How to Kill Home Ownership

Posted: February 11, 2011 Filed under: commercial banking, Economic Develpment, financial institutions, Surreality, Team Obama, We are so F'd | Tags: Bail out of Fannie Mae and Freddie Mac, Timothy Giethner 38 CommentsYour house is about to become even harder to sell, even more unlikely to appreciate, and even more unaffordable to more people. Be prepared to go back to the past. All those young Obama Democrats better love their landlords. They’re likely to be stuck with them for some time. Every think you’d see a headline like this for a Democratic President? Here’s one from NPR Today: Obama Administration: Not Everybody Should Own A Home,

For decades, U.S. housing policy seemed to assume that more home ownership was always better.

At one point in the early ’90s, the government launched the “National Homeownership Strategy,” whose stated goal was to “attempt to help all American households become homeowners.”

So perhaps the most striking thing in today’s housing finance report from the Obama administration is the simple idea that not everybody should own a home (emphasis added):

The Administration believes that we must continue to take the necessary steps to ensure that Americans have access to an adequate range of affordable housing options. This does not mean all Americans should become homeowners. Instead, we should make sure that all Americans who have the credit history, financial capacity, and desire to own a home have the opportunity to take that step. At the same time, we should ensure that there are a range of affordable options for the 100 million Americans who rent, whether they do so by choice or necessity.

This is idea, in turn, leads to the Obama administration’s main conclusion: Fannie Mae and Freddie Mac should cease to exist.

I’ve been a critic of the way Fannie Mae and Freddie Mac were managed for about 15 years. They were packaging up loans and paying bonuses like the worst of the Wall Street set. This had nothing to do with their basic government franchise agreement which is to provide long term funds to back up home loans. The packaging and wheeling and dealing were part and parcel of Fannie and Freddie trying to mimic Wall Street and privatization. However, they both provided products with implied government guarantees. This implies a higher level of due diligence in underwriting and packaging that they basically ignored. It’s similar to USDA grade beef. There was a guarantee that these loans would hold mortgage insurance and be underwritten carefully. The root cause of the problems were not the attempts to get more qualified people into affordable mortgages, it was to feed Wall Street greed and shovel money to their executives who were frequently just political hacks. They simply did the worst of the Wall Street practices at a much higher volume with a more damaging result because of the US stamp of approval; the implicit guarantee.

Now, we have a back to the gilded age future ahead of us. What has made these loans work as loans and the securities that back the loans work is the implied low risk with a decent rate of return. Many, many pension funds and institutional investors hold huge numbers of Fannie and Freddie Securities because they’ve always had high ratings. Most of these pension funds and institutional investors are sources of long term funds. There’s not a lot of a lenders that will lend long these days and that’s going to be a problem for most people looking for a home now more than ever. My guess is that most home loans will now go down to terms of about 15-20 years or they’ll be completely variable rate. That means the homeowner will have to bet on the rate to get an affordable mortgage and gamble their incomes will go up to secure the lowest rates and longest terms. Both of these are highly risky bets. Past data has shown that most people loose with these kinds of mortgages.

Plus, that’s if they can get the funding at all. Without something similar, I doubt that the major sources of these funds which are usually forced into safe investments will be available. Either that, or you’re going to lock in to a fixed rate but for an intermediate term loan. Think about your own house loan and what that would mean for you. You either double your house payment or take the bet that the rate won’t go up enough to force you to default in the future. Most people don’t have sophisticated enough knowledge of economics to even make an educated guess. My guess is that if they take the loan at all, they’ll go for the short term fixed rate loan on a much cheaper house. This is going to change the complexion of the housing market for ever if it goes through as planned.

This is a President used the gipper metaphor for himself. This is the White House that wants less Government in the Mortgage system.

The Obama administration wants to shrink the government’s role in the mortgage system — a proposal that would remake decades of federal policy aimed at getting Americans to buy homes and would probably make home loans more expensive across the board.

The Treasury Department rolled out a plan Friday to slowly dissolve Fannie Mae and Freddie Mac, the government-sponsored programs that bought up mortgages to encourage more lending and required bailouts during the 2008 financial crisis.

Exactly how far the government’s role in mortgages would be reduced was left to Congress to decide, but all three options the administration presented would create a housing finance system that relies far more on private money.

“It’s clear the administration wants the private sector to take a more prominent role in the mortgage rates, and in order for that to happen, mortgage rates have to go up,” said Thomas Lawler, a housing economist in Virginia.

Abolishing Fannie and Freddie would rewrite 70 years of federal housing policy, from Fannie’s creation as part of the New Deal to President George W. Bush’s drive for an “ownership society” in the 2000s. It would transform how homes are bought and redefine who can afford them.

Treasury Secretary Timothy Geithner said the plan would probably not happen for at least five years and would proceed “very carefully.” In the meantime, he said the companies would have the cash they need to meet their existing obligations.

There are other ways to do this. Most would have to do with tighter governance of Fannie and Freddie and elimination of private sector practices of bonuses for volume when government guarantees are involved. Also, a cap for the mortgages to prices more standard through out the country rather than Washington DC would help. Fannie and Freddie should have no place in the jumbo market. Here’s a few of the proposals that are in the White House program.

The Obama administration proposals include raising the rates Fannie and Freddie charge to banks for loan guarantees to the same levels as private banks. Private mortgages for so-called jumbo loans, which are not covered by government guarantees, currently cost between 0.5% and 0.75% more than government-backed mortgages. So, if Fannie and Freddie’s fees were to rise to the market level, mortgage rates across the U.S. might rise substantially.

The administration also proposed lowering the maximum value of a mortgage that can qualify to be federally backed from the current $729,750 to $625,500. That’s a widely suggested move that would attract the private sector to make more loans in the upper range of the market. The proposal also called for Fannie, Freddie and the FHA to set a minimum down payment requirement of 10%. Currently, the agencies are authorized to make loans with no down payments at all.

The big issue is what to do about the government guarantee that assures investors who buy Fannie and Freddie mortgage bonds that the U.S. government will pay back the bonds in the event the underlying mortgages default. Because of that guarantee, Fannie and Freddie can offer lower interest rates than the private sector. Investors, especially foreign investors, were burned by subprime bonds during the financial crisis, and now they won’t touch private mortgage bonds without a government guarantee.

There’s obvious problems with Fannie and Freddie but they mostly lie with how it was managed and how it morphed as more up income and high price assets were put into play. Helping upper income people or expensive real estate markets weren’t originally part of the charter. Making it more like a bank isn’t going to remove the abuses but add to them. Bonuses for production quotas lead to reduced quality.

It would be more prudent to take Fannie and Freddie back to their roots rather than to them strip them of their ability to provide affordable mortgages to entry level home owners. The management got caught up in production over quality of loans because they got bonuses. That was a huge problem. The connection to affordable housing initiatives was never the problem. Churning out crap to feed the investment frenzy of Wall Street and peeling off bonuses for their executives led to their sloppy loan processing. They caught the same disease that plagued the private sector at a larger volume. Congress also did a poor job of oversight.

This move will leave a huge gap in two places. First, it will impact investment portfolios that rely on long term, relatively safe but decent yield-bearing assets. It will also remove one more route to the American dream for ordinary Americans. Let’s just say we’re all taking one for the Gipper.

Trouble for Barney and Friends

Posted: December 9, 2008 Filed under: U.S. Economy | Tags: Bail out of Fannie Mae and Freddie Mac 4 CommentsI’ve got many criticisms from Leftblogosphere because I continue to criticize the lending and borrowing practices that have left Fannie and Freddie at the mercy of the taxpayer. I believe they also contributed mightily to the problems we face now in the mortgage and financial markets. Again, I would like to emphasis here that I a NOT against affordable housing and that I worked against redlining when I worked in the mortgage/thrift industry in the 1980s. I do think it is completely bad banking as well as unfair to everyone involved to place people in mortgages that they cannot possibly pay. I’ve always supported special bond financing dedicated to helping folks with either less than stellar credit ratings, first time home buyers with little to put down, or revitalizing neighborhoods where increased home ownership would help the community. Lending to folks without income and placing anyone but the most sophisticated investor in an exotic mortgage are both completely unethical in my opinion.

Anyway, with that said, here’s some interesting news coming from the Fannie and Freddie rescue process from the AP wire.

December 9, 2008Fannie, Freddie execs turned aside warnings

By ALAN ZIBEL AP Real Estate WriterTop executives at mortgage finance companies Fannie Mae and Freddie Mac ignored warnings that they were taking on too many risky loans long before the housing market plunged, according to documents released by a House committee.E-mails released by the House Oversight and Government Reform Committee on Tuesday show that former Fannie CEO Daniel Mudd and former Freddie Mac CEO Richard Syron disregarded recommendations that they stay away from riskier types of loans.

“Their own risk managers raised warning after warning about the dangers of investing heavily in the subprime and alternative mortgage market. But these warnings were ignored” by the two chief executives, said Rep. Henry Waxman, D-Calif., the committee’s chairman. “Their irresponsible decisions are now costing the taxpayers billions of dollars.”

Four former top executives of the two companies were poised to defend their stewardship in a hearing held by the House committee.

Fannie and Freddie own or guarantee around half the $11.5 trillion in U.S. outstanding home loan debt. The two companies are the engines behind a complex process of buying, bundling and selling mortgages as investments.

They traditionally backed the safest loans, 30-year fixed rate mortgages that required a down payment of at least 20 percent. But in recent years, they lowered their standards, matching a decline fueled by Wall Street banks that backed the now-defunct subprime lending industry.

Republicans blame Fannie and Freddie, and homeownership policies of the Clinton administration for sowing the seeds of the financial meltdown. Democrats defend the companies’ role in encouraging homeownership and stress that Wall Street banks ” not Fannie and Freddie ” led the dramatic decline in lending standards.

Freddie Mac last month asked for an initial injection of $13.8 billion in government aid after posting a massive quarterly loss. Fannie Mae has yet to request any government aid but has warned it may need to soon.

For years the two companies flexed their lobbying muscle in Washington to thwart efforts to impose tighter regulation.

Internal Freddie Mac budget records obtained by The Associated Press show $11.7 million was paid to 52 outside lobbyists and consultants in 2006. Power brokers such as former House Speaker Newt Gingrich and former Sen. Alfonse D’Amato of New York were recruited with six-figure contracts.

The more difficult questions will come next year, when lawmakers weigh what role, if any, the two companies play should play in the mortgage market.

Options include taking the companies private, morphing them into a public utility or a federal agency, or leaving them as government-sponsored entities that have private shareholders and profits, with tougher regulations.

Given this information looks truthful, my guess is that there may be some actionable lawsuits at the very least against management. It is also possible that the overseers (read Barney and friends) could become entangled in the web of culpability. Look for this to continue make headlines as we determine what to do with the mess these two quasi-agencies made with the mortgage market. What role did the the folks responsible for oversight play in this mess and how will they be held to account?

Those who forget the past are condemned …

Posted: October 1, 2008 Filed under: U.S. Economy | Tags: bail out, Bail out of Fannie Mae and Freddie Mac, Fannie, Financial Crisis, HOLC 6 Comments(cross-posted at the Confluence)

I’m having difficulty digesting a lot of the news and hoopla surrounding this financial crisis. There are some things that are really worrying to me. It’s not so much the crisis itself, which I actually understand, but the responses. I am reminded of the saying that those who forget the past are condemned to repeat it. I think this basically sums up much of why I feel so desperate when I watch the response to this crisis unfold on TV. It’s time to stop the blame and start the problem-solving.

First, what really bothers me is the inability of ANY of the politicians to either REALIZE how they contributed to this or understand what lead to this. A recent post by myiq2xu mentioned a speech by Senator Obama who offhandedly referred to the period of deregulation of industries that went on during the 70s. He has been hammering his every talking point with the Republicans did this to us. Useful, I suppose when trying to get elected based on something other than your credentials, but disingenuous at the very least. I keep wondering if he JUST doesn’t know the history of deregulation or he’s purposefully lying to us.

The deregulation of the telcom industry, the airline industry and the banking industry came about during the Carter regime. When I was a fresh out of grad school economist, I worked for a bank then a Savings and Loan. The Monetary Control Act of 1980 (okay, i’m dating myself) was a response to the problem of traditional banks and thrifts hemorrhaging deposits to Money Market Accounts. The root of deregulation started with Jimmy Carter’s administration. Hasn’t any one told him this or does he just like to go on misspeaking? The fight against the deregulation against Fannie and Freddie–probably the biggest contributors to this latest moral hazard problem–was led by the Democrats also. Why can’t we just be honest about this and say that each of the parties had a hand in this and learn from the past?

Second, I lived through the S&L crises and the economy that prevailed in the early 80s. My first house loan had an interest rate of 17.67% which got discounted to a beneficent 12.67% because I worked for the thrift that gave me the loan. House loans aren’t even half that at the moment. Two other folks besides me got house loans that month from the biggest thrift in the heartland. I’d say that was a credit crunch, wouldn’t you? I also worked the money desk at that time and remember the interbank loan (Fed Funds rate) bopping between 4% and 21% on any given day. Both of these rates are a far cry from the current rates as is the unemployment rate which sat between 12 and 13% for some time. Remember, these were the morning in America years of the early 80s. We currently have a 6.1% unemployment rate.

My father lived through the great depression. At that time, the unemployment rate peaked between 25% to 29%. The foreclosures that happened during that time occurred because no one had jobs and no one had unemployment insurance. When they closed the banks, there was no FDIC so, you lost your life savings. Today, we have unemployment insurance, the FDIC, and various other types of insurance that minimize the loss you experience on your deposits –even money market funds. You may experience paper losses, but you will not loose EVERYTHING! There are safeguards against much of the worst situations experienced during the depression. I’m not sure that given today’s economy, which is sluggish and experiencing problems but is not as bad as either of these two periods, we need this rush to judgment. Why aren’t we thinking this bail-out plan through more?

Which brings me back to today. We solved many of the problems of the previous financial crisis with government intervention. The HOLC bought up many defaulting mortgages, renegotiated them when possible, and held on to the properties, insuring they wouldn’t drive land and house prices down further. During the S&L crisis, the RTC bought out S&Ls, unwound the assets, and sold the sellable ones while holding onto the bad stuff, until the market turned around. The government can afford to hold paper losses on its books. Private industry cannot. Government can help put a bottom price on these markets. This is what it needs to do. It does not need to end the alternative minimum tax, change the taxes on corporations, or fund ACORN and La Raza.

Which brings me back to today. We solved many of the problems of the previous financial crisis with government intervention. The HOLC bought up many defaulting mortgages, renegotiated them when possible, and held on to the properties, insuring they wouldn’t drive land and house prices down further. During the S&L crisis, the RTC bought out S&Ls, unwound the assets, and sold the sellable ones while holding onto the bad stuff, until the market turned around. The government can afford to hold paper losses on its books. Private industry cannot. Government can help put a bottom price on these markets. This is what it needs to do. It does not need to end the alternative minimum tax, change the taxes on corporations, or fund ACORN and La Raza.

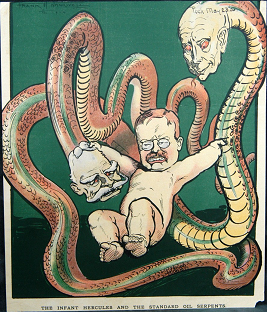

Which brings me to one more point, when do we stop turning these unprofitable behemoths into megacompanies that become too big to fail? Haven’t we learned anything in the past about this? Why are we creating more Freddies and Fannies? It is not fair to the taxpayer for the profits to be privatized, but the losses to be turned to the public. During the last 30 years, we’ve allowed mergers to create these giant companies that are behaving more and more like monopolies. This is not good for a free market system. If we are allowing them to become so big and letting them get away with extraordinary profits during good times, than making them subject to public largess if they fail, what is the difference between this and just nationalizing them altogether? Didn’t we learn these lessons during the trustbusting years of Teddy Roosevelt? Isn’t the basis of our monopoly law the Sherman Anti-trust regulations that were set up in the 19th century? Why have we forgotten the excesses of the gilded age?

Yes, it’s broken. Yes, it needs to be fixed. But can some one in Washington just pick a few history and economics textbooks so we’re not condemned to relearn the lessons of the past and do it with everyone’s tax dollars?

Crisis Strategy: Getting it Right the first time

Posted: September 28, 2008 Filed under: Uncategorized | Tags: Bail out of Fannie Mae and Freddie Mac, Financial Crisis, U.S. Economy 8 Comments(Cross-posted at The Confluence)

There are very little details out in the public concerning the supposedly ironed-out terms that will solve the current financial crisis. Almost every one is worried that the terms of the rescue will involve taxpayers bailing out Wall Street High Rollers and their bonus-loving CEOs. If you review Financial Economics literature, you will discover that there are several findings in the studies done by economists that can provide guidance to every one on the best way to approach the bail-out. One of the most recent studies comes from the International Money Fund. It is by Luc Laeven and Fabian Valencia and was posted this month at the IMF research website.

If you’re not familiar with regression analysis which is the analytical method of choice here, stay away from the last half of this paper. However, you may find some interesting things in the first section because it includes a huge database that looks at all systematically important financial crises between 1970 and 2007. This means the database has 42 crises in 37 countries. It looks at steps taken by government to solve these crises and the length and depth of the crisis.

Here’s the link: http://www.imf.org/external/pubs/ft/wp/2008/wp08224.pdf

Another good source of information for suggestions is the Brit Magazine The Economist. Many of its articles are also available on line and are not technical in nature.

If you’re not up to looking at the details, let me try to explain some of the things that Financial Economists have learned since the Great Depression. You should look for some of these dos and don’ts when we finally get to see the details of the plan. Sixty years of study and growing theories has shown us that the tactical approaches–which mostly involve containing the crisis–are very expensive and don’t work too well. Usually, containment approaches happen while the crisis is unfolding. As an example of this, I will point to the bail-outs of individual banks and financial institutions that have happened to date. We’ve seen this containment tactic most of this year.

Governments can respond to these kinds of crises in many ways. In a lot of cases, we see reallocation of wealth from taxpayers to Banks and other institutions that hold debt. When wealth transfers like this happen, many problems happen in the general economy. The existing research done in this area shows that providing assistance to banks and their borrowers can actually increase loan losses to banks and in many cases lead to laxes in regulation that can be abused. Study-after-study shows that individual bank bail-out is usually not a good approach. Other costly and not that efficient tactical steps can include accomodative policies like direct government guarantees of bank liabilities or injecting ‘liquidity’ into the bank itself by lending money to the bank. The literature shows that none of these steps necessarily lead to a speedier recovery.

So what strategies can our country adopt to staunch the current crisis? Proposals vary, but a good example of something that worked would be the comprehensive plan we had back under the first Bush administration during the S&L meltdown. The RTC (Resolution Trust Corporation) was set up in 1989 to deal with the many, many S&L bankruptcies. The purpose of the RTC was to dispose of failed S&L assets in a way that didn’t drive prices on the properties and assets down. It put a bottom price on things like farm land or houses that were the underlying assets held by the thrifts. In the case of situation now, a new ‘agency’ would buy troubled mortgage-backed securities from the market and hold them until there was a turn around in their value.

This new agency could also serve another purpose similar to a depression-era institution called the Home Owner’s Loan Corporation. Hillary has suggested this type of agency whose purpose would be to buy and restructure existing mortgages. This would basically keep many folks in their homes with mortgages they could handle. For this to work, it has to be geared towards folks that can actually follow-through and make their payments. It could not be a social largess program because that would only create more loan losses in the long run. It’s purpose would be to keep folks in their homes as well as put faith back into house prices and the mortgage market. It would also alleviate the downward pressure on home prices. A new agency would be allowed to hold the loans and troubled securities until the market function agains and the assets once again become valuable. Many of the assets in some of these securities are fine now and could just be repackaged. The profits need to be returned to the taxpayer and used to pay down the debt. We should ensure that the proceeds do not go to any politician’s pet project.

At the same time, we need to look for better oversight of derivatives markets. The big issue that can be layed squarely at the feet of the Bush Administration and Greenspan is their inability to see the need for regulation of these markets. The existance of this market (which serves a similiar function to insurance) injected more ‘moral hazard’ into the banking community. This means if you think you’ve got something insured, you’re more likely to act haphazardly. We already had banks being encouraged to loosen their underwriting standards for certain borrowers by Fannie and Freddie. With the invention of these innovations, banks were covered, or so they thought, even if they did practice lax lending standards. These derivatives were an attempt to manage credit risk. However, as we have seen, actually placing accurate vales on this contracts just created more uncertainty. The implied consent and guarantee of the government via Fannie and Freddie exacerbated the misvaluation in a market with no oversight. We need to re-visit the regulatory responsibilities of the SEC and the FED and update them so that they reflect the existence of these extremely sophisticated and difficult to understand markets. Also, something has to be done about Fannie and Freddie and how their role to feed loans to creditworthy middle class Americans warped into some social engineering plan that began the lax lending standards and provided opportunities for exploitation.

So, do we need a bail-out? Yes. Unfortunately, financial contagions do act as a disease and can create economic downturns that impact everyone. All you have to do is crack a book on the Great Depression to see how problems in banks and stock markets eventually transfer over to Main Street. What is needed is the least expensive and most prudent approach. The literature tells us that it must be systematic and not just tactical. You need to strengthen the market, not just select players. I’ve outlined a few things that financial economists have learned about past crises. I’d hope we get the details out pretty soon so you can look and see if the bailout is consistent with these principles.

Fasten your seltbelts, it’s going to be a bumpy night

Posted: July 15, 2008 Filed under: U.S. Economy | Tags: Add new tag, Bail out of Fannie Mae and Freddie Mac, bernanke, paulso 2 CommentsGet rid of your variable rate loans quickly and hold on to your jobs. The Fed’s about to raise rates. Bernanke and Paulson continue the tango to deal with the economy. Today’s news brought a record, whopping exchange rate for the Euro against the dollar and at the moment the Dow Jones Average is down triple digits. If I thought my morning coffee and blogging was going to be quiet, I was wrong. What’s going on in the financial markets right now is to economists as Hurricane Katrina was to meteorologists. This is as big as it gets. So here’s the most interesting of all my MarketWatch updates this morning.

source: http://www.marketwatch.com/ (This is site is affliated with the WSJ)

WASHINGTON (MarketWatch) – The potential for runaway price hikes is the top concern of Federal Reserve policymakers, according to testimony by Fed chairman Ben Bernanke and the accompanying report on the economic outlook of his colleagues on the central bank released Tuesday. FOMC members were more uncomfortable about the inflation outlook in June than they had been at any point in the year, according to the Fed’s monetary report to Congress. The Fed is worried that high oil prices, combined with the weak dollar, will increase business costs and prices. At the same time, it could make workers demand higher compensation because of the more expensive cost of living. As a result, most Fed members viewed the possibility that inflation could come in higher than expected in coming months.

I’ve been telling my students for months that interest rate drops were going to stop. I was rather suprised by the last one. However, problems in the housing market were trumping the higher inflation rates indicated by the CPI and the Fed’s preferred measure the CPE. Evidently, the Fed has decided that rising prices are more of a danger than a recession and have just announced in a big way there will be no more rate drops. My guess is they will quietly and slowly start pulling money out of the economy. Usually this is done with a series of open market sales of treasury bills by the fed. As the increased demand for the bonds/bills drives bond prices down, it will drive interest rates up.

So this market watch bulletin was followed by two other ones pretty quickly. One stated that GM was suspending dividends–something highly unusual for this type of stock. Also, it is cutting 20% of salary costs to boost it’s liquidity. This undoubtedly means either a hiring freeze or more layoffs. It’s possible it could be elimination of bonuses or salary cuts. Either way, it’s more bad news for the Michigan.

Then there was this next big of information. Did i mention my email box was full of MarketWatches today?

June retail sales fizzle despite stimulus

WASHINGTON (MarketWatch) – U.S. retail sales rose a disappointing 0.1% in June despite nearly $50 billion in stimulus checks for consumers, Commerce Department data released Tuesday revealed. Sales were boosted by higher prices for gasoline, food and other consumer goods. The figures are seasonally adjusted but are not adjusted for inflation. It was the weakest sales since February’s 0.2% decline. Sales in June were held back by the biggest drop in auto sales in more than two years. By contrast, sales at the malls and shopping centers were relatively healthy, stimulated by the tax rebate checks, Excluding the 3.3% drop in auto sales, sales rose 0.8%, the slowest in three months.

That didn’t surprise me at all. Rebates are usually the worst way to stimulate the economy. Most of them wind up paying off already purchased items. How many of you used the checks to pay down a credit card?

What continues to amaze me in all of this is the topics in political debate. The candidates are not getting that it’s the economy stupid! Obama is giving a ‘major’ speech on Iraq. McCain was out speaking to the Latino vote on immigration yesterday. Somebody needs to put these two through some freshmen economics courses and quick! Their lack of interest and knowledge is glaring and gives the appearance they really don’t care. Economic news of this sort is becoming a daily event. Their responses have been to send out their talking heads. Let’s face it, their economic advisers doing their thing on CNN and Fox, is not the same as the candidates showing some grasp of the problems. Frankly, I think they’re afraid of taking questions and looking ignorant. Obama is only effective on the teleprompter and McCain when he talks off the cuff. Any real dialogue would just emphasize their vacuity on the subject.

Recent Comments