Broken Windows And The Stealing Of Hearts

Posted: March 8, 2012 Filed under: Bailout Blues, Banksters, Corporate Crime, corruption, Department of Homeland Security, Domestic Policy, double-speak, Economy, Eric Holder, ethics, financial institutions, George W. Bush, Global Financial Crisis, indefinite detention, Injustice system, Patriot Act, The Bonus Class, The Great Recession, torture, U.S. Economy 21 Comments Yesterday I read an interesting essay by William Black over at New Economic Perspectives. In the essay, Black, who headed the forensic audit team during the S&L crisis, pulls forward the Broken Window Theory, a criminological model based on a simple and some have said simplistic idea. The theory was introduced by James Q. Wilson and received a fair amount of popularity during the 1990s, particularly in conservative circles.

Yesterday I read an interesting essay by William Black over at New Economic Perspectives. In the essay, Black, who headed the forensic audit team during the S&L crisis, pulls forward the Broken Window Theory, a criminological model based on a simple and some have said simplistic idea. The theory was introduced by James Q. Wilson and received a fair amount of popularity during the 1990s, particularly in conservative circles.

Readers might remember Rudy Giuliani’s ‘war against graffiti,’ his zero-tolerance campaign in NYC. That effort, the elimination of the squeegee men and the crack down on street prostitution among other things were based on the broken window philosophy, which uses an abandoned building metaphor.

Imagine a building in any neighborhood [although Wilson focused exclusively on what he termed ‘blue-collar crime.’] The first broken window of our abandoned building if left unrepaired sends a clear message to antisocial types: no one cares about this building. So, it’s open season on all the other windows, on anything of value that’s been left behind. If the owner doesn’t care about the integrity of the building then the street tough is encouraged to vandalize and take whatever’s not nailed down.

The attitude feeds on itself or so the theory goes. Honest citizens are less likely to confront the petty thief, which only encourages others to act out in destructive, antisocial ways. Honest citizens begin to feel overwhelmed and outnumbered and stop safeguarding their own neighborhoods. What’s the point? they say. No one cares. Communities begin to self-destruct.

Now whether you buy into this crime theory or not, I think the metaphor holds when you consider what we’ve been witnessing in the degradation of our financial markets, our legal system, even the refusal to admit that ‘there’s trouble in River City.’

As Professor Black points out, if we were to take Wilson’s theory and apply it to the explosion of ‘white collar crime’ within our financial system, it would be a major step in restoring the integrity of our system and bolstering peer pressure against misconduct. As it stands now, Wall Street movers and shakers and their DC handmaidens have implemented business-as-usual policies that reward the thief and punish the whistleblower. As Black points out in the essay:

We have adopted executive and professional compensation systems that are exceptionally criminogenic. We have excused and ignored the endemic “earnings management” that is the inherent result of these compensation policies and the inherent degradation of professionalism that results from allowing CEOs to create a Gresham’s dynamic among appraisers, auditors, credit rating agencies, and stock analysts. The intellectual father of modern executive compensation, Michael Jensen, now warns about his Frankenstein creation. He argues that one of our problems is dishonesty about the results. Surveys indicate that the great bulk of CFOs claim that it is essential to manipulate earnings. Jensen explains that the manipulation inherently reduces shareholder value and insists that it be called “lying.” I have seen Mary Jo White, the former U.S. Attorney for the Southern District of New York, who now defends senior managers, lecture that there is “good” “earnings management.”

My husband had some unsettling experience in this area. Early in his career, he worked as a CPA [the two companies will remain nameless]. But in each case, he was ‘asked’ to clean up the numbers, make them look better than they were. He refused and found himself on the street, looking for employment elsewhere. I remember him saying at the time, ‘Look, I’m a numbers guy. I’ve never been good at fiction writing.’ This was back in the late 70s early 80s, so this attitude has been a long time in the making. Now, we’re seeing accounting fraud that is literally off the charts. Is it any wonder the country’s financial system is on life support?

But in each case, he was ‘asked’ to clean up the numbers, make them look better than they were. He refused and found himself on the street, looking for employment elsewhere. I remember him saying at the time, ‘Look, I’m a numbers guy. I’ve never been good at fiction writing.’ This was back in the late 70s early 80s, so this attitude has been a long time in the making. Now, we’re seeing accounting fraud that is literally off the charts. Is it any wonder the country’s financial system is on life support?

We can see the destructive results of this careless, corrupt posturing all around us. Professor Black continued:

Fiduciary duties are critical means of preventing broken windows from occurring and making it likely that any broken windows in corporate governance will soon be remedied, yet we have steadily weakened fiduciary duties. For example, Delaware now allows the elimination of the fiduciary duty of care as long as the shareholders approve. Court decisions have increasingly weakened the fiduciary duties of loyalty and care. The Chamber of Commerce’s most recent priorities have been to weaken Sarbanes-Oxley and the Foreign Corrupt Practices Act. We have made it exceptionally difficult for shareholders who are victims of securities fraud to bring civil suits against the officers and entities that led or aided and abetted the securities fraud. The Private Securities Litigation Reform Act of 1995 (PSLRA) has achieved its true intended purpose – making it exceptionally difficult for shareholders who are the victims of securities fraud to bring even the most meritorious securities fraud action.

Reading this, I immediately sensed we could apply the metaphor just as easily to our legal predicament. Dak wrote to this yesterday—about the disheartening disrepair of our justice system, which was badly wounded during the Bush/Cheney years with the help of eager lawyers like John Yoo, stretching, reinterpreting, rewriting the parameters on the subjects of torture, indefinite detention, rendition, etc.

Not to be outdone, Eric Holder stood before Northwestern University’s Law School the other day and with the same twisted logic, explained away due process, otherwise known as ‘how to justify assassination.’ In this case, American citizens, those the President deems are a threat to the Nation, can be killed on native ground or foreign soil. Jonathon Turley, law professor at George Washington University and frequent legal commentator in the media, headed a recent blog post as follows: Holder Promises to Kill Citizens with Care.

Sorry, this does not make me feel better. What it does make me think is lawlessness simply breeds more lawlessness. The Broken Window theory writ large. As Turley explained:

The choice of a law school was a curious place for discussion of authoritarian powers. Obama has replaced the constitutional protections afforded to citizens with a “trust me” pledge that Holder repeated yesterday at Northwestern. The good news is that Holder promised not to hunt citizens for sport.

Holder proclaimed that “The president may use force abroad against a senior operational leader of a foreign terrorist organization with which the United States is at war — even if that individual happens to be a U.S. citizen.” The use of the word “abroad” is interesting since senior Administration officials have asserted that the President may kill an American anywhere and anytime, including the United States. Holder’s speech does not materially limit that claimed authority. He merely assures citizens that Obama will only kill those of us he finds abroad and a significant threat. Notably, Holder added “Our legal authority is not limited to the battlefields in Afghanistan.”

Turley went on to comment that Holder was vague, to say the least, when it came to the use of these ‘new’ governmental/executive powers, claiming that the powers-that-be will only kill citizens when:

“the consent of the nation involved or after a determination that the nation is unable or unwilling to deal effectively with a threat to the United States.”

And as far as ‘due process?” Holder declared that:

“a careful and thorough executive branch review of the facts in a case amounts to ‘due process.’”

Chilling! As Turley grimly noted in an earlier post, this is no longer the land of the free.

Seemingly unrelated was this report from the New York Times: the heart of Dublin’s 12th-century patron saint was stolen earlier this week from Christ’s Church Cathedral. The heart of Laurence O’Toole had been housed in a heart-shaped box, safely secured [or so church authorities believed] within an iron cage. The relic’s disappearance was preceded by a rash of reliquary robberies from churches, monasteries and convents around Ireland. According to the article:

The small cage hosting the heart-shaped box containing the relic was tucked away in an innocuous alcove at the side of a small altar. Visitors to the cathedral on Monday stared at the twisted bars and the empty space behind. The bars themselves were sundered evenly.

According to Dermot Dunne, dean of Christ Church, the box had lain undisturbed for centuries. He had no idea why someone would take it.

Whether it’s the heart of a saint or the heart of a Nation, the theft is a grievous insult. The crime betrays the public trust and our basic sense of decency. But the thieves of O’Tooles’s heart performed a curious act before exiting.

The Irish culprits lit candles at two of the Cathedral’s altars. Which means the perpetrators possessed, at the very least, an ironic sense of tradition.

The same cannot be said of our homegrown hooligans. Crass greed and the lust for unlimited power have their own dark tradition. As Americans, we do not expect vice to be confused with virtue. In the past, we could not imagine a blatant disrespect for the Rule of Law–crimes ignored, excused, then openly declared necessary for whatever raison du moment.

Not here, we told ourselves repeatedly. Not in the United States.

Perhaps, we should light candles of our own. A small devotion for the lost and dying.

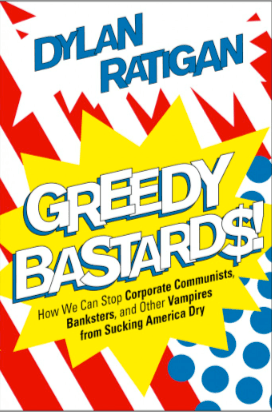

Greedy Bastards

Posted: January 26, 2012 Filed under: Banksters, commercial banking, Corporate Crime, corruption, financial institutions, Global Financial Crisis, investment banking, lobbyists, U.S. Economy, U.S. Politics | Tags: Dylan Ratigan, extractionism vs capitalism, Greedy Bastards 15 CommentsNo, I am not making an editorial comment.

But after nonstop blathering served up by the GOP, only to be followed by President Obama’s Teddy Roosevelt impersonation [although I have to admit—the State of the Union was a surprisingly good speech], I thought a moment of palate cleansing might be in order. In this case Dylan Ratigan offers up the sorbet.

Ratigan is someone willing to call out the shysters, the casino players and shakedown artists, including their political handmaidens for what they truly are, and ‘Greedy Bastards’ is the title of his newly released book. The author’s name may ring a bell because Dylan Ratigan has a public platform on MSNBC, an hour-long show Monday through Friday. The program airs at 4:00 pm, EST, in my neck of the woods.

Ratigan’s slant focuses on the collision of worlds, that of finance and politics, how the incestuous relationship is literally squeezing the life out of the United States. His take is not an indictment of capitalism. Rather it is an indictment of what is posing as capitalism, a system he refers to as ‘extractionism.’

Ratigan is not a newcomer or a pundit simply reading a script. He worked the financial beat with Bloomberg News, serving as Global Managing Editor to Corporate Finance until 2003. He’s also the former anchor and co-creator of CNBC’s Fast Money. He has launched and anchored a number of financially-related broadcasts over the years but decided to leave Fast Money after the 2008 financial meltdown. Ratigan has publicly stated that he was personally disgusted by the Wall Street banking sector’s shakedown of the American public. The Dylan Ratigan Show was launched to provide discussion and analysis of the financial/government intersection, a system that has acquiesced to the wanton theft of the Nation’s wealth and resources by . . . Greedy Bastards, of course.

Though the show has been on air for three years, Ratigan has admitted that his voice was finally heard after an infamous meltdown last August. It was an on-air rant that would have made Patty Chayefesky proud, a Howard Beale moment.

That woke people up! It also led to Ratigan’s Get the Money Out [of politics] Movement, working towards a Constitutional Amendment to remove the corrosive element of money in the political sphere. And then, there’s the book.

One thing I liked about Ratigan’s approach is that instead of pointing out one segment of the population for public pillorying, his title basically refers to a state of mind and the all too frequent way of doing business and politics in the 21st century.

For instance, in the case of capitalism, Ratigan uses the example of venture capital, a subject that has come up in reference to Romney’s connection to Bain & Company, specifically Bain Capital. From Chapter 1:

If I start a venture capital firm that lends out money to drug researchers trying to find new cures for disease, and I get rich doing it, then I made my money by investing in the productive future of the country. I used my money in a way that facilitated scientific innovation and a cure. I’m what the director of the Havas Media Lab Umair Haque a ‘capitalist who makes.’ But instead, if I take the same money and use it to lobby for changes in government regulation—changes that help me trick a union into investing its retirement savings in flawed investments so that I can collect the commissions—then I may move as many dollars into my bank account as someone who funded cures for diseases, but I haven’t made anything. I’m a ‘capitalist who takes,’ exploiting my power to influence the government for my own private gain, no matter the harm to anyone else. I’m a greedy bastard.

The latter example, taking money from others without providing anything of value is, according to Ratigan, the opposite of capitalism. An extractionist system loses increasing value over time until there’s nothing left. Call it the vampire or vulture model. A system based on the extractionist principle, provides no incentive for people to make good deals, where both sides benefit. Instead, it rewards those who take and give nothing in return.

Sound familiar?

Ratigan covers the areas that have pushed the extractionist model to the max: banking, education, healthcare, energy, trade negotiations and the unholy alliance of government and big money fueling the feeding frenzy of the Nation’s resources and our future. But unlike many gloom and doom tomes, Ratigan offers solutions and brings an optimism to the subject, namely that we have the ideas, the people and yes, even the money to solve what at times seems insolvable. He concludes in a rather convincing way that what is needed is a realignment between investment and the needs of capable, innovative people. If loans and investments offered the highest returns when they provided the highest value as opposed to simply taking the highest risk, then prevailing attitudes and business practices would shift and win/win deals would be created.

Sound like pie in the sky? I don’t think so. Yes, it’s a matter of will, public pressure to exact the necessary changes but this realignment idea is possible by citing the goals first, and then targeting the resources to get there. Ratigan refers to this as hotspotting—zeroing in on the problem, determining what methodology provides the best results, and then aiming resources to match those needs.

Sound like pie in the sky? I don’t think so. Yes, it’s a matter of will, public pressure to exact the necessary changes but this realignment idea is possible by citing the goals first, and then targeting the resources to get there. Ratigan refers to this as hotspotting—zeroing in on the problem, determining what methodology provides the best results, and then aiming resources to match those needs.

Though some critics have dismissed this idea, it is very attuned to what Bill Clinton recently suggested in his Esquire interview about highlighting the successes and needs across the country, and then linking them, matching them up. Just another turn on the realignment idea:

. . . the two best things you could do are the infrastructure bank and a simple SBA-like loan guarantee for all building retrofits, where the contractor or the energy-service company guarantees the savings. So that allows the bank to loan money to let a school or a college or a hospital or a museum or a commercial building or factories for lease unencumbered by debt to loan it on terms that are longer, so you can pay it back only from your utility savings. You could create a million jobs doing that because of the home models that are out there now.

There are these two guys on Long Island who started a little home-repair deal. They got thirty-five employees now, and they’re — they can go in, tell you how much they’ll save you. There’s an operation in Nebraska that’s in and out in a day, and they’re averaging more than 20 percent savings, and conservative Republican Nebraska is the only state in the country that has 100 percent publicly owned power.

And,

You’ve got Orlando with those one hundred computer-simulation companies. They got into computer simulation because you have the Disney and Universal theme parks, and Electronic Arts’ video-games division. And the Pentagon and NASA desperately need simulation, for different reasons. So there you’ve got the University of Central Florida, the biggest unknown university in America, fifty-six thousand students, changing curriculum, at least once a year, if not more often, to make sure they’re meeting whatever their needs are, and they’re recruiting more and more professors to do this kind of research that will lead to technology transfers to the companies. You’ve got Pittsburgh actually becoming a real hotbed of nanotechnology research. You’ve got San Diego, where there are more Nobel-prize-winning scientists living than any other city in America. You’ve got the University of California San Diego and other schools there training people to do genomic work. Qualcomm is headquartered there, and there are now seven hundred other telecom companies there, and you’ve got a big private foundation investing in this as well as the government, and nobody knows who’s a Republican or who’s a Democrat, they’re just building this networking.

We have fabulously innovative, creative people working on all kinds of things. Our true wealth is in our people; our true value is . . . us.

Ratigan is now on a 30-million jobs tour showcasing business enterprises that are, in fact, answering a need, offering value to their communities, providing jobs and in the best capitalist tradition—making a profit.

The endnote is that the country hasn’t lost its edge. We’ve lost the path that works, the one that values quality and integrity. Greedy Bastards will always exist, those hoping to make a quick buck [or trillions of bucks] off the backs of others. They have no shame. The goal is to make them and their thievery the exception, not the rule.

Btw, Ratigan’s book is highly readable, written for the layperson. No economic degrees required. If you’ve been following the financial blowout and/or Ratigan’s show, this will be a fast review. If you’re just starting to pay attention, consider the book a primer—what the country underwent and where we need to go. The sooner, the better. Ratigan encourages us to reclaim our voice, demanding that our people and country come first.

It’s a worthy message. Read the book. Get the word out.

Is This the Conversation We’ve Been Waiting For . . . Or Not?

Posted: January 14, 2012 Filed under: #Occupy and We are the 99 percent!, 2012 primaries, Banksters, Congress, Corporate Crime, corporate money, Economy, income inequality, Regulation, Republican Tax Fetishists | Tags: crony capitalism, Financial Crisis, Mitt Romney, Newt Gingrich, U.S. Economy 22 CommentsThe recent brouhaha over Newt Gingrich and Mitt Romney locking horns over Romney’s involvement [I created 100,000 jobs] at Bain Capital  has raised speculation that a conversation about capitalism, the way it’s been practiced these last 30-40 years, is about to commence, a conversation that is way overdue.

has raised speculation that a conversation about capitalism, the way it’s been practiced these last 30-40 years, is about to commence, a conversation that is way overdue.

The irony is that the issue has been brought to the fore by Republican candidates, none of whom questioned the blowback of leveraged buyouts [LBO] and private equity firms in the past or even whispered the traitorous phrases–crony capitalism, vulture capitalism–in public. In fact, the centerpiece of GOP economic theory is free market fundamentalism—set the market free, unfetter business from governmental regulation and Heaven’s Gate will open.

Not quite.

There’s the 2008 meltdown to contend with, the abuses of Wall Street and a clear example that Greenspan’s ‘self-regulating’ market theory was a cruel and greedy joke. Following the meltdown, Greenspan himself glumly admitted his worldview was incorrect.

In addition, we have plenty of evidence that the so-called Trickle-Down philosophy has not ‘raised all ships’ as heralded by the true believers but rather led to huge income disparities, flat wages and the death-rattle of the middle-class.

Yes, there is the question of globalization. Like it or not, we have grown interconnected. But when decisions are made purely on profit, the quicker the better, then transferring manufacturing abroad, exploiting cheap foreign labor, taking advantage of lax worker safety rules and nonexistent environmental regulations begins to make a twisted sort of sense. So, too with trade agreements made deliberately lopsided and unfair because these ‘deals’ have no national loyalty. Profit is king; all else is subservient.

The long-term damage is massive. We don’t have to speculate about this. The evidence is everywhere in our unemployment numbers [which are far worse than reported] and the slide into poverty for alarming numbers of Americans. Add in the housing crisis, still escalating health care costs, the Gulf oil spill, endless wars, the battles over extracting oil, coal and natural gas while refusing to work on rational and workable alternative energy policies, and . . .

Well, it’s enough to make your head explode.

But suddenly, the door has flown open for a conversation on what it means to be a shareholder capitalist. The unquestioned virtue of profit over all else has begun to raise its ugly head.

For instance, what value [if any] is created for a society when money is valued above all else, valued over the welfare of fellow citizens–the sick, the disabled, even our children. What value is maintained when corners are cut, laws rewritten, ridiculous tax policies hyped as necessary for growth and future job creation? But the mythical jobs, positions offering a living wage, never come. What does it mean when massive profits stream only to the top tier of the population, the so-called job creators, while everyone and everything else is left to flounder?

I call it a no-value deal–a lie, a theft–the magnitude of which hollows out a society, sucks it dry.

For too long Newt Gingrich [for all his caterwauling now] and his like-minded buddies have called it the free enterprise system. Free for whom? Certainly not for the families who have lost their homes, seen their jobs exported and have no reasonable expectation that their own children will ever see better times. Not with the continuation of what Dylan Ratigan has termed Extractionism, a system that takes money from others without offering anything of value, anything that actually promotes growth or improves society. This is a system that merely fills the coffers of the Extractionists, while they play a heady game of King of the Mountain and continue to spread the folklore that this is what freedom and liberty look like.

But let’s be fair. Mitt Romney is not the devil incarnate, nor is Bain Capital the worst of the worst. Much of what Newt Gingrich’s SuperPac is selling to the electorate conveniently let’s Wall Street and multinational corporations off the hook. The ads fail to mention the cushy collusion of legislators who push laws and tax breaks to keep the circle spinning. And Washington Democrats who may be dancing the happy dance now are just as guilty of supporting the status quo, going along to get along, eagerly taking campaign donations from their own smiling Extractionists.

But let’s be fair. Mitt Romney is not the devil incarnate, nor is Bain Capital the worst of the worst. Much of what Newt Gingrich’s SuperPac is selling to the electorate conveniently let’s Wall Street and multinational corporations off the hook. The ads fail to mention the cushy collusion of legislators who push laws and tax breaks to keep the circle spinning. And Washington Democrats who may be dancing the happy dance now are just as guilty of supporting the status quo, going along to get along, eagerly taking campaign donations from their own smiling Extractionists.

Is this the conversation Republicans are offering?

Sorry, no.

Rush Limbaugh has been apoplectic on the issue. According to Limbaugh, Gingrich has ‘Gone Perot.’

So you might say that Newt now has adopted the Perot stance, because he just said it: ‘I’m gonna make sure that Romney doesn’t come out of New Hampshire with any momentum whatsoever.’ And he’s using language that the left uses, and he’s attempting to make hay with this. You know, he’s trying to dredge up and have long-lasting negatives attach to Romney [this is what’s so unsettling about this] in the same way the left would say it. You could, after all these bites, say, “I’m Barack Obama, and I approve this message.

Rudy Giuliani also weighed in.

What the hell are you doing, Newt?” Giuliani said this morning on “Fox and Friends.” “The stuff you’re saying is one of the reasons we’re in this trouble now.

This whole ignorant populist view of the economy that was proven to be incorrect with the Soviet Union with Chinese communism.

Oh yes, the ‘ignorant populist’ view that has beamed a light on business as usual. Which btw, is not working, except for a tiny fraction of the American public. If anything, Uncle Newt has pulled back the curtain and revealed an unsettling truth.

This might not be the full-throated conversation Americans need to engage in. Still it’s a beginning from a most unexpected quarter, whose raison d’etre is as caught up in short-term results as are its economic principles. Almost Occupy Wall St. in nature, the conversation is now in the open. This is a conversation that defies Mitt Romney’s suggestion that sensitive subjects are better left to the privacy of ‘quiet rooms.’

This is the conversation of the moment. The first word, the opening sentence. It has just begun.

Have We Died and Gone to Heaven?

Posted: December 14, 2011 Filed under: #Occupy and We are the 99 percent!, Banksters, Congress, Corporate Crime, corruption, Democratic Politics, legislation | Tags: 2011: days of revolt, Financial Crisis, Rule of Law 5 CommentsJust read a heads-up from OpEd News that Tammy Baldwin [WI] has proposed H.Con Res. 85 for consideration to prevent any Wall Street settlement[s] and/or immunity against criminal or civil charges, where fraud [aka criminal activity] is indicated, requiring investigation and subsequent prosecution by Federal and state authorities.

Halleluiah!

This is in addition to the investigations that Attorney Generals Eric Schneiderman [NY], Beau Biden [DE], Martha Coakley [MA], Catherine Cortez Masto [NV] and Karmala D. Harris [CA] are pursuing in the mortgage foreclosure crisis, namely robosigning, origination and securities fraud, as well as NY District Court Judge Jed Rakoff, who notably [and bravely] refused to sign off on a ‘deal’ between the SEC and Citigroup in another case involving securities fraud.

Forty-eight representatives have signed to co-sponsor the proposed bill. I think it’s safe to say that the Occupy Wall St. Movement has had an impact, voicing the concerns and anger of the 99%, the ordinary citizen, all of us, who would be thrown into the clink for breaking the law. Particularly for brazen theft. Yet bank CEOs and managers, mortgage servicers, realtors, accountants, lawyers and variety of regulators and auditors have been routinely given a pass [get out of jail card[.

Dare I say our lawmakers are finally listening? Let’s hope so because unless the Rule of Law is re-established unequivocally there can be no faith in the system. The Law applies to all or it is invalidated, applying to none.

Thumbs up to Congresswoman Baldwin [who is running for the Wisconsin Senate seat in 2012] and her colleagues listed below. If one of these gentlemen or gentlewomen represent your district, an appreciative email might be in order. If your representative’s name does not appear you may want to send a questioning email or pick up the phone–just to say ‘hello’ and btw why aren’t you supporting The Rule of Law?

Those of us not in the streets, still have our voices.

Let them be heard.

Rep. Earl Blumenauer [OR]

Rep. Michael Capuano [MA]

Rep. David Cicilline [RI]

Rep. Steve Cohen [TN]

Rep. John Conyers [MI]

Rep. Elijah Cummings [MD]

Rep. Danny Davis [IL]

Rep. Peter DeFazio [OR]

Rep. Keith Ellison[MN]

Rep. Bob Filner[CA]

Rep. Marcia Fudge [OH]

Rep. Raul Grijalva [AZ]

Rep. Luis Gutierrez [AZ]

Rep. Janice Hahn [CA]

Rep. Alcee Hastings [FL]

Rep. Rep. Maurice Hinchey [NY]

Rep. Rush Holt [NJ]

Rep. Michael Honda [CA]

Rep. Jay Inslee [WA]

Rep. Jesse Jackson [IL]

Rep. Henry Johnson [GA]

Rep. Marcy Kaptur [OH]

Rep. Dennis Kucinich [OH]

Rep. James Langevin [RI]

Rep. John Larson [CT]

Rep. Barbara Lee [CA]

Rep. Edward Markey [MA]

Rep. Doris Matsui [CA]

Rep. James McGovern [MA]

Rep. Gwen Moore [WI]

Rep. Grace Napolitano [CA]

Del. Eleanor Norton [DC]

Rep. John Olver [MA]

Rep. Mike Quigley [IL]

Rep. Bobby Rush [IL]

Rep. Loretta Sanchez [CA]

Rep. Janice Schakowsky [IL]

Rep. Louise Slaughter [NY]

Rep. Michael Thompson [CA]

Rep. John Tierney [MA]

Rep. Edolphus Towns [NY]

Rep. Niki Tsongas [MA]

Rep. Maxine Waters [CA]

Rep. Lynn Woolsy [CA]

UPDATE: Just received an email indicating that cosponsors now number 50 [don’t have the additional names].

Recent Comments