Yup, it’s another dismal day

Posted: March 2, 2009 Filed under: Equity Markets, Global Financial Crisis, U.S. Economy 6 Comments As AIG announced the worst losses ever achieved by any corporation, the equity markets headed south–REALLY SOUTH. Unemployment figures are expected to be the worst in 60 years. It’s hard to find good news these days when it comes to the economy. I did find one mixed blessing. I’ve talked a little bit about the Paradox of Thrift in other posts. It’s one of Keynes ideas as to what made the Great Depression more than a normal recession. It has to do with the psychology of households as they begin to worry about a bad economy. It’s a paradox because what is sensible for the individual household during a recession actually will make the recession worse in the long run. The nature of this type of a downturn in the economy is basically lack of ‘aggregate demand’. That is economistese for no one is buying anything they don’t absolutely require. Every one is saving more and holding on to their money. As the economy worsens, folks save more and hold onto even more money. This just deepens the problem. That is why Keynes explained the only way out is for the federal government to spend. The only way to increase demand that point is going to come from the government as long as businesses, households, and the foreign sector are all scaling back. It is really necessary now because most states have balanced budget amendments which cause them to exacerbate the paradox of thrift. In other words it just makes the recession deeper.

As AIG announced the worst losses ever achieved by any corporation, the equity markets headed south–REALLY SOUTH. Unemployment figures are expected to be the worst in 60 years. It’s hard to find good news these days when it comes to the economy. I did find one mixed blessing. I’ve talked a little bit about the Paradox of Thrift in other posts. It’s one of Keynes ideas as to what made the Great Depression more than a normal recession. It has to do with the psychology of households as they begin to worry about a bad economy. It’s a paradox because what is sensible for the individual household during a recession actually will make the recession worse in the long run. The nature of this type of a downturn in the economy is basically lack of ‘aggregate demand’. That is economistese for no one is buying anything they don’t absolutely require. Every one is saving more and holding on to their money. As the economy worsens, folks save more and hold onto even more money. This just deepens the problem. That is why Keynes explained the only way out is for the federal government to spend. The only way to increase demand that point is going to come from the government as long as businesses, households, and the foreign sector are all scaling back. It is really necessary now because most states have balanced budget amendments which cause them to exacerbate the paradox of thrift. In other words it just makes the recession deeper.

Market Watch announced the news from the Commerce Department that the U.S. Savings rate has risen to a 14 year  high. This is very much in keeping with what Keynes suggested happened during the Great Depression. The other hint that we’ve had that this is a demand led recession is that prices are not increasing and real income is up.

high. This is very much in keeping with what Keynes suggested happened during the Great Depression. The other hint that we’ve had that this is a demand led recession is that prices are not increasing and real income is up.

Disposable real incomes rose in January at the fastest pace since May as annual pay raises and cost-of-living increases took effect, the Commerce Department said. Real disposable incomes (adjusted for inflation and after taxes) increased 1.5%, despite the third straight decline in income from wages and salaries,

Meanwhile, real (inflation-adjusted) consumer spending increased 0.4% in January, the largest increase since November 2007 and only the second increase in the past eight months.

Prices increased 0.2% in January, the first increase since September. Core consumer prices – which strip out food and energy prices to get a better view of underlying inflation – rose 0.1%. Consumer prices are up 0.7% in the past year, while core prices are up 1.6%.

With disposable incomes rising faster than spending, the personal savings rate rose to 5%, the highest since March 1995. At an annual rate, personal savings rose to a record $545.5 billion.

The savings rate could go even higher, with consumers trying to pay down their debts, live within their means and boost their savings to make up for their lost wealth. The savings rate “has a long way further to go,” said Ian Shepherdson, chief domestic economist for High Frequency Economics.

The January income report was much stronger than anticipated. Economists were looking for nominal incomes to fall 0.1%, but they rose 0.4%. Nominal spending rose 0.6%, rather than the 0.4% expected.

It appears that a lot of the income increase came from other cost of living adjustments to folks with federal pensions and increase in salaries to Federal Workers. Incomes from other sources fell. It seems that small business owners were perhaps the hardest hit. Wage supplements (read bonuses) and Transfer payments (read social security and other monies to non-workersfrom the government) also increased. These are all things you would expect to see during a recession. If real income continues to go up, which is possible, this is actually NOT good. Well, let me rephrase that, it is GOOD if you have and can keep your job. It is NOT good because if your wages are relatively expensive and businesses still have less customers, it improves your chances of losing your job.

The other thing increased savings does is decrease the multiplier for fiscal stimulus. Tax cuts and/or government spending will have less of an impact because more money is saved or used to pay down bills. The Paradox of Thrift hits tax cut stimulus worse however, since the first round of government spending still goes out as 100% spending. This is especially true if it’s given to states to spend because they not only spend all of it, they usually spend locally. Giving money to folks that will spend it and not save it is key during a time of depressed demand. In terms of households, that would be the poor and the young.

Here’s a site with some really nice wonky graphs if you need any more convincing that we’re not done with this bad economy yet. The graphs show a desperate house markets, dismal inventory orders, and the really bad revised GDP numbers for last quarter. I’m still wondering how low we can go in all of the asset markets. So, I wish I could give you something to look forward too other than some nice spring weather. I just continue to be amazed and how rapidly things are unravelling. The stock market which is probably the most forward looking indicator of future economic activity we have is dropping again as I write. Again, we need some pretty bold action on all fronts and we are getting none.

If you’re interested in reading one more article wondering if the Tim Geithner will wake up and do something with banking, you may want to check thisout. Noam Scheiber of The New Republic wonders “Whats Stopping Geithner?”

Here’s a taste:

Which is why Geithner’s goal with the bank plan may not have been to solve the crisis so much as demonstrate he could eventually be trusted with more money. Talk to administration officials these days, and you typically hear phrases like “show results” and “rebuild credibility”–language befitting a political crisis rather than an economic one. As Orin Kramer, a hedge fund manager and prominent Obama supporter, recently told me, “Until you establish credibility–that you are going to run a program with transparency and accountability, which isn’t a gift shop–you cannot get additional financial authority from Congress.” Obama’s speech, with its tough talk about forcing banks to “demonstrate how taxpayer dollars result in more lending” and warning CEOs not to use “taxpayer money to pad their paychecks or buy fancy drapes,” was aimed directly at this problem.

And here’s where things get truly alarming: If Obama officials are able to “show results”–which most observers take to mean increased lending–then they probably won’t need the money they’ll be able to tap. But, if they’re unable to show results, it will most likely have been for lack of money, which they’ll have a hard time getting more of. It’s a classic CATCH-22: The very reason you’d ask for help disqualifies you from receiving it.

Wow, maybe I should just go back to bed and pull the covers over my head. Oh, wait, I can’t do that. I’m watching 35 kids take their first economics test praying they can stay in school until all of this is over. Well, I pray for that and also that whatever I can teach them about economics helps them become better decision makers than the crowd that’s out there in the real world now.

Martin Wolf on Fareed Zakaria: Worth a View

Posted: March 1, 2009 Filed under: Global Financial Crisis, president teleprompter jesus, Team Obama, U.S. Economy | Tags: Fareed Zakaria, JM Keynes, Martin Wolf, Obama economics, politics as usual, Rush Limbaugh, Steven Harper 9 Comments

FT's Martin Wolf

I’m not one to recommend CNN programming these days. Actually, I’m not one to recommend programming on any of the TV stations these days. However, I find FT’s Martin Wolf one of the few voices of economic reason in the world. He was interviewed on Fareed Zakaria’s program today. It’s one of the few CNN programs left with an international twist. They’ve watered down most of the new shows to the point I consider People Magazine a better source of global news. This program will be repeated this evening at 5 est so you may want to try to watch. Also, Canadian PM Harper is on the program. Both the Canadians and the Brit’s have economists for PMs. It’s amazing to listen to his interview because it’s full of wonky specifics rather than hopey changeyness–that as Martin Wolf says–lacks boldness of vision and action in its actualization. Listen to Harper. It’s an amazing contrast to some one who needs a teleprompter with words penned by a 27 year old frat boy to form a complete sentence.

Fareed Zakaria never insults the intelligence of his audience. That is also a reason I enjoy his program. He wants to stimulate discussions and thought. He has a juicy wonderful list of books that he recommends. This week’s selection is a biography of Keynes. You might know him as the father of economics and government stimulus, but he was also a very interesting character. He frequently attended white house dinners with

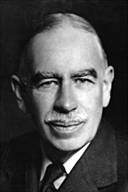

JM Keynes

his husband of the moment and was known for writing some fairly outrageous social and political commentary. The book is: John Maynard Keynes, Economist, Philosopher, Statesman” by Robert Skidelski. I’m putting it on my summer reading list.

One of the primary reasons that I listen to Martin Wolf is that he is English so he has no political dogs in the hunt for a return to global prosperity. His focus is purely on getting out of this mess. That is why I’m listening to him even more than Paul Krugman. Krugman may have tenure at Princeton and a Noble prize, but much of his column has to do with maintaining popularity here at home. After all, he won’t get invited to all those sexy parties if he criticizes the home team too shrilly. Brit Wolf gives the Obama economic team an English B for a grade. That would translate roughly to a D here in the United States. He says that it’s not that the talent isn’t there because it is very much there. Wolf says that there is a time that calls for bold action. This was a time when bold action could be taken. He also says what we have gotten is basically carefully parsed politics as usual which is anything but bold.

Recent Comments