Finally Friday Reads: Back to the Supply Chain Blues

Posted: April 25, 2025 | Author: dakinikat | Filed under: #FARTUS, #MAGAnomics, kakistocracy, kleptocracy, MAGA goes after the Rule of Law, racism in MAGA | Tags: #FARTUS Mafia State, @johnbuss.bsky.social John Buss, ICE Deportations, Supply Chain issues from Trump Tariffs, Trump Tariffs | 6 Comments

“Kids say the darndest things.” John Buss, @repeat1968

Good Day, Sky Dancers!

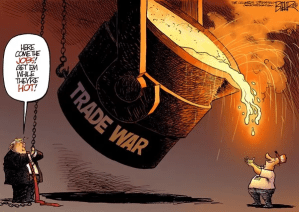

File this under news you can use. You know that I warn y’all when I throw dem bones and come up with something you need to know. I will give you some analysis that should give you a heads-up on shortages at most major retailers, likely starting within two weeks. You may remember that our Black Swan Event, the COVID-19 pandemic, led to the Great Toilet Paper Panic of 2020. This upcoming one will be worse and was self-inflicted with the worst economic policy ever. We can’t completely predict the size or length because of the erratic and ever-changing policy that has disrupted equity markets and will shortly be felt in the availability of so many things that I can’t possibly list here.

However, I can tell you that the country’s largest retailers have already warned the White House. They’re also seeing a series of cargo ships return with empty containers, and that East and West Coast Ports are already showing severe drops in activity. Two of the largest retailers–Target and Walmart–met with the White House on Monday. This brief explanation comes from Bloomberg via Yahoo Finance. Yahoo Finance is actually a source I recommend to students and use a lot for assignments reflecting equity markets. The information and reprints of articles are not behind a paywall. “Walmart, Target Executives Meet Trump As Tariff Fears Spread.”

Disruptions caused in large part by Trump’s tariffs have posed challenges for retailers that are main drivers of the US economy. A selloff in US assets deepened Monday amid tariff anxiety and Trump’s threats against Federal Reserve Chair Jerome Powell.

Shares of the companies ticked up after news of the meeting, but Walmart and Home Depot remained down for the day. Target rose less than 1% at the close of trading.

American companies have warned that business could slow in the months ahead as the import taxes go into place. While companies have operated with tariffs for several years, the magnitude and fast-changing nature of Trump’s levies have become a unique problem.

Trump’s duties on nearly all trading partners and a litany of sectors, including metals, are threatening to increase prices on everything from spirits and apparel to electronics and furniture. Those changes are expected to further hamper consumer demand, as Americans have already been price-sensitive following years of inflation.

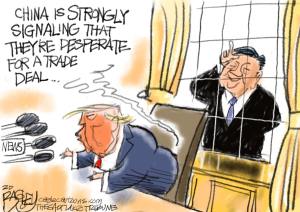

In addition to the cavalcade of overseas officials seeking lower tariffs, Trump has indicated he would be open to negotiating on rates with corporate leaders.

“We’ll also talk to companies. You know, you have to show a certain flexibility. Nobody should be so rigid,” the US president told reporters on April 13.

Trump’s administration exempted smartphones, computers and other electronics from its so-called reciprocal tariffs. The decision marked a temporary reprieve for global technology manufacturers, including Apple Inc. and Nvidia Corp., though officials later said the US would craft other specific duties for those products and started the process by launching an investigation into semiconductor imports.

This tells us he’s willing to deal with corporations looking for exemptions. These first exemptions are for the Billionaire Tech Bros. Also, “duties” have come into play.

This tells us he’s willing to deal with corporations looking for exemptions. These first exemptions are for the Billionaire Tech Bros. Also, “duties” have come into play.

When importing products to other countries, there are always import fees to be paid at customs. It’s important to note the distinct differences between taxes, tariffs, and duties and how they influence the costs of shipping products internationally. Here is a quick guide to these three types of import fees.

- All duties are based on product characteristics, specifically the HTS code, and the certificate of origin.

- Tariffs are fees applied to specific products from specific countries for specific times, they are determined by international trade negotiations and can change at the whim of the current government.

- Import taxes (for example, VAT or GST) are fixed rates calculated by the total value of the product imported into the country.

Every country has different import tax and duty obligations, with different rates, rules, and declaration forms. It’s important to work with trusted international partners to ensure you comply with the current regulations, so that you don’t have any surprise fees coming your way after you import your products.

The bottom line is that they all cause the price of the products to go up and generally reduce employment and availability of goods. Prices up. Unemployment up. That’s the basic definition of a country in a Stagflation Cycle. It’s the worst of both worlds because you get inflation and unemployment. I’ve dug into the numbers to date, and it appears the Walmart and Target leaders have legitimate fears. There are many trade publications that follow supply lines and chains. Obviously, railroads, ports, shipping, and air transit are important sectors because their business depends on goods in transit. Then they’re are the importers and exporters of the goods and services. You can see the loss of exchange by looking at the numbers. You know me. I love to make those numbers dance and sing. What you can see is that there are empty containers coming into ports. What this turns into is empty shelves.

The bottom line is that they all cause the price of the products to go up and generally reduce employment and availability of goods. Prices up. Unemployment up. That’s the basic definition of a country in a Stagflation Cycle. It’s the worst of both worlds because you get inflation and unemployment. I’ve dug into the numbers to date, and it appears the Walmart and Target leaders have legitimate fears. There are many trade publications that follow supply lines and chains. Obviously, railroads, ports, shipping, and air transit are important sectors because their business depends on goods in transit. Then they’re are the importers and exporters of the goods and services. You can see the loss of exchange by looking at the numbers. You know me. I love to make those numbers dance and sing. What you can see is that there are empty containers coming into ports. What this turns into is empty shelves.

So, let’s head to the industry publications. This information comes from Transport Topics which focuses on the impact of loss of trade in ports and airports. Basically, it’s where the shipments come in or leave. “US-China Tariffs Hit Amazon, FedEx, UPS Distribution Links. L.A., Long Beach Ports Project 10% Cargo Volume Drop.” The important thing to look for is an outlier that may signal a trend change. Here’s their analsyis of the data they are gathering to help these businesses make decisionis.

President Donald Trump’s tariffs on Chinese imports threaten to disrupt Southern California’s trade and logistics economy, a sector that moves a third of the nation’s container cargo and supports nearly 2 million jobs, according to a new analysis.

Trump’s 145% tariff on Chinese imports is expected to dramatically reduce volumes through the ports of Los Angeles and Long Beach, the nation’s busiest container gateway, according to a report by the Southern California Leadership Council and the Los Angeles County Economic Development Corp. China’s 125% retaliatory duties on U.S. goods are likely to drag down outbound traffic.

“That’s going to hurt the people who unload the cargo when it lands in our ports, the longshoremen, the people who ship it on rail or truck to the warehouses, the people who store it in warehouses and send it on to its final destination,” said SCLC co-chair and former California Gov. Gray Davis in a press conference on April 22.

President Donald Trump’s tariffs on Chinese imports threaten to disrupt Southern California’s trade and logistics economy, a sector that moves a third of the nation’s container cargo and supports nearly 2 million jobs, according to a new analysis.

Trump’s 145% tariff on Chinese imports is expected to dramatically reduce volumes through the ports of Los Angeles and Long Beach, the nation’s busiest container gateway, according to a report by the Southern California Leadership Council and the Los Angeles County Economic Development Corp. China’s 125% retaliatory duties on U.S. goods are likely to drag down outbound traffic.

“That’s going to hurt the people who unload the cargo when it lands in our ports, the longshoremen, the people who ship it on rail or truck to the warehouses, the people who store it in warehouses and send it on to its final destination,” said SCLC co-chair and former California Gov. Gray Davis in a press conference on April 22.

China remains Southern California’s largest trading partner, with roughly $130 billion in imports passing through the twin ports last year, according to the report. Los Angeles port officials expect cargo volumes to fall by at least 10% as early as May, with declines likely to continue through the end of the year.

Together, the ports handle roughly 35% of all U.S. containerized cargo and anchor a vast logistics network that stretches through the Inland Empire.

The region is home to major distribution centers, rail systems and trucking routes used by Amazon, Walmart, FedEx, UPS and Prologis, a real estate giant specializing in warehouses. Trade and transportation directly employs more than 900,000 workers in Southern California and indirectly supports nearly 2 million jobs.

Amazon ranks No. 1 on the Transport Topics Top 100 list of the largest logistics companies in North America, and No. 1 on the Top 50 list of the largest global freight carriers.

UPS and FedEx rank Nos. 1 and 2, respectively, on TT’s Top 100 list of the largest for-hire carriers in North America, and Nos. 5 and 43 on the logistics TT100. On the global freight TT50, FedEx ranks No. 2 and UPS No. 3.

Walmart ranks No. 1 on TT’s Top 100 list of the largest private carriers in North America.

The tariffs tit-for-tat also leaves thousands of the region’s importers facing inputs that potentially are two-and-a-half times more expensive, forcing companies to absorb the price increases or pass them on to consumers, the report said.

Forbes has more information on the shrinking number of goods coming to the ports headed to the businesses above. You may have heard that a lot of containers coming into the west coast ports are nowarriving empty. Thas has important ramifications.

Forbes has more information on the shrinking number of goods coming to the ports headed to the businesses above. You may have heard that a lot of containers coming into the west coast ports are nowarriving empty. Thas has important ramifications.

Background

The $8.5 trillion retail industry and the 132 million American households it serves are facing rapidly rising prices across the board should the proposed reciprocal tariffs be imposed. The National Retail Federation estimated tariffs could cost Americans up to $78 billion in annual spending power across six categories of goods, including apparel, toys, furniture, household appliances, footwear and travel goods. That estimate does not include food and beverage, which totaled $1.5 trillion in spending last year for off-premise personal consumption, according to the Bureau of Economic Analysis.

Vulnerabilities Vary

Walmart customers have less on the line should tariffs be imposed. Only about 33% of the products it carries are sourced internationally, though China and Mexico are its most significant trading partners. On the other hand, Target imports about 50% of its merchandise, including 30% of its private label brands come from China. And Home Depot reports 50% of its goods are sourced in North America, though how much comes in from Canada is not specified.

Crucial Quote

“Retailers rely heavily on imported products and manufacturing components so that they can offer their customers a variety of products at affordable prices. A tariff is a tax paid by the U.S. importer, not a foreign country or the exporter. This tax ultimately comes out of consumers’ pockets through higher prices,” said NRF vice president of supply chain and customs policy Jonathan Gold in a statement.

Consumers Vote Against Tariffs

American voters want government policy officials to focus on bringing down inflation and the cost of groceries as their top priorities rather than implementing tariffs to reset global trade, according to an NRF/Morning Consult survey among 2,000+ voters conducted at the end of March, before Trump’s “Liberation Day” tariff announcement. Some 76% of those surveyed expect prices to go up if tariffs are implemented. Rising prices will be a blow to all American households, but most especially to those in vulnerable communities, such as low-income households, working-class families, the elderly, families with small children, rural communities, farmers and small businesses.

Tangent

Adding to worries about retail supply chains is a report that product import levels will drop sharply in May and continue to decline through the rest of the year. The NRF predicts a total net volume decline of 15% or more by year-end, which will likely mean selective product shortages on retailers’ shelves.

Paying The Price Of Tariffs

American Apparel & Footwear Association CEO Steve Lamar told CNBC, “Higher prices, job losses, product shortages, and bankruptcies will be only some of the adversity the U.S. economy weathers while the President pursues this ill-advised tariff policy.”

Here is more on empty shipping containers returning to American Ports from Fortune. “Trump’s trade war has already sparked a massive cancellation of shipments from China to the U.S.” This article is new today and the analsyis is provided by Sasha Rogelberg.

Here is more on empty shipping containers returning to American Ports from Fortune. “Trump’s trade war has already sparked a massive cancellation of shipments from China to the U.S.” This article is new today and the analsyis is provided by Sasha Rogelberg.

-

In the weeks following President Donald Trump’s 145% tariff on China, shipping of Chinese imports to the U.S. have fallen steeply as companies try to avoid the price increases on products. The whiplash of companies stockpiling inventory ahead of tariffs, then pulling back on imports from China, is exacerbating a supply chain nightmare that will likely also have negative impacts on consumers.

Early shipping data is already beginning to show a clear drop off in imports from China as a result of President Donald Trump’s trade war, and logistics experts are warning continued tariffs could send the industry—and broader economy—into choppy waters.

With U.S. tariffs on China ballooning to 145%, companies have reacted accordingly, spending the months preceding Trump’s second term ramping up shipments in order to stockpile inventory of specific components predicted to be hit hard by tariffs. But immediately following the April 9 “Liberation Day,” ocean-shipped orders have done a 180, with volumes dropping dramatically. The Trump administration is now floating a substantial cut to Chinese tariffs, though some taxes would still remain.

To make matters more complicated for the freight industry, the administration is also pushing forward with a port fee for Chinese vessels, meaning that carriers made in China may incur levies up to $1.5 million when they visit an American port, part of a continued effort to discourage trade with China. The White House did not respond to Fortune’s request for comment.

Just weeks into the new tariff policy, U.S. imports from China have plummeted, with volumes falling more than 10% the week of April 7 compared to volumes the year before, and nearly 30% the week of April 14, according to a report published Tuesday by supply-chain platform Project44. Prior to the first week of April import volumes were consistently higher than they were the year higher, suggesting some companies pushed up order shipments in order to dodge the impact of tariffs.

Since the tariffs’ implementation, the rate of “blank sailings,” or when a carrier skips a scheduled port of call usually as a result of slowing demand, has also increased. While the East Coast saw 24 blank sailings, a 100% increase since the introduction of Chinese tariffs in February, the West Coast saw 21 blank sailings, a 31% increase from February.

The sudden drop in import activity is a sign that after months of companies scrambling to understand how to respond to tariff threats, they have finally needed to pull the trigger on a shipping strategy, and have decided at this time to pull back, according to Eric Fullerton, vice president of product marketing at Project44

“Businesses are really responding in a very, very distinct way,” he told Fortune. “A lot of that strategic planning and cost optimization and diversification, all of these strategies and approaches that they’ve been thinking through are actually to be shown in reality.”

Data from the Port of Long Beach, California—the largest U.S. port and the closest to China—backs up Project 44’s findings. The port reported 16 fewer ships to arrive in May, resulting in about 60 ships to arrive compared to the port’s usual monthly total of 80. Approximately half of imports to the Port of LA come from China.

“It’s my prediction that in two weeks time, arrivals will drop by 35%, as essentially all shipments out of China for major retailers and manufacturers has ceased, and cargo coming out of Southeast Asia locations is much softer than normal, with the tariffs now in place at this moment, and the news comes out and changes almost hourly,” Gene Seroka, executive director of the Port of LA, said in a Thursday meeting with the LA Board of Harbor Commissioners.

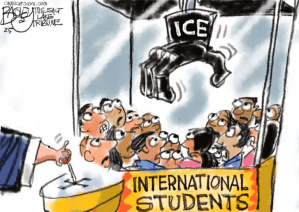

I suggest you plan accordingly. In another about face, Politico reports that “Trump administration reverses abrupt terminations of foreign students’ US visa registrations, DOJ announced the reversal in federal court after weeks of intense scrutiny by courts and dozens of restraining orders issued by judges.”

I suggest you plan accordingly. In another about face, Politico reports that “Trump administration reverses abrupt terminations of foreign students’ US visa registrations, DOJ announced the reversal in federal court after weeks of intense scrutiny by courts and dozens of restraining orders issued by judges.”

“The Trump administration has restored the student visa registrations of thousands of foreign students studying in the United States who had minor — and often dismissed — legal infractions.

The Justice Department announced the wholesale reversal in federal court Friday after weeks of intense scrutiny by courts and dozens of restraining orders issued by judges who deemed the mass termination of students from a federal database — used by universities and the federal government to track foreign students in the U.S. — as flagrantly illegal.

The terminations caused concern and even panic for thousands of students who feared the possibility they had lost their legal immigration status and could be quickly deported. Many who sued over the move said their schools had also blocked their ability to continue taking classes or conducting research, sometimes just weeks before graduation.

The terminations from the federal database earlier this month sparked more than 100 lawsuits, with judges in more than 50 of the cases — spanning at least 23 states — ordering the administration to temporarily undo the actions. Dozens more judges seemed prepared to follow suit before Friday’s reversal.

April Ryan Reports today on the erasure of historical achievements by black Americans at blackpress USA. “The Smithsonian PURGE: Trump Team Removes Artifacts of Black Resistance. Critics warn: it’s not just history being erased—it’s identity.”

Black Press USA has learned that Trump officials are sending back exhibit items to their rightful owners and dismantling them—starting with the 1960 Woolworth’s lunch counter sit-in exhibit.

“This president is a master of distraction and is destroying what it took 250 years to build. Here’s another distraction in his quest for attention. Another failure of his first 100 days,” said North Carolina Rep. Alma Adams, responding to efforts to physically remove the Greensboro, North Carolina, Woolworth’s lunch counter exhibit from the National Museum of African American History and Culture—affectionately known as the “Blacksonian.”

The exhibit features portions of the original lunch counter and highlights the story of four Black male students from North Carolina A&T who were brutally attacked after sitting at the whites-only counter Feb. 1, 1960. When denied service, the students refused to leave. Their defiance ignited a wave of lunch counter sit-ins across the South and became a major flashpoint in the Civil Rights Movement.

Adams added, “We are long past the time when you can erase history—anyone’s history. You can take down exhibits, close buildings, take down websites, ban books, and try to change history, but we are long past that point. We will never forget!”

Black Press USA has also obtained a letter from Dr. Amos Brown, long-standing civil rights leader and pastor of Third Baptist Church in San Francisco—also known as the home church of former Vice President Kamala Harris.

The letter notifies Dr. Brown that the museum is returning a Bible and George W. Williams’s History of the Negro Race in America, 1618-1880, one of the first books on racism in the U.S. Black Press USA has obtained emails from April 10 and 15, 2025, confirming the transfer.

I don’t know about you, but I’m not sure I’m going to be able to get through these next few years with out crying daily.

What’s on your Reading and Blogging list today?

Did you like this post? Please share it with your friends:

- Share on Facebook (Opens in new window) Facebook

- Share on Reddit (Opens in new window) Reddit

- Share on Pinterest (Opens in new window) Pinterest

- Share on Tumblr (Opens in new window) Tumblr

- Share on Mastodon (Opens in new window) Mastodon

- Share on LinkedIn (Opens in new window) LinkedIn

- Email a link to a friend (Opens in new window) Email

- Print (Opens in new window) Print

- Share on X (Opens in new window) X

- Share on Threads (Opens in new window) Threads

- Share on Bluesky (Opens in new window) Bluesky

- More

Recent Comments