Finally Friday Reads: Burning down the Economy

Posted: August 1, 2025 Filed under: #FARTUS, #MAGAnomics, #We are so Fucked | Tags: Burning Down the Economy, MAGAnomics will kill us, trade wars, Trump Tariffs 15 Comments

“I’m pretty sure Rosie O’Donnell isn’t the one who is a threat to humanity. No one chokes better than King Donald.” John Buss, @repeat1968

Good Day, Sky Dancers!

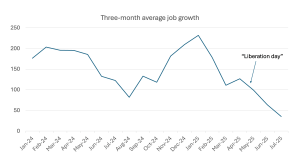

Our country’s economy is in trouble. The first signs of stagflation are showing up in our jobs and GDP numbers. More are coming as the chaos surrounding a chaotic and dangerous tariff scheme is put into effect based on political gripes and whims. The gripes of wrath are upon us. It’s too hot to wear my hood and robe because climate change is also throttling the world. None of this was necessary. We are ruled by greedy men of small vision. I’ll start with the weak jobs report and the downward revisions to the recent jobs numbers because it will be easier to speak to. The tariff mess is so chaotically applied that it takes a more detailed look because each country brings different goods to us. Grab your support buddy or blanket. Bad news is never a solo event.

Jeff Cox of CNBC analyzes the oncoming economic crash. “U.S. added just 73,000 jobs in July, and numbers for prior months were revised much lower.” I assume Yam Tits will try to blame Biden, but this is on him. Well, he did get some help from DOGE, which is probably the most costly debacle in the country’s history outside of invading Iraq. This will undoubtedly cost the Republican Party some seats in the midterms. It’s probably why they’re scurrying around to gerrymander states like Texas. As of now, I trust the numbers coming out of the usual agencies. But, I will warn you that I fear the administration will try to cook the books as this gets worse.

Nonfarm payroll growth was slower than expected in July and the unemployment rate ticked higher, raising potential trouble signs for the U.S. labor market as President Donald Trump ramps up tariffs.

Job growth totaled a seasonally adjusted 73,000 for the month, above the June total of 14,000 but below even the meager Dow Jones estimate for a gain of 100,000, the Bureau of Labor Statistics reported Friday. June and May totals were revised sharply lower, down by a combined 258,000 from previously announced levels.

At the same time, the unemployment rate rose to 4.2%, in line with the forecast.

The June total came down from the previously stated 147,000, while the May count fell to just 19,000, revised down by 125,000.

Stock market futures fell further after the news while Treasury yields also were sharply lower.

“This is a gamechanger jobs report,” said Heather Long, chief economist at Navy Federal Credit Union. “The labor market is deteriorating quickly.”

The weak report, including the dramatic revisions, could provide incentive for the Federal Reserve to lower interest rates when it next meets in September. Following the report, futures traders raised the odds of a cut at the meeting to 75.5%, up from 40% on Thursday, according to CME Group data.

The problem with that last statement is that we still have inflation on the upper policy bound, and the tariffs will make that worse in the coming weeks. Stagflation is the one phenomenon that makes monetary policy quite weak. You have to decide which is worse because if you go after inflation, you get more unemployment. The reverse is also true. You have to be my age or older to remember the terrible stagflation of the 1970s. It’s the worst of both worlds. Nobel Prize-winning Paul Krugman writes on “The Meaning of a Weak Jobs Report. It’s (probably) the tariff uncertainty, stupid.” He plans to write a piece on tariffs on Sunday, so please be sure to read that. Most of us never thought we’d see the stupidity of tariffs again, so we never plan too much lecture or reading time for it. But no one expected a president so unfit for office as Yam Tits.

It’s highly likely that what we’re seeing is the effect of Trump’s tariffs — or more precisely the uncertainty that his erratic tariff policy has created.

Contrary to myth, tariffs don’t necessarily cause high unemployment. They make the economy less efficient and poorer, but don’t necessarily reduce the total number of jobs. For example, Britain in the 1950s had high tariffs and import controls, but also full employment. The claim that Smoot-Hawley caused the Great Depression is a myth, one fostered in part by anti-Keynesians who didn’t want to admit that the problem was inadequate demand and the answer fiscal stimulus.

But Trump has brought something special to the mix: Not just high tariffs, but unpredictable tariffs. Since April 2 nobody (probably Trump included) has had no idea what tariff rates will be for the next few months, let alone for the long term.

As many of us pointed out, this uncertainty was a huge deterrent to business investment. Build a factory based on the assumption that tariffs will go back down to more normal levels, and you risk having a stranded investment if 20-25 percent tariffs are here to stay. Build a factory based on the assumption that high tariffs are the new normal, and you’ll have a stranded investment if Trump chickens out.

So many of us predicted an economic slowdown caused not by the level of tariffs but by uncertainty. Yet the predicted slowdown, while visible in “soft” data like surveys, kept not showing up in the hard data, making these predictions look all wrong.

Hard data, however, aren’t as hard as we’d like. Payroll numbers, in particular, rely a lot on assumptions and interpolations, and are often revised.

And the revised numbers now show exactly the kind of uncertainty-induced slowdown I and many others predicted.

These numbers don’t show the long-run damage from Trump’s tariffs, which are really a completely different story. In fact, the short-run jobs picture may improve now that it’s clear that there won’t be any real trade deals, just Smoot-Hawley redux as far as the eye can see.

One thing is clear: The previously reported good numbers were proof of Trump’s brilliance. Now that they’ve been revised away, the bad numbers are clearly Biden’s fault, or maybe Jerome Powell’s, or Barack Obama’s.

Forbes put these depressing numbers right in the headline. “Unemployment Rose To 4.2% in July, As Hiring Fell Sharply. The U.S. job market appeared to lose steam last month, according to Labor Department data released Friday, as the Federal Reserve warned the effects of President Donald Trump’s tariffs on the economy have yet to be seen. “ The analysis is by Ty Roush. I’m going to remind you of the Humphrey-Hawkins mandate to the Fed by Law before we go into this one. It’s also called The Full Employment and Balanced Growth Act. This is a Wiki overview, so it’s short and sweet. It was signed just as I entered graduate school to study Economics.

Forbes put these depressing numbers right in the headline. “Unemployment Rose To 4.2% in July, As Hiring Fell Sharply. The U.S. job market appeared to lose steam last month, according to Labor Department data released Friday, as the Federal Reserve warned the effects of President Donald Trump’s tariffs on the economy have yet to be seen. “ The analysis is by Ty Roush. I’m going to remind you of the Humphrey-Hawkins mandate to the Fed by Law before we go into this one. It’s also called The Full Employment and Balanced Growth Act. This is a Wiki overview, so it’s short and sweet. It was signed just as I entered graduate school to study Economics.

In response to rising unemployment levels in the 1970s, Representative Augustus Hawkins and Senator Hubert Humphrey created the Full Employment and Balanced Growth Act. It was signed into law by President Jimmy Carter on October 27, 1978, and codified as 15 USC § 3101. The Act explicitly instructs the nation to strive toward four ultimate goals: full employment, growth in production, price stability, and balance of trade and budget. By explicitly setting requirements and goals for the federal government to attain, the Act is markedly stronger than its predecessor (an alternate view is that the 1946 Act concentrated on employment, and Humphrey–Hawkins, by specifying four competing and possibly inconsistent goals, de-emphasized full employment as the sole primary national economic goal). In brief, the Act:

- Explicitly states that the federal government will rely primarily on private enterprise to achieve the four goals.

- Instructs the government to take reasonable means to balance the budget.

- Instructs the government to establish a balance of trade, i.e., to avoid trade surpluses or deficits.

- Mandates the Board of Governors of the Federal Reserve to establish a monetary policy that maintains long-run growth, minimizes inflation, and promotes price stability.

- Instructs the Board of Governors of the Federal Reserve to transmit a Monetary Policy Report to the Congress twice a year outlining its monetary policy.

- Requires the President to set numerical goals for the economy of the next fiscal year in the Economic Report of the President and to suggest policies that will achieve these goals.

- Requires the Chairman of the Federal Reserve to connect the monetary policy with the Presidential economic policy.

The Act set specific numerical goals for the President to attain. By 1983, unemployment rates should be not more than 3% for persons aged 20 or over and not more than 4% for persons aged 16 or over, and inflation rates should not be over 4%. By 1988, inflation rates should be 0%. The Act allows Congress to revise these goals over time. (As of 2017 the Federal Reserve has had a target inflation rate of 2%, not 0%. 0% inflation is not considered ideal and can lead to deflation which can hurt the economy.)

If private enterprise appeared not to be meeting these goals, the Act in its original form, though not in its ultimate iteration, expressly allowed the federal government to create a “reservoir of public employment,” provided of course that the legislation to establish the “reservoir” managed to become ratified. These jobs would have been required to be in the lower ranges of skill and pay to minimize competition with the private sector.

The Act directly prohibits discrimination on account of sex, religion, race, age, and national origin in any program created under the Act.

I can only imagine the ketchup flinging in that gaudily redone Oval Office if someone explains this to him. However, he does think he’s above the law, as are his stupid sharpie orders. But let’s get back to the current unemployment problem.

I can only imagine the ketchup flinging in that gaudily redone Oval Office if someone explains this to him. However, he does think he’s above the law, as are his stupid sharpie orders. But let’s get back to the current unemployment problem.

It’s not immediately clear whether Trump’s tariffs have directly affected the number of jobs available, though retail and automotive sectors have recorded an increase in layoffs. The retail market cut nearly 80,500 jobs in July, a year-over-year increase of 249%, according to the Challenger report, as companies cited tariffs, inflation, and economic uncertainty.

Following the Federal Reserve’s policymaking meeting in July, during which the agency opted to hold interest rates between 4.25% and 4.5%, Fed Chair Jerome Powell noted there were several economic reports ahead before the Fed considers a rate easement, including Friday’s labor report. Powell said the unemployment rate would be a focus, as the Fed operates on a dual mandate of setting rates to keep inflation and unemployment low, though he warned about the looming impacts of Trump’s tariffs, as there is a “long way to go” before the long-term effects of those are known. Tariff costs are starting to raise consumer prices, Powell said Wednesday, and “we expect to see more of that.” The Fed’s policymaking panel will meet again on Sept. 17, and there’s about 39% odds the agency opts for a quarter-point reduction, according to CME’s FedWatch. There’s a higher chance during its Oct. 29 meeting, at 61.3% odds.

The worst American President ever announced his latest version of the tariff schemes today that he thinks will punish other countries, but will, indeed, punish American Businesses and households. His executive orders will undoubtedly go down in history as attempts to overrule what should be the business of Congress. “FURTHER MODIFYING THE RECIPROCAL TARIFF RATES.” Yes, it was in all caps, so when in Rome. (Maybe I should say Rome burning)

The worst American President ever announced his latest version of the tariff schemes today that he thinks will punish other countries, but will, indeed, punish American Businesses and households. His executive orders will undoubtedly go down in history as attempts to overrule what should be the business of Congress. “FURTHER MODIFYING THE RECIPROCAL TARIFF RATES.” Yes, it was in all caps, so when in Rome. (Maybe I should say Rome burning)

By the authority vested in me as President by the Constitution and the laws of the United States of America, including the International Emergency Economic Powers Act (50 U.S.C. 1701 et seq.) (IEEPA), the National Emergencies Act (50 U.S.C. 1601 et seq.), section 604 of the Trade Act of 1974, as amended (19 U.S.C. 2483), and section 301 of title 3, United States Code, I hereby determine and order:

Section 1. Background. In Executive Order 14257 of April 2, 2025 (Regulating Imports With a Reciprocal Tariff To Rectify Trade Practices That Contribute to Large and Persistent Annual United States Goods Trade Deficits), I found that conditions reflected in large and persistent annual U.S. goods trade deficits constitute an unusual and extraordinary threat to the national security and economy of the United States that has its source in whole or substantial part outside the United States. I declared a national emergency with respect to that threat, and to deal with that threat, I imposed additional ad valorem duties that I deemed necessary and appropriate.

I have received additional information and recommendations from various senior officials on, among other things, the continued lack of reciprocity in our bilateral trade relationships and the impact of foreign trading partners’ disparate tariff rates and non-tariff barriers on U.S. exports, the domestic manufacturing base, critical supply chains, and the defense industrial base. I also have received additional information and recommendations on foreign relations, economic, and national security matters, including the status of trade negotiations, efforts to retaliate against the United States for its actions to address the emergency declared in Executive Order 14257, and efforts to align with the United States on economic and national security matters.

For example, some trading partners have agreed to, or are on the verge of agreeing to, meaningful trade and security commitments with the United States, thus signaling their sincere intentions to permanently remedy the trade barriers that have contributed to the national emergency declared in Executive Order 14257, and to align with the United States on economic and national security matters. Other trading partners, despite having engaged in negotiations, have offered terms that, in my judgment, do not sufficiently address imbalances in our trading relationship or have failed to align sufficiently with the United States on economic and national-security matters. There are also some trading partners that have failed to engage in negotiations with the United States or to take adequate steps to align sufficiently with the United States on economic and national security matters.

After considering the information and recommendations that I have recently received, among other things, I have determined that it is necessary and appropriate to deal with the national emergency declared in Executive Order 14257 by imposing additional ad valorem duties on goods of certain trading partners at the rates set forth in Annex I to this order, subject to all applicable exceptions set forth in Executive Order 14257, as amended, in lieu of the additional ad valorem duties previously imposed on goods of such trading partners in Executive Order 14257, as amended.

That basically is a bunch of gibberish. Wall Street Journal, our nation turns its lonely eyes to you and the analysis of Sharon Terlep. “Why Ford’s Made-in-America Strategy Hurts It in Trump’s Trade War. The company says new tariff deals with Japan, the EU, and South Korea put it at a disadvantage.'” Do you suppose he’s killing the American Automobile Industry just to spite Obama, who once saved it?

That basically is a bunch of gibberish. Wall Street Journal, our nation turns its lonely eyes to you and the analysis of Sharon Terlep. “Why Ford’s Made-in-America Strategy Hurts It in Trump’s Trade War. The company says new tariff deals with Japan, the EU, and South Korea put it at a disadvantage.'” Do you suppose he’s killing the American Automobile Industry just to spite Obama, who once saved it?

There is an irony in Detroit right now: The automaker most reliant on U.S. manufacturing is among the hardest hit by tariffs.

Ford Motor F -2.94%decrease; red down pointing triangle, the second-largest American carmaker, prides itself on making most of its vehicles in the U.S. Some 80% of the cars Ford sells in the U.S. are built there, and it makes more vehicles in the U.S. than any other automaker.

But the Dearborn, Mich., company said the Trump administration’s latest trade deals with Japan, the European Union and South Korea put it at a disadvantage with foreign rivals. Those deals now set a 15% tariff rate, which is lower than the 25% auto tariff that went into effect this spring.

Ford faces steeper tariffs on many parts as well as higher costs for imported aluminum, which is subject to 50% duties. Ford, one of the industry’s biggest users of aluminum, buys the material from U.S. suppliers who pass on a chunk of their tariff costs.

Treasury Secretary Scott Bessent said in a CNBC interview that Ford’s predicament is due to “idiosyncratic” factors, as the company’s F-series pickups are made with aluminum, which isn’t readily available in the U.S. Bessent said the administration hopes to cut a deal with Canada to address aluminum costs in particular. “I admire Ford,” he said.

When President Trump rolled out his tariff plan in April, he railed against the tariffs other countries had imposed on U.S.-made vehicles and said his new trade policy would help restore the U.S. to be an industrial powerhouse.

U.S. automakers have long complained that they struggle to compete with foreign rivals that enjoy lower labor costs, higher levels of government support and less-stringent regulations.

“For decades now, it has not been a level playing field for U.S. automakers globally, with either tariffs or trade barriers,” General Motors Chief Executive Mary Barra said earlier this year. “So I think tariffs is one tool that the administration can use to level the playing field,” she said.

As the trade policy was rolled out, the U.S. automakers found themselves also vulnerable to the tariffs. Trump slapped duties on steel and aluminum, on automotive parts and on all imported foreign vehicles, even those made by American carmakers.

During the era of the North American Free Trade Agreement, GM, Ford and Stellantis expanded significant portions of their manufacturing capacity to Mexico and Canada. Those products became subject to tariffs.

Around half of what GM sells in the U.S. it makes abroad; Ford builds most of its vehicles in the U.S. but relies heavily on imported parts. A trade deal that helps one might weaken the other.

“Ford has more reason to complain,” said Daniel Roeska, a Bernstein analyst. “If you’re now lowering tariffs and letting more cars and content flow into the U.S., that relatively disadvantages Ford more than others.”

All three companies have reported big tariff costs. Ford said it paid $800 million in the second quarter. GM put its tab at $1.1 billion. Stellantis, which makes the U.S. brands Chrysler, Ram and Jeep, said tariffs shaved $350 million from its bottom line.

Tesla, which builds all the vehicles it sells in the U.S. domestically and gets most parts in North America, said tariffs cost its automotive unit $200 million.

When the Trump administration started striking deals with big trading partners in recent weeks, Ford executives cringed with each deal.

This is the headline at CNBC. “Live Updates: Trump’s tariffs kick in, reversing decades of global trade expansion.” Your homework today is to compare the minimum wage ($7.25) to a pound of any meat or fresh vegetable. Then, develop a budget that can feed 2 adults and 2 kids. “U.S. Trade Representative Jamieson Greer is calling Trump’s new tariffs a “knockout win.” He just doesn’t follow up with who exactly Trump has knocked out.

This is the headline at CNBC. “Live Updates: Trump’s tariffs kick in, reversing decades of global trade expansion.” Your homework today is to compare the minimum wage ($7.25) to a pound of any meat or fresh vegetable. Then, develop a budget that can feed 2 adults and 2 kids. “U.S. Trade Representative Jamieson Greer is calling Trump’s new tariffs a “knockout win.” He just doesn’t follow up with who exactly Trump has knocked out.

Trump’s new tariffs are hitting several countries’ imports harder than the rates that had initially been announced for those nations on April 2.

Brazil’s rate jumped from 10% to 50%, as Trump ramps up criticism of the country’s treatment of former Brazilian President Jair Bolsonaro.

Canada is also facing a large increase, with its previously announced rate of 25% being upped to 35%.

Trump cited Canada’s “continued inaction” in curbing the flow of fentanyl and drugs for imposing the higher rate, according to an executive order.

Switzerland was hit with a jump from 31% to 39%, among the highest rates of the new tariffs.

Swiss President Karin Keller-Sutter said that she spoke to Trump on Thursday but did not reach an agreement with him to forestall that spike.

– Laya Neelakandan

To continue …

Switzerland reels from 39% tariff announcement

Swiss businesses broadly believed they were close to a framework trade deal with the U.S. — instead they have been rocked by news of a 39% tariff, one of the highest in the world, to apply from Aug. 7.

“This unpredictability imposes a rising risk premium on financial assets,” Beat Wittmann, chairman and partner at Porta Advisors, said in emailed comments. “This will lead to a weakening of the Swiss economy, the Swiss Franc and the Swiss equity market, particularly the all-important export sector.”

Consultancy Capital Economics estimates that a 39% tariff could knock 0.6% off Swiss GDP, or more if it extends to pharmaceuticals.

However, analysts also noted Friday that there was still time for Switzerland to negotiate new rates before the end of next week. Read more here.

— Jenni Reid

President Donald Trump imposed sweeping new tariffs on imports from across the world, escalating an aggressive trade policy aimed at spurring domestic manufacturing in the United States.

In addition, Trump took separate action on July 31 to raise tariffs on Canadian goods from 25% to 35%.

U.S. stocks were lower on August 1, ahead of what turned out to be a disappointing July jobs report that saw unemployment rise from 4.1% to 4.2%.

The new tariff rates, which will go into effect in seven days, came before an Aug. 1 deadline Trump gave about 180 countries to either reach trade deals or face higher import duties. Trump had twice set earlier deadlines for new tariffs before backing down.

In April White House trade advisor Peter Navarro had predicted “90 deals in 90 days,” but the haul has been modest: U.S. negotiators made eight trade deals in 120 days before Trump ordered the new tariffs.

A top White House economic adviser acknowledged that “uncertainty” over President Trump’s tariffs contributed to the weaker than expected jobs report.

Council of Economic Advisers Chairman Stephen Miran argued on MSNBC that July’s number was “decent” but admitted that downward revisions to May and June “are not great.” He chalked those up to seasonal factors such as teachers on summer break and cited Trump’s border policies, which he said were eliminating jobs held by foreign workers.

Just so you know, the Commerce and Labor Departments use statistical tools to remove the seasonal factors in the unemployment rates. So the BBC has a heading we can all appreciate today. This is from Jennifer Clarke. “What tariffs has Trump announced and why?” Anyone who takes a shot at why Trump does something is a hero in my book.

Just so you know, the Commerce and Labor Departments use statistical tools to remove the seasonal factors in the unemployment rates. So the BBC has a heading we can all appreciate today. This is from Jennifer Clarke. “What tariffs has Trump announced and why?” Anyone who takes a shot at why Trump does something is a hero in my book.

US President Donald Trump has announced a 35% tariff on Canada from 1 August. He also announced new tariff rates for dozens of countries that will come into effect on 7 August.

Since returning to office in January, Trump has introduced a series of these import taxes, and threatened many more.

He argues that the tariffs boost American manufacturing and protect jobs.

However, his volatile international trade policy has thrown the world economy into chaos, and a number of firms have increased prices for US consumers as a result.

What are tariffs and how do they work?

Tariffs are taxes charged on goods bought from other countries.

Typically, they are a percentage of a product’s value.

A 10% tariff means a $10 product has a $1 tax on top – taking the total cost to the importer $11 (£8.35).

Companies that bring foreign goods into the US have to pay the tax to the government.

They may pass some or all of the extra cost on to customers. Firms may also decide to import fewer goods.

At the end of May, a US trade court ruled that Trump did not have the authority to impose some of the tariffs he has announced, because he did so under national emergency powers.

But the following day, an appeals court said the relevant taxes could stay in place while the case continued.

Why is Trump using tariffs?

Trump says tariffs will encourage US consumers to buy more American-made goods, increase the amount of tax raised and boost investment.

He wants to reduce the gap between the value of goods the US buys from other countries and those it sells to them – known as the trade deficit. He argues that America has been taken advantage of by “cheaters”, and “pillaged” by foreigners.

The president has announced different tariffs against specific goods, and imports from individual countries.

Many of these have been subsequently amended, delayed or cancelled altogether.

Critics accuse Trump of making dramatic and sometimes contradictory policy statements as a negotiating tactic to encourage trade partners to agree deals that benefit the US.

Trump has made other demands alongside the tariffs.

Setting out the first tariffs of his current term against China, Mexico and Canada, he said all three countries must do more to stop migrants and illegal drugs reaching the US.

Separately, on 14 July, Trump threatened to introduce significant tariffs against companies trading with Russia, if a deal to end the war in Ukraine was not reached within 50 days.

- 50% tariff on steel and aluminium imports

- 50% tariff on copper imports from 1 August

- 25% tariff on foreign-made cars and imported engines and other car parts

On 8 July, Trump threatened to impose a 200% tariff on pharmaceutical imports but no further details have been confirmed.

Trump has also said the global tariff exemption covering goods valued at $800 or less will end on 29 August.

He had already removed the so-called “de minimis” exemption for products from China and Hong Kong, to restrict American’s purchase of cheap clothes and household items from commerce sites like Shein and Temu.

Continue reading the article for more really good basic information. And now you know why it’s called the dismal science. Well, not exactly, that was originally because of clergyman Thomas Robert Malthus and the entire idea that we’d eventually overpopulate the world, use up all the resources, and die. Early economists studied that notion, but quickly dropped it when the entire notion of technological changes came about. The problem is that just like climate change, we know a lot about what helps and hurts an economy, but that doesn’t mean the leaders of a given country will use it. (Especially if they’re as stupid as our current president.)

Continue reading the article for more really good basic information. And now you know why it’s called the dismal science. Well, not exactly, that was originally because of clergyman Thomas Robert Malthus and the entire idea that we’d eventually overpopulate the world, use up all the resources, and die. Early economists studied that notion, but quickly dropped it when the entire notion of technological changes came about. The problem is that just like climate change, we know a lot about what helps and hurts an economy, but that doesn’t mean the leaders of a given country will use it. (Especially if they’re as stupid as our current president.)

Sorry, this is so late, but I’ve had to change my entire sleeping hours based on when it’s cool enough to get the house temperatures down. The humidity and heat here have been awful. But hey, Climate change is fake, right?

What’s on your Reading, Blogging, and Action list today?

This is from USA Today.

This is from USA Today.

Recent Comments