Obama Team Announces TARP Plan: Market Crashes

Posted: February 10, 2009 Filed under: Equity Markets, Global Financial Crisis, New Orleans, president teleprompter jesus, Team Obama, U.S. Economy | Tags: Depression, Geithner, Obama presser, Obamanomics, TARP 2 CommentsI hope you weren’t planning on using any of those savings that you may still have left sitting out there in anything market-related soon. The Dow Jones ( at this writing) is off over 350 points. All of the blue chip components tumbled. The S&P and OTC markets aren’t faring any better. This is how Market Watch sees it right now:

The recent strength shown by U.S. stocks vanished on Tuesday as the government unveiled a new bank-rescue plan and congressional action neared on a fresh round of fiscal stimulus for the wheezing U.S. economy.

That basically amounts to a reaction of last night’s speechification and presser and this morning’s announcement of thunderous boos. Fed Chair Ben Bernanke is speaking right now and that’s not really helping either. The investment/business community doesn’t think any of the largess from either the TARP or the Stimulus Plan are really going to do anything. Treasury Bond prices are dropping also. This additional snippet from Market Watch sums it up well.

“First, we’re going to require banking institutions to go through a carefully designed comprehensive stress test, to use the medical term. We want their balance sheets cleaner, and stronger. And we are going to help this process by providing a new program of capital support for those institutions which need it,” said Geithner.

Despite the forceful words, Geithner noted his office was still exploring options and details for an asset value program, with little answer on what to do about banks’ toxic assets.

That last paragraph is basically at the crux of the problem. The current administration is bringing no plan to the table to actually deal with the problem. Perhaps because Geithner was so instrumental in the original TARP, he’s just sticking with what already didn’t work rather than trying to think outside of the box. The market has lost around 3-4% already and there’s several more hours of trading to go. Hang on to your cookie jars kids, you’re going to need them as a stable replacement for your local bank.

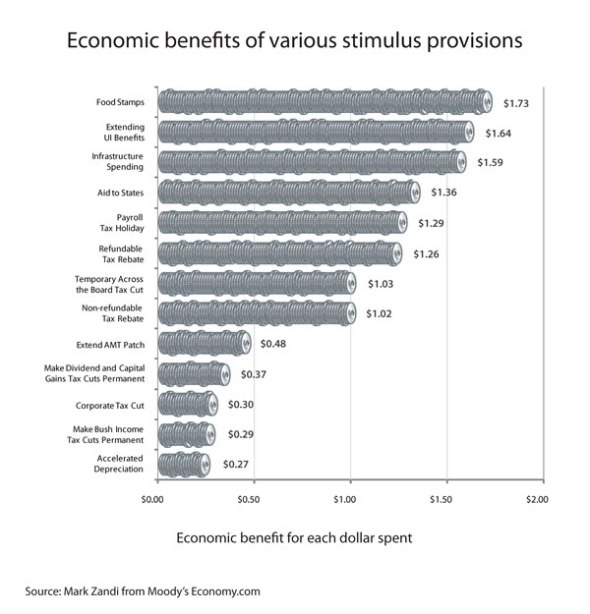

Meanwhile, the senate managed to pass that the stimulus bill 61-37. That’s way shy of the 80 votes that Obama had wanted. The final bill has $838 billion worth of stuff that includes a lot of tax cuts (not likely to stimulate anything but Grover Norquist and The Club for Growth) and money for cash strapped states. I’ve brought up links to the Economic Policy Institute earlier but I really like this graph that even my freshmen could grasp about what works and doesn’t work in stimulus plans.

You can see the difference between the items where you get more bang than a buck and less than a buck’s worth of bang while contributing to the deficit. Notice those tax cuts that wind up costing more than they stimulate and think the last eight years of Dubya of which we seem to be repeating.

You can see the difference between the items where you get more bang than a buck and less than a buck’s worth of bang while contributing to the deficit. Notice those tax cuts that wind up costing more than they stimulate and think the last eight years of Dubya of which we seem to be repeating.

Here’s one that I picked up from Brad DeLong’s Grasping Reality with Both Hands that had my Freshman gasping as I was trying to set their hair afire. (I think it worked, btw.) Any one facing this job market should panic. Just anecdotal, but in the market for finance professors, this year universities were taking resumes only at the last two conferences. Last year, the best people had been hired up before either of the conferences were held and only the marginal remained. The hottest academic jobs are definitely on hold. In my years of both public and private sector economisting, I’ve NEVER seen anything like this.

Please notice the incredible level of job losses. If you’ve managed to get through a calculus course, you’ll see that the first, second and third derivatives are negative which is not true on the other series at similar points. Basically, for you nonmath types, this indicates nothing but a downward trend or as I like to put it, straight off a cliff.

Please notice the incredible level of job losses. If you’ve managed to get through a calculus course, you’ll see that the first, second and third derivatives are negative which is not true on the other series at similar points. Basically, for you nonmath types, this indicates nothing but a downward trend or as I like to put it, straight off a cliff.

So, President Obama rambled an economics lecture last night that made me happy that he was getting all those economics briefings. It was also pretty obvious that most of his advisers must have their hair on fire too, because he did have a sense of edgy panic when he talked about the situation. However, ‘edgy panic’ is not what I want in a president. I want a president to talk about we have nothing to fear but fear itself who then says something to the effect of let’s do what works instead of bargaining away what will with folks that aren’t interested in watching you succeed.

I have to say, last night over Margaritas with my neighbors, I was searching for folks that wanted to diversify their food options with neighborhood gardening. I had a lot of takers. After all, when the army and your police force spend a good amount of time and money flying sleek black helicopters around the skies of your city practicing for food riots, it’s kind of one of those wake up moments. That goes for sleepy freshmen and drunk Cajuns. Is your hair on fire yet? Because if it isn’t, you haven’t been listening.

Meanwhile, I’m adding a page to my own blog for sharing sustainability and survival stories. Feel free to visit and contribute.

Recent Comments