more accepting of the warts and faults inherent in the hypothesis–notice it is still a hypothesis and not a theory–but finance people still have a tendency to worship at its alter. Economists started out as philosopher social scientists–which is also why the big money is in finance–so they’re a little more open to the idea that markets aren’t all that efficient all the time. I linked to the Wikipedia explanation of the idea for you which is adequate for our purposes. The deal is when you build rational expectations into an economics model or investment model this is what you assume.

To assume rational expectations is to assume that agents‘ expectations may be individually wrong, but are correct on average. In other words, although the future is not fully predictable, agents’ expectations are assumed not to be systematically biased and use all relevant information in forming expectations of economic variables.

This basically rules out wrong group think that won’t deny “relevant information”. If that was the case in reality, there would be no holocaust deniers, evolution deniers, climate change deniers, or flat earthers of substantial numbers to influence the average. Basically, we’d have to accept the “average” rationality of today’s Republican Party and given the existence, electability and popularity of Rick Santorum, Michelle Bachmann, and Ron Paul, I’ll rest my case and reject that. We have a major political party that’s basically a cult of irrationality these days.

There are two really important real life phenomenon that make that assumption look really bad in finance research. One is a little paradox called the Home Bias Puzzle where research has basically shown that most people will still buy investments from their own country despite the availability of better deals abroad. The second is momentum. This is the pack animal behavior in the market where you see something hit the market and suddenly every one is moving that direction when it doesn’t make much sense on a fundamentals level. This is when I sell all my stock holdings. The little voice inside of me will go: “wtf is this rally for? The economy isn’t all that great! I think I better get out of here before they realize they’re all on something!” This is how I’ve managed to remove my “ass”ets and avoid the major crashes since way back in the 1980s.

Whenever you get a financial crises or financial bubbles, you tend to get the panicked cow phenomenon in that if one is spooked the rest chase wildly along. They’ve even programed this behavior into their computers oddly enough. Oh, and btw, none of the strategies and no market guru like Cramer or Buffet or Jesus your neighborhood grocer could ever be right and beat the market consistently if the financial markets were truly rational and efficient. That’s another story, just accept my word for it right now.

I took an Advanced Investments Seminar because I had to for my final elective having no other choice and was subjected the entire semester to the work of Eugene Fama whose big fat head will be in Denver with me next month. Fama is considered the father of modern finance and efficient markets is his dogma. He’s one of the jerks that was drinking the two overly expensive bottles of wine with Paul Ryan that BB wrote about awhile back. The other jerk being his son in law John Cochrane whose asset pricing models always assume the same efficient markets hypothesis. The two of them have dominated finance for decades now and in my mind it’s held the entire field back and caused much damage in the real world. I had to recreate the research in many of Fama’s seminal papers and the most noticeable lunacy to me was how his data sets back then always skipped the Great Depression Era. His data sets usually involved equity market indices like the Dow Jones average during periods that excluded financial panics. That never struck me as honest, but then, I’m not one of the Finance gods–there really are no goddesses–and so I don’t really get a say.

Again, I don’t want to teach this stuff so I generally avoid classes where the textbooks ooze it. I inherited the sincerity gene from my father which causes me to go apostate on my students which may help their critical thinking skills but won’t further the ass-kissing group think skills required in today’s finance jobs. Also, I’m late to academic life and spent the 80s doing hedging, forecasting interest rates, pricing financial assets and liabilities, and generally surrounded by rational senior management thoughts like: “Gee, we’ll get bigger if we do this merger and I’ll get a bonus! Who cares if it drags our income and balance sheet into the depths of hell?” I can also give you examples from the 90s too. Irrational market decisions ooze from marketing divisions and departments daily.

So, behavioral finance and economics looks at the herd mentality that was originally identified as “animal spirits” by J.M. Keynes during the time period and stock market behavior that Eugene Fama likes to systematically ignore. Keynes didn’t have the luxury of skipping over the data of the Great Depression. The kind of apostate philosophy that drives me actually has a label and basically looks at decision making under risky and generally unpredictable situations. In a lot of cases, people don’t make decisions in these circumstances rationally. BB and I have been having some phone conversations about the topic because as a psychologist, she’s very interested in human behavior. Human behavior very much causes people to do different things under times of risk. Let’s face it, people and hence markets aren’t very rational a lot of the time when they’re panicked about losing their jobs, their businesses, their homes, and their savings. They’re a lot more efficient, rational decision makers when circumstances are not risky and unpredictable or when the biggest decision variables are messy and not well understood. Then, there’s the existence of powerful “deciders” who think their egos have a better understanding of alchemy than their necromancers and are on the look out for narratives to reinforce their beliefs. Remember the word narrative because it plays a big role here in where I’m going and where Robert J. Shiller went.

So, this background chat brings me to the topic of this blog post which is a project syndicate article by Robert J. Shiller who is a very well respected economist and dabbles in behavioral economics. He is well known for the Case-Shiller index which measures activity in the housing market in some key markets. (BTW, Case is a big sunspot equilibrium sort as is Douglas Diamond who the Republicans ran out of the District earlier this year.) I’ve taught out of his textbooks. He teaches at Yale and co-authored a book with Nobel Prize winning George “market for lemons” Akerlof called “Animal Spirits: How Human Psychology Drives the Economy and Why It Matters for Global Capitalism.”. His voice is important in this day and age of people chasing confidence fairies and reacting to events here and in Europe rather irrationally which frequently happens during periods of great uncertainty and increased risk.

I’m consistently amazed at the success of the narrative that Republicans have managed to push into the national psyche that we’re over taxed and that our national debt is horrendous as its never been before and that our children and grand children will be crushed by it. You even hear President Obama spew the stuff and he should know better given his ability to access any of the aforementioned economists by phone easily. As I’ve said before with the use of data and nifty graphs, the debt was far worse after World War 2, the tax rates far higher and none of us or the US economy was the worse for it. Really, would you have rather they not borrowed money to fight World War 2 and lived with those results instead? We had nothing but debt when started out as a country and also after the Civil War. As long as you have lots of really high quality assets and people and the power to tax and print money, it’s NO BIG DEAL! Greece does not have Bill Gates and Microsoft continually pumping out huge amounts of value. We have him and lots more like them! People have been reacting to ideological nonsense and narratives. We have a failure of governance and policy because of this. That’s hardly rational. It’s also causing bad effects in our home prices, the value of our savings, and our ability get and keep jobs.

So, here’s Shiller writing on “The Great Debt Scare” about how this ideological nonsense has shaken consumer confidence in both Europe and the U.S. causing a “perverse dynamic” that has been discouraging consumption and investment which has brought about economic weakness. What this basically shows is that the psychology of self-fulfilling prophecies is alive and well in financial markets. Rational Markets my swamp people ass!

We now have a daily index for the US, the Gallup Economic Confidence Index, so we can pinpoint changes in confidence over time. The Gallup Index dropped sharply between the first week of July and the first week of August – the period when US political leaders worried everyone that they would be unable to raise the federal government’s debt ceiling and prevent the US from defaulting on August 2. The story played out in the news media every day. August 2 came and went, with no default, but, three days later, a Friday, Standard & Poor’s lowered its rating on long-term US debt from AAA to AA+. The following Monday, the S&P 500 dropped almost 7%.

Apparently, the specter of government deadlock causing a humiliating default suddenly made the US resemble the European countries that really are teetering on the brink. Europe’s story became America’s story.

There is something—most likely hard wired–in people that creates highly irrational narratives ( we call them frames) to justify stuff that occurs even in the face of incredible evidence against the frame. It’s why there are so many evolution and climate change deniers. The narrative makes them feel better than the reality. We all edit out the data coming from those periods of intense irrationality–like Fama did with the Great Depression–to justify our pet juicy rationalizations. It’s like the post-trauma narrative you create to justify something you did when your lizard brain kicked in. Republican and so called conservative operatives seem to thrive on spinning lizard brain activity into parable like narratives to hone their advantage.

Changes in public confidence are built upon such narratives, because the human mind is very receptive to them, particularly human-interest stories. The story of a possible US default is resonant in precisely this way, implicating as it does America’s sense of pride, fragile world dominance, and political upheavals.

Indeed, this is arguably a more captivating story than was the most intense moment of the financial crisis, in 2008, when Lehman Brothers collapsed. The drop in the Gallup Economic Confidence Index was sharper in July 2011 than it was in 2008, although the index has not yet fallen to a lower level than it reached then.

So, what do these current confidence surveys tell us according to Shiller?

The timing and substance of these consumer-survey results suggest that our fundamental outlook about the economy, at the level of the average person, is closely bound up with stories of excessive borrowing, loss of governmental and personal responsibility, and a sense that matters are beyond control. That kind of loss of confidence may well last for years.

That said, the economic outlook can never be fully analyzed with conventional statistical models, for it may hinge on something that such models do not include: our finding some way to replace one narrative – currently a tale of out-of-control debt – with a more inspiring story.

So after our lizard brain causes fight or flight, the Captain Picard part of our brain tells us to make our narratives so. What we are building into our psyche is not any kind of analysis based on rational views of historical data, economic theory, or for that matter, common sense. What we are building into our psyche is a narrative that isn’t very rational and that’s impacting our behavior and the behavior of markets. Now, if we could just stop the press from reinforcing all the irrational crap out and about these days maybe we could sit down, take a few deep breaths, and peel back the layers of skin on the onion of those destructive narratives. Think about it. Yes, the Garden of Eden story is a great narrative, but what explains the carbon dating data on rocks, the dinosaur bones, and the vast existence of several varieties of protohumans’ remains better? Dinosaurs and Neanderthals in the Garden of Eden with Adam and Eve (not Steve or Lilith) or the Big Bang THEORY and the THEORY of evolution? What explains the financial crisis and the fallout better? The narrative that it’s too much government debt, too high taxes, and too much regulation that were all at much lower levels now than after the World War 2 economic boom or excessive speculation in the markets and exotic, difficult to price, unregulated derivatives, NINJA loans, government encouragement of monopoly and oligopoly power, and fiscal policy known to suppress economic growth? Your choice. Theory or comforting bed time tale.

Helluva Weekend doesn’t even cover the outrage heard around the country. However, it appears it’s getting a little late in the game to shut down this offensive move on the American Experiment. Just seeing the polling and the angry constituents all over the country over the Zelinsky Shake Down should’ve lit a fire under the proud party of Chicken Hawks. It didn’t. We have more evidence of chickens than hawks. This is also part of The Bulwark’s Monday Money Quarter-backing.

Helluva Weekend doesn’t even cover the outrage heard around the country. However, it appears it’s getting a little late in the game to shut down this offensive move on the American Experiment. Just seeing the polling and the angry constituents all over the country over the Zelinsky Shake Down should’ve lit a fire under the proud party of Chicken Hawks. It didn’t. We have more evidence of chickens than hawks. This is also part of The Bulwark’s Monday Money Quarter-backing. If you think that’s bad, check out the opinions of House Leader Mike Johnson. No Republican has been left out of this party. Heather Cox Richardson has another example of Mike Johnson’s inability to lead or take a stand for our country. He’s staked out the coward’s gavel. She wrote this yesterday in her Substack

If you think that’s bad, check out the opinions of House Leader Mike Johnson. No Republican has been left out of this party. Heather Cox Richardson has another example of Mike Johnson’s inability to lead or take a stand for our country. He’s staked out the coward’s gavel. She wrote this yesterday in her Substack  Jen Ruben writes this at

Jen Ruben writes this at  Whatever funds they’ve raised by the deaths and disposal of humanity, they will turn over to Greedy Billionaires and Businesses. However, the focus right now is still on

Whatever funds they’ve raised by the deaths and disposal of humanity, they will turn over to Greedy Billionaires and Businesses. However, the focus right now is still on  So, I will get to some of the economic impact of Trump’s Tariff Mania. I hope you don’t need a new car, just for starters. This is from

So, I will get to some of the economic impact of Trump’s Tariff Mania. I hope you don’t need a new car, just for starters. This is from From the

From the So, if you can’t say you’re cutting all these things to end runaway government spending, try not reporting it. That might work, right? This is from the relentlessly brave AP.

So, if you can’t say you’re cutting all these things to end runaway government spending, try not reporting it. That might work, right? This is from the relentlessly brave AP.  Yahoo Finance

Yahoo Finance

Recent Comments