Smoking Green Shoots Won’t Change the Numbers

Posted: June 8, 2009 Filed under: Equity Markets, Global Financial Crisis, president teleprompter jesus, Team Obama, U.S. Economy | Tags: Bankruptcies, Council of Economic Advisors, Geithner, Goolsbee, Romer, Summers, Unemployment figures 4 Comments

H/T Calculuated Risk who reports that Bankruptcies in May UP. http://www.calculatedriskblog.com/2009/06/consumer-bankruptcy-filings-up-sharply.html

I’ve been hesitant to dissect the recent bad news on the unemployment front too much because it’s going to get a lot worse and I’ll probably have more to say on that later. Remember, we’re just beginning to unwind the automobile industry and the affiliated small businesses and industries that it sustains. As that occurs, there will be a multiplying effect in small towns every where. Most of these small cities are sustained by car dealers and maybe one or two factories, as these businesses disappear, so will the small businesses providing services to employees. It’s going to get much worse folks. Since we’ve had stories from some of our own friends, we know that that impact strikes our near and dear.

That’s why I’ve been really confused as to why the administration seems to think by just talking up a few possible changes, which could yet be classified as random variation given there has not been enough time to actually establish a statistically significant pattern, they expect wishful change. Perhaps it’s just a continuation of the election season. If it’s repeatedly read from a teleprompter, it will happen. Just clap REALLY loud if you believe in green shoots!!! It will revive the economy!

The first crack in the plaster happened when Goolsbee let slip this little GEM on Fox News on Sunday. Michael Bowman writes:

The White House says America’s employment picture is worse than the Obama administration had anticipated just a few months ago. The somber admission follows the latest jobless report showing the highest unemployment rate the United States has seen in more than 25 years.

U.S. unemployment jumped a half percent in May, to 9.4 percent prompting this comment by Austan Goolsbee, a member of President Barack Obama’s Council of Economic Advisors:

“The economy clearly has gotten substantially worse from the initial predictions that were being made, not just by the White House, but by all of the private sector,” said Austan Goolsbee.

Economists point out that the current jobless rate is already higher than the hypothetical rate that was used to calculate the health of banks and other financial institutions in so-called “stress tests” earlier this year. And, the upward unemployment trajectory is expected to continue in coming months, even if the overall economy begins to recover.

Austan Goolsbee spoke on Fox News Sunday:

“It is going to be a rough patch [difficult period], not just in the immediate term, but for a little bit of time [in the future],” he said. “You have to turn the economy around, and jobs and job growth tends to come after you turn the economy around.”

Super Heroes of Macroeconomics

Posted: March 22, 2009 Filed under: Uncategorized | Tags: AIG, bail out, Fraud, Geithner, Obama, Summers, TARP, Wealth Transfers, zombie banks 11 CommentsSomebody must have a lot of time on their hands to write a song called “Hey, Paul Krugman” but still, if the angsty, artsy fartsy creative class that foisted this POTUS on us is finally waking up, then Twitter me when the Revolution comes. I’ve even read the orange cheeto place and seems even a few of them are beginning to see the writing on their blackberries.

So, Paul is still appalled and speaking out against the Zombie Plan. I’d say this is another sfz! warning to the White House. What I can’t repeat enough is that it’s not just Paul. It’s not just me. It’s everyone with any knowledge of macroeconomics and the financial system.

Why am I so vehement about this? Because I’m afraid that this will be the administration’s only shot — that if the first bank plan is an abject failure, it won’t have the political capital for a second. So it’s just horrifying that Obama — and yes, the buck stops there — has decided to base his financial plan on the fantasy that a bit of financial hocus-pocus will turn the clock back to 2006.

I don’t know if you’ve ever sat in an economics class, but most of you who have will attest that few economics professors are what you would call the dramatic, excitable types. However, I’ve seen more animation out of them recently than I’ve seen in all recent Marvel Comic Books.

I don’t know if you’ve ever sat in an economics class, but most of you who have will attest that few economics professors are what you would call the dramatic, excitable types. However, I’ve seen more animation out of them recently than I’ve seen in all recent Marvel Comic Books.

From “Reasons Why The Obama Administration will not solve this crisis by the end of 2009” at The Underground Investor:

Consider that President-elect Obama voted FOR the horrible $700 billion bailout plan that accomplished less than zero in fixing the global economy while only transferring wealth from people that were struggling the most to the unethical financial executives that created this problem. These were my exact words in October, 2008, verbatim, about the eventual effect of the bailout plan: “Don’t believe the media spin. This will fix nothing. Even if and when the government overpays Wall Street and US banks by 300%, 500% and 1000% for their toxic assets, this temporarily recapitalizes these financial institutions but only creates A MUCH BIGGER PROBLEM for the future.” If I understood why the bailout plan would most definitely fail, as I blogged here, and the next President of the United States could not, that is a scary thought. On the other hand, if President Obama understood that the bailout plan would likely accomplish nothing but the transference of wealth from hard-working citizens to corrupt financial executives and still voted for the bill, then this action needs no further discourse.

From FT’s Willem Buiter:

Why are the unsecured creditors of banks and quasi-banks like AIG deemed too precious to take a hit or a haircut since Lehman Brothers went down? From the point of view of fairness they ought to have their heads on the block. It was they who funded the excessive leverage and risk-taking of banks and shadow banks. From the point of view of minimizing moral hazard – incentives for future excessive risk taking – it is essential that they pay the price for their past bad lending and investment decisions. We are playing a repeated game. Reputation matters.

Three arguments for saving the unworthy hides of the unsecured creditors are commonly presented:

- Unless the unsecured creditors are made whole, there will be a systemic financial collapse, with dramatic adverse consequences for the real economy.

- If the unsecured creditors are forced to take a hit, no-one will ever lend to banks again or buy their debt.

- The ultimate ‘beneficial owners’ of these securities – notably pensioners drawing their pensions from pension funds heavily invested in unsecured bank debt and owners of insurance policies with insurance companies holding unsecured bank debt – would suffer a large decline in financial wealth and disposable income that would cause them to cut back sharply on consumption. The resulting decline in aggregate demand would deepen and prolong the recession.

I believe all three arguments to be hogwash.

Zombie Banks must DIE!

Posted: March 21, 2009 Filed under: Global Financial Crisis | Tags: AIG, Anna Schwartz, Dean Banker, Financial Bailout, Geithner, impeach president Obama, James Galbraith, joseph stiglitz, Krugman, Paul Craig Roberts, zombie banks 5 Comments Well, the Obama administration has decided to take the Zombie route which is something I’ve repeatedly argued against. But why just take my word for it? Let’s start with Nobel prize winning economist Paul Krugman reporting on his NY Times blog today in a thread aptly titled Despair over Financial Policy.

Well, the Obama administration has decided to take the Zombie route which is something I’ve repeatedly argued against. But why just take my word for it? Let’s start with Nobel prize winning economist Paul Krugman reporting on his NY Times blog today in a thread aptly titled Despair over Financial Policy.

The Geithner plan has now been leaked in detail. It’s exactly the plan that was widely analyzed — and found wanting — a couple of weeks ago. The zombie ideas have won.

The Obama administration is now completely wedded to the idea that there’s nothing fundamentally wrong with the financial system — that what we’re facing is the equivalent of a run on an essentially sound bank. As Tim Duy put it, there are no bad assets, only misunderstood assets. And if we get investors to understand that toxic waste is really, truly worth much more than anyone is willing to pay for it, all our problems will be solved.

Just about every economist and financial blog on the web, especially the progressive ones, have warned against this option since similar plans put Japan into its lost decade of recession, high deficits, unemployment, and financial malaise. This is worse than I even expected of the Obama administration. This basically means more BIG subsidies for BIG investors. It is nothing less than a massive transfer of wealth to the people and institutions most responsible for this mess from those of us that will suffer the most and have the most to lose. This threatens our jobs, our children’s future, and our country’s standing as the world’s largest single country economy. This is THE single worst possible decision.

This from Calculated Risk:

With almost no skin in the game, these investors can pay a higher than market price for the toxic assets (since there is little downside risk). This amounts to a direct subsidy from the taxpayers to the banks.

From Yves Smith Naked Capitalism:

The New York Times seems to have the inside skinny on the emerging private public partnership abortion program. And it appears to be consistent with (low) expectations: a lot of bells and whistles to finesse the fact that the government will wind up paying well above market for crappy paper.

Key points:

The three-pronged approach is perhaps the most central component of President Obama’s plan to rescue the nation’s banking system from the money-losing assets weighing down bank balance sheets, crippling their ability to make new loans and deepening the recession….

The plan to be announced next week involves three separate approaches. In one, the Federal Deposit Insurance Corporation will set up special-purpose investment partnerships and lend about 85 percent of the money that those partnerships will need to buy up troubled assets that banks want to sell.

Yves here. If the money committed to this program is less than the book value of the assets the banks want to unload (or the banks are worried about that possibility), the banks have an incentive to try to ditch their worst dreck first.In addition, it has been said in comments more than once that the banks own some paper that is truly worthless. This program won’t solve that problem. Back to the piece:

In the second, the Treasury will hire four or five investment management firms, matching the private money that each of the firms puts up on a dollar-for-dollar basis with government money.

Yves here. Hiring asset managers to do what? Some investors get 85% support (more as is revealed later), others get dollar for dollar? This makes no sense unless very different roles are envisaged (but how will the price for assets given to the asset managers be determined? Or are these for the off balance sheet entities that should be but are still not yet consolidated, like the trillion dollar problem hanging around at Citi?) Back to the article:

In the third piece, the Treasury plans to expand lending through the Term Asset-Backed Secure Lending Facility, a joint venture with the Federal Reserve.

Yves again. While the first TALF deal got off well, Tyler Durden points out its capacity is 2.7 times pre-credit mania annual issuance levels, which means the $1 trillion considerably overstates its near term impact. And credit demand by all accounts is far from robust. Cheap credit is not enticing in an environment of weak to falling asset prices and job uncertainty.

…

And notice the utter dishonesty: a competitive bidding process will protect taxpayers. Huh? A competitive bidding process will elicit a higher price which is BAD for taxpayers!

Dear God, the Administration really thinks the public is full of idiots. But there are so many components to the program, and a lot of moving parts in each, they no doubt expect everyone’s eyes to glaze over.

Later in the article, there is language that intimates that the banks will put up assets and take what they get. However, the failure to mention a reserve (a standard feature in auctions) does not mean one does not exist. Or the alternative may be, since bidding will almost certainly be anonymous, is to let the banks submit a bid, which would serve as a reserve. That is the common procedure at foreclosure auctions, when the bank puts in a bid equal to the mortgage value (so either a foreclosure buyer takes the bank out or the bank winds up owning the property).

From Financial Armageddon:

No Surprise to Anyone

If there is anything to be learned from the current crisis, it is the fact that Washington has a habit of screwing things up.

From setting up corrupt and self-serving government-sponsored enterprises that fail to accomplish their stated goals, to ill-conceived and underfunded insurance schemes, guarantee programs, and safety nets that don’t provide the benefits claimed, to rules and regulations that leave those who are “protected” high and dry, it’s amazing how often good intentions go wrong when the politicians are in charge.

From George Washington’s Blog:

Does a Single Independent Economist Buy the Geithner-Summers-Bernanke Approach?

Does a single independent economist buy the Geithner-Summers-Bernanke approach?

On the left, you have:

- Nobel economist Joseph Stiglitz saying that they have failed to address the structural and regulatory flaws at the heart of the financial crisis that stand in the way of economic recovery, and that they have confused saving the banks with saving the bankers

- Nobel economist Paul Krugman saying their plan to prop up asset prices “isn’t going to fly”. He also said:

At every stage, Geithner et al have made it clear that they still have faith in the people who created the financial crisis — that they believe that all we have is a liquidity crisis that can be undone with a bit of financial engineering, that “governments do a bad job of running banks” (as opposed, presumably, to the wonderful job the private bankers have done), that financial bailouts and guarantees should come with no strings attached. This was bad analysis, bad policy, and terrible politics. This administration, elected on the promise of change, has already managed, in an astonishingly short time, to create the impression that it’s owned by the wheeler-dealers.

- Prominent economists like Nouriel Roubini, James Galbraith, Dean Banker, Michael Hudson and many others slamming their approach

On the right, you have:

- Leading monetary economist Anna Schwartz saying that they are fighting the last war and doing it all wrong

- Former Assistant Secretary of the Treasury and former editor of the Wall Street Journal Paul Craig Roberts lambasting their approach

- Economist John Williams saying “the federal government is bankrupt … If the federal government were a corporation … the president and senior treasury officers would be in federal penitentiary.”

- Prominent economist Marc Faber and many others tearing their approach to shreds.

Of course, other Nobel economists, high-level fed officials, former White House economist, and numerous others have slammed their approach as well.

Sure, the economists for the banks and other financial giants which are receiving billions at the government trough think that the Geithner-Summers-Bernanke approach is swell.

And perhaps a couple of economists for investment funds which use their giant interventions into the free market to make some quick money.

But other than them, no one seems to be buying it.

I may be one of the few in the chorus singing soprano, but I’m in a very huge chorus singing sfz! that this is the worst possible of ALL choices. This is nothing more than a wealth transfer that will accomplish nothing other than keeping banks and financial institutions that are basically bankrupt on live support long enough to drain the daylight out of any recovery. This President is AWOL from his job. Not only is he AWOL, but he is incompetent. He can go on Leno, he can go on sixty minutes, he can give lavish St Patrick’s Day parties and he can hold town meetings in California but he is totally incapable of staying in Washington and doing his job. By allowing this, he will have stolen more from every single honest taxpayer in this country than even Darth Cheney and the Texas Village idiot did with their adventures in nation building and subsidy of the oil and gas industries and the military industrial sectors. If somebody in Congress doesn’t act to stop this, I say we start calling them to demand impeachment proceedings. We’ll be lucky if we come out of recession by the time my daughters reach retirement.

There I said it. If President Obama doesn’t stop this nonsense now he should be impeached for criminal misuse of tax payer’s money.

Yes, it’s an AIG Thread. Discuss.

Posted: March 18, 2009 Filed under: Equity Markets, Global Financial Crisis, president teleprompter jesus, Team Obama, U.S. Economy | Tags: AIG bonuses, Geithner, Summers, timeline 3 CommentsThe peasantry appears ready to pick up the pitchforks and storm the castle over the AIG bonuses. So what sayeth the King’s men? What’s the word from our Regent’s best? Well, here’s the real bottom line according to the NY Times.

New York’s efforts against A.I.G. have overshadowed those of the Treasury secretary, Timothy F. Geithner, the official who is responsible for the financial bailout, along with the Federal Reserve. The White House and Treasury have been besieged by questions about why Mr. Geithner did not know sooner about the bonus payments due this month, and whether he could have done more to stop them, prompting White House officials to assert President Obama’s continued confidence in Mr. Geithner.

“He more than has the president’s complete confidence,” said Rahm Emanuel, the White House chief of staff. As angry as the president is at the news about A.I.G., which he learned Thursday, Mr. Emanuel said, “his main priority is getting the financial system stabilized, and he believes this is a big distraction in that effort.”

It appears the henchman let slip something important. It’s all a ‘big distraction’. POTUS is so angry he can tell a joke. Meanwhile, more and more comes out concerning ‘what the President knew and when he knew it.” I have to say one thing, we got the time line for this immediately after the request came at yesterday’s press conference. Gibb’s may not be the most eloquent of Press Secretaries but when he promises missing information, he does deliver.

CNN’s Wolf Blitzer and Ali Velshi are reporting that they reported on the bonuses back in January 28 so why the kerfuffle today? Also, who is going to be the Judas Goat for this one? FDL’s Jane Hamshear calls Dodd the ‘sin eater’ here and thinks the President is trying to protect Geithner. Jane puts together a time line that more aptly reflects the idea that the President had to hear about the bonuses way back when but didn’t really LISTEN until they became a problem.

Here’s Jane’s take on Dodd’s original provision (removed by Geithner and Summers) on executive pay.

Dodd’s version prohibited TARP recipients from paying out bonuses, retention awards or incentive compensation to the 25 most highly compensated employees. It also prohibited any employee of a company receiving TARP funds from making more than the President. Both provisions would have been in effect so long as a company was receiving TARP funds. Since AIG just paid out $1 million in bonuses to 73 employees, Dodd’s version limiting all employees to what the President made (roughly $500,000) would have substantially nipped that in the bud.

So, at this point we have to ask a question. Do we have a renegade Secretary of the Treasury in cahoots with the President’s personal Economics adviser or a President who probably knew what was going on and didn’t really care until the peasants made an issue of it? Now we have an issue with which congress critters of both parties can make hay. Geithner is going to testify before the House next week on March 24 and 26 according to the WSJ about the AIG bonuses. Meanwhile, AIG’s current CEO testified and plans to ask employees to return the bonuses. ( Pretty, Pretty please, give back at LEAST HALF).

AIG Chairman and Chief Executive Edward Liddy, appearing before a U.S. House subcommittee, said the company has asked employees at its financial-products division who received more than $100,000 to “step up” and return at least half the payments.

“We’ve heard the American people loudly and clearly these past few days,” Mr. Liddy said, claiming that some employees have already volunteered to give up their entire bonus.

He warned, however, that the request could backfire if the employees who received the retention bonuses decide to resign from the firm. “They will return it, but they will return it with their resignations,” Mr. Liddy said.

So after a good yammering, I mean hammering from congress, Liddy once again explains the role of the bonuses.

Mr. Liddy said that the “cold realities of competition” for customers and employees played a role in the firm’s decision to make the payments, which have spurred a public backlash given the roughly $170 billion the government has used to prop up the troubled insurer.

“Because of this, and because of certain legal obligations, AIG has recently made a set of compensation payments, some of which I find distasteful,” Mr. Liddy said.

Describing the financial-products division, Mr. Liddy called it an “internal hedge fund” that exposed the company to extreme market risk. The result, he said, was that “mistakes were made at AIG on a scale few could have ever imagined possible.”

“Those missteps have exacted a very high price, not only for AIG but for America’s taxpayers, the federal government’s finances and the economy as a whole,” said Mr. Liddy, who took over AIG as part of the government’s rescue of the firm in September.

It seems every one finds them distasteful. Even the president “coughed” and joked with “anger” after being properly motivated by his teleprompter. So once again, congress critters will draft legislation to control executive compensation at companies receiving TARP money. Barney (the congressman, not the dinosaur) wants the President as ‘de facto CEO’ of AIG to institute a lawsuit to get the funds back. But wait, they did do that during drafting of the stimulus package. Dodd edited it. Summers and Geithner removed it. What next?

Meanwhile, over at the FED they continue to try break up AIG into pieces. They also appear to be more the source of Wall Street attention that both the hearings and today’s Presidential work-avoidance trip to California. The market rallied on news of the latest from the FOMC. They’re letting loose the printing presses to ease credit. So evidently, while the peasantry revolt, the congressmen act revolting, and the President flies to give another speech and appear on Leno, the bankers are at play.

Let’s just grab some popcorn and discuss.

The Best Laid Plans Of Mice and Men

Posted: February 26, 2009 Filed under: U.S. Economy | Tags: 2009 Budget, Geithner, Obama, Orzag 2 Comments

Los Tres Amigos: Obama, Geithner, Orzag

The Obama Administration just handed Congress a $3.6 trillion budget. The budget is one of the best ways of seeing what a President lays out as priorities and can be linked to many campaign promises. While it demonstrates a vision, what remains after congress hacks through it tends to be a more reliable gauge of the direction since compromise will shortly rule the day. I’m going to outline some of the major points and point you to some media coverage. We’ll have to watch over time what gets sold out and haggled away. That will really show the priorities and not just the posturing.

The overall tone of the budget shows a more activist government in the areas of health and education mostly paid for by families making over $250,000 a year, singles making more than $200,000 and various business interests. The WSJ has the numbers here.

As expected, tax increases will rise for singles earning $200,000 and couples earning $250,000, beginning in 2011 — for a total windfall of $656 billion over 10 years. Income tax hikes would raise $339 billion alone. Limits on personal exemptions and itemized deductions would bring in another $180 billion. Higher capital gains rates would bring in $118 billion. The estate tax, scheduled to be repealed next year, would instead be preserved forever, with the value of estates over $3.5 million — $7 million for couples — taxed at 45%.

Businesses would be hit, too. The budget envisions reaping $210 billion over the next decade by limiting the ability of U.S.-based multinational companies to shield overseas profits from taxation. Another $24 billion would come from hedge fund and private equity managers, whose income would be taxed at income tax rates, not capital gains rates. Oil and gas companies would be hit particularly hard, with the repeal of multiple tax credits and deductions.

There is a shift away from the oil and gas industry reliance as well as removal of some of their tax privileges. One of the more ambitious plans is that of an emissions trading program. Under this scheme, the government will set a cap on the allowable amount of green house gases and businesses will have to buy permits if they want to pollute above their allotment.

In one of the budget’s most ambitious proposals, the president plans to cap the emissions of greenhouse gases, forcing polluters to purchase permits for emissions that would be slowly brought down to 14% below 2005 levels by 2020 and 83% below 2005 levels by 2050. The sale of those permits, beginning in 2012, would reap $646 billion through 2019.

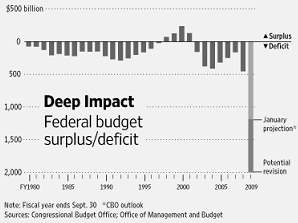

One of the most interesting things is the percentage of federal debt in relation to GDP. It’s at an historic high unlike anything seen for a long time. This is especially interesting coming after a “Fiscal Responsibility” Summit. The deficit estimates are based on pretty optimistic numbers which makes that summit look like even more of a marketing event

hats off to bb for this one ... WHOA!!!

from the land of Oz.

The president blamed the nation’s economic travails on the administration that preceded him and on a nation that lost its bearings. His budget plan projects a federal deficit of $1.75 trillion for 2009, or 12.3% of the gross domestic product, a level not seen since 1942 as the U.S. plunged into World War II.

I’m still wondering if we’re going to be able to float all that debt. Again, however, these are preliminary numbers and I’m certain Congress will bargain them down and around to other places. What the Administration compromises on will tell its true agenda. Republicans and business interests are not likely to go quietly into the night on any of this.

Recent Comments