Blurry Brain Syndrome

Posted: December 8, 2008 Filed under: Equity Markets, U.S. Economy | Tags: automobile bailout, Detroit Three bailout, nationalization, privatization 5 Comments The first day of every economics course I teach, I always describe what I call Blurry Brain. I tell my students that they’re going to experience it frequently as they wrap their minds around the abstract theory that is taught in economics class. Some times something will seem very clear but when they look at it again, it will look very strange and they’ll experience Blurry Brain. Eventually, however, things should click for them as long as they stick with studying it.

The first day of every economics course I teach, I always describe what I call Blurry Brain. I tell my students that they’re going to experience it frequently as they wrap their minds around the abstract theory that is taught in economics class. Some times something will seem very clear but when they look at it again, it will look very strange and they’ll experience Blurry Brain. Eventually, however, things should click for them as long as they stick with studying it.

In order to make it all easier, I start teaching an abstract concept and model by telling a very intuitive story. At the root of all good theory is a story and it should make sense at the intuitive level. Theory should reflect common sense. After that, I explain we have to take some thing that is very intuitive and put into a place where we can study and poke at it like a scientist with a stick and a frog. However, we don’t have frogs and sticks in our economics laboratory. Physicists don’t have those things either. We only have numbers and math relationships. We have to take these very intuitive ideas and make them testable or we can’t prove if we have a valid theory. If we don’t have theory, then we don’t have those common sense stories that guide our understanding of the world.

Theories must be testable so that they come from hypotheses that can be proved or disproved. That is why evolution is a theory. It is testable and has been proved over and over. God is an idea that can never be proved or tested. God has to stay a hypothesis in terms of the scientific method because we can’t empirically test the existence of a ‘god’. Some folks try to infer god, but when it comes to science, you pretty much have to stay within the realm of things that can be deduced from data. If you can experience the data directly, you can test the idea or hypothesis, you can prove it true or false, and you can contribute to theory.

I’m not a theoretician although I do try to bandy about a big idea ever so often. I test things empirically as well as teach. That means I have to take the big ideas and make them testable to see if they can fold themselves into theory or add some insight to a theory. Usually, I don’t have a problem with that because I’ve had quite a few years to wrap my brain around the abstract concepts and have read many studies. I haven’t had a big case of blurry brain for some time because I’ve worked with these concepts enough to have built up the neural pathways. You see, frequently, blurry brain comes from exercising parts of your brain that have never had to fire a synapse. Anything abstract like theory will generally cause students to get blurry brain because they’ve just not had experience thinking that way before. Back in the 70s, when you finally got the thing into focus and realized what it was telling you, going beyond just memorizing the stuff because your brain would blur, they would call this a ‘click’ moment. Some one reminded me of click moments over the weekend because it was used to deal with those times when you’d get the idea of sexism. In that way, it’s similar to clearing up blurry brain. You can say, whoa, I get it now! Well, today, I’m looking for a click moment because it’s impacting my ability to research.

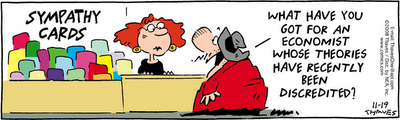

So why, after years of explaining the macroeconomy have I gone back to blurry brain? Why am I suddenly looking at everything I planned to stick in a model and empirically test and think about while thinking this isn’t going to work any more? I think it’s because I’m looking around at reality at the moment and realizing things are happening that are shaking our assumptions to the root. Possibly even shaking our theories.

Do you realize that we just nationalized the U.S. banking system and that we are about to basically nationalize the automobile industry too? Can you wrap your mind around what that means politically and economically without getting blurry brain? One of the areas I followed for years is called “Thatcherism” because it started in the U.K. with conservative PM Margaret Thatcher. She began a denationalization campaign that has been successfully followed through out the word. Most countries have been selling off their national industries. This includes everything from Telecoms to Transportations to Heavy Industry to Natural Resources. Countries that have traditionally owned a majority stake in their nation’s businesses have shed those things consistently since the 1980s and with good results. The literature shows that these companies increase labor and capital productivity and lower costs. Other than maintaining some kind of national health system, most industrialized nations have headed towards the laissez-faire side of the economic spectrum in all nonstrategic industries. Just think of the major changes in the transition economies alone. (These are the countries that were part of the old Soviet system.) So, theory and empirical evidence suggests that moving towards a system with less government control generally creates efficiencies. We’ve seen this happen in many, many markets so that the old command and control economies have basically been replaced by some kind of market-driven system. The lessons of the last 20 or so years is that the market system is best and usually produces the best results. Both theory and evidence suggest that.

Yet, every day when I turn on the tv I find yet another company begging to avoid the market. I always have known that corporations really don’t like Economic Darwinism which is the nature of real market capitalism. They don’t want to evolve or be subjected to the survival of fittest via low cost curves or innovation unless it produces extraordinary profits which we know from basic microeconomic theory is not sustainable. In perfect market capitalism, extraordinary profits never last very long and companies that are not run efficiently don’t either. So what is with corporations these days? They want to be monopolies AND to be protected and coddled so they don’t fail when the market basically tells them they are a failure. CEOs want their companies to be nationalized despite knowing from the few low-level economics classes they took as MBAs that this really isn’t a good outcome for the society. There are circumstances where government intervention in a market is necessary. Yes, market failure is one of them. But market failure and management failure are two different things. Usually governments enter functioning markets when it involves situations where the public gets stuck with ‘external’ costs that private companies should be bearing but can somehow avoid. They usually can sneak these costs (like pollution, noise, or overuse of public resources) on us unless we can force the justice system to place the costs back on them. Yet, here we have a situation where private entities are begging the government to nationalize the costs, while they still privatize any profit or gain. They are doing this by convincing us that doing nothing will create a much larger public cost.

Economists had enough data from the Great Depression to know that the public cost of bank and market failure is huge. This is why there was rush for the bail out of banks. We have already had regulations and assurances involved in this market that were imposed the first time the market failed. Any finance prof studying markets will generally pull the financial institutions out of the study unless the study is about financial institutions themselves. This is because of the heavy regulation and unique fiduciary role of financial institutions. We know it would create a huge public costs because we’ve seen it happen before.

Now, they are trying to convince us that the automobile industry is another one of those markets. Because of the bad unemployment data on Friday, more folks have been convinced there will be a huge public cost to letting any of the Detroit Three go into bankruptcy. Politicians with no grasp of basic economics (including Barrack Obama) are now convince we’ll have these HUGE social costs. Yet, hearings last week uncovered three companies with three distinct situations. Ford will most likely not need the loan guarantees. They said as much. They appear to be in a position to survive and have been restructuring themselves for some time. Chrysler is NOT a publicly held company. A group of extremely wealthy individuals took them private about a year ago. This group of investors were not drug or drugged into the deal. They read the details, saw the business plans, and bought the company anyway. This leaves GM which is obviously a bloated company with too much capacity and commitments to handle. They may not make it until year end.

So, we are in a situation where the so-called heir to Reaganomics is going to use trickle up economics because we have these huge companies with close to monopoly power. Most of these companies are huge not because they are efficient, innovative, and cost saving industries but because they were allowed to merge to behemoth size and major market share by the same gang in the District that now yells at them for being bad managers. Many of us may actually lose our jobs to save theirs.

Let me say that again. MANY of US may actually LOSE our jobs to SAVE theirs. If my state does not get money from the FEDs to cover short falls, my university will have to stop hiring teachers even when we need them. Already, California has decreased the number of university students it will accept in the fall. These will be students that will wind up unemployed if they don’t become students. If Federal monies go to the automobile industry, it may not go to other things. If tax money rushes to save GM and the companies that it suckles, that money is not going to go to other industries. Take a good look at your job, because that could mean that either private or public money that would keep your company/institution afloat, could be funnelled to an industry that has been misusing funds for years.

This is a major transfer of wealth here and you better start to wrap your minds around it.

I still haven’t wrapped my brain around what all this means. I’m going to throw it open here for you to chew on. I’ve always thought known that corporations seek monopoly powers and that they will do everything in their power to entice and buy legislators to give them laws that will set them up as monopolies. It’s one thing to want to be a monopoly and have the power and profit that goes with that, it’s completely another thing to beg the government to fund you and help you make decisions. Basically, this says your company is so inept, that it will be more profitable and more efficient if it is nationalized. This goes against all theory and evidence we’ve ever seen unless a market can not function under any other circumstances or is unique and important it must be run by the government. Most product markets NEVER fall under this category. Is this huge transfer of our wealth to these mismanaged industries going to cost us more than the problems we inherit if they fail? If we have far more capacity, capital and resources dedicated to an industry that can’t sell its products, is it a good use of public money to allow them to carry on? Better yet, do you want to bargain your job and future away to keep these folks in business a few years longer? Would you rather your money go to paying for better education facilities and national health or a bloated 20th century industry that fights innovation and progress every step of the way?

It appears that both the Bush administration and the Obama transition team are making this decision for you. Do you trust them or what the so-called market is telling you? So let’s go back to the common sense story part of economic theory. What is in your garage? What do you really want in your garage? Do you trust any of the Big Three to give it to you? Are you rushing to buy their stock right now because you think they have a bright future and you want to profit from it? You are the market, you know. Now, I will say that I think there’s a continued market for my Mustang, but I really don’t want to put my future taxes into the Pontiac. That’s the very intuitive part of this story. Do you want a Pontiac, a big ol’ hulking GMAC, or a Saturn in your garage any time soon?

I don’t know about you, but I have a really bad case of blurry brain but I’m not sure it’s coming from economic theory. I think its because the economic theory and the common sense story behind it aren’t connecting with the political reality.

“One of the areas I followed for years is called “Thatcherism” because it started in the U.K. with conservative PM Margaret Thatcher. She began a denationalization campaign that has been successfully followed through out the word. Most countries have been selling off their national industries. This includes everything from Telecoms to Transportations to Heavy Industry to Natural Resources. Countries that have traditionally owned a majority stake in their nation’s businesses have shed those things consistently since the 1980s and with good results. The literature shows that these companies increase labor and capital productivity and lower costs. Other than maintaining some kind of national health system, most industrialized nations have headed towards the laissez-faire side of the economic spectrum in all nonstrategic industries.”

Read Adam Smith. Some things are natural monopolies and SHOULD be run by the state (any national network – roads, railways, post, telecoms etc). Some things are socially vital – and should be run by the state – (hospitals, schools housing). If you privatise what was a state monopoly you produce a private monopoly which can make profits for a while. But they hive off “unprofitable” sectors (rural post and transport, eduction and health care for the poor) and eventually the social fabric disintegrates. Very soon economists will reinvent the wheel and call for the state to “prime the pump”. Once tax payers’ money is poured in, the private sector will reprivatise. In the UK we’ve seen this process happen time and again.

capella: i think if you read further down, you’ll se that’s what I said … that there are some strategic markets that belong under the government as well as there are some market failures that are appropriate to government response also … i’m still don’t think the auto industries belong in this category.. i think GM going through the bankruptcy process would be just fine like the airline industry here. Ford is unlikely to wind up there. There are also some successful transplants here of both German and Japanese carmakers.

This was a great post Dakinikat. I was only commenting on the statement that privatised companies “increase labor and capital productivity and lower costs”. How do they do that? Usually by shedding “unprofitable” sectors which the tax payer then has to fund; by cutting the workforce and forcing lower wages, often through introducing part time work for women or outsourcing to third world workers; by substituting cheaper components etc etc. The Thatcher reforms devastated British manufacturing, dismantled the health service and ruined national transport and telecoms systems. A few people got extremely wealthy it’s true.

\that’s the lesson of the last 20 years or so, I believe.

It’s silly to say that those things are natural monopolies. Aside from roads, there is absolutely no reason why there can’t be competition in any of those fields.

The same applies to housing, health, and education, the latter two of which are de facto or de jure nationalized in this country, and both of which consume increasingly large inputs with less and less to show for it. America is currently the leader in health care innovation. Any sort of NHS would strangle that innovation.

Ben: The definition of a natural monopoly is a market where costs are minimized and the market operates most efficientyl when there is only one company involved … costs are minimized for most utilities when one company provides the service and as long as it forced into average pricing, instead of monopoly pricing or price discrimination, it will be more efficient than any form of competition.

You really need to take a microeconomics course. Competition is defined by many small firms with homogenous products and No barriers to entry … very few markets actually conform to these definitions … most are monopolistic competition which in many cases is closer to monopoly than competition …

also, the US has extremely high health care costs, the worst for an industrialized nation and it is not the leader in health care innovation. it’s something like 5th or 6th. The health care industry is a failing market right now in the U.S.

Also, oddly enough, the one things monopoly do really well is research and development and innovation… much better than competition because they don’t have to worry about competing on cost curves and pricing … this enables them to free up resources for research that competition never does … tons of empirical research supports that.