Billy O’Reilly’s mother would be ashamed!

Posted: February 12, 2009 Filed under: Main Stream Media Comments Off on Billy O’Reilly’s mother would be ashamed!Once again, an infamous journalistic bully with access to a prime time audience goes after a woman. Famously arrogant and mean Bill O’Reilly of Fox news has nothing better to do than pick on elderly women. He attacked veteran journalist Helen Thomas after the Obama presser monday night. He spent nearly his entire program last night justifying calling her a “wicked witch” and even brought in the irrelevant comic Dennis Miller to take some of the heat. Miller sang an incredibly off key and patronizing “You are So Beautiful to Me” for Thomas.

Veteran Journalist Bonnie Erbe, among others, have dedicated their columns and blogs calling down O”Reilly.

Bill O’Reilly mocks everyone—all right, I get it. He’s a venom-spitting curmudgeon and works hard to build that image and protect his niche. But calling veteran journalist Helen Thomas a “wicked witch” after her question to President Obama at his news conference last night was not only ugly, it was petty.

O’Reilly is living proof there are a lot of hateful TV viewers out there because they must get a rise out of watching an angry homunculus who’s outlived his useful life span. What else would prompt someone to watch his show? Quite frankly I’d have a better time parking on a freeway in rush hour and dealing with all the angry motorists, than watching Venom Boy spew. Can’t somebody recommend to O’Reilly a competent psychotherapist? But then where would angry TV news viewers go to watch highly-paid cobras?

Bernard Goldberg joined in the witch hunt later by saying “Helen Thomas’ 15 minutes were up during the Lincoln administration.”

Why are these guys allowed to get away with passing this kind of meanness off as news commentary? Why are they even given airtime? Is America that desperate for entertainment that picking on elderly women as means of ego gratification of the likes of O’Reilly yields huge salaries and audiences? There’s a reason I don’t watch Tweety, KO, Rush, and O’Reilly. What I want to know is why do people watch these jerks and why do they get paid money to spew sexism and play ground bully commentary?

Dismal Science, Dismal Economy, Dismal Policy

Posted: February 11, 2009 Filed under: Global Financial Crisis, president teleprompter jesus, U.S. Economy, Uncategorized Comments Off on Dismal Science, Dismal Economy, Dismal Policy I’ve been closely following blogs of other economists this week since we’ve had so many major things come down the pipe having to do with the dismal science and the even more dismal economy. I thought I’d just highlight what’s out there at the moment. I promise, I’ll avoid all the folks that felt it necessary to blog the banker’s testimony live.

I’ve been closely following blogs of other economists this week since we’ve had so many major things come down the pipe having to do with the dismal science and the even more dismal economy. I thought I’d just highlight what’s out there at the moment. I promise, I’ll avoid all the folks that felt it necessary to blog the banker’s testimony live.

Brad DeLong of U.C. Berkely noted something of interest concerning the new TARP money. It’s not economics, but it’s juicy. I just love reading Grasping Reality with Both Hands. It has that wonky snark I find inspiring. These are his first two points from a thread entitled Brief Notes.

- Called the Geithner Plan, not the Obama Plan–distancing of the president from the proposal.

- Reinforced by Axelrod leaks to Labaton and Andrews painting Geithner as the Wall Street loving holdover–and this the person to take the blame if things go south.

I think this mean’s move over, Geithner’s joining us under the bus. After yesterday’s reports of senators and staff laughing at its presentation and the market dive, how long will the Secretary of Tax Evasion last? I’m taking bets, if any one is interested.

Obama Team Announces TARP Plan: Market Crashes

Posted: February 10, 2009 Filed under: Equity Markets, Global Financial Crisis, New Orleans, president teleprompter jesus, Team Obama, U.S. Economy | Tags: Depression, Geithner, Obama presser, Obamanomics, TARP 2 CommentsI hope you weren’t planning on using any of those savings that you may still have left sitting out there in anything market-related soon. The Dow Jones ( at this writing) is off over 350 points. All of the blue chip components tumbled. The S&P and OTC markets aren’t faring any better. This is how Market Watch sees it right now:

The recent strength shown by U.S. stocks vanished on Tuesday as the government unveiled a new bank-rescue plan and congressional action neared on a fresh round of fiscal stimulus for the wheezing U.S. economy.

That basically amounts to a reaction of last night’s speechification and presser and this morning’s announcement of thunderous boos. Fed Chair Ben Bernanke is speaking right now and that’s not really helping either. The investment/business community doesn’t think any of the largess from either the TARP or the Stimulus Plan are really going to do anything. Treasury Bond prices are dropping also. This additional snippet from Market Watch sums it up well.

“First, we’re going to require banking institutions to go through a carefully designed comprehensive stress test, to use the medical term. We want their balance sheets cleaner, and stronger. And we are going to help this process by providing a new program of capital support for those institutions which need it,” said Geithner.

Despite the forceful words, Geithner noted his office was still exploring options and details for an asset value program, with little answer on what to do about banks’ toxic assets.

That last paragraph is basically at the crux of the problem. The current administration is bringing no plan to the table to actually deal with the problem. Perhaps because Geithner was so instrumental in the original TARP, he’s just sticking with what already didn’t work rather than trying to think outside of the box. The market has lost around 3-4% already and there’s several more hours of trading to go. Hang on to your cookie jars kids, you’re going to need them as a stable replacement for your local bank.

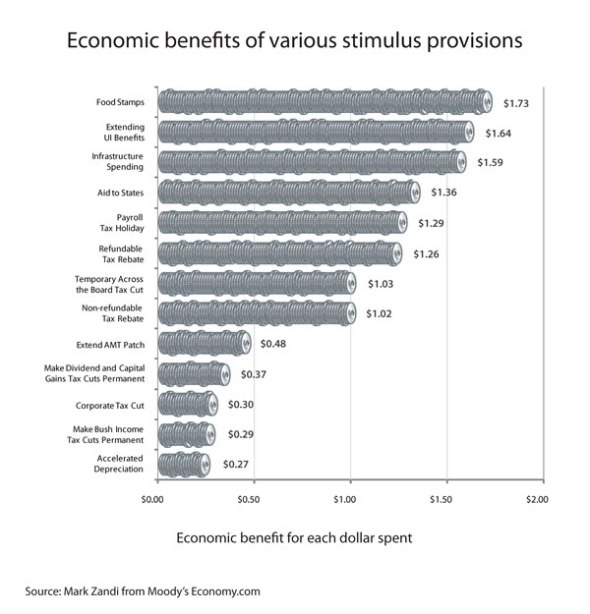

Meanwhile, the senate managed to pass that the stimulus bill 61-37. That’s way shy of the 80 votes that Obama had wanted. The final bill has $838 billion worth of stuff that includes a lot of tax cuts (not likely to stimulate anything but Grover Norquist and The Club for Growth) and money for cash strapped states. I’ve brought up links to the Economic Policy Institute earlier but I really like this graph that even my freshmen could grasp about what works and doesn’t work in stimulus plans.

You can see the difference between the items where you get more bang than a buck and less than a buck’s worth of bang while contributing to the deficit. Notice those tax cuts that wind up costing more than they stimulate and think the last eight years of Dubya of which we seem to be repeating.

You can see the difference between the items where you get more bang than a buck and less than a buck’s worth of bang while contributing to the deficit. Notice those tax cuts that wind up costing more than they stimulate and think the last eight years of Dubya of which we seem to be repeating.

Here’s one that I picked up from Brad DeLong’s Grasping Reality with Both Hands that had my Freshman gasping as I was trying to set their hair afire. (I think it worked, btw.) Any one facing this job market should panic. Just anecdotal, but in the market for finance professors, this year universities were taking resumes only at the last two conferences. Last year, the best people had been hired up before either of the conferences were held and only the marginal remained. The hottest academic jobs are definitely on hold. In my years of both public and private sector economisting, I’ve NEVER seen anything like this.

Please notice the incredible level of job losses. If you’ve managed to get through a calculus course, you’ll see that the first, second and third derivatives are negative which is not true on the other series at similar points. Basically, for you nonmath types, this indicates nothing but a downward trend or as I like to put it, straight off a cliff.

Please notice the incredible level of job losses. If you’ve managed to get through a calculus course, you’ll see that the first, second and third derivatives are negative which is not true on the other series at similar points. Basically, for you nonmath types, this indicates nothing but a downward trend or as I like to put it, straight off a cliff.

So, President Obama rambled an economics lecture last night that made me happy that he was getting all those economics briefings. It was also pretty obvious that most of his advisers must have their hair on fire too, because he did have a sense of edgy panic when he talked about the situation. However, ‘edgy panic’ is not what I want in a president. I want a president to talk about we have nothing to fear but fear itself who then says something to the effect of let’s do what works instead of bargaining away what will with folks that aren’t interested in watching you succeed.

I have to say, last night over Margaritas with my neighbors, I was searching for folks that wanted to diversify their food options with neighborhood gardening. I had a lot of takers. After all, when the army and your police force spend a good amount of time and money flying sleek black helicopters around the skies of your city practicing for food riots, it’s kind of one of those wake up moments. That goes for sleepy freshmen and drunk Cajuns. Is your hair on fire yet? Because if it isn’t, you haven’t been listening.

Meanwhile, I’m adding a page to my own blog for sharing sustainability and survival stories. Feel free to visit and contribute.

Enabling the Damned: TARP Redux

Posted: February 7, 2009 Filed under: Global Financial Crisis, president teleprompter jesus, U.S. Economy Comments Off on Enabling the Damned: TARP Redux Well, tax payer rip-off, part deux will be officially announced on Monday according to the New York Times.

Well, tax payer rip-off, part deux will be officially announced on Monday according to the New York Times.

Officials hope that that part of the plan is not labeled a “bad bank” administered by the government, although they expect that some might call it that.

No matter what it is called, the government would assume some of the risk of declining assets at the heart of the economic crisis. But by relying on a combination of private investors and government guarantees, the administration hopes to reduce its exposure to losses and avoid the problem of having to place a value on assets that the institutions have been unable to sell.

I’m not even sure where to start other than there probably is some law somewhere against being an accomplice to robbery and we should send out a sheriff with an arrest warrant fast!

The banking plan will involve a close review of financial institutions, possibly including a so-called stress test to measure whether they have enough resources to weather a continued economic decline. It will also enable the government, when it provides a new round of investment, to convert the warrants for preferred stock it has already received from many institutions into common stock. The move, which essentially would swap debt for equity, would help relieve the balance sheets of those institutions, although it would also hurt other existing shareholders by diluting their common stock.

Lawmakers said they were told that Mr. Geithner would not spell out the details of much of the program next week, including how the government would use more than $50 billion from that program to help homeowners facing foreclosure.

Notice the priorities. We give more to the banks FIRST, THEN we get around to the homeowners facing foreclosure. I’ve said this time and again, but it bears repeating. Without establishing a bottom to asset prices, none of this will do ANY good. Asset prices include those of homes AND all those fancy derivatives surrounding them.

The plan appears to try to deal with excessive executive compensation and bonuses but does not have any teeth that would force banks to loan the money. They can still recapitalize or purchases other banks which they most likely will do while there is still no bottom to asset prices.

For weeks, administration officials have been exploring several alternatives for reducing the wave of foreclosures. One proposal involves Fannie Mae and Freddie Mac, the mortgage finance companies now under government control, to help further stabilize the housing markets by providing guarantees on low-rate mortgages.

Another proposal, said to be favored by Lawrence H. Summers, the senior White House economic official, would provide incentives to entice investors in pools of mortgages — and the companies that service mortgages — to refinance troubled home loans.

Now this is more intriguing, but again, why entice and incent people that you’re basically throwing money at? MANDATE it! Provide the guarantees on the mortgages and make them refinance the homes! While your at it, make them hold on to the assets they we fund rather than trying to palm crap loans off on the secondary market. If the wind up with Fannie or Freddie, we’re just giving them the money, and they’re sending us more NEW crap. Make them give loans they have to hold on to! That’ll send them to a crash course in Underwriting 101. Give loans to people that can afford them. Don’t overloan to speculators. Don’t loan based on thinking you can pass the trash! Giving them no cost capital basically allows them to take on even more risk. Without setting some boundaries, this is essentially an act of robbery! I wouldn’t buy their stocks under these conditions so why am I being forced to fund convertible warrents for them? Maybe it’s because Penny Pritzker and the worst of the worst were sitting on Obama’s finance committee when he was running for office and now have cushy positions on his economic advisory board. What say you?

Oh, and one more thing … not that these banks donated money to campaigns (guess whose?) and paid huge sums for the inauguration bash, NOW we see restrictions on lobbying.

This week’s new restrictions on executive pay and last week’s announcement of new lobbying rules that banks and other groups seeking assistance must follow have been part of the effort by the Obama administration to restore credibility to the program and regain support in Congress. That effort will be essential if the administration returns to Congress for more money.

I guess it takes a pig to create a pig in a poke these days. I’m going to have to look into selling pork bellies short. I have a feeling there’s a ton of them about to hit the market and the fan.

A quick breath up from the global economy for me and …

Posted: February 5, 2009 Filed under: A My Pet Goat Moment, Team Obama, U.S. Economy | Tags: blue dog democrats, obama stimulus plan, stimulus plan DOA 1 Commentback home … here.

To this headline at Politico: Obama Losing Stimulus Message War

and to this quote:

At this crucial juncture in the push to pass an economic recovery package, President Barack Obama finds himself in the most unlikely of places: He is losing the message war.

Despite Obama’s sky-high personal approval ratings, polls show support has declined for his stimulus bill since Republicans and their conservative talk-radio allies began railing against what they labeled as pork barrel spending within it.

The sheer size of it — hovering at about $900 billion — has prompted more protests that are now causing some moderate and conservative Democrats to flinch and, worse, hesitate.

and more from Today’s New York Times:

For all the saber-rattling, the fate of the bill, which is the centerpiece of President Obama’s economic agenda, seemed tied up in a meeting on Thursday in the Dirksen Senate office building, where Senator Ben Nelson, Democrat of Nebraska, and Senator Susan Collins, Republican of Maine, were leading an effort to cut the price tag of the bill.

Talk about your little engines that could! I could almost enjoy this if it wasn’t so painfully important to get this right. So far, President Obama has mailed in a letter to WAPO, scheduled a national news conference on Monday, and had a super bowl party and the senators from Maine and Nebraska remained unmoved by the charm attack!

Something tells me that this Congress is not going to take this new President very seriously if this keeps on going. Some one remind me, here, who is the majority party? Why are the Republicans acting more in control now than they were say, six months ago?

Senator Lindsey Graham even sounded dynamic on Fox with this little gem.

President Obama has been “AWOL” in negotiations over the economic stimulus package, Sen. Lindsey Graham said Thursday in a scathing rebuke of the new president.

The South Carolina Republican told FOX News that Obama has not been providing leadership, and he criticized the president for giving TV interviews and writing an editorial touting the package, rather than addressing the complaints of lawmakers.

“This process stinks,” Graham told FOX News, before repeating a lot of his criticisms on the Senate floor. “We’re making this up as we go and it is a waste of money. It is a broken process, and the president, as far as I’m concerned, has been AWOL on providing leadership on something as important as this.”

How macho can one be if the senate’s most closeted log cabin Republican can manage a more masculine soundbite than President Obama? I mean, it’s down right embarrassing. I’m going to have to wear a papersack over my head to vote Democrat any more, if this keeps up.

If you’ve read anything I’ve written here recently, you know what I think about what needs to be done. This is ridiculous. Its worse than a sexfree honeymoon! How can some one come in and screw the one big thing up so quickly? Meanwhile, I’m planting the Obama Victory Garden this week. It’ll save me some time in the breadlines.

Recent Comments