As Expected, Obama’s 2014 Budget Includes Chained CPI

Posted: April 5, 2013 | Author: bostonboomer | Filed under: Barack Obama | Tags: Chained CPI, cutting Social Security, Grand Betrayal | 55 CommentsHere we go, folks. The Associated Press (via Business Insider) reports that Obama’s New Budget Will Contain The Infamous ‘Chained CPI.’ The story is based on a anonymous leak from “an administration official.

The proposal attempts to strike a compromise with congressional Republicans on the Fiscal 2014 budget by combining the president’s demand for higher taxes with GOP insistence on reductions in entitlement programs.

The official, who spoke on a condition of anonymity to describe a budget that has yet to be released, said Obama would reduce the federal government deficit by $1.8 trillion over 10 years.

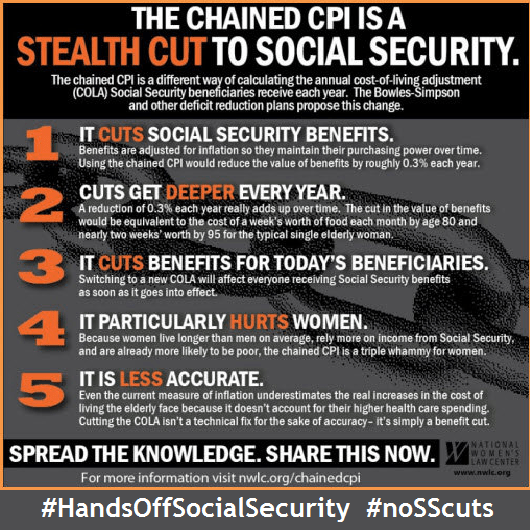

A key feature of the plan Obama is proposing for the federal budget year beginning Oct. 1 is a revised inflation adjustment called “chained CPI.” This new formula would effectively curb annual annual increases in a broad swath of government programs, but would have its biggest impact on Social Security.Obama’s budget proposal also calls for additional tax revenue, including a proposal to place limits on tax-preferred retirement accounts for wealthy taxpayers. Obama has also called for limits on tax deductions by the wealthy, a proposal that could generate about $580 billion in revenue over ten years.

The inflation adjustment would reduce federal spending over 10 years by about $130 billion, according to past White House estimates. Because it also affects how tax brackets are adjusted, it would also generate about $100 in higher taxes and affect even middle income taxpayers.

This is completely unacceptable. We should not have to rely on the stubbornness of right wing opposition to tax increases to save us from our supposedly Democratic President, but that’s the position we’re in right now. Obama has basically just put his 2011 “grand bargain” (already rejected by Boehner), put it down on paper and called it a budget.

Michael Lind at Salon writes that Obama is “making a historic mistake on Social Security.”

President Obama reportedly is unveiling a budget using the chained CPI inflation measure to cheat elderly Americans out of the benefits they were promised. In two previous posts I’ve explained the perversity of the current debate about Social Security. The tax-favored private components of America’s mixed private-public retirement system — programs like employer pensions, 401Ks and IRAs — are inefficient, volatile and subject to manipulation by overcompensated, fee-extracting money managers. In contrast, the Social Security program is simple and efficient, and has low overhead costs. And yet the bipartisan establishment, including many “progressive” Democrats as well as Republicans, wants to cut Social Security — the part that works — and expand tax-favored private savings, the inefficient, unstable and inequitable part.

While cutting Social Security makes no sense at all in terms of economics or public policy, it makes excellent sense in terms of the selfish class interests of the super-rich. They have extracted about half the gains from economic growth in the U.S. in the last half-century and recycle some of their profits to fund politicians, and lobbyists, as well as mercenary propagandists who pose as neutral think tank experts. Social Security’s contribution to the retirement income of the rich is negligible, while the top 20 percent receives around 80 percent of the income from tax-favored private retirement savings accounts like 401Ks. Naturally many of America’s oligarchs want the public discussion to be solely about cutting Social Security benefits for the bottom 80 percent, rather than 401Ks for the top 20 percent. To paraphrase Leona Helmsley, Social Security is for the little people. And if we cannot afford all of our present public-plus-private retirement system … well, as the saying in Tsarist Russia had it, let any shortage be shared among the peasants.

Elite discourse on this subject is radically at odds with public opinion. According to a February 2013 Pew poll, only 10 percent of Americans want to cut Social Security while 41 percent want to increase Social Security benefits. It’s time to change the public conversation about retirement security in America to reflect the beliefs and interests of the struggling many, not the fortunate few. We need to change the subject from cutting Social Security while subsidizing luxury retirements for the elite to cutting retirement subsidies for upper-income groups while expanding Social Security benefits for the majority of American retirees.

Please go read the whole thing and then we all need to bombard the White house with calls and e-mails.

Did you like this post? Please share it with your friends:

- Share on Facebook (Opens in new window) Facebook

- Share on Reddit (Opens in new window) Reddit

- Share on Pinterest (Opens in new window) Pinterest

- Share on Tumblr (Opens in new window) Tumblr

- Share on Mastodon (Opens in new window) Mastodon

- Share on LinkedIn (Opens in new window) LinkedIn

- Email a link to a friend (Opens in new window) Email

- Print (Opens in new window) Print

- Share on X (Opens in new window) X

- Share on Threads (Opens in new window) Threads

- Share on Bluesky (Opens in new window) Bluesky

- More

Recent Comments