Who let the Sharks Out?

Posted: October 3, 2008 Filed under: U.S. Economy | Tags: bailouts, Fannie Mae, Financial Crisis, Freddie Mac, Investment banks 4 CommentsAs the economy continues its slide towards recession, we now have a pork-laden rescue of many of the folks both responsible for the recession as well as the crisis. TARP may unfreeze the credit markets, but until we responsibly regulate the financial markets that are now shoveling troubled assets onto taxpayers and until we support the prices of their underlying assets (that would be folks’ homes), we will not solve the problem.

I focused recently on the lax lending standards that helped to create the housing bubble (fueled also by the Fed who kept interest rates too low, too long after 2001). It was the red meat thrown into the piranha pool. Let’s talk about what the piranhas did with the red meat once they had it.

I focused recently on the lax lending standards that helped to create the housing bubble (fueled also by the Fed who kept interest rates too low, too long after 2001). It was the red meat thrown into the piranha pool. Let’s talk about what the piranhas did with the red meat once they had it.

Let me mention first that we’ve nearly been here before when Long-Term Capital Management (LTCM) came close to collapse in September 1998 at the time when Russia had difficult repaying its debt. The Fed rescued the fund and showed that some guys are just “too-big-to-fail”. The Fed wanted to stop possible contagion coming from the failure from spreading to commercial banks. Studies at the time showed that losses to investment banks during this type of contagion could be huge (including one done by my Financial Intermediaries Seminar prof). They noticed that investment banks would be far more vulnerable to losses than depository institutes. This small crisis that most folks probably don’t even remember was the canary in the coal mine.

Meanwhile, the primary mortgage market was coming under the spell of the underwrite-nearly-everything mentality spurred on by Fannie and Freddie. We’ve mentioned that Fannie and Freddie also imply a government guarantee. Now, we have a situation where the Fed has shown its readiness to put the tax payer’s money behind anything it deems too big to fail. Both actions were like chumming the waters. Rising house prices were just more blood on the water. It was only time before the piranhas and sharks came to feed. They were being encouraged to ignore risk and that’s not a wise thing to do.

Five investment banks, including Goldman Sachs, approached the SEC with a proposal around 2004. They sought an exemption for their brokerage units from old depression-era regulations that limited the amount of debt they could incur. An exemption from this leverage rule would free up a heckuva lot of money to invest in some new-fangled investments: mortgage-backed securities, credit derivatives, and credit default swaps. They got permission. Enter the net capital rule that enabled the piranhas and the sharks. During the next few years, leverage ratios increased until for about every dollars worth of equity held by an investment bank, there was around $30 in debt.

Credit default swaps act like insurance. They are instruments intended to cover losses to banks and bondholders when companies fail to pay their debts. Since 2000, the market has boomed from about $900 billion to more than $45.5 trillion. This about twice the size of the entire U.S. stock market. The market for credit default swaps as well as the market for mortgage securities were left unregulated. Many folks have been worried about this market for some time.

The Comptroller of the Currency, a federal bank regulator warned that increased trade in swaps during 2007 was putting a strain on processing systems that were used to handle swaps. Swaps are essentially what brought down AIG. Back in the beginning of the year, AIG found that it had incorrectly valued some of the swaps and announced that mistake would cause the company to lose $6.3 billion more than they had estimated before.

Placing correct values on Swaps and Mortgage securities is very difficult. Big banks, insurance companies and hedge funds are among the financial institutions that trade these derivatives. CDS tend to be private agreements where buyers of the protection/insurance agrees to pay a premium to the seller over time. (Much like an insurance policy premium). The seller pays only if a particular crisis occurs. These contracts can also be bought and sold. Because the market is basically unregulated, no one quite knows when the swaps are sold and to whom they are sold. This can be a problem when the protection is required, say like when the Hurricane Katrina of asset bubbles bursts in the housing market. Just so you know, the largest players in this market are JP Morgan Chase, Citibank, and Bank of American. All WAY too big to fail, right?

Enter speculators as this market gets large. Speculators (read HEDGE FUNDS) have used these instruments to bet on a company or a bank’s failure. Funny thing is there is actually more value now out there in the derivatives than there is in the underlying assets. Remember, this is BEFORE the bubble bursts and brings the asset prices down even further. So credit default swaps are basically default insurance, although they can’t be named that. So what happens when every one needs to make a claim on their insurance and can’t exactly locate your contract and it probably resides with some one who is in worse shape than you? (Ah, let your imaginations run away with you, it’s bad.)

So, let’s get back to our Pirahanas and Sharks. They’re being encouraged to loosen up those lending standards by Fannie and Freddie AND they can buy insurance too if their bad loans go bad. How can you lose with a deal like that? It doesn’t appear that you can, does it? So what do you do? Continue underwriting loans for folks without income, folks without credit, folks that are even dead. (Yes, dead, I’m not making that up.)

I think you can see that what we have here is the perfect storm. So let me get back to what this bill doesn’t do. It DOESN’T stop the assets from continuing to go bad, at least in the housing end of things. It DOESN’T regulate any of the players in this market although the investment banks are now under the jurisdictions of bank holding companies and basically the FED. It DOESN’T deal with the leverage issue. It DOESN’T punish any one for lending bad loans even. No one is getting yelled at for encouraging this — not Fannie and Freddie, not the FED and not the SEC. Definitely not the congresscritters that enabled them either, at least not yet.

What we are witnessing is the creation of more TOO BIG TO FAIL critters AND we’re giving them more money to lend out and we have inadequate regulation. It’s time to take the chum out of the water, folks!

Those who forget the past are condemned …

Posted: October 1, 2008 Filed under: U.S. Economy | Tags: bail out, Bail out of Fannie Mae and Freddie Mac, Fannie, Financial Crisis, HOLC 6 Comments(cross-posted at the Confluence)

I’m having difficulty digesting a lot of the news and hoopla surrounding this financial crisis. There are some things that are really worrying to me. It’s not so much the crisis itself, which I actually understand, but the responses. I am reminded of the saying that those who forget the past are condemned to repeat it. I think this basically sums up much of why I feel so desperate when I watch the response to this crisis unfold on TV. It’s time to stop the blame and start the problem-solving.

First, what really bothers me is the inability of ANY of the politicians to either REALIZE how they contributed to this or understand what lead to this. A recent post by myiq2xu mentioned a speech by Senator Obama who offhandedly referred to the period of deregulation of industries that went on during the 70s. He has been hammering his every talking point with the Republicans did this to us. Useful, I suppose when trying to get elected based on something other than your credentials, but disingenuous at the very least. I keep wondering if he JUST doesn’t know the history of deregulation or he’s purposefully lying to us.

The deregulation of the telcom industry, the airline industry and the banking industry came about during the Carter regime. When I was a fresh out of grad school economist, I worked for a bank then a Savings and Loan. The Monetary Control Act of 1980 (okay, i’m dating myself) was a response to the problem of traditional banks and thrifts hemorrhaging deposits to Money Market Accounts. The root of deregulation started with Jimmy Carter’s administration. Hasn’t any one told him this or does he just like to go on misspeaking? The fight against the deregulation against Fannie and Freddie–probably the biggest contributors to this latest moral hazard problem–was led by the Democrats also. Why can’t we just be honest about this and say that each of the parties had a hand in this and learn from the past?

Second, I lived through the S&L crises and the economy that prevailed in the early 80s. My first house loan had an interest rate of 17.67% which got discounted to a beneficent 12.67% because I worked for the thrift that gave me the loan. House loans aren’t even half that at the moment. Two other folks besides me got house loans that month from the biggest thrift in the heartland. I’d say that was a credit crunch, wouldn’t you? I also worked the money desk at that time and remember the interbank loan (Fed Funds rate) bopping between 4% and 21% on any given day. Both of these rates are a far cry from the current rates as is the unemployment rate which sat between 12 and 13% for some time. Remember, these were the morning in America years of the early 80s. We currently have a 6.1% unemployment rate.

My father lived through the great depression. At that time, the unemployment rate peaked between 25% to 29%. The foreclosures that happened during that time occurred because no one had jobs and no one had unemployment insurance. When they closed the banks, there was no FDIC so, you lost your life savings. Today, we have unemployment insurance, the FDIC, and various other types of insurance that minimize the loss you experience on your deposits –even money market funds. You may experience paper losses, but you will not loose EVERYTHING! There are safeguards against much of the worst situations experienced during the depression. I’m not sure that given today’s economy, which is sluggish and experiencing problems but is not as bad as either of these two periods, we need this rush to judgment. Why aren’t we thinking this bail-out plan through more?

Which brings me back to today. We solved many of the problems of the previous financial crisis with government intervention. The HOLC bought up many defaulting mortgages, renegotiated them when possible, and held on to the properties, insuring they wouldn’t drive land and house prices down further. During the S&L crisis, the RTC bought out S&Ls, unwound the assets, and sold the sellable ones while holding onto the bad stuff, until the market turned around. The government can afford to hold paper losses on its books. Private industry cannot. Government can help put a bottom price on these markets. This is what it needs to do. It does not need to end the alternative minimum tax, change the taxes on corporations, or fund ACORN and La Raza.

Which brings me back to today. We solved many of the problems of the previous financial crisis with government intervention. The HOLC bought up many defaulting mortgages, renegotiated them when possible, and held on to the properties, insuring they wouldn’t drive land and house prices down further. During the S&L crisis, the RTC bought out S&Ls, unwound the assets, and sold the sellable ones while holding onto the bad stuff, until the market turned around. The government can afford to hold paper losses on its books. Private industry cannot. Government can help put a bottom price on these markets. This is what it needs to do. It does not need to end the alternative minimum tax, change the taxes on corporations, or fund ACORN and La Raza.

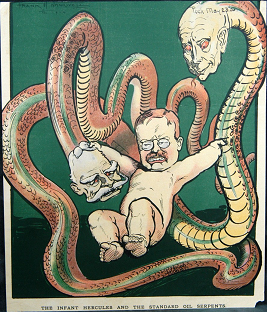

Which brings me to one more point, when do we stop turning these unprofitable behemoths into megacompanies that become too big to fail? Haven’t we learned anything in the past about this? Why are we creating more Freddies and Fannies? It is not fair to the taxpayer for the profits to be privatized, but the losses to be turned to the public. During the last 30 years, we’ve allowed mergers to create these giant companies that are behaving more and more like monopolies. This is not good for a free market system. If we are allowing them to become so big and letting them get away with extraordinary profits during good times, than making them subject to public largess if they fail, what is the difference between this and just nationalizing them altogether? Didn’t we learn these lessons during the trustbusting years of Teddy Roosevelt? Isn’t the basis of our monopoly law the Sherman Anti-trust regulations that were set up in the 19th century? Why have we forgotten the excesses of the gilded age?

Yes, it’s broken. Yes, it needs to be fixed. But can some one in Washington just pick a few history and economics textbooks so we’re not condemned to relearn the lessons of the past and do it with everyone’s tax dollars?

The No Bailouts Act

Posted: September 30, 2008 Filed under: U.S. Economy, Uncategorized | Tags: Alternatives to bailouts, Financial Crisis, No Bail Outs Act, Peter DeFazio 2 CommentsCongressman Peter DeFazio from Oregon has sent a letter to colleagues offering an alternative to the current $700 billion bailout. It is worth a look.

| DeFazio Introduces the No BAILOUTS Act | | Print | |

|

The following is a Dear Colleague sent by Representative DeFazio introducing his No BAILOUTS Act, which would Address the current financial crisis without putting the American taxpayer on the hook for billions of dollars.

Dear Democratic Colleague:

The House of Representatives rejected the $700 bailout yesterday. Distinguished economists across the world have stated it would not have solved the problem at hand. However, we can potentially solve this liquidity problem at little cost to the taxpayer. I am proposing that Congress drop the Paulson Plan, and instead pass the No BAILOUTS Act. The No BAILOUTS Act provides an alternative to the Paulson Proposal to address the current credit crunch. Once Congress addresses the liquidity shortfalls in our financial markets, a Democratic Congress can turn to Democratic solutions to address the broader economic crises we face today. Specifically, Congress can work to resolve the housing crisis across the country and pass effective job stimulus, which is the response Main Street America expects and deserves. While Democrats and Republicans may disagree on the underlying solutions to solve the economic crises we face, the No BAILOUTS Act – a regulatory based proposal – has the potential for significant bipartisan support. The Paulson Premise Flawed Simon Johnson, a former chief economist as the International Monetary Fund, stated today in the New York Times of Paulson’s plan, “It’s our view that this package, in a fundamental sense, will not solve the problem.” Other economic analysts noted yesterday that the credit markets around the world were almost entirely dysfunctional even when political leaders and investors assumed that Congress had reached a deal and would easily approve the bailout. There is no reason to believe Paulson’s plan will work.

Alternatives We have credible alternatives to the Paulson/Bush $700 billion gamble. William Isaac, the chairman of the FDIC during the previous worst financial crisis in the United States during the 1980s, believes Congress can address the current crisis with simple changes to Securities and Exchange Commission (SEC) rules. Mr. Isaac points out that while we face serious financial challenges today, many banks are still in good shape. This allows Congress to take swift, uncomplicated steps to ensure the financial markets return to working order. After that, we can work to resolve the housing crisis and pass effective job stimulus. Today I am offering an alternative to the Wall Street bailout that will correct the capital shortfalls experienced by many financial institutions and help protect the integrity and quality of the securities market. My plan could be implemented promptly meeting the demands of the Bush Administration to act immediately without putting the American taxpayer on the hook for billions of dollars. No BAILOUTS Act Bringing Accounting, Increased Liquidity, Oversight and Upholding Taxpayer Security 1) Require the Securities and Exchange Commission (SEC) to require an economic value standard to measure the capital of financial institutions. This bill will require SEC to implement a rule to suspend the application of fair value accounting standards to financial institutions, which marks assets to the market value, no matter the conditions of the market. When no meaningful market exists, as is the current market for mortgage backed securities, this standard requires institutions to value assets at fire-sale prices. This creates a capital shortfall on paper. Using the economic value standard as bank examines have traditionally done will immediately correct the capital shortfalls experienced by many institutions. 2) Require the Securities and Exchange Commission to restricting naked short sells permanently This bill will require SEC to implement a rule that blocks naked selling, selling a stock short without first borrowing the shares or ensuring the shares can be borrowed. Such practices many times harm the companies represented in the sales and hurt their efforts to raise capital. There is no economic value produced by naked short sales, but significant negative effects. 3) Require the Securities and Exchange Commission to restore the up-tick rule permanently. This bill will require SEC to implement a rule that blocks short sales without an up-tick in the market. On September 19, 2008, the SEC approved a temporary pause of short selling in financial companies “to protect the integrity and quality of the securities market and strengthen investor confidence.” This rule prevents market crashes brought on by irrational short term market behavior. 4) “Net Worth Certificate Program” This bill will require FDIC to implement a net worth certificate program. The FDIC would determine banks with short-term capital needs and the ability to financially recover in the foreseeable future. For those entities that qualify, the FDIC should purchase net worth certificates in these institutions. In exchange, these institutions issue promissory notes to repay the FDIC, counting the amount “borrowed” as capital on their balance sheets. This exchange provides short term capital, with not cash outlay. Interest rates on the certificates and the FDIC notes should be identical so no subsidy is necessary. Participating banks must be subject to strict oversight by the FDIC including oversight of top executive compensation and if necessary the removal of poor management. Financial records and business plans should be subject to scrutiny while participating in the program. In 1982, Congress approved a program, known as the Net Worth Certificate Program, that allowed banks and thrifts to apply for immediate capital assistance. From 1982 to 1993, banks with total assets of $40 billion participated in the program. The majority of these banks, 75%, required no further assistance beyond the certificate program. 5) Increase the FDIC Insurance limit from $100,000 to $250,000. The bill will require the FDIC raise its limit to provide depositors confidence that their money is safe and help eliminate runs on banks which are destabilizing to the industry.

Sincerely

Peter DeFazio Member of Congress |

Crisis Strategy: Getting it Right the first time

Posted: September 28, 2008 Filed under: Uncategorized | Tags: Bail out of Fannie Mae and Freddie Mac, Financial Crisis, U.S. Economy 8 Comments(Cross-posted at The Confluence)

There are very little details out in the public concerning the supposedly ironed-out terms that will solve the current financial crisis. Almost every one is worried that the terms of the rescue will involve taxpayers bailing out Wall Street High Rollers and their bonus-loving CEOs. If you review Financial Economics literature, you will discover that there are several findings in the studies done by economists that can provide guidance to every one on the best way to approach the bail-out. One of the most recent studies comes from the International Money Fund. It is by Luc Laeven and Fabian Valencia and was posted this month at the IMF research website.

If you’re not familiar with regression analysis which is the analytical method of choice here, stay away from the last half of this paper. However, you may find some interesting things in the first section because it includes a huge database that looks at all systematically important financial crises between 1970 and 2007. This means the database has 42 crises in 37 countries. It looks at steps taken by government to solve these crises and the length and depth of the crisis.

Here’s the link: http://www.imf.org/external/pubs/ft/wp/2008/wp08224.pdf

Another good source of information for suggestions is the Brit Magazine The Economist. Many of its articles are also available on line and are not technical in nature.

If you’re not up to looking at the details, let me try to explain some of the things that Financial Economists have learned since the Great Depression. You should look for some of these dos and don’ts when we finally get to see the details of the plan. Sixty years of study and growing theories has shown us that the tactical approaches–which mostly involve containing the crisis–are very expensive and don’t work too well. Usually, containment approaches happen while the crisis is unfolding. As an example of this, I will point to the bail-outs of individual banks and financial institutions that have happened to date. We’ve seen this containment tactic most of this year.

Governments can respond to these kinds of crises in many ways. In a lot of cases, we see reallocation of wealth from taxpayers to Banks and other institutions that hold debt. When wealth transfers like this happen, many problems happen in the general economy. The existing research done in this area shows that providing assistance to banks and their borrowers can actually increase loan losses to banks and in many cases lead to laxes in regulation that can be abused. Study-after-study shows that individual bank bail-out is usually not a good approach. Other costly and not that efficient tactical steps can include accomodative policies like direct government guarantees of bank liabilities or injecting ‘liquidity’ into the bank itself by lending money to the bank. The literature shows that none of these steps necessarily lead to a speedier recovery.

So what strategies can our country adopt to staunch the current crisis? Proposals vary, but a good example of something that worked would be the comprehensive plan we had back under the first Bush administration during the S&L meltdown. The RTC (Resolution Trust Corporation) was set up in 1989 to deal with the many, many S&L bankruptcies. The purpose of the RTC was to dispose of failed S&L assets in a way that didn’t drive prices on the properties and assets down. It put a bottom price on things like farm land or houses that were the underlying assets held by the thrifts. In the case of situation now, a new ‘agency’ would buy troubled mortgage-backed securities from the market and hold them until there was a turn around in their value.

This new agency could also serve another purpose similar to a depression-era institution called the Home Owner’s Loan Corporation. Hillary has suggested this type of agency whose purpose would be to buy and restructure existing mortgages. This would basically keep many folks in their homes with mortgages they could handle. For this to work, it has to be geared towards folks that can actually follow-through and make their payments. It could not be a social largess program because that would only create more loan losses in the long run. It’s purpose would be to keep folks in their homes as well as put faith back into house prices and the mortgage market. It would also alleviate the downward pressure on home prices. A new agency would be allowed to hold the loans and troubled securities until the market function agains and the assets once again become valuable. Many of the assets in some of these securities are fine now and could just be repackaged. The profits need to be returned to the taxpayer and used to pay down the debt. We should ensure that the proceeds do not go to any politician’s pet project.

At the same time, we need to look for better oversight of derivatives markets. The big issue that can be layed squarely at the feet of the Bush Administration and Greenspan is their inability to see the need for regulation of these markets. The existance of this market (which serves a similiar function to insurance) injected more ‘moral hazard’ into the banking community. This means if you think you’ve got something insured, you’re more likely to act haphazardly. We already had banks being encouraged to loosen their underwriting standards for certain borrowers by Fannie and Freddie. With the invention of these innovations, banks were covered, or so they thought, even if they did practice lax lending standards. These derivatives were an attempt to manage credit risk. However, as we have seen, actually placing accurate vales on this contracts just created more uncertainty. The implied consent and guarantee of the government via Fannie and Freddie exacerbated the misvaluation in a market with no oversight. We need to re-visit the regulatory responsibilities of the SEC and the FED and update them so that they reflect the existence of these extremely sophisticated and difficult to understand markets. Also, something has to be done about Fannie and Freddie and how their role to feed loans to creditworthy middle class Americans warped into some social engineering plan that began the lax lending standards and provided opportunities for exploitation.

So, do we need a bail-out? Yes. Unfortunately, financial contagions do act as a disease and can create economic downturns that impact everyone. All you have to do is crack a book on the Great Depression to see how problems in banks and stock markets eventually transfer over to Main Street. What is needed is the least expensive and most prudent approach. The literature tells us that it must be systematic and not just tactical. You need to strengthen the market, not just select players. I’ve outlined a few things that financial economists have learned about past crises. I’d hope we get the details out pretty soon so you can look and see if the bailout is consistent with these principles.

The Real Whiners and Losers

Posted: July 14, 2008 Filed under: U.S. Economy | Tags: Bail out of Fannie Mae and Freddie Mac, Financial Crisis, Mortgage Crisis 6 CommentsIf there are whiners in the U.S. economy, it has to be the American Investor who is never satisfied with a normal rate of return. These investors frequently ‘rent-seek’. In Financial Economics, this is akin to finding some way around the market by gaining power over market regulators or lawmakers, or decision makers. It is best understood as a form of political bribery or executive extortion. The majority of investors and businesses are looking for monopoly profits and ways to earn them. They really don’t want to be part of a competitive market and true market capitalism. They are simply seeking monopoly and the extraordinary profits that come from having monopoly control of a market.

rate of return. These investors frequently ‘rent-seek’. In Financial Economics, this is akin to finding some way around the market by gaining power over market regulators or lawmakers, or decision makers. It is best understood as a form of political bribery or executive extortion. The majority of investors and businesses are looking for monopoly profits and ways to earn them. They really don’t want to be part of a competitive market and true market capitalism. They are simply seeking monopoly and the extraordinary profits that come from having monopoly control of a market.

Monopoly profits are way beyond the ability of the normal investment and are usually due to some kind of manipulation, control, or problem (which we call friction) in a market. It is due to something other than a market behaving as Adam’s Smith’s invisible hand would suggest. It is a form of winning from something other than fair play. Frequently, it is due to capturing regulators or gaining advantage by forcing some kind of law using lawmakers eager to support business but ignorant of economics.

No group is more guilty of this than investors in Financial Markets. In the theoretical realm, most financial markets would not exist if everything were perfect in markets. This is especially true of banks. They exist because of imperfect information. They make profits by taking advantage of weaknesses in markets. However, many are not satisfied with skimming a small fee for providing information and some services that make life easier for the financially ill-equipped. They want to make WHOPPING FEES. The greed goes up and down Wall Street. Their enablers are both Democrat and Republican Senators and Congressman that allow them to operate without restriction, give them tax breaks for any whim, and turn a back when they engage in grossly speculative behavior but seek bail out at the slightest turn of the market.

My Market Watch Newsletter hit my email even before the markets could open in the U.S. and well after the Asian markets reacted badly. As well, they should. Government should NEVER allow businesses to gamble when it comes to house loans or folks’ life savings. They’re bailing out the predators. Now, will they help the prey?

WASHINGTON (MarketWatch) — The implicit government guarantee of Fannie Mae and Freddie Mac is now explicitThe Senate passed its version of the legislation last week and sent it back to the House of another vote. It is expected to get to President Bush for his signature before Congress leaves town for its summer recess at the beginning of August.It would be logical to attach the lifeboat for Fannie and Freddie to the housing rescue measure.It is not clear how Congress will react to Paulson’s request. The Treasury secretary said he has been in close contact with the Congressional leadership over the weekend, so his request will not come as a surprise to lawmakers.That would be a bitter pill for Fannie and Freddie, which have been at loggerheads with the central bank over the capital issue for years.

In a dramatic statement released Sunday, the White House and Federal Reserve moved to give the mortgage giants the capital they need to survive the depression in the housing market and turmoil in financial markets that had left them dangling over a cliff.Of most immediate importance, the Fed’s board of governors voted to open up its emergency discount window to Fannie and Freddie.In addition, Treasury Secretary Henry Paulson announced that he will seek Congressional authorization to by stock in the two companies and increase the government’s credit line.At the moment, each company may borrow only $2.25 billion.In return for the capital, Paulson said that the Bush administration would ask Congress to grant the Fed a “consultative” role in the capital standards of the companies.The housing rescue package that is nearing final approval by Congress would put in place a strong independent regulator for the companies is slowly moving through Congress. Paulson says he wants a new provision allowing the Fed to work hand-in-hand with the new agency.

Both of these agencies are chartered by Congress but owned by private stockholders. In a continuing melodrama where investors insist on unrealistic REAL returns, CEOs and CFOs buy special treatment in Washinton and seek surreptitious ways to circumvent regulatory responsibility as well as responsibilities to the customers they serve. Financial Institutions serve a special role in the economy. They not only return profits to investors, they are the keyholders to the American Dream. They hold funding for college, for homes, and for a secure and stress-free retirement. If they do not live up to both their fiduciary responsibilities as well as their responsibilities to function as proper underwriters, they deserve to be nationalized and to have their for profit status stripped from them.

I know this is a somewhat radical view. However, this is hardly the first time this sort of thing has happened. We have lived through the excesses of the period leading to the great depression. We have lived also, through the period of greed known as the 80s with its financial excesses and the dot.com bubble. If executive officers are not rewarded by investors for taking prudent and long run view points to their investments, perhaps they should be nonprofits when the stakes are so high they will fall to the taxpayer when bad management prevails.

We can not afford investors that wish to profiteer extraordinarily from the least among us. Nor can we afford, as a citizenry, to tolerate management that will cave to pressure to produce above market rates of return from investments that should NOT perform thusly. High rates of returns come from high risk assets which frequently tank. High risk usually comes from uncredit worthy or highly speculative investments. If we learned anything from the Great Depression, it is that some management decisions can not be left to the weak minded and ill-informed asset manager who makes fees based on volume and return. They can leave with their profits. The duped borrower becomes homeless or pensionless. Bad underwriting leaves a mess that taxpayer cleans up one way or the other.

I ask Barney Frank, Ben Bernanke, and all those with regulatory responsibilities to ask themselves this question. When is it that certain financial decisions, when made by the market, are so incredibly hurtful that they can not be allowed? After all, this is not the market for beer, or jeans, or some kind of stinky perfume. When it involves the financial devastation of ordinary Americans seeking homes, college educations, and secure retirements, is NOT their interest as important as the profits of the risk takers? It is TIME for regulation to catch up with the twists and turns of these new derivatives markets and of the investors who ask for more profit than they are entitled. It is one thing to make a profit from competitive advantage or from creating a better mouse trap, it is nothing but chicanery to make a profit from stealing from information asymmetries which is the souped up way that we financial economists say the customers are generally uninformed and vulnerable.

It is time to QUIT bailing out the managers and the investors and time to start protecting the customers and borrowers. When lenders turn making loans into a game of charades, the borrower cannot be blamed for misreading the signals. When lawmakers turn their back to one side of the market and are complicent with the other, they are as bad as the perpetrator of the fraud.

Recent Comments