My Jaded Crystal Ball

Posted: May 11, 2012 Filed under: Bailout Blues, Banksters, Equity Markets, financial institutions | Tags: Credit Default swaps, financial innovation, financing outside of TRACE, securitization 11 Comments Okay, this is wonky. I’ve been avoiding writing about securitization for awhile because it can even get the best of people that know financial markets. You may remember that some one asked me where the next bubble lurked and I said commodities. Now, that’s actually a dangerous place for a bubble because commodities are things you eat and things that make your house light up and your car run. The housing bubble pretty much wiped out middle class wealth in the west. What would a commodities bubble burst do in the right markets? Well, think Mad Max or at least The Grapes of Wrath. Conversely, it could lead to a massive drop in key prices like that of oil. Imagine that one!

Okay, this is wonky. I’ve been avoiding writing about securitization for awhile because it can even get the best of people that know financial markets. You may remember that some one asked me where the next bubble lurked and I said commodities. Now, that’s actually a dangerous place for a bubble because commodities are things you eat and things that make your house light up and your car run. The housing bubble pretty much wiped out middle class wealth in the west. What would a commodities bubble burst do in the right markets? Well, think Mad Max or at least The Grapes of Wrath. Conversely, it could lead to a massive drop in key prices like that of oil. Imagine that one!

Here’s some interesting finds from FT Alphaville on the securitization of commodities. It’s titled “The subpriming of commodities” for effect.

It’s always been common practice for commodity inventory to be financed by banks by being pledged as security for the loans in question.

The problem comes if such enterprises, instead of using the inventory for general business purposes, are encouraged to stockpile for the sole purpose of liquidity provision and the opportunity to punt on the underlying commodities themselves. It’s a process which arguably artificially pumps up demand for the underlying inventory.

Bundle all those loans together, meanwhile — ideally into a product that can be sold to buyside investors seeking exposure to commodities — and suddenly you’ve got a direct source of funding for an ever-more speculative game.

When it comes to the larger players, meanwhile, this arguably transcends ‘trade finance’ even further — especially if it involves the setting up of a large number of special purpose vehicles to accomplish the process.

Here, for example, are the thoughts of Brian Reynolds, chief market strategist at Rosenblatt Securities, regarding what’s going on:

A little more than a year ago we picked up on a trend that we termed the “sub-priming” of commodities. Wall Street has been increasingly been doing structured finance deals wrapped around commodities, and this has added a bid for them while also making them vulnerable to downdrafts.

We know that many equity investors think (or at least hoped) that, after the disastrous record of wrapping pipeline and telecom assets in the 1990’s and sub-prime housing in the last decade, financial market reforms such as Dodd-Frank would have eliminated structured finance as a macro driver. When Dodd-Frank was proposed it envisioned standardized derivatives being placed on exchanges and clearinghouse. We felt it would encourage more non-standardized, exotic, and opaque structures to be created, and in the two years since it was enacted that’s what seems to have happened.

Important trends indeed. Yet, as Reynolds also notes, they’re also very hard to quantify given they mostly occur off-balance sheet:

This process is virtually impossible to quantify. We know that’s a disappointment to equity investors who are used to dealing with voluminous information, but that’s the nature of structured finance. Many structured finance deals are private in nature. As such most people, even those in the credit markets, did not know the full extent of the structuring going on in the 1990’s or the last decade until those firms, which were trapped by “Special Purpose Vehicles” (SPVs), such as Enron, WorldCom and Citigroup, became forced sellers. But over the last year we’ve heard more and more anecdotal evidence of Wall Street increasingly structuring commodity deals, such as structured notes and swaps and even using commodities as collateral.

In Reynold’s opinion — even though he’s not a commodity expert per se — this activity significantly increases the risk of a sharp drop in oil in the coming year, especially since structured finance transactions usually come with caps and floors, which act as important support and resistance levels.

That’s an interesting analysis for oil or copper. However, what happens if the commodities in question happen to be food? The only place this used to happen significantly was the gold market. Actually, it’s understandable for oil too. But is Wall Street so hungry for financial innovation that they’re willing to bet the world’s food supply on it? Yes, of course. They’ve already done it several times. History teaches us that it drives the prices up to unreasonable and unsustainable levels that take all kinds of people down when prices collapse.

Here’s an interesting bit on a contango that happened in the wheat market that already led to a food price crisis in 2007-2008. This one had the Goldman Sachs brand all over it. Last year, a similar situation occurred with the Oil Market and the same player.

On Monday, April 11, Goldman Sachs told its clients to sell commodities, and the market reacted with a $4 tumble in the price of West Texas Intermediate (WTI) crude oil and sell offs in other commodities.

On Thursday, April 14, the leaders of the “BRICS” nations (Brazil, Russia, India, China and South Africa), meeting in Sanya, China, continued to press for a new world monetary system that has a much lower reliance on the dollar, and called for stronger regulation of commodity derivatives to dampen excessive volatility in food and energy prices.

We are in another commodity price run up, like that experienced in the 2005-2008 period. Such commodity price frenzies have devastating consequences for the world’s poor who, in some instances, already spend half of their income on food. Today, in the U.S. itself, the rise in the price of gasoline to more than $4 per gallon threatens an economy still struggling to free itself from the still lingering effects of the last bursting bubble.

It appears that the Western economic systems have become ever more volatile over the past decade. That is, bubbles, followed by severe contractions, are appearing more often and with increased severity. This is in stark contrast to the dampening of the business cycle we observed, and celebrated, in the 1980s and 1990s. So, what changed?

In Harper’s last July, Fredrick Kaufman wrote an article entitled The Food Bubble, which explained the reasons for the run up in agricultural commodity prices just prior to the ’08 financial meltdown and worldwide recession. The popular business media gave the article short shrift. But, most of what Kaufman observed as the causes of the commodity price run up in the ’05-’08 period is now being repeated, a short three years later.

I’m finding all this interesting as I watch Jamie Dimon squirm on the big hedge loss reported by JP Morgan. That’s the $2 billion mark to market loss that makes me thing we’re on the verge of 2007 redux. Specifically, the market concentration is incredible because “the whale” created a huge problem for tons of hedge funds. Also, the regulator appeared to be asleep at the switch. You remember are old friends the Credit Default Swaps?

99 per cent of all CDS trades live in an information warehouse called DTCC, to which the regulators of the banks have access in however much detail they want!!! What kind of regulator doesn’t go and look at the that, when the mere public, aggregated info shows this?

Go check out the accompanying graph.

Anyway, I’m not going to get long winded and all financial economist on you, but sheesh, how many times does history have to repeat itself in markets before we get some one to do something useful? I’m just reminded of all the little canaries that died on the way to the big 2007 blow up that people ignored. How many canaries have to die this time out before we get another big one

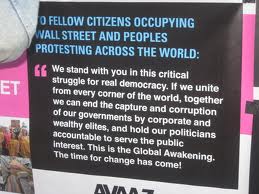

Blueprint For Accountability, Long Overdue

Posted: March 24, 2012 Filed under: #Occupy and We are the 99 percent!, Banksters, Blueprint for Accountability, corporatism, corruption, ethics, just because, Rule of Law 21 CommentsMark your calendars for this Tuesday, March 27th, 7:00 pm [EST]. Why? The Culture Project will be running another of its Town Hall discussions, a live stream production from Georgetown University. Stellar participants include: Eliot Spitzer, Matt Taibbi, Dylan Ratigan, Ron Suskind, Van Jones, Heather McGhee and Jessie LaGreca. See brief bio background here.

live stream production from Georgetown University. Stellar participants include: Eliot Spitzer, Matt Taibbi, Dylan Ratigan, Ron Suskind, Van Jones, Heather McGhee and Jessie LaGreca. See brief bio background here.

The discussion topic? It’s all in the title—accountability, the very essence of a sound democracy, yet sadly, an ingredient we’ve seen purposely, repeatedly ignored and shunned by government and corporate leaders alike.

Occupy Wall St. brought public attention to the problem—the yawning divide between the 1% and everyone else. Now, the hard work begins: how do we, public and private citizens alike, steer ourselves back to the premise that the Rule of Law is essential and applies to everyone. How do we make our demands felt inside a broken, corrupt system, where our vote is compromised by big money, our voices drowned in the sludge of corporate and financial interests?

The plan or blueprint needs fresh dialogue, new ideas.

What precisely is the Culture Project? you might be asking. From the site:

CULTURE PROJECT is dedicated to addressing critical human rights issues by creating and supporting artistic work that amplifies marginalized voices. By fostering innovative collaboration between human rights organizations and artists, we aim to inspire and impact public dialogue and policy, encouraging democratic participation in the most urgent matters of our time.

The Accountability series is a slight departure from what the group has done before—programs addressing human rights issues. But in a sense all of our rights are at peril, as is self-evident in the on-going Presidential campaign rhetoric.

The Accountability series is a slight departure from what the group has done before—programs addressing human rights issues. But in a sense all of our rights are at peril, as is self-evident in the on-going Presidential campaign rhetoric.

The first of the series was launched with MSNBC’s Rachel Maddow in a discussion on torture and the War on Terror. Subsequent presentations featured Robert Kennedy, Jr. ,who spoke to the continuing diminishment of American values and Cornell West last September spoke on the 40th Anniversary of the Attica Prison Rebellion.

I wasn’t aware of these programs. Hattip to Alternet for bringing me up to speed and alerting readers about the program scheduled for Tuesday night

This is another example of networking getting the message out and a live stream presentation made available, reaching a far wider audience than would normally be the case.

Personally, I’m a great fan of Eliot Spitzer. Despite his past personal problems, I think he has a true gift in explaining the financial/legal shenanigans that Wall St. adopted and continues to practice as business as usual. All at the expense of the American public. Dylan Ratigan has his own MSNBC TV show, Monday through Friday. He’s a former financial guy himself and has a book out “Greedy Bastards,” which has spent weeks and weeks on the NY Best Seller’s List. He’s been screaming daily about the country’s breakdown, the systemic corruption and lawlessness pervading everything—the financial sector, education, healthcare, energy, etc. Matt Taibbi writes for the Rolling Stone and has been equally merciless in calling the TBTF’s out for the highway robbers they were and continue to be. Add the other voices on the panel and I suspect the conversation will be lively and worth the 2-hour investment of time.

Live stream program will be found here.

Should be an interesting, informative night. Let the brainstorming begin!

Broken Windows And The Stealing Of Hearts

Posted: March 8, 2012 Filed under: Bailout Blues, Banksters, Corporate Crime, corruption, Department of Homeland Security, Domestic Policy, double-speak, Economy, Eric Holder, ethics, financial institutions, George W. Bush, Global Financial Crisis, indefinite detention, Injustice system, Patriot Act, The Bonus Class, The Great Recession, torture, U.S. Economy 21 Comments Yesterday I read an interesting essay by William Black over at New Economic Perspectives. In the essay, Black, who headed the forensic audit team during the S&L crisis, pulls forward the Broken Window Theory, a criminological model based on a simple and some have said simplistic idea. The theory was introduced by James Q. Wilson and received a fair amount of popularity during the 1990s, particularly in conservative circles.

Yesterday I read an interesting essay by William Black over at New Economic Perspectives. In the essay, Black, who headed the forensic audit team during the S&L crisis, pulls forward the Broken Window Theory, a criminological model based on a simple and some have said simplistic idea. The theory was introduced by James Q. Wilson and received a fair amount of popularity during the 1990s, particularly in conservative circles.

Readers might remember Rudy Giuliani’s ‘war against graffiti,’ his zero-tolerance campaign in NYC. That effort, the elimination of the squeegee men and the crack down on street prostitution among other things were based on the broken window philosophy, which uses an abandoned building metaphor.

Imagine a building in any neighborhood [although Wilson focused exclusively on what he termed ‘blue-collar crime.’] The first broken window of our abandoned building if left unrepaired sends a clear message to antisocial types: no one cares about this building. So, it’s open season on all the other windows, on anything of value that’s been left behind. If the owner doesn’t care about the integrity of the building then the street tough is encouraged to vandalize and take whatever’s not nailed down.

The attitude feeds on itself or so the theory goes. Honest citizens are less likely to confront the petty thief, which only encourages others to act out in destructive, antisocial ways. Honest citizens begin to feel overwhelmed and outnumbered and stop safeguarding their own neighborhoods. What’s the point? they say. No one cares. Communities begin to self-destruct.

Now whether you buy into this crime theory or not, I think the metaphor holds when you consider what we’ve been witnessing in the degradation of our financial markets, our legal system, even the refusal to admit that ‘there’s trouble in River City.’

As Professor Black points out, if we were to take Wilson’s theory and apply it to the explosion of ‘white collar crime’ within our financial system, it would be a major step in restoring the integrity of our system and bolstering peer pressure against misconduct. As it stands now, Wall Street movers and shakers and their DC handmaidens have implemented business-as-usual policies that reward the thief and punish the whistleblower. As Black points out in the essay:

We have adopted executive and professional compensation systems that are exceptionally criminogenic. We have excused and ignored the endemic “earnings management” that is the inherent result of these compensation policies and the inherent degradation of professionalism that results from allowing CEOs to create a Gresham’s dynamic among appraisers, auditors, credit rating agencies, and stock analysts. The intellectual father of modern executive compensation, Michael Jensen, now warns about his Frankenstein creation. He argues that one of our problems is dishonesty about the results. Surveys indicate that the great bulk of CFOs claim that it is essential to manipulate earnings. Jensen explains that the manipulation inherently reduces shareholder value and insists that it be called “lying.” I have seen Mary Jo White, the former U.S. Attorney for the Southern District of New York, who now defends senior managers, lecture that there is “good” “earnings management.”

My husband had some unsettling experience in this area. Early in his career, he worked as a CPA [the two companies will remain nameless]. But in each case, he was ‘asked’ to clean up the numbers, make them look better than they were. He refused and found himself on the street, looking for employment elsewhere. I remember him saying at the time, ‘Look, I’m a numbers guy. I’ve never been good at fiction writing.’ This was back in the late 70s early 80s, so this attitude has been a long time in the making. Now, we’re seeing accounting fraud that is literally off the charts. Is it any wonder the country’s financial system is on life support?

But in each case, he was ‘asked’ to clean up the numbers, make them look better than they were. He refused and found himself on the street, looking for employment elsewhere. I remember him saying at the time, ‘Look, I’m a numbers guy. I’ve never been good at fiction writing.’ This was back in the late 70s early 80s, so this attitude has been a long time in the making. Now, we’re seeing accounting fraud that is literally off the charts. Is it any wonder the country’s financial system is on life support?

We can see the destructive results of this careless, corrupt posturing all around us. Professor Black continued:

Fiduciary duties are critical means of preventing broken windows from occurring and making it likely that any broken windows in corporate governance will soon be remedied, yet we have steadily weakened fiduciary duties. For example, Delaware now allows the elimination of the fiduciary duty of care as long as the shareholders approve. Court decisions have increasingly weakened the fiduciary duties of loyalty and care. The Chamber of Commerce’s most recent priorities have been to weaken Sarbanes-Oxley and the Foreign Corrupt Practices Act. We have made it exceptionally difficult for shareholders who are victims of securities fraud to bring civil suits against the officers and entities that led or aided and abetted the securities fraud. The Private Securities Litigation Reform Act of 1995 (PSLRA) has achieved its true intended purpose – making it exceptionally difficult for shareholders who are the victims of securities fraud to bring even the most meritorious securities fraud action.

Reading this, I immediately sensed we could apply the metaphor just as easily to our legal predicament. Dak wrote to this yesterday—about the disheartening disrepair of our justice system, which was badly wounded during the Bush/Cheney years with the help of eager lawyers like John Yoo, stretching, reinterpreting, rewriting the parameters on the subjects of torture, indefinite detention, rendition, etc.

Not to be outdone, Eric Holder stood before Northwestern University’s Law School the other day and with the same twisted logic, explained away due process, otherwise known as ‘how to justify assassination.’ In this case, American citizens, those the President deems are a threat to the Nation, can be killed on native ground or foreign soil. Jonathon Turley, law professor at George Washington University and frequent legal commentator in the media, headed a recent blog post as follows: Holder Promises to Kill Citizens with Care.

Sorry, this does not make me feel better. What it does make me think is lawlessness simply breeds more lawlessness. The Broken Window theory writ large. As Turley explained:

The choice of a law school was a curious place for discussion of authoritarian powers. Obama has replaced the constitutional protections afforded to citizens with a “trust me” pledge that Holder repeated yesterday at Northwestern. The good news is that Holder promised not to hunt citizens for sport.

Holder proclaimed that “The president may use force abroad against a senior operational leader of a foreign terrorist organization with which the United States is at war — even if that individual happens to be a U.S. citizen.” The use of the word “abroad” is interesting since senior Administration officials have asserted that the President may kill an American anywhere and anytime, including the United States. Holder’s speech does not materially limit that claimed authority. He merely assures citizens that Obama will only kill those of us he finds abroad and a significant threat. Notably, Holder added “Our legal authority is not limited to the battlefields in Afghanistan.”

Turley went on to comment that Holder was vague, to say the least, when it came to the use of these ‘new’ governmental/executive powers, claiming that the powers-that-be will only kill citizens when:

“the consent of the nation involved or after a determination that the nation is unable or unwilling to deal effectively with a threat to the United States.”

And as far as ‘due process?” Holder declared that:

“a careful and thorough executive branch review of the facts in a case amounts to ‘due process.’”

Chilling! As Turley grimly noted in an earlier post, this is no longer the land of the free.

Seemingly unrelated was this report from the New York Times: the heart of Dublin’s 12th-century patron saint was stolen earlier this week from Christ’s Church Cathedral. The heart of Laurence O’Toole had been housed in a heart-shaped box, safely secured [or so church authorities believed] within an iron cage. The relic’s disappearance was preceded by a rash of reliquary robberies from churches, monasteries and convents around Ireland. According to the article:

The small cage hosting the heart-shaped box containing the relic was tucked away in an innocuous alcove at the side of a small altar. Visitors to the cathedral on Monday stared at the twisted bars and the empty space behind. The bars themselves were sundered evenly.

According to Dermot Dunne, dean of Christ Church, the box had lain undisturbed for centuries. He had no idea why someone would take it.

Whether it’s the heart of a saint or the heart of a Nation, the theft is a grievous insult. The crime betrays the public trust and our basic sense of decency. But the thieves of O’Tooles’s heart performed a curious act before exiting.

The Irish culprits lit candles at two of the Cathedral’s altars. Which means the perpetrators possessed, at the very least, an ironic sense of tradition.

The same cannot be said of our homegrown hooligans. Crass greed and the lust for unlimited power have their own dark tradition. As Americans, we do not expect vice to be confused with virtue. In the past, we could not imagine a blatant disrespect for the Rule of Law–crimes ignored, excused, then openly declared necessary for whatever raison du moment.

Not here, we told ourselves repeatedly. Not in the United States.

Perhaps, we should light candles of our own. A small devotion for the lost and dying.

Recent Comments