The Best Laid Plans Of Mice and Men

Posted: February 26, 2009 Filed under: U.S. Economy | Tags: 2009 Budget, Geithner, Obama, Orzag 2 Comments

Los Tres Amigos: Obama, Geithner, Orzag

The Obama Administration just handed Congress a $3.6 trillion budget. The budget is one of the best ways of seeing what a President lays out as priorities and can be linked to many campaign promises. While it demonstrates a vision, what remains after congress hacks through it tends to be a more reliable gauge of the direction since compromise will shortly rule the day. I’m going to outline some of the major points and point you to some media coverage. We’ll have to watch over time what gets sold out and haggled away. That will really show the priorities and not just the posturing.

The overall tone of the budget shows a more activist government in the areas of health and education mostly paid for by families making over $250,000 a year, singles making more than $200,000 and various business interests. The WSJ has the numbers here.

As expected, tax increases will rise for singles earning $200,000 and couples earning $250,000, beginning in 2011 — for a total windfall of $656 billion over 10 years. Income tax hikes would raise $339 billion alone. Limits on personal exemptions and itemized deductions would bring in another $180 billion. Higher capital gains rates would bring in $118 billion. The estate tax, scheduled to be repealed next year, would instead be preserved forever, with the value of estates over $3.5 million — $7 million for couples — taxed at 45%.

Businesses would be hit, too. The budget envisions reaping $210 billion over the next decade by limiting the ability of U.S.-based multinational companies to shield overseas profits from taxation. Another $24 billion would come from hedge fund and private equity managers, whose income would be taxed at income tax rates, not capital gains rates. Oil and gas companies would be hit particularly hard, with the repeal of multiple tax credits and deductions.

There is a shift away from the oil and gas industry reliance as well as removal of some of their tax privileges. One of the more ambitious plans is that of an emissions trading program. Under this scheme, the government will set a cap on the allowable amount of green house gases and businesses will have to buy permits if they want to pollute above their allotment.

In one of the budget’s most ambitious proposals, the president plans to cap the emissions of greenhouse gases, forcing polluters to purchase permits for emissions that would be slowly brought down to 14% below 2005 levels by 2020 and 83% below 2005 levels by 2050. The sale of those permits, beginning in 2012, would reap $646 billion through 2019.

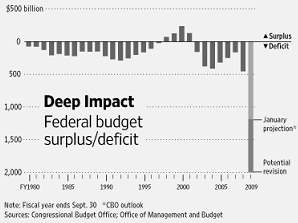

One of the most interesting things is the percentage of federal debt in relation to GDP. It’s at an historic high unlike anything seen for a long time. This is especially interesting coming after a “Fiscal Responsibility” Summit. The deficit estimates are based on pretty optimistic numbers which makes that summit look like even more of a marketing event

hats off to bb for this one ... WHOA!!!

from the land of Oz.

The president blamed the nation’s economic travails on the administration that preceded him and on a nation that lost its bearings. His budget plan projects a federal deficit of $1.75 trillion for 2009, or 12.3% of the gross domestic product, a level not seen since 1942 as the U.S. plunged into World War II.

I’m still wondering if we’re going to be able to float all that debt. Again, however, these are preliminary numbers and I’m certain Congress will bargain them down and around to other places. What the Administration compromises on will tell its true agenda. Republicans and business interests are not likely to go quietly into the night on any of this.

Recent Comments