Those who forget the past are condemned …

Posted: October 1, 2008 Filed under: U.S. Economy | Tags: bail out, Bail out of Fannie Mae and Freddie Mac, Fannie, Financial Crisis, HOLC 6 Comments(cross-posted at the Confluence)

I’m having difficulty digesting a lot of the news and hoopla surrounding this financial crisis. There are some things that are really worrying to me. It’s not so much the crisis itself, which I actually understand, but the responses. I am reminded of the saying that those who forget the past are condemned to repeat it. I think this basically sums up much of why I feel so desperate when I watch the response to this crisis unfold on TV. It’s time to stop the blame and start the problem-solving.

First, what really bothers me is the inability of ANY of the politicians to either REALIZE how they contributed to this or understand what lead to this. A recent post by myiq2xu mentioned a speech by Senator Obama who offhandedly referred to the period of deregulation of industries that went on during the 70s. He has been hammering his every talking point with the Republicans did this to us. Useful, I suppose when trying to get elected based on something other than your credentials, but disingenuous at the very least. I keep wondering if he JUST doesn’t know the history of deregulation or he’s purposefully lying to us.

The deregulation of the telcom industry, the airline industry and the banking industry came about during the Carter regime. When I was a fresh out of grad school economist, I worked for a bank then a Savings and Loan. The Monetary Control Act of 1980 (okay, i’m dating myself) was a response to the problem of traditional banks and thrifts hemorrhaging deposits to Money Market Accounts. The root of deregulation started with Jimmy Carter’s administration. Hasn’t any one told him this or does he just like to go on misspeaking? The fight against the deregulation against Fannie and Freddie–probably the biggest contributors to this latest moral hazard problem–was led by the Democrats also. Why can’t we just be honest about this and say that each of the parties had a hand in this and learn from the past?

Second, I lived through the S&L crises and the economy that prevailed in the early 80s. My first house loan had an interest rate of 17.67% which got discounted to a beneficent 12.67% because I worked for the thrift that gave me the loan. House loans aren’t even half that at the moment. Two other folks besides me got house loans that month from the biggest thrift in the heartland. I’d say that was a credit crunch, wouldn’t you? I also worked the money desk at that time and remember the interbank loan (Fed Funds rate) bopping between 4% and 21% on any given day. Both of these rates are a far cry from the current rates as is the unemployment rate which sat between 12 and 13% for some time. Remember, these were the morning in America years of the early 80s. We currently have a 6.1% unemployment rate.

My father lived through the great depression. At that time, the unemployment rate peaked between 25% to 29%. The foreclosures that happened during that time occurred because no one had jobs and no one had unemployment insurance. When they closed the banks, there was no FDIC so, you lost your life savings. Today, we have unemployment insurance, the FDIC, and various other types of insurance that minimize the loss you experience on your deposits –even money market funds. You may experience paper losses, but you will not loose EVERYTHING! There are safeguards against much of the worst situations experienced during the depression. I’m not sure that given today’s economy, which is sluggish and experiencing problems but is not as bad as either of these two periods, we need this rush to judgment. Why aren’t we thinking this bail-out plan through more?

Which brings me back to today. We solved many of the problems of the previous financial crisis with government intervention. The HOLC bought up many defaulting mortgages, renegotiated them when possible, and held on to the properties, insuring they wouldn’t drive land and house prices down further. During the S&L crisis, the RTC bought out S&Ls, unwound the assets, and sold the sellable ones while holding onto the bad stuff, until the market turned around. The government can afford to hold paper losses on its books. Private industry cannot. Government can help put a bottom price on these markets. This is what it needs to do. It does not need to end the alternative minimum tax, change the taxes on corporations, or fund ACORN and La Raza.

Which brings me back to today. We solved many of the problems of the previous financial crisis with government intervention. The HOLC bought up many defaulting mortgages, renegotiated them when possible, and held on to the properties, insuring they wouldn’t drive land and house prices down further. During the S&L crisis, the RTC bought out S&Ls, unwound the assets, and sold the sellable ones while holding onto the bad stuff, until the market turned around. The government can afford to hold paper losses on its books. Private industry cannot. Government can help put a bottom price on these markets. This is what it needs to do. It does not need to end the alternative minimum tax, change the taxes on corporations, or fund ACORN and La Raza.

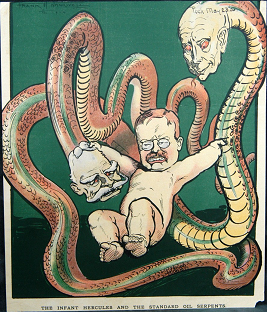

Which brings me to one more point, when do we stop turning these unprofitable behemoths into megacompanies that become too big to fail? Haven’t we learned anything in the past about this? Why are we creating more Freddies and Fannies? It is not fair to the taxpayer for the profits to be privatized, but the losses to be turned to the public. During the last 30 years, we’ve allowed mergers to create these giant companies that are behaving more and more like monopolies. This is not good for a free market system. If we are allowing them to become so big and letting them get away with extraordinary profits during good times, than making them subject to public largess if they fail, what is the difference between this and just nationalizing them altogether? Didn’t we learn these lessons during the trustbusting years of Teddy Roosevelt? Isn’t the basis of our monopoly law the Sherman Anti-trust regulations that were set up in the 19th century? Why have we forgotten the excesses of the gilded age?

Yes, it’s broken. Yes, it needs to be fixed. But can some one in Washington just pick a few history and economics textbooks so we’re not condemned to relearn the lessons of the past and do it with everyone’s tax dollars?

Thanks for putting this in perspective, dakinikat.

If they were nationalized in the first place, the companies and corporations would not have gone crazy with extraordinary profits. The money would have been distributed amongst various governmental programs.

Even if people did remember the past mistakes, greed, arrogance and bloody mindedness, the thought that “That won’t happen this time, and anyway, we’re making too much money to care,” would prevent them from learning from them.

It’s human nature to miscalculate risk and so in a banking sector where targets have to be met, the only option is to start borrowing to more and more people, with less and less ability to repay and at some point that is always going to fall apart.

I go back to something I’ve said before, dakinikat needs to run for office. 🙂

Without a doubt the most sane approach to this crisis I have read.

The bailout plan has -been- thought through. Cui bono?

It’s not about you, or anyone else. It’s not about keeping the economy “stable” or anything like that.

It’s about the politicians getting power for themselves and money for their friends.

Another thing from the past to remember is that a gigantic piece of legislation, hurriedly rushed through in response to a hue and cry of “the sky is falling” never seems to do what we are promised it will. Congress put off dealing with this complicated problem until they could scare, blackmail and bribe its passage. A pox on both their houses and both parties in those houses.